Blockchain research firm Kaiko says XRP liquidity has improved “significantly” in the U.S. after July’s court ruling in the case against the SEC.

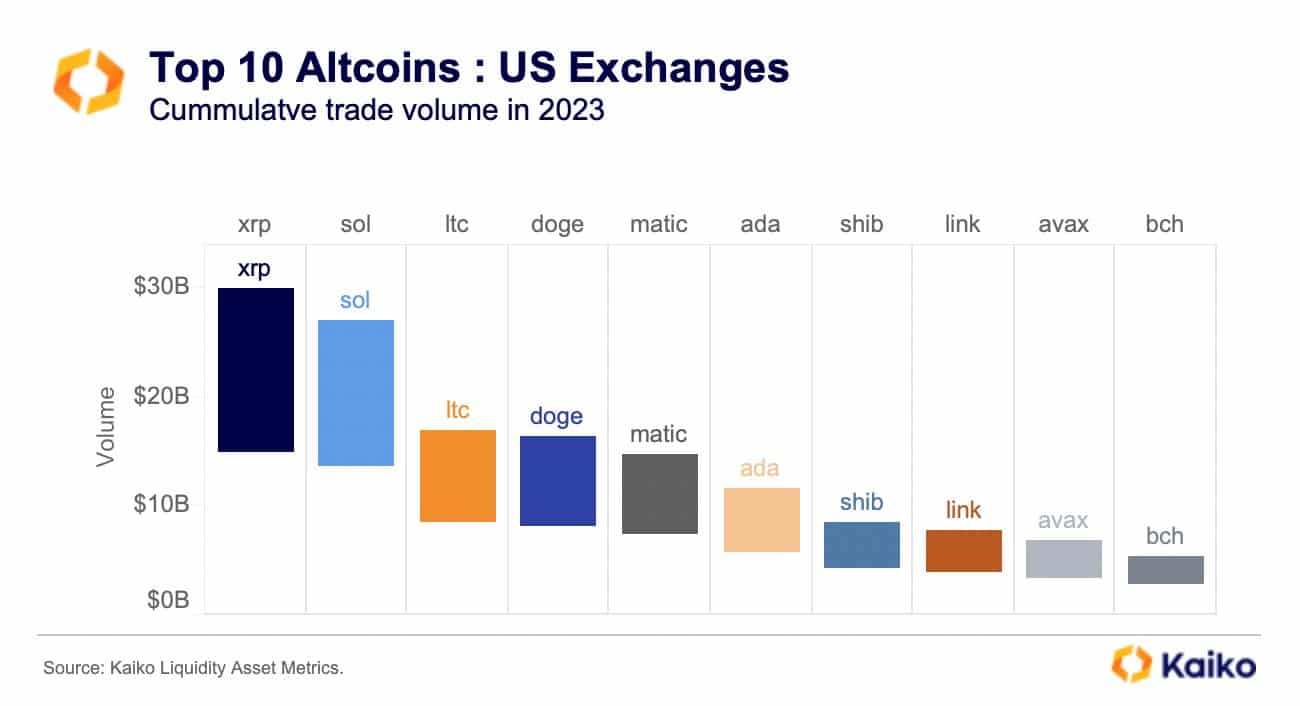

Ripple’s token XRP has become the most traded altcoin on U.S.-based platforms, surpassing Solana’s SOL token by trading volume.

According to data published by Dessislava Ianeva, a research analyst at Kaiko, XRP’s cumulative trading volume in 2023 in the U.S. reached $30 billion, while SOL has accumulated around $28 billion in trades so far.

For instance, Litecoin’s (LTC) cumulative volume is below the $20 billion mark at press time.

Kaiko claims XRP’s liquidity has improved “significantly” after Federal District judge Analisa Torres ruled that XRP is not an unregistered security, except when used to raise funds from institutions. The U.S. Securities and Exchange Commission, in its turn, argued that Ripple raised $1.3 billion via sales of XRP, which it considered as an unregistered security.

After the ruling was announced, XRP’s market depth rose from an average of $8 million in June to $12 million in early September, Kaiko notes.

“The trend could suggest that the outlook for the token has improved after the ruling, with more market makers willing to provide liquidity.”

Kaiko

The court’s ruling, however, is not a total victory for Ripple Labs as the SEC claims the recent court order in favor of Ripple Labs represents complex legal challenges that warrant an appeal of the ruling. The agency now seeks to initiate an appeal in light of the July 13 court decision, which didn’t align with the SEC’s objectives regarding overseeing cryptocurrency markets.

As of press time, XRP is trading at $0.51, according to data from CoinMarketCap.

Read More: crypto.news

QuarkChain

QuarkChain  ROAM Token

ROAM Token  DODO

DODO  MetFi

MetFi  Avant Staked USD

Avant Staked USD  Cronos Bridged WBTC (Cronos)

Cronos Bridged WBTC (Cronos)  Propy

Propy  REVOX

REVOX  Magic Internet Money (Ethereum)

Magic Internet Money (Ethereum)  Hippocrat

Hippocrat  Nobody Sausage

Nobody Sausage  Shentu

Shentu  Autonolas

Autonolas  Bridged Tether (opBNB)

Bridged Tether (opBNB)  Bedrock BTC

Bedrock BTC  Avalanche Bridged WETH (Avalanche)

Avalanche Bridged WETH (Avalanche)  Cortex

Cortex  Huobi

Huobi  Sanctum Infinity

Sanctum Infinity  BugsCoin

BugsCoin  SpaceN

SpaceN  Artificial Liquid Intelligence

Artificial Liquid Intelligence  SMARDEX

SMARDEX  Vine

Vine  Hunt

Hunt  Stronghold

Stronghold  Escoin

Escoin  LOFI

LOFI  Cobak

Cobak  Looped Hype

Looped Hype  dForce

dForce  Milady Meme Coin

Milady Meme Coin  Guild of Guardians

Guild of Guardians  Ekubo Protocol

Ekubo Protocol  Binance-Peg Avalanche

Binance-Peg Avalanche  MESSIER

MESSIER  f(x) Protocol fxUSD

f(x) Protocol fxUSD  ao Computer

ao Computer  ANyONe Protocol

ANyONe Protocol  AxonDAO Governance Token

AxonDAO Governance Token  Zedxion

Zedxion  BIM

BIM  Web 3 Dollar

Web 3 Dollar  Gemini Dollar

Gemini Dollar  HashKey Platform Token

HashKey Platform Token