Galxe is your passport into Web3. Complete quests, earn rewards, and explore the Metaverse.

Dear Bankless Nation,

If you’re familiar with my writing style… you know I write some really long-form pieces.

-

Ethereum is an Emergent Structure – 5,000 words, 18 min read

-

The Protocol Sink Thesis – 5,500 words, 20 min read

-

Ultra Sound Money – 6,300 words, 23 min read

-

The Bankless Nation piece, which became the opening greeting in every single Bankless newsletter, was a whooping 11,000 words, took 40 minutes to read, and had to be split into two parts (I, II).

Previously, I’ve read these articles aloud on the Bankless YouTube, for those who prefer audio/video content… but these videos have felt uninspired, and missing the magic of YouTube-native content.

The purpose of Bankless has always been to incept the ideas and values of crypto-economics into as many people as possible, to accelerate the future, and jump the gap between the glory days of Web2 and the maturation of Web3 apps and services. In pursuit of that mission, Bankless is pioneering new frontiers!

This article is also a video essay, on a brand new Bankless YouTube channel, dedicated to hosting a new format of content: fast-paced storytelling, with all visual aids and anecdotes needed to fully understand a complex topic, in 20 minutes or less.

So if you like this kind of video content, subscribe to the new Bankless YouTube, and watch this article in video form!

Today’s piece is my model for answering the question “Why is Crypto Full of Scams?”

– David

Bankless Writer: David Hoffman, Co-Founder of Bankless

To the outside world, crypto is that corner of the internet where you go and lose money to scams and rugpulls.

It’s where some YouTuber tells you about a token thats called PAMP or SAFEMOON and its GOING TO PUMP 1000x and YOU NEED TO BUY RIGHT NOW and GET ON THE ROCKETSHIP.

That’s what crypto is, right?

Bankless readers know that’s not what we’re about.

Bankless has a different vision for crypto: a land of opportunity, a new frontier, a digital world, built on free and open-source software, that allows us to exit from the Wall Street and Silicon Valley institutions that have captured the world we live in.

So then why do most people think crypto is full of scams? And if it is full of scams, why do people keep coming to learn about it?

What keeps them curious? Or is crypto really just one big scam?

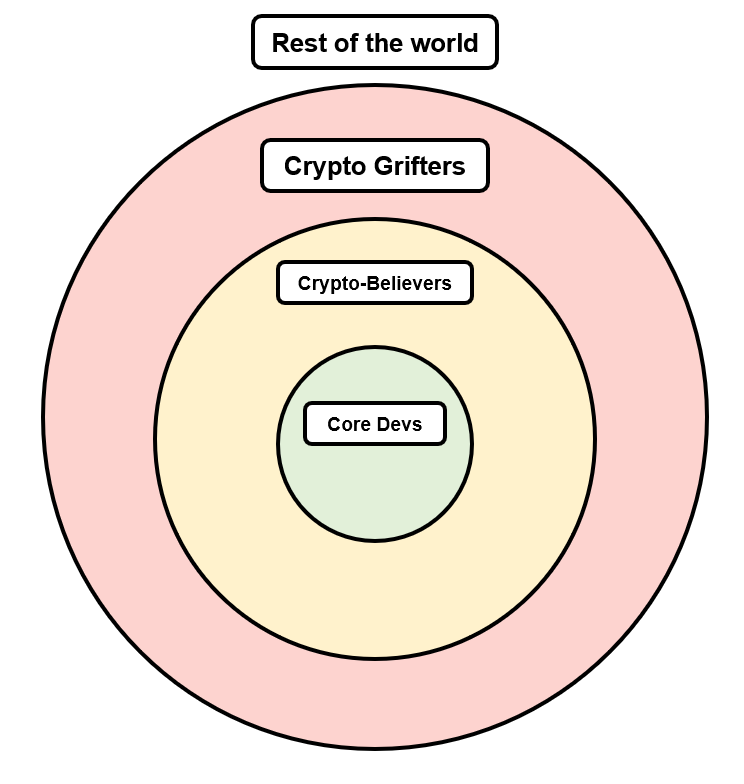

Today’s article presents my “Concentric Circles of the Crypto industry” model, which explains why so many people outside of crypto think the industry is a scam.

This mental model can help equip crypto-newbies with the knowledge that helps to navigate the Dark Forest of crypto a little easier, and with a little more understanding as to the types of people you find in crypto — which ones to pay attention to, and which ones to avoid.

My model for who composes the crypto industry is a set of four concentric circles.

The Core Devs at the center, the rest of world on the outside, with the Crypto Believers, and Grifters in the middle.

-

The Core Devs

-

Crypto-Believers

-

The Grifters

-

The rest of the world

Let’s start at the center. The Core Devs are the builders and philosophers who are building this industry out from first principles. They deeply understand the current problems of the world, how cryptography and blockchain technology are good at addressing them, and its radical implications for the future. They understand the philosophy, the code, and the moral good that this technology can bring to the world.

This is what we mean when we say “crypto values”.

In this circle, you’ll find Satoshi Nakomoto, the anonymous creator of Bitcoin, who birthed the Bitcoin blockchain, and then slowly disappeared into the internet because he knew that Bitcoin would be better if it didn’t have a leader.

You’ll also find Vitalik Buterin, the creator of Ethereum. Vitalik is a digital monk, a savant of cryptography, philosophy, math, and of course, crypto-economics, or crypto. Vitalik desires to build public goods and social systems that promote global well-being. Even while being fantastically wealthy, he’s been known to sleep in hostels and live out of a single backpack, because he doesn’t want to consume more resources than what he needs.

He is a crypto-monk for the digital age.

Being a Core Dev can be a thankless job. Building open-source software often goes unappreciated and receives limited compensation relative to the value it brings to the world.

Bitcoin Core devs work every day to make Bitcoin a little better. Ethereum core devs meet in public every week to discuss what to work on next, and what society needs out of the foundations that they’re building.

These people are here because they believe in the mission, they see a better future ahead, and they need to help build it into existence.

The Core Devs are the purists at the center of the crypto universe, and their leadership creates the ultimate gravitational pull. These are the revolutionaries of good hearts and sound minds, and for a cryptographic-power future… and they’re all huge nerds, in the best of ways.

We are here for them… and they are here for us.

The next ring out are the Crypto Believers.

These are the crypto power users. These people believe in the same future that the Core Devs are building, and are living ontop of the foundations that Core Devs have set.

But this circle is not just users! It’s also application developers, DAO members, and companies, who are all building out interwoven layers of products and services around these new protocols.

Ethereum is a protocol, and we all organize around it.

Apps like Uniswap, Aave, or Maker are built on the Ethereum app layer with smart contracts. DAOs like BanklessDAO, PleasrDAO or even Constitution DAO organize using Ethereum. Companies also organize around Ethereum, like venture funds, news agencies, or media companies… like Bankless!

This circle is filled with settlers, not tourists.

These are crypto citizens who are building structures in this new frontier, who test the products in their experimental phases, who are all slowly becoming more bankless by managing their money and property on crypto rails, and who are building new digital identities for themselves. These settlers are here to inhabit an open and free metaverse, built using open-source software and the open-source ethos.

These are people like Rune Christensen, the guy who saw the need of a decentralized dollar and created the vision for MakerDAO… before DAOs were even a thing! Now, billions of DAI exist to escape their government’s mismanaged currency.

Or Hayden Adams who single-handedly built Uniswap, a public and free asset exchange system just after learning how to code and with the help of a $10,000 grant from the Ethereum foundation.

This layer of crypto is where the values being built into the base level protocols by the Core Devs, come to be expressed in the applications that are built on top of them.

Then there are also those like Cami Russo, who lived in Argentina and experienced for herself how hyperinflation of the Argentine Peso created demand for products out of the crypto industry. DAI, the crypto-native stablecoin, has had a ton of adoption in Argentina, because it’s the tool that’s available to Argentines to escape inflation rates of 50-100%.

Cami studied journalism, and after becoming crypto-pilled, she built the media publication The Defiant.

Anthony Sassano is another one of my favorite crypto believers. He makes a video updating the world as to what happened in the Ethereum ecosystem in the last 24 hours. Every day.

This is the layer of Crypto that broadcasts the progress being made in this industry. Protocol core devs and application builders tend to not be very good at marketing themselves, because their attention is on building the future. The crypto industry relies on the surrounding community to get that done.

And this surrounding community only exists because we are all here for the same reasons: the belief that crypto is here to build a better and more free world… and that it is a necessary step for humanity to progress into the future.

This world of crypto is what a lot of the public doesn’t see or can’t comprehend.

And a big reason why that is so… is because the Crypto Grifters separate it from the rest of the world.

In between the crypto believers and the rest of world is an obstacle course…an asteroid belt, of Crypto Grifters, who make it difficult to hear the signal coming from the true spearhead of the crypto industry.

Grifters are loud, self-promoting and grandiose.

They employ polarizing tactics and styles that we’ve seen work very well in politics. Crypto Grifters aren’t stupid – they understand that there is a ton of wealth to be extracted on the crypto-frontier… and they’re here to play that game. To cut corners. To find shortcuts and take the easy way out.

They sell you fools gold and steal your money.

Crypto Grifters are why crypto has a bad name.

They’re louder and more bombastic than normal crypto folks. They market themselves more than they build technology. They often don’t care about the technology that they building, all they care is that they can make money off of it… regardless of how sustainable or ethical it is.

Crypto Grifters knowingly build malicious products meant to trap the nearest naïve crypto noobie.

They create paid Telegram channels where they share “alpha”, but actually just dump on you instead. They make convoluted DeFi projects that really just transfer money from your pocket to theirs, if you get caught in their traps.

Most Grifters show up in bull markets, and copy the thing that’s hot at the moment. They made fake ICOs in 2017 or low-effort NFT projects with Fiver in 2021.

Where there’s a profit to be made, the Grifters can smell it and they come running, ready to grift.

Crypto Grifters have a few things in common:

-

An egotistical personality… someone who is large, bombastic, and sometimes kind of a bully.

-

A small, but highly engaging and manic community comes to form around these people, a kind of cult of personality. They repeat the messages, they say the lines, and they shill a token. They silence dissent, and they’re the classic mix of both humans and bots that we’ve come to know in the world of modern social media.

-

A product or system that is fundamentally unsustainable… even if it doesn’t seem like it in the moment. A shiny new crypto product, that just doesn’t make sense under the hood… and ultimately has a date with destiny.

There was Alex Mashinsky, who built and operated Celsius, a custodial borrowing and lending service. A centralized company, that took in customers’ crypto-assets, and paid them high yields for their deposit. This is a normal business, and it’s called a bank. And there are plenty of legitimate products and services in crypto that do this.

But Mashinsky wore the banner of DeFi, and talked a big game about how DeFi will bring down the Banks. But he built a bank! Celsius took customer deposits, deployed completely irresponsible and leveraged risky trading strategies, and gambled away other people’s money.

Then there was Daniele Sesta who built the Wonderland ecosystem. Following behind Sesta closely was an army of Pepe Frog accounts swarming him wherever he would go in the internet. Crypto Twitter, YouTube comments, livestream chat boxes… you name it.

They invaded and infested the digital spaces that crypto-people spend time in, and inhabited our mind space, cause they were so god damn loud. We’ve seen this strategy before, both inside and outside of crypto, but in crypto, when theres money at stake, these internet armies can become deafening.

Anyway, Wonderland collapsed when people realized that an unbacked stablecoin is just an obfuscated ponzi scheme, and also when one of the anonymous co-founders of the project was discovered to be Michael Patryn, a convicted money launderer, and co-founder of the QuadringaCX exchange, the one with the mysterious death of the founder, after it was discovered that the exchange had become insolvent.

Then there was Do Kwon… the eccentric and aggressive founder of Terra. The biggest capital destruction event in crypto history, where $50B in capital went to zero.

The Terra ecosystem lost all its incoming money flows overnight, revealing itself to be an unsustainable structure…

…which kinda looks like a giant Ponzi in hindsight.

And just like Sesta, Do Kwon had a massive army of self-described “Lunatics”. Ryan and I were super skeptical of the Terra Luna project, and when we voiced our criticisms and dissent, we were hounded by these raving lunatics all over Twitter.

Do Kwon’s behavior enabled this. As Terra pumped, Do Kwon got louder and more aggressive on Twitter while simultaneously rallying his followers.

When Mike Novogratz, CEO of Galaxy got a Terra Luna tattoo on his arm, Ryan replied on Twitter and said “This makes me question everything I know about crypto”, to which Do Kwon snarkily responded “Don’t worry, it wasn’t much”

And there are so many other grifters out there.

Richard Heart — f#@k that guy

BitBoy — He’s the Alex Jones of Crypto

The entirety of Ripple Labs — who markets XRP currency as an “inter-bank exchange currency” then funds itself by dumping XRP on retail investors under this narrative.

The list of grifts goes on.

Yes and no.

We can’t stop the grifters directly. That’s the bargain we make when we uphold the value of permissionless above all others.

Access for everyone is a core value; it cannot be sacrificed.

Just like the internet, no one has to ask permission to use crypto… it’s a public utility in money and finance, and it’s available to anyone with an internet connection. And these public utilities become more useful over time, as the financial world of DeFi gets built and improves organically as more people use it.

Unfortunately, this same property of permissionlessness means that it’s really hard to stop grifters from grifting. Permissionless financial innovation allows us — you and me — to break free from the financial prisons that Banks and Wall Street put us in, but it also means it’s tough to stop others from trying to make unethical money.

While we can’t stop them head-on, we don’t have to live with them.

We fight them with education. As an industry, we do need to get better at reaching the masses before the grifters do. The massive marketing efforts that leverage grandiose and bombastic tactics are hard to compete with. Crypto is complicated, and understanding what makes this industry tick is harder than just listening to some charismatic individual who’s telling you to buy their token.

The good news is that today, most people have a basic intuition to stay away from spam emails and viruses on the internet.

Eventually, crypto will be no different.

Bankless is here to fight the grifters head on, and make sure that the good being built here is expressed to the rest of the world, so the world can know that Crypto is here to set you free… and that we hate the grifters as much as you do.

Since the dawn of Crypto… the Grifters have always managed to find the ears and eyes of the crypto noobies, and sell them snake oil, before the crypto believers can find them.

They hard to fight, because they’re aggressive and hungry, and they also have to grift better than their fellow grifters… because only the best grifters win.

At Bankless, we use this metaphor of ‘Going West’ in crypto. Going into the frontier… into the unknown. In pursuit of new opportunity, on new horizons. There’s potential out here, and we all want to get wealthy while we build out this new land, together.

And as you go westward… you may run into bandits. Highwaymen. Thugs. Traps. They steal your money, and make your life difficult.

But it is possible to avoid them, if you know how to identify the signals

The best way to take on the crypto frontier is together. As a group. Which is why we built the Bankless Nation, a collective group of west-going individuals, who have all hitched our wagons together, because we can teach each other the tricks and tips to making big in crypto, and avoiding the traps and scammers.

Crypto is risky. You could lose what you put in.

It’s not for everyone, but we are headed west.

This is the frontier. Isn’t not for everyone, but we’re glad you’re with us on the Bankless journey. Thanks a lot.

Subscribe to Bankless. $22 per mo. Includes archive access, Inner Circle & Badge.

👉 Explore the FuelVM and discover its superior developer experience!

Want to get featured on Bankless? Send your article to submissions@banklesshq.com

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. Additionally, the Bankless writers hold crypto assets. See our investment disclosures here.

Read More: newsletter.banklesshq.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Solana

Solana  XRP

XRP  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  Avalanche

Avalanche  TRON

TRON  Toncoin

Toncoin  Stellar

Stellar  Wrapped stETH

Wrapped stETH  Shiba Inu

Shiba Inu  Wrapped Bitcoin

Wrapped Bitcoin  Polkadot

Polkadot  Chainlink

Chainlink  WETH

WETH  Bitcoin Cash

Bitcoin Cash  Sui

Sui  Pepe

Pepe  NEAR Protocol

NEAR Protocol  LEO Token

LEO Token  Uniswap

Uniswap  Litecoin

Litecoin  Wrapped eETH

Wrapped eETH  Aptos

Aptos  Hedera

Hedera  Internet Computer

Internet Computer  USDS

USDS  Cronos

Cronos  Ethereum Classic

Ethereum Classic  POL (ex-MATIC)

POL (ex-MATIC)  Render

Render  Bittensor

Bittensor  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Ethena USDe

Ethena USDe  Arbitrum

Arbitrum  Filecoin

Filecoin  Celestia

Celestia  Dai

Dai  Algorand

Algorand  Stacks

Stacks  Bonk

Bonk  WhiteBIT Coin

WhiteBIT Coin  Cosmos Hub

Cosmos Hub