Bitcoin (BTC) denied the market fresh volatility at the June 23 Wall Street open as traders attempted to guess its next targets.

Bitcoin lacks “strong confirmation” of new upside

Data from Cointelegraph Markets Pro and TradingView showed BTC price action continuing to hover around $30,000.

A second day of sideways trading thus greeted market participants as prior upside stalled close to the yearly high at $31,000.

Popular trader Daan Crypto Trades suggested that this area represented a popular invalidation point for those shorting BTC after its recent upside.

“Most of the shorts that entered during this consolidation will likely have their stops sitting above that local high at ~$30.8K,” part of a tweet read on the day.

“This makes for an excellent liquidity grab. Line in the sand is the $29.8K region & Daily Open.”

Those shorts may still win out, however, according to Maartunn, a contributor at on-chain analytics platform CryptoQuant.

Noting rising open interest on exchanges against flat price performance, Maartunn noted that “flushing” that open interest has recently been accompanied by a snap drop in BTC/USD.

— Maartunn (@JA_Maartun) June 23, 2023

Trader Crypto Chase acknowledged that he had not got “strong confirmation” of an imminent continuation to $31,000.

Still in this long from 29.6K, half size as I TP’d half at 30.1K last night. Looks okay still, but realistically I’m not getting any strong confirmation from this LTF consolidation. The retest of 29.8K followed by bullish MSB is decent, but I don’t read too deep into it. https://t.co/v2lEq3WFBO

— Crypto Chase (@Crypto_Chase) June 23, 2023

For fellow trader Elizy meanwhile, there was no discernible change in mood from the day prior as consolidation continued.

While having “no intention of going short,” he told Twitter followers, there was likewise not much interest in entries while BTC price action acted in a tight range.

Wait-and-see mode returns

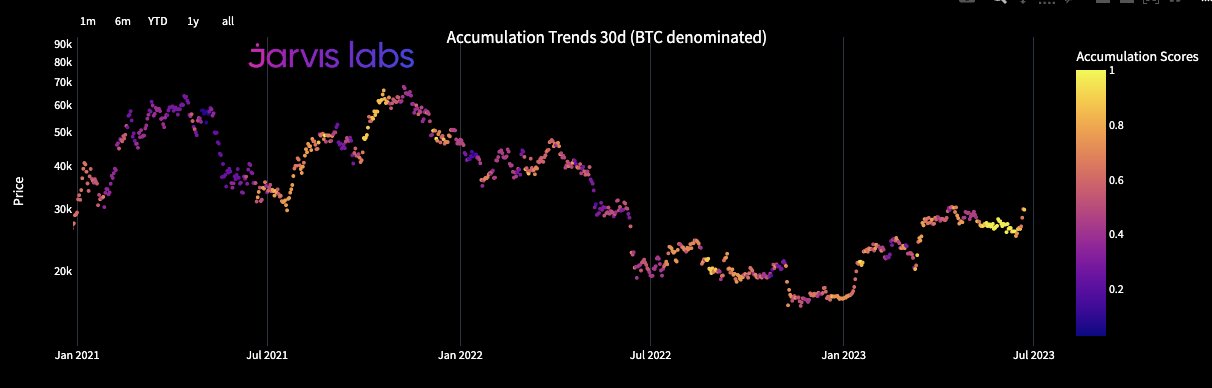

Elsewhere, the latest market update from crypto analytics firm Jarvis Labs underscored the unclear nature of low-timeframe price action.

Related: Bitcoin ‘parabolic advance’ means BTC price all-time high in 2023 — Trader

“I’m a bit uncertain right here,” founder Ben Lilly concluded after investigating various data sets.

“I’m starting to write off $24k before options expiry, and instead lean towards a push higher into $32k range.”

Lilly referenced the upcoming options expiry on June 23, worth over $700 million. Thanks to strong accumulation, it would be a mistake to bet on the rally fizzling too soon.

“All of this tells me, one cannot be quick to fade this rally,” he concluded.

“My gut was saying yea, fade it bc the halving is too far off. But a few data points are saying the opposite. Perhaps a fade will present itself in July. For now, let’s track the data to see if the trend continues.”

Magazine: Bitcoin is on a collision course with ‘Net Zero’ promises

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Read More: cointelegraph.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Solana

Solana  USDC

USDC  Lido Staked Ether

Lido Staked Ether  XRP

XRP  Dogecoin

Dogecoin  Toncoin

Toncoin  Cardano

Cardano  Shiba Inu

Shiba Inu  Avalanche

Avalanche  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Bitcoin Cash

Bitcoin Cash  Polkadot

Polkadot  Chainlink

Chainlink  NEAR Protocol

NEAR Protocol  Polygon

Polygon  Internet Computer

Internet Computer  Litecoin

Litecoin  Uniswap

Uniswap  LEO Token

LEO Token  Dai

Dai  First Digital USD

First Digital USD  Ethereum Classic

Ethereum Classic  Aptos

Aptos  Hedera

Hedera  Stacks

Stacks  Mantle

Mantle  Cronos

Cronos  Stellar

Stellar  Cosmos Hub

Cosmos Hub  Filecoin

Filecoin  Renzo Restaked ETH

Renzo Restaked ETH  OKB

OKB  Immutable

Immutable  XT.com

XT.com  Render

Render  Pepe

Pepe  Arbitrum

Arbitrum  Bittensor

Bittensor  Maker

Maker  Optimism

Optimism  dogwifhat

dogwifhat  Wrapped eETH

Wrapped eETH  The Graph

The Graph