This is an opinion editorial by Jenna Bunnell, senior manager for content marketing at Dialpad.

No matter what your opinions are on bitcoin, it is obvious that it is here to stay and will continue to grow in use.

As a virtual peer-to-peer currency bitcoin has become widely accepted in many countries. You can sell your bitcoin for cash, or trade them with peers across different networks and use it to invest in anything from art to property.

However, as it is a virtual currency, the question arises; what happens when you die? While it’s a morbid thought, it is important to plan ahead for your family and loved ones. So, what happens to bitcoin when you die and how do you include BTC in any inheritance plans? Is it a simple process to include BTC in a will like you would with tangible assets such as your house and your bank accounts?

What Is Bitcoin?

Image sourced from kyivpost.com

The origins of Bitcoin lie way back in 2008 when a white paper was released titled “Bitcoin: A Peer-to-Peer Electronic Cash System” authored by Satoshi Nakamoto (a name assumed to be a pseudonym, maybe even belonging to more than one person). The idea behind the white paper was to create a fully digital currency that would exist outside the normal centralized controls of banks and governments.

At its core lies peer-to-peer software and the use of high levels of encryption (based on the SHA-256 algorithm designed by the U.S. National Security Agency). All transactions are recorded in publicly available ledgers on servers around the world and anyone with a computer can set up one of these servers, known as nodes.

Every time a transaction happens, it is broadcast to the entire network and shared between nodes. These transactions are collected, roughly every 10 minutes, into a block and added to the blockchain.

People often have the misconception that they need to buy whole units, but BTC can actually be subdivided by up to seven decimal places, creating smaller and more affordable units — sats.

Once you have bought (or mined) bitcoins, then you keep them in a digital wallet which you can access using special software. Given that these coins do not exist in real life, and that ownership is based on agreement among members of the network, just how do you decide what happens to bitcoin when you die? Moreover, as many BTC owners memorize the key to their wallet and keep no other records, what happens if they suddenly die?

Memento Mori

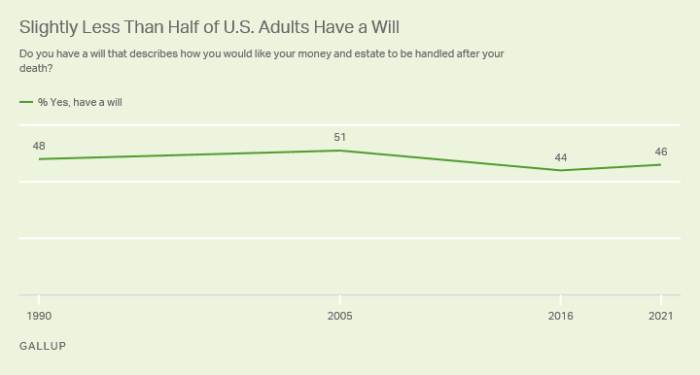

Image sourced from news.gallup.com

It’s not the most pleasant thing to talk or think about, but death is inevitable. Less than 50% of adults in the U.S. have already made a will, though of course, this figure varies across age groups — over 75% of people over 65 have made one while only 20% of people under 30 have made a will.

From a legal perspective in the U.S., it can be quite confusing. The IRS doesn’t view cryptocurrencies as currencies but rather as tradable commodities that can be taxed by the relevant authorities. Yet we treat them as assets too and thus must have some form of legal control when it comes to inheritance.

That control or oversight comes from the Revised Uniform Fiduciary Access to Digital Assets Act (RUFADAA). This law was developed so as to provide relevant parties (such as lawyers or fiduciaries) with clarity and a legal way of dealing with any digital assets held by a deceased person’s estate (or indeed when a person is incapacitated).

The law was written by the Uniform Law Commission (ULC) so that states could then examine it and adopt it. As of 2021, 47 states had enacted the law. So, for the U.S. at least, there is a framework that governs management of digital assets, something that will come as a relief to many who were previously unsure.

How Does RUFADAA Work?

You have to first consider that there are three groups of people who have a vested interest in what happens:

- The owner of the digital assets who may want a level of privacy.

- The custodian of those assets (businesses who make, store or…

Read More: bitcoinmagazine.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Solana

Solana  USDC

USDC  XRP

XRP  Lido Staked Ether

Lido Staked Ether  Toncoin

Toncoin  Dogecoin

Dogecoin  Cardano

Cardano  Shiba Inu

Shiba Inu  Avalanche

Avalanche  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Polkadot

Polkadot  Chainlink

Chainlink  Bitcoin Cash

Bitcoin Cash  NEAR Protocol

NEAR Protocol  Polygon

Polygon  Litecoin

Litecoin  Internet Computer

Internet Computer  Fetch.ai

Fetch.ai  Uniswap

Uniswap  LEO Token

LEO Token  Dai

Dai  Pepe

Pepe  Ethereum Classic

Ethereum Classic  Hedera

Hedera  Render

Render  Aptos

Aptos  Wrapped eETH

Wrapped eETH  First Digital USD

First Digital USD  Immutable

Immutable  Cosmos Hub

Cosmos Hub  Cronos

Cronos  Mantle

Mantle  Filecoin

Filecoin  Stellar

Stellar  Stacks

Stacks  Arweave

Arweave  Renzo Restaked ETH

Renzo Restaked ETH  OKB

OKB  The Graph

The Graph  dogwifhat

dogwifhat  Optimism

Optimism  Arbitrum

Arbitrum  Bittensor

Bittensor