Dear Bankless Nation,

L2s are big business. The opportunities are massive and it’s clear from the token market caps of many relatively early projects that users have huge expectations.

Are Rollups too centralized? And if that’s the case today, how long until they prioritize decentralization? Today, we dig into one of the big centralization solutions for rollups.

– Bankless team

Bankless Writer: 563

If you’re a DeFi nerd like me, you love a good rollup. Swapping, lending, borrowing, and trading – all for pennies – at a near-frictionless experience that a few years ago seemed unreachable. If, at times, the experience feels more similar to a centralized chain like BNB Chain as opposed to using Ethereum, well, your Spidey senses might not be too far off.

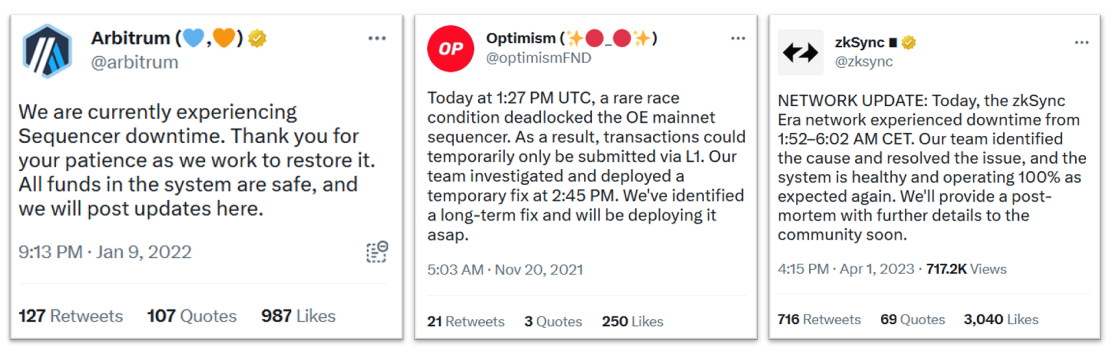

While the lightning-fast transaction confirmations and low fees have enticed DeFi users to flock to rollups, most L2s are still struggling to decentralize. And though trolls on Crypto Twitter love to rub Solana’s downtime in its users’ faces… Ethereum L2s aren’t perfect either.

The single point of failure often lies in the Sequencer for these chains. You may have heard that Arbitrum and Optimism plan on “decentralizing” their Sequencer, but how does that work? And (more importantly) why haven’t they done it yet?

The state of rollup sequencers today

When you sign a transaction on a rollup chain, it hangs out with the other transactions in the rollup’s mempool, basically an on-chain waiting room. The Sequencer then orders the transactions so they can be built into blocks and executed.

Sequencers are unique to rollups, where they are used to both efficiently package transactions, as well as give users quick (soft) commitments that their transactions will eventually be sent to the Layer 1.

Today, most rollups rely on a single in-house Sequencer to order transactions. Along with increasing the probability of downtime, this model creates trust assumptions. Dependence on centralized actors leave rollup transactors vulnerable to censorship – a major sticking point to the decentralization-maxis among us. If, for any reason whatsoever, the Sequencer doesn’t want you transacting on their chain, you may have little to no recourse in accessing your capital.

And while the seemingly-obvious solution would be to institute a method of decentralizing this crucial role, many rollup teams have prioritized increased market share over decentralization right now. These teams figure that their time is best-spent building development tools, onboarding new partners, and engaging with their community. Building the significant infrastructure needed to stand up a decentralized set of Sequencers takes time, and comes with minimal impact to the casual retail user – all not to mention the fact that these centralized Sequencers have been raking in the fees.

For these reasons, if you were to ask most projects when they intend to decentralize their Sequencer, the answer is likely “Soon!™”. But with some glaring needs visible, Shared Sequencers offer an elegant solution.

The Solution = Shared Sequencers

The concept behind a Shared Sequencer (SS) is actually quite simple. They propose to establish a decentralized network of Sequencing nodes that rollups could collectively plug into in order to replace their single centralized Sequencer.

Instead of just one Sequencer calling all of the shots, this network would elect a new leader for each round of sequencing, effectively eliminating the single-point-of-failure of liveness and censorship that comes with a centralized Sequencer.

Rollups being able to “plug” and “unplug” into these networks provides a clean transition and allows for healthy competition in the SS space. If one SS network is (for whatever reason) mistreating its users or extracting too much value, it is trivial for its rollup customers to move on to greener pastures among its competition.

So, instead of zkSync or Starknet bootstrapping the hardware for an entirely new set of sequencers from the ground-up, SS networks offer “Decentralization as a Service.” Relying on teams to be lazy about “low-priority” project milestones is a cozy little niche that SS projects are filling.

An exciting eventuality of many rollups plugging into a common SS network is atomic transactions. Since the Shared Sequencer can sequence transactions from multiple rollups simultaneously, cross-rollup operations become much simpler. Imagine being able to arbitrage ETH between Arbitrum and Optimism – with the guarantee that your buy on Arbitrum will only succeed if your sell on Optimism also goes through. This effectively allows users to cross-margin between rollups, potentially solving the liquidity fragmentation problem that is so ubiquitous in DeFi today.

Sequencer decentralization will be a big part of rollups maturing, and there are tons of options – PoS, PoE, PoA, MEVA, consensus or no consensus, the list goes on

But let’s focus on the really fun stuff here – shared sequencers (SSs), SUAVE, and X-chain atomicity

— Jon Charbonneau (@jon_charb) March 19, 2023

To recap, Shared Sequencers offer several benefits over the current design:

- Censorship resistance

- Atomic cross-rollup composability

- Liveness (low/no downtime) guarantees

- Plug-and-play solution for existing & new rollups

So – what’s the catch? Understandably, with new tech, comes new hurdles. The main concern voiced by the community boils down to value accrual and incentive distribution.

Modularizing the data flow away from the well-defined Ethereum value stream introduces some new MEV pain points, such as the possibility of the SS leeching value away from the L1 and/or aggregating MEV to the dominant SS network.

While these appear to be solvable problems, developers need to ensure that incentives don’t shift too far away from the Layer 1 chain. If sufficient value does not flow to the base layer, dishonest behavior could be expected to follow. For example, if the rollup sequencing network is siphoning off more than its fair share of MEV, it may become more profitable for a malicious validator to fork the rollup contract instead of managing it honestly.

Having a pre-built network of decentralized sequencers to plug into is a game-changer for scrappy builders. The many exciting new zero-knowledge and app-specific rollups launching on the horizon would rather be focusing on fine-tuning their product instead of having to stand up an entire set of sequencers.

The playing field

Teams like Astria, Espresso, and (tangentially) Flashbots are at the forefront of this technology and are working to help build towards a decentralized future for rollups.

Astria is fully embracing the modularity narrative with its Shared Sequencing project. Spun out from the Celestia team, Astria will be using Celestia’s Data Availability layer and plan to “dogfood” their SS with the launch of Astria EVM. Our builder readers will be excited to learn that their devnet/testnet will be live within the next few weeks.

Espresso’s SS will be using a custom consensus called HotShot, which promises higher throughput and faster finality than other designs. They also plan on engaging Ethereum’s validator set for security via restaking protocols like EigenLayer 👀. Their first testnet environment, Americano, is live now and there are some more testnets around the corner.

Never ones to be absent from a narrative, the Flashbots team is stepping up to the plate with SUAVE (or “Single Unifying Auction for Value Expression”) – looking to make the block building process more trustless and collaborative. Their novel “preferences” design offers an innovative way for users to interact with a cross-chain network of builders – each jockeying for the user’s attention.

This project will take time (likely years) to develop, and in the end, Vitalik might be right in saying that “Block production is centralized, but block validation is trustless and highly decentralized.” But it’s worth a shot in the name of decentralization… right?

These tools are moving us closer to “out of the box” decentralization, and that’s something us wannabe-Cypherpunks can rally behind. So even if “Soon!™” becomes “Never,” Shared Sequencers could offer rollups a much-needed lifeline.

Action steps:

Read More: www.bankless.com

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Avalanche

Avalanche  Sui

Sui  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Toncoin

Toncoin  Shiba Inu

Shiba Inu  Stellar

Stellar  Wrapped Bitcoin

Wrapped Bitcoin  Polkadot

Polkadot  Hedera

Hedera  WETH

WETH  Bitcoin Cash

Bitcoin Cash  Uniswap

Uniswap  Pepe

Pepe  LEO Token

LEO Token  Hyperliquid

Hyperliquid  Litecoin

Litecoin  Wrapped eETH

Wrapped eETH  NEAR Protocol

NEAR Protocol  Internet Computer

Internet Computer  Ethena USDe

Ethena USDe  USDS

USDS  Aptos

Aptos  Aave

Aave  Mantle

Mantle  Bittensor

Bittensor  Virtuals Protocol

Virtuals Protocol  POL (ex-MATIC)

POL (ex-MATIC)  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Render

Render  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  MANTRA

MANTRA  Arbitrum

Arbitrum  Tokenize Xchange

Tokenize Xchange  Ethena

Ethena  WhiteBIT Coin

WhiteBIT Coin