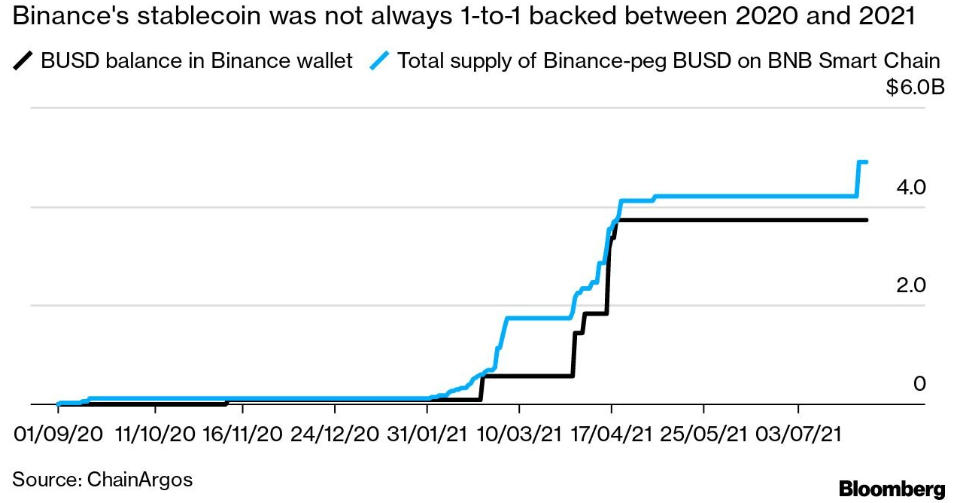

Binance failed to follow its procedures for BUSD reserves between 2020 and 2021 since it didn’t keep enough reserves to support its BUSD stablecoin, according to a report by Bloomberg.

The mismanagement led to Binance-peg BUSD being undercollateralized three times between 2020 and 2021, with collateral gaps exceeding $1 billion on each occasion, according to data shared by Jonathan Reiter, co-founder of blockchain analytics company ChainArgos.

Furthermore, Reiter analysis demonstrated that the amount of Binance-peg BUSD issued on Binance’s BNB Smart Chain network indicated that the exchange issued new Binance-peg BUSD tokens over the period without locking up the equivalent amount of Paxos-issued BUSD tokens in its Ethereum wallet as collateral.

Worth noting when users purchase Binance-Peg BUSD, Binance buys BUSD from Paxos and then mints the equivalent amount of Binance-Peg BUSD tokens on the blockchain they selected. Following that, users receive their Binance-Peg BUSD, and an equal amount of BUSD is locked on Ethereum.

Nevertheless, a Binance spokesperson has confirmed that, at present, the Binance-peg BUSD is fully backed, and there was no impact on Paxos’s BUSD. He also maintained that the earlier events were due to operational delays. The Spokesperson said:

“Recently, the process has been much improved with enhanced discrepancy checks to ensure it’s always 1-1 pegged.”

After the collapse of FTX last year, Binance faced increased withdrawals from customers and diminished trading volumes. BUSD withdrawals from the exchange led the stablecoin supply to decline by over 15% within 24 hours, according to reports from Dec. 14.

However, Binance CEO Changpeng Zhao has defended the exchange, saying that the firm will emerge stronger from its challenges.

Read More: cryptoslate.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Wrapped Bitcoin

Wrapped Bitcoin  Sui

Sui  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Avalanche

Avalanche  Hyperliquid

Hyperliquid  Stellar

Stellar  Shiba Inu

Shiba Inu  LEO Token

LEO Token  Hedera

Hedera  Bitcoin Cash

Bitcoin Cash  Toncoin

Toncoin  Litecoin

Litecoin  Polkadot

Polkadot  USDS

USDS  WETH

WETH  Monero

Monero  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Wrapped eETH

Wrapped eETH  Bitget Token

Bitget Token  Pepe

Pepe  Ethena USDe

Ethena USDe  Pi Network

Pi Network  Coinbase Wrapped BTC

Coinbase Wrapped BTC  WhiteBIT Coin

WhiteBIT Coin  Bittensor

Bittensor  Dai

Dai  Uniswap

Uniswap  Aave

Aave  NEAR Protocol

NEAR Protocol  Aptos

Aptos  OKB

OKB  Jito Staked SOL

Jito Staked SOL  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Ondo

Ondo  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Internet Computer

Internet Computer