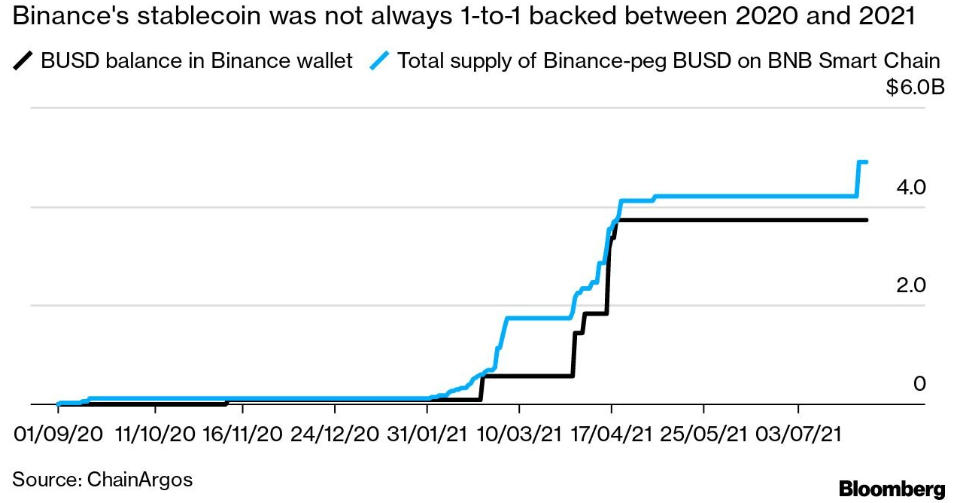

Binance failed to follow its procedures for BUSD reserves between 2020 and 2021 since it didn’t keep enough reserves to support its BUSD stablecoin, according to a report by Bloomberg.

The mismanagement led to Binance-peg BUSD being undercollateralized three times between 2020 and 2021, with collateral gaps exceeding $1 billion on each occasion, according to data shared by Jonathan Reiter, co-founder of blockchain analytics company ChainArgos.

Furthermore, Reiter analysis demonstrated that the amount of Binance-peg BUSD issued on Binance’s BNB Smart Chain network indicated that the exchange issued new Binance-peg BUSD tokens over the period without locking up the equivalent amount of Paxos-issued BUSD tokens in its Ethereum wallet as collateral.

Worth noting when users purchase Binance-Peg BUSD, Binance buys BUSD from Paxos and then mints the equivalent amount of Binance-Peg BUSD tokens on the blockchain they selected. Following that, users receive their Binance-Peg BUSD, and an equal amount of BUSD is locked on Ethereum.

Nevertheless, a Binance spokesperson has confirmed that, at present, the Binance-peg BUSD is fully backed, and there was no impact on Paxos’s BUSD. He also maintained that the earlier events were due to operational delays. The Spokesperson said:

“Recently, the process has been much improved with enhanced discrepancy checks to ensure it’s always 1-1 pegged.”

After the collapse of FTX last year, Binance faced increased withdrawals from customers and diminished trading volumes. BUSD withdrawals from the exchange led the stablecoin supply to decline by over 15% within 24 hours, according to reports from Dec. 14.

However, Binance CEO Changpeng Zhao has defended the exchange, saying that the firm will emerge stronger from its challenges.

Read More: cryptoslate.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Solana

Solana  USDC

USDC  XRP

XRP  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Toncoin

Toncoin  Cardano

Cardano  Shiba Inu

Shiba Inu  Avalanche

Avalanche  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Polkadot

Polkadot  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  NEAR Protocol

NEAR Protocol  Polygon

Polygon  Internet Computer

Internet Computer  Litecoin

Litecoin  Uniswap

Uniswap  Fetch.ai

Fetch.ai  LEO Token

LEO Token  Dai

Dai  Ethereum Classic

Ethereum Classic  Hedera

Hedera  Aptos

Aptos  First Digital USD

First Digital USD  Pepe

Pepe  Cronos

Cronos  Stacks

Stacks  Cosmos Hub

Cosmos Hub  Mantle

Mantle  Filecoin

Filecoin  Immutable

Immutable  Stellar

Stellar  dogwifhat

dogwifhat  Render

Render  XT.com

XT.com  OKB

OKB  Renzo Restaked ETH

Renzo Restaked ETH  Optimism

Optimism  Bittensor

Bittensor  Arbitrum

Arbitrum  Maker

Maker  Wrapped eETH

Wrapped eETH  The Graph

The Graph