We’ve updated our airdrop guide for our Bankless Premium members! Explore dozens of opportunities to earn the next big airdrop when you subscribe.

Also access the Inner Circle Discord, claim your community badge, and enjoy exclusive Token reports and premium content when you subscribe!

Dear Bankless nation,

Here’s a recap of the biggest crypto news in the second week of October.

There’s a bunch of hacks and exploits across DeFi this week, starting with the Solana-based trading protocol Mango Markets. The protocol was fairly widely used, with one of the top transaction counts in Solana Q2.

The first thing to note about the Mango Markets (MNGO) hack is that it’s not really a hack, but market manipulation that played by all the rules. A quick summary: The attacker opened a perpetuals position on MNGO with his first account, which he then longed on a second account, shooting up the spot price of MNGO from $0.03 to $0.91.

With paper profits on his second account, he took a loan of ~$120M on the protocol that wiped out the protocol’s treasury (see Joshua Lim’s tweet thread and OtterSec for more details).

The attacker then created a governance proposal which offered to pay back about half of the loaned money in exchange for not criminally prosecuting him (he also voted yes on it). That vote didn’t pass. As of the latest, Mango DAO is agreeing to pay the attacker a whopping $47M bounty.

The attacker is alleged to be ponzishorter.eth AKA Avraham Eisenberg.

Temple DAO is an old Ethereum-based Olympus DAO fork. Users earn a share of its treasury yields by staking its FRAX-backed native token TEMPLE. The DAO launched Stax Finance in May, introducing liquid staking for stakers. A smart contract error on Stax’s code enabled one hacker to drain ~$2.3M on Oct 11. In its official post-mortem:

At 9:11am EST, A total of 321,154 xLP tokens were taken from the xLP Staking contract. These tokens were swapped for precisely 1,418,303 $TEMPLE and 1,262,438 $FRAX. 1,418,303 $TEMPLE was then sold for 1,116,243 FRAX.

Rabby Wallet is a self-custodial Ethereum-based browser extension wallet by DeBank that supports more than 30 chains. The protocol suffered a hack due to a smart contract bug. If you’re a user, check for your address and revoke approvals for the wallet’s swap service.

2/ We’ve organized a list of affected addresses which still have approvals for the exploited contracts. Please examine if your address is on the list and revoke approvals for Rabby Swap ASAP.

Do Bored Ape Yacht Club NFTs constitute securities? That’s the question the SEC is asking this week as it turns its regulatory eye to Yuga Labs. As originally reported in Bloomberg:

The SEC is examining whether certain nonfungible tokens from the Miami-based company are more akin to stocks and should follow the same disclosure rules… [The SEC] is also examining the distribution of ApeCoin, which was given to holders of Bored Ape Yacht Club and related NFTs.

ApeCoin, if you recall, was launched back in March as the official token for the Yuga Lab’s “Otherside” Metaverse, around the same time that Yuga Labs bought the CryptoPunks and Meebits NFT collections from Larva Labs.

Note that even though APE was airdropped to BAYC holders, and even though Yuga Labs announced its intentions to adopt APE as the token for its own products, ApeCoin was positioned under operation by “ApeCoin DAO”, which in turn is supported by “Ape Foundation” and officially unaffiliated from Yuga Labs. Whether or not the eye of Sauron will accept that distinction is a whole different question. See more on this on William Peaster’s Metaversal.

You can read the full brief here. Support Coin Center by donating here.

We’re looking at Bitcoin next week – here’s what’s lined up:

-

William is taking a journey down the Bitcoin DeFi ecosystem

-

Noah Smith is joining us on the pod

-

Muneeb Ali is giving us the lowdown on Bitcoin DeFi’s latest

– Donovan

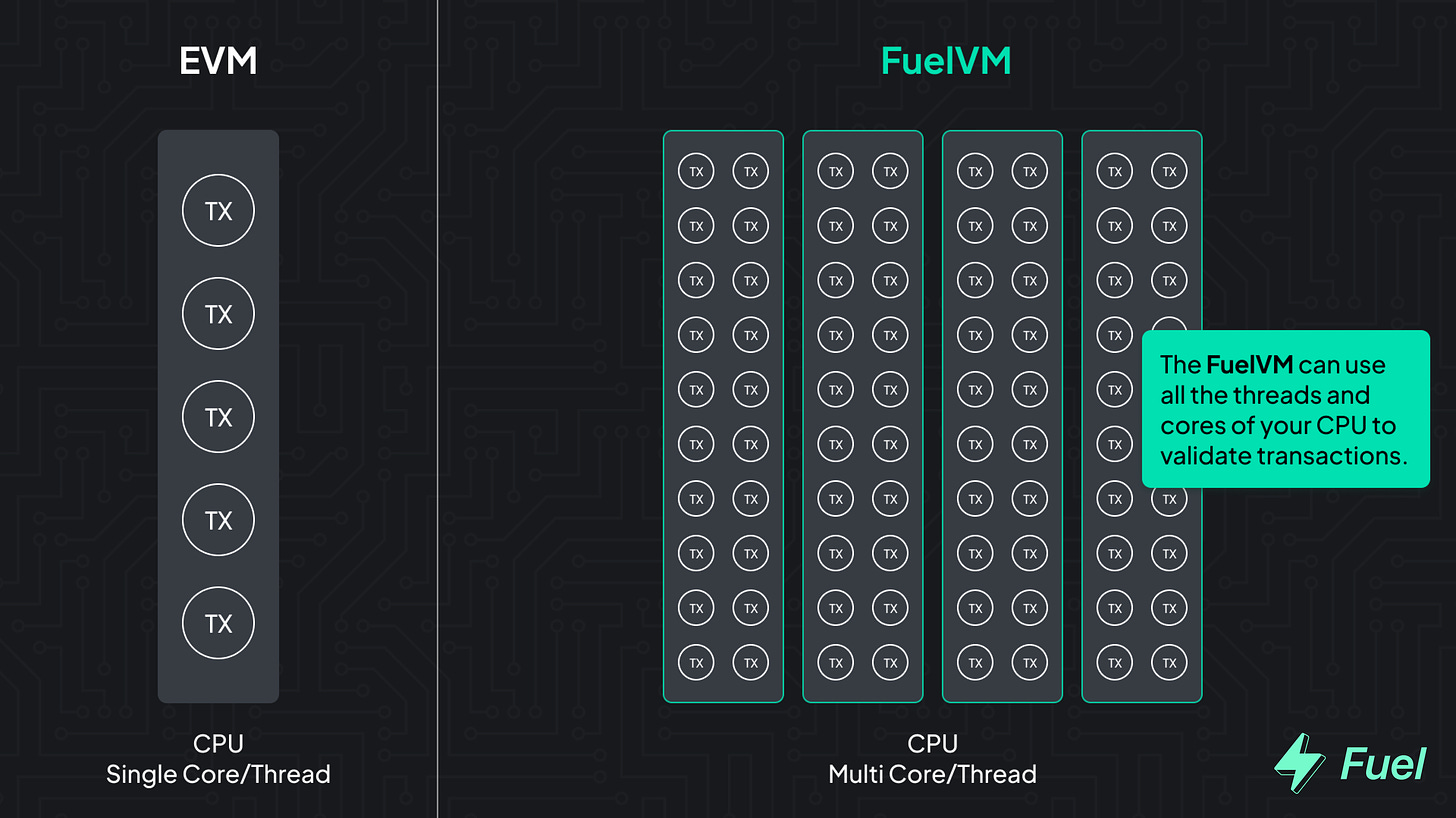

👉 Explore the FuelVM and discover its superior developer experience!

Listen to podcast episode | Apple | Spotify | YouTube | RSS Feed

Bankless Premium Members get access to perks like these:

Launch your own raffle for Bankless Badge holders! Go ahead. We can’t stop you.

🗞️ Latest Weekly Rollup! Download the week in crypto to your brain in one show.

Listen to podcast episode | Apple | Spotify | YouTube | RSS Feed

✨See all listings on the Bankless Job Board✨

Go Bankless. $22 / mo. Includes archive access, Inner Circle & Badge—(pay w/ crypto)

Modular blockchains are the future. L2s alone won’t solve the scaling problem; for this, we need to move toward a modular architecture. Fuel is the fastest execution layer for the modular blockchain stack, enabling maximum security and the highest flexible throughput.

👉 Go beyond the limitations of the EVM: explore the FuelVM

Want to get featured on Bankless? Send your article to submissions@banklesshq.com

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. Additionally, the Bankless writers hold crypto assets. See our investment disclosures here.

Read More: newsletter.banklesshq.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Avalanche

Avalanche  Sui

Sui  Wrapped stETH

Wrapped stETH  Toncoin

Toncoin  Shiba Inu

Shiba Inu  Chainlink

Chainlink  Wrapped Bitcoin

Wrapped Bitcoin  Stellar

Stellar  Hedera

Hedera  Polkadot

Polkadot  WETH

WETH  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Uniswap

Uniswap  Pepe

Pepe  Hyperliquid

Hyperliquid  Wrapped eETH

Wrapped eETH  NEAR Protocol

NEAR Protocol  Ethena USDe

Ethena USDe  USDS

USDS  Internet Computer

Internet Computer  Aptos

Aptos  Aave

Aave  Mantle

Mantle  POL (ex-MATIC)

POL (ex-MATIC)  Cronos

Cronos  MANTRA

MANTRA  Ethereum Classic

Ethereum Classic  Render

Render  Bittensor

Bittensor  Monero

Monero  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Tokenize Xchange

Tokenize Xchange  Dai

Dai  Virtuals Protocol

Virtuals Protocol  Arbitrum

Arbitrum