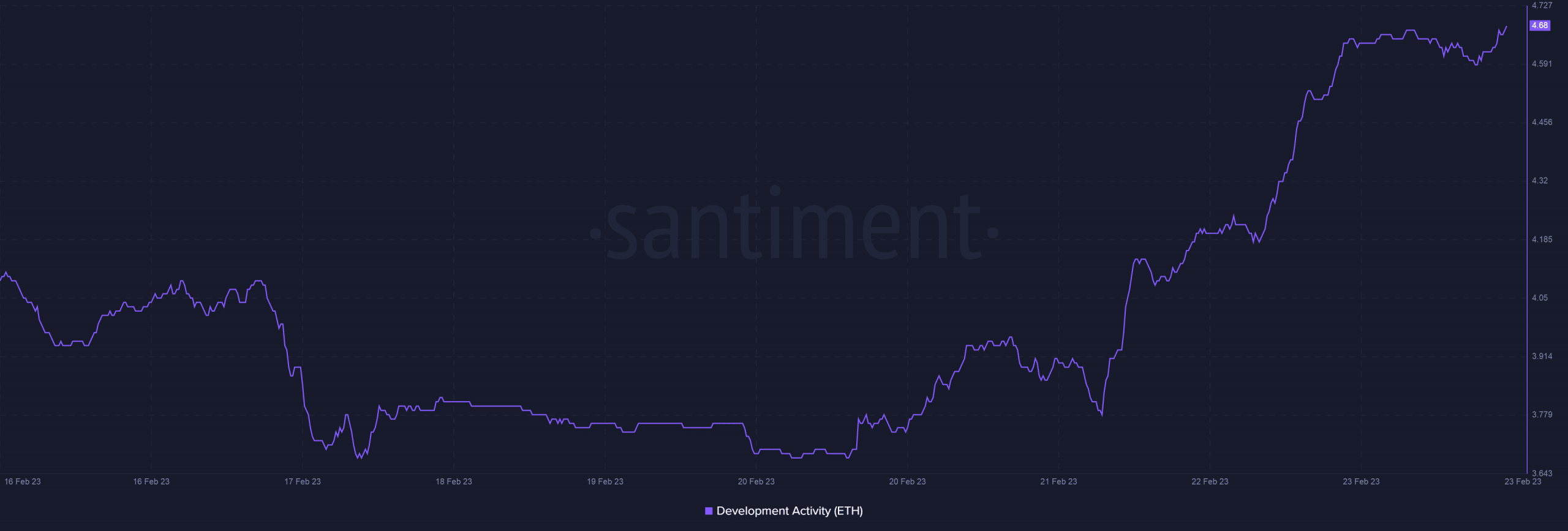

- Ethereum’s development activity jumped sharply over the past week.

- The number of long positions for ETH increased substantially over the past two days.

The Ethereum [ETH] community was upbeat about the upcoming Shanghai Upgrade which would enable the withdrawal of staked ETH, marking an end to a two-year wait.

In the build-up to the upgrade, Ethereum developers provided key updates on the testing front.

Ethereum developers have started to test MEV-Boost, builder, and relay software a few test networks where the Shanghai upgrade has been activated like the Zhejiang testnet and Devnet 7. MEV-Boost software is being tested alongside staked ETH withdrawals and so far, no issues have… https://t.co/b9nNNlPACA

— Wu Blockchain (@WuBlockchain) February 24, 2023

One of the developers gave an update about testing staked ETH withdrawals on the Zhejiang testnet and stated that no issues were found.

The team was working towards Shanghai Upgrade on the Sepolia testnet before the much-awaited launch on the Ethereum mainnet in March.

With a major upgrade around the corner, ETH developers sprung into action. The development activity jumped sharply over the past week, data from Santiment showed.

Read Ethereum’s [ETH] Price Prediction 2023-24

Stakes are high!

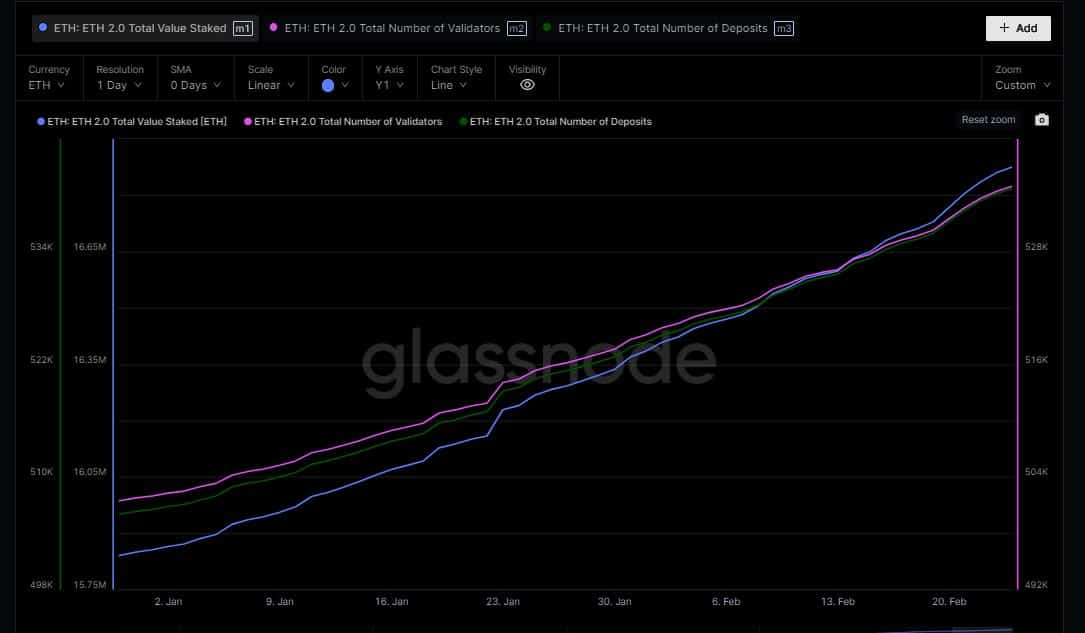

In anticipation of the Shanghai Upgrade, the Ethereum ecosystem recorded a spurt in staking activity. As per data from Glasssnode, the total value staked and the number of stakers rose steadily over the past few weeks.

At the time of writing, more than 16 million ETH were locked in the network’s smart contracts, representing a growth of 6% since the start of 2023.

The other reason behind the growth in staking could be the jump in validators’ revenue. As per Staking rewards, the revenue surged almost 40% over the last 30 days, incentivizing users to participate in staking activity.

Will ETH see a bullish pivot?

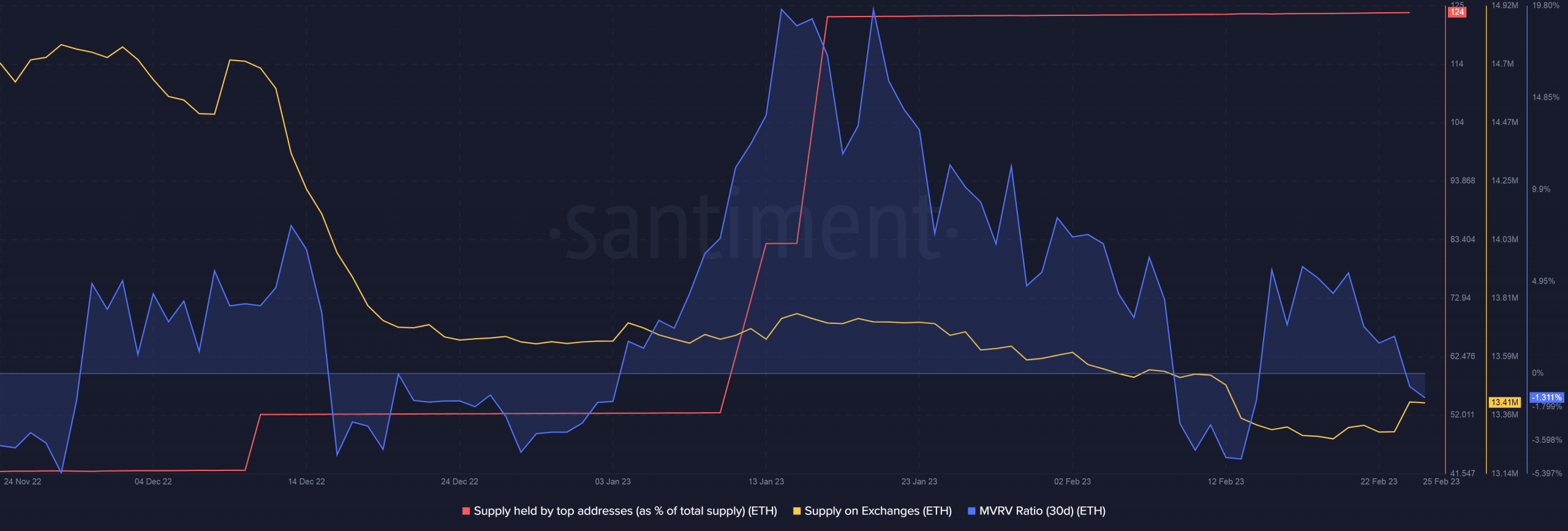

ETH dipped below $1600 at press time, data from CoinMarketCap showed. The coin was under considerable stress over the past week, having shed nearly 6% of its value.

Having said that, big addresses were bullish on ETH’s price, which was evidenced by the increasing supply held by top addresses. The dip in total supply on exchanges lent more credence to the accumulation idea.

The 30-day MVRV Ratio went into negative territory, indicating that sales won’t give back profits to ETH holders. This could keep selling activity in check and pump ETH’s price in the days to come.

Is your portfolio green? Check out the Ethereum Profit Calculator

Additionally, the number of long positions for ETH increased substantially over the past two days, implying that investors expected ETH to pump in the coming days.

Read More: ambcrypto.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  Wrapped Bitcoin

Wrapped Bitcoin  Hyperliquid

Hyperliquid  Wrapped stETH

Wrapped stETH  Sui

Sui  Chainlink

Chainlink  LEO Token

LEO Token  Avalanche

Avalanche  Stellar

Stellar  Bitcoin Cash

Bitcoin Cash  Toncoin

Toncoin  Shiba Inu

Shiba Inu  USDS

USDS  Hedera

Hedera  WETH

WETH  Wrapped eETH

Wrapped eETH  Litecoin

Litecoin  Monero

Monero  Polkadot

Polkadot  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Ethena USDe

Ethena USDe  Bitget Token

Bitget Token  Pepe

Pepe  Pi Network

Pi Network  Coinbase Wrapped BTC

Coinbase Wrapped BTC  WhiteBIT Coin

WhiteBIT Coin  Aave

Aave  Uniswap

Uniswap  Dai

Dai  Ethena Staked USDe

Ethena Staked USDe  Bittensor

Bittensor  OKB

OKB  Cronos

Cronos  Aptos

Aptos  NEAR Protocol

NEAR Protocol  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Jito Staked SOL

Jito Staked SOL  Internet Computer

Internet Computer  sUSDS

sUSDS  Ethereum Classic

Ethereum Classic