Zcash (ZECUSD) is trading bearish for the last year, but looking at the wave structure from Elliott wave perspective, we can see it forming and potentially finishing an ending diagonal a.k.a. wedge pattern within wave (C) of an (A)-(B)-(C) correction from the highs.

Looking at the ZECUSD daily chart, we can see a leading diagonal in wave (A), then a complex W-X-Y correction in wave (B), followed by final sell-off within the wedge formation within wave (C). Well, technically speaking, ZECUSD is trading at strong support zone, but at this stage it’s important to wait for confirmations. So, only if we see sharp rebound or impulsive recovery back above 83 first bullish evidence level, only then we can confirm support in place and bulls back in the game.

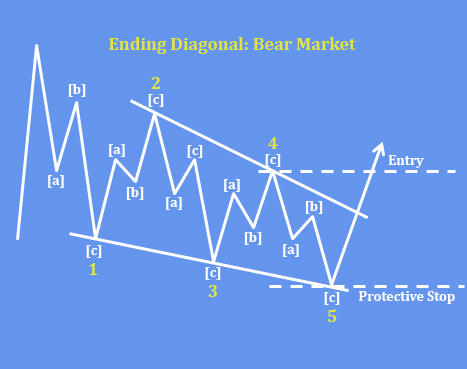

The ending diagonal (wedge) pattern is a special type of wave that occurs in wave 5 of an impulse. An ending diagonal pattern is a type of pattern that can occur at the completion of a strong move. It reflects a “calming” of the market sentiment such that price still moves generally in the direction of the larger move, but not strongly enough to produce an impulsive wave. Ending diagonals consist of five waves, labeled 1-2-3-4-5, where each wave subdivides into three legs. Waves 1 and 4 overlap in price, while wave 3 can not be the shortest amongst waves 1, 3 and 5.

LIMITE TIME OFFER for wavetraders services: Get 2 Months For Price of 1.

Read More: news.google.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Wrapped Bitcoin

Wrapped Bitcoin  Toncoin

Toncoin  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  USDS

USDS  Wrapped stETH

Wrapped stETH  Avalanche

Avalanche  Shiba Inu

Shiba Inu  Sui

Sui  Hedera

Hedera  Litecoin

Litecoin  Polkadot

Polkadot  MANTRA

MANTRA  Bitcoin Cash

Bitcoin Cash  Bitget Token

Bitget Token  WETH

WETH  Ethena USDe

Ethena USDe  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Pi Network

Pi Network  Hyperliquid

Hyperliquid  Wrapped eETH

Wrapped eETH  WhiteBIT Coin

WhiteBIT Coin  Monero

Monero  Uniswap

Uniswap  Aptos

Aptos  Dai

Dai  NEAR Protocol

NEAR Protocol  Pepe

Pepe  sUSDS

sUSDS  OKB

OKB  Gate

Gate  Cronos

Cronos  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Mantle

Mantle  Tokenize Xchange

Tokenize Xchange  Internet Computer

Internet Computer  Ethereum Classic

Ethereum Classic