[ad_1]

Dear Bankless Nation,

You’ve probably noticed that ETH gas prices are pretty steep right now – a major contributor to this has been rampant MEV activity surrounding memecoin fever.

Today, we dig into what Ethereum developers are doing to smooth MEV incentives and give value back to everyday users.

-Bankless team

Bankless Writer: Donovan Choy

When EIP-1559 was implemented on Ethereum in August 2021, it marked the first time the network began burning ETH. The upgrade redirected a portion of the fees that users previously paid to block validators (known as the base fee) to be burned.

To date, more than 3.2 million ETH out of the current circulating supply of 120 million has been burned post-EIP-1559. Ethereum bulls love ETH burns because it makes the asset more scarce and therefore more valuable.

But, can we burn even more ETH? Ethereum devs want the network to do so. The next big “ETH burning” upgrade on the Ethereum roadmap is “MEV-burn”, what Ethereum researchers Justin Drake and Dom refer to in the Bankless podcast as a “logical continuation” of EIP-1559.

A quick MEV primer

A quick MEV primer

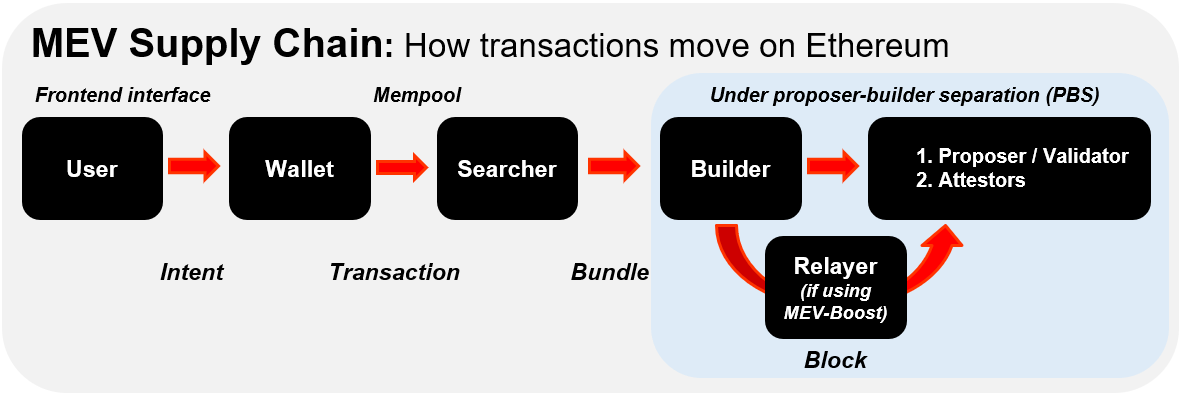

Ethereum’s original protocol design was naive. It assumed that users would simply send transactions to block validators that neutrally would build blocks, but in practice, profitable rent-seeking opportunities in block-building led to an exploitable market. This phenomenon came to be known as MEV i.e., “maximal-extractable value.” Fast forward to present and some 566K ETH has been extracted in total from ordinary Ethereum users thanks to MEV.

There are a couple of problems with MEV.

First, MEV is monetary value that is being extracted from everyday users. Second, MEV distorts the incentives for block validators to behave neutrally, which creates blockchain instability. MEV bots engage in competitive attacks like frontrunning, DDOS attacks, eclipse attacks and chain reorgs all in pursuit of a big, fat MEV bounties. Alternatively, ETH stakers on the Beacon chain may choose to have their collateral slashed if the profit from the MEV bounty exceeds it. While this doesn’t happen frequently, when it does, it’s bad for Ethereum.

The motivations behind MEV feel inevitable. Executing trades faster makes for extremely profitable opportunities that arbitrageurs and speculators are willing to pay extraordinary amounts of gas for. This blockspace demand to be first, and the “contention fees” that are produced from it, is what MEV-Burn is targeted at.

For a fuller understanding of MEV, see our

Beginner’s Guide to MEV

What is MEV-Burn?

What is MEV-Burn?

MEV-Burn is just one part of the multi-year Ethereum roadmap to address MEV problems head-on. The solution aims to return MEV to ETH holders by burning what is currently being extracted by MEV participants. This amounts to an indirect redistribution of value to ETH holders, bringing more scarcity to the asset and reducing sell pressure by block validators.

The secondary goal of MEV-Burn is to reduce chain instability by equalizing MEV profits for block builders. This is otherwise known as “MEV-smoothing”, which as its name suggests, wants to smooth out the “spike” of MEV rewards. Ethereum devs want the pursuit of MEV profits to be dull, predictable, and stable, rather than the big-game hunting affair that it is today.

Here’s where it gets tricky – in order to know how much MEV can be burned or smoothed out, the Ethereum protocol first has to find a way to quantify MEV based on how much block proposers (AKA builders) are willing to “neutrally” pay for it in a hypothetically efficient market. We don’t know those numbers today because the block building market as it exists currently is an opaque, off-chain market where volatile MEV profits abound.

This is why MEV-Burn requires another major Ethereum network upgrade known as proposer-builder separation (PBS) to first be completed. PBS splits the traditional validator role into two separate roles: proposers and block builders. The goal of PBS is to prevent block builders from being able to simultaneously select and order the transactions to be included in said block. That division of labor strips block builders of the ability to engage in the kinds of transaction discrimination that form the very essence of MEV.

When PBS is said and done, block proposers will no longer be able to tell which transactions are more valuable to include first or second. Proposers will have no choice but to submit “neutral” fee bids for the blocks that block builders have assembled for them. This market process will exist fully on-chain, as opposed to the off-chain market that is supported by Flashbot’s third-party MEV-Boost software today.

Only after all of this happens does the path to MEV-Burn begin. With full visibility into neutral block proposer bids on the Beacon chain, the Ethereum protocol can execute MEV-Burn.

The benefits of MEV-Burn

The benefits of MEV-Burn

At present, Ethereum issues 686K ETH annually as rewards for ETH validators. Note that this issuance is compounded by the result of validators coming in for a piece of MEV profits, which in turn increases issuance. MEV-Burn is expected to further cut this annual money printing by an estimated 400K – 500K ETH.

For a full breakdown of these numbers, watch the podcast episode with Justin Drake and Dom embedded above.

Stabilized MEV profits also means fewer incentives for block validators to redirect capital towards staking, particularly during bull markets when issuance rewards are heightened. This expands the economic bandwidth of ETH and preserves capital for dapp collateral such as decentralized stablecoin collateralization, lending, other forms of staking, etc.

As with many Ethereum proposals, MEV-Burn will not be ready in the short-term and is instead looking at a 3-5 year time frame. But if the reward for waiting is to finally exit the MEV dark forest, it’s probably a worthwhile wait.

Action steps:

[ad_2]

Read More: www.bankless.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Wrapped Bitcoin

Wrapped Bitcoin  Hyperliquid

Hyperliquid  Wrapped stETH

Wrapped stETH  Sui

Sui  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Chainlink

Chainlink  Stellar

Stellar  Avalanche

Avalanche  Toncoin

Toncoin  USDS

USDS  WhiteBIT Coin

WhiteBIT Coin  Shiba Inu

Shiba Inu  Wrapped eETH

Wrapped eETH  WETH

WETH  Litecoin

Litecoin  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Hedera

Hedera  Monero

Monero  Ethena USDe

Ethena USDe  Polkadot

Polkadot  Bitget Token

Bitget Token  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Uniswap

Uniswap  Pepe

Pepe  Pi Network

Pi Network  Aave

Aave  Dai

Dai  Ethena Staked USDe

Ethena Staked USDe  Bittensor

Bittensor  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  OKB

OKB  Cronos

Cronos  Aptos

Aptos  Internet Computer

Internet Computer  NEAR Protocol

NEAR Protocol  Jito Staked SOL

Jito Staked SOL  sUSDS

sUSDS  Ethereum Classic

Ethereum Classic