Decentralized exchange Uniswap Labs has raised $165 million in a Series B funding round that had participation from some of blockchain’s biggest venture firms, putting the company on track to expand into other crypto-focused domains.

The funding round was led by Polychain Capital with additional participation from several existing investors, including Andreessen Horowitz, Paradigm, Variant and SV Angel. The funding round confirms earlier reporting from Cointelegraph that Uniswap was looking to raise between $100 million and $200 million.

Uniswap said the funding would go toward expanding its existing product offerings and improving the user experience through new web applications, developer tools and a shift toward mobile. The company also plans on launching nonfungible tokens (NFTs) projects in the future.

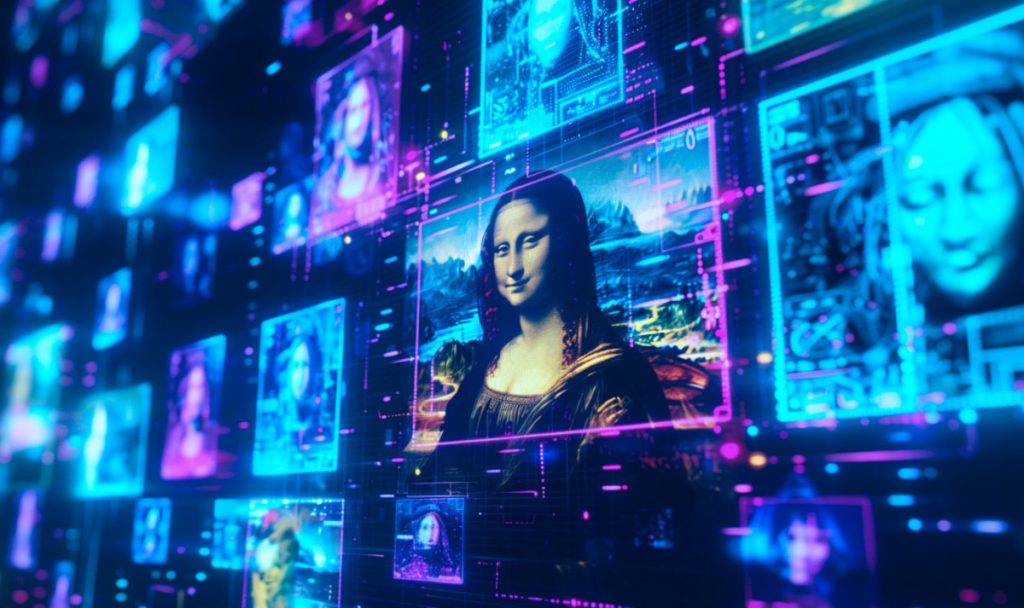

The official announcement was titled “Bringing Web3 to Everyone,” a sign that Uniswap was looking to incorporate many of the core ideas that separate Web3 from the current Web2 environment.

1/ We’re proud to announce that we’ve raised $165 million in Series B funding to bring the powerful simplicity of Uniswap to even more people across the world https://t.co/ChilydWOEO

— Uniswap Labs (@Uniswap) October 13, 2022

Uniswap rose to prominence during the decentralized finance craze of 2020 as traders began scouring exchanges for low-cap DeFi projects. By February 2021, Uniswap’s cumulative trade volumes had surpassed $100 billion for the first time. Uniswap’s cumulative trading volume has since grown to $1.2 trillion, according to founder Hayden Adams.

Related: Decentralized exchange Uniswap v3 gets ‘Warp’ed’ onto StarkNet

While demand for DeFi products has dried up over the past year, the sector has continued to operate as advertised during one of the most volatile periods in crypto history. DeFi platforms are filling a void left by the implosion of centralized financed companies as borrowers seek out new credit opportunities.

Read More: cointelegraph.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Solana

Solana  Lido Staked Ether

Lido Staked Ether  USDC

USDC  XRP

XRP  Dogecoin

Dogecoin  Toncoin

Toncoin  Cardano

Cardano  Shiba Inu

Shiba Inu  Avalanche

Avalanche  Wrapped Bitcoin

Wrapped Bitcoin  TRON

TRON  Chainlink

Chainlink  Polkadot

Polkadot  Bitcoin Cash

Bitcoin Cash  Uniswap

Uniswap  NEAR Protocol

NEAR Protocol  Litecoin

Litecoin  Polygon

Polygon  Wrapped eETH

Wrapped eETH  LEO Token

LEO Token  Dai

Dai  Pepe

Pepe  Internet Computer

Internet Computer  Ethereum Classic

Ethereum Classic  Fetch.ai

Fetch.ai  Ethena USDe

Ethena USDe  Aptos

Aptos  Renzo Restaked ETH

Renzo Restaked ETH  Monero

Monero  Render

Render  Hedera

Hedera  Filecoin

Filecoin  Mantle

Mantle  Stellar

Stellar  Cosmos Hub

Cosmos Hub  Stacks

Stacks  OKB

OKB  Cronos

Cronos  Arbitrum

Arbitrum  Immutable

Immutable  First Digital USD

First Digital USD  Injective

Injective  dogwifhat

dogwifhat  Sui

Sui  The Graph

The Graph