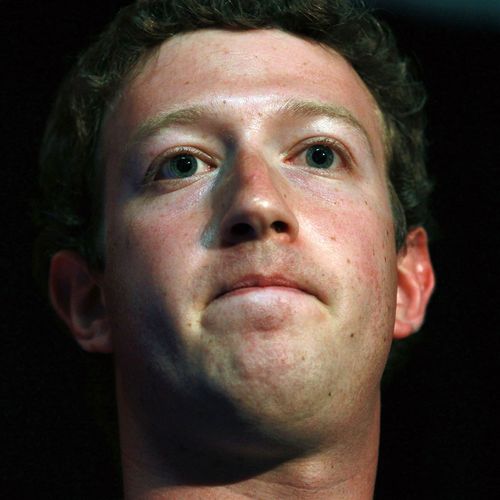

It was around this time fledgling start-up Oculus Rift caught the Facebook billionaire’s eye.

Oculus was known primarily for its fully immersive headset, and the possibilities that opened up for gaming.

“Imagine sharing not just moments with your friends online but entire experiences and adventures,” he said.

“One day, we believe this kind of immersive, augmented reality will become a part of daily life for billions of people.”

Oculus, Zuckerberg hoped, would give his company the competitive jump on rivals into the metaverse, a virtual world in which people live, work, shop and interact with others.

And Zuckerberg went in on this vision. Big.

Up to 15,000 people worked at 12 Reality Labs facilities around the world, and under Zuckerberg’s direction, Meta invested billions of dollars in their work.

Was the visionary’s gamble going pay off, they wondered, as the stock kept falling, or was one of the world’s most powerful tech companies sailing into oblivion?

In trying to answer that question, Wired magazine’s editor-at-large Steven Levy believes Zuckerberg – and Meta – will probably be victims of a phenomenon known as the innovator’s dilemma.

Coined by Harvard professor Clayton Christensen, the theory unpicks the power of disruption, and why market leaders – such as Meta – will ultimately fail as technologies and industries change.

“So they’re going to be doomed by the next wave of technology which comes over.”

The emergence of mobile technology was a “near-death experience” for Facebook, Levy said, and that experience had shaped Zuckerberg’s metaverse strategy.

Levy said Zuckberg was “paranoid” about the next big tech trend.

“He doesn’t want to be a victim of the innovator’s dilemma … so he gets obsessed with virtual reality.”

The rest is history, and in 2014 Zuckerberg acquired Oculus.

Eight years later, the jury is still out on the metaverse.

“He makes this giant bet … thinking this is the only way he could save Facebook,” Levy said.

“And now, in 2022, he’s losing his grip on being the master of this universe while chasing the next universe.”

David Katz, chief investment officer at Matrix Asset Advisors, told 9news.com.au Zuckerberg had been “tone deaf” while pouring billions and vast resources into Reality Labs’ work on the metaverse.

US technology stocks had dipped all year, Katz said, but Meta was “the worst performing” megacap tech stock of all, in large part because of the billions Zuckerberg had sanctioned towards the metaverse.

“One of the reasons that the market has been so frustrated with (Meta) is that the company has basically let costs run wild.”

Despite lingering doubts, Levy described Zuckerberg as a “genius” who should probably be given the benefit of the doubt to win his big bet, if he dialled in spiralling costs and did not lose focus on Facebook, Instagram, Reels and WhatsApp.

“He’s a visionary who has run a spectacular business,” Levy said.

Like Katz, Amanda Lotz, a professor at Queensland University of Technology’s Digital Media Research Centre, said it would be foolish to write off Zuckerberg.

But there were a number of “big unknowns” about his vision.

At its core, Meta is a company that is all about “attracting your attention so that your attention can be sold,” Lotz said.

“For the most part, we’re all creating the content that is attracting that attention.”

There is a lot of infrastructure – real and virtual – Meta must build to create its metaverse space, and the cost of that is unknown, she said.

“And the extent to which we are going to turn up (in the metaverse) and either pay to be there or buy things there or be advertised to there, those are just all really big unknowns.”

Read More: news.google.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  Wrapped Bitcoin

Wrapped Bitcoin  Hyperliquid

Hyperliquid  Sui

Sui  Wrapped stETH

Wrapped stETH  Chainlink

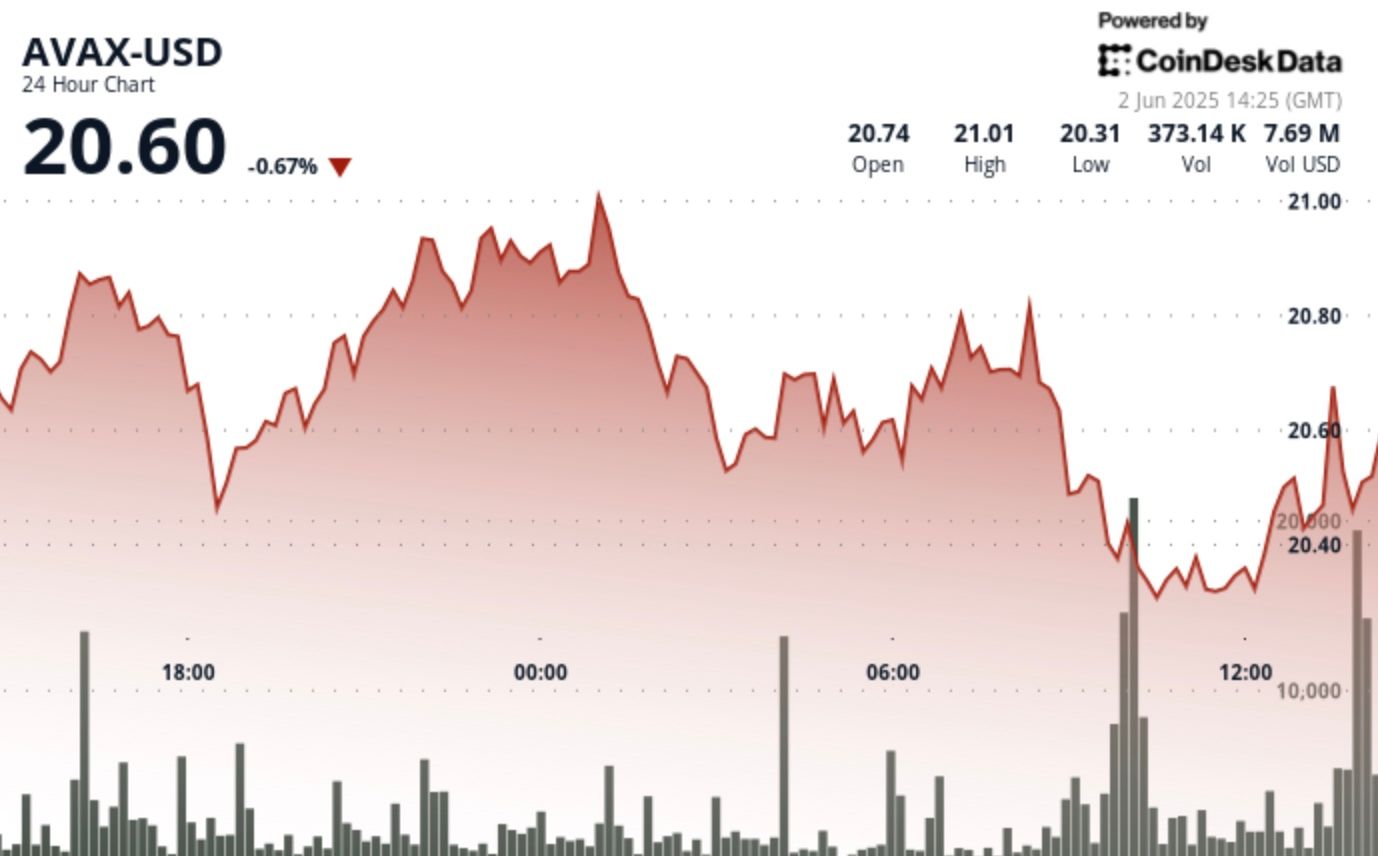

Chainlink  Avalanche

Avalanche  Stellar

Stellar  Bitcoin Cash

Bitcoin Cash  Toncoin

Toncoin  LEO Token

LEO Token  Shiba Inu

Shiba Inu  Hedera

Hedera  USDS

USDS  Litecoin

Litecoin  WETH

WETH  Monero

Monero  Wrapped eETH

Wrapped eETH  Polkadot

Polkadot  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Ethena USDe

Ethena USDe  Bitget Token

Bitget Token  Pepe

Pepe  Pi Network

Pi Network  Coinbase Wrapped BTC

Coinbase Wrapped BTC  WhiteBIT Coin

WhiteBIT Coin  Aave

Aave  Uniswap

Uniswap  Dai

Dai  Bittensor

Bittensor  Ethena Staked USDe

Ethena Staked USDe  Cronos

Cronos  Aptos

Aptos  NEAR Protocol

NEAR Protocol  OKB

OKB  Jito Staked SOL

Jito Staked SOL  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Internet Computer

Internet Computer  Ondo

Ondo  Ethereum Classic

Ethereum Classic