In Brief

The crypto market saw significant activity this week, with Bitcoin, Ethereum, and TON experiencing price surges, increased institutional interest through ETF developments and inflows, and notable blockchain advancements, despite some volatility caused by factors like German government Bitcoin sales and Mt. Gox repayments.

Bitcoin News & Macro

Bitcoin has had a dramatic week, with major price and sentiment swings keeping investors on the edge. The German government caused major jitters, dumping 3,000 BTC in just one hour. This led to worries about more sell-offs as Germany plans to release another $276 million worth of Bitcoin.

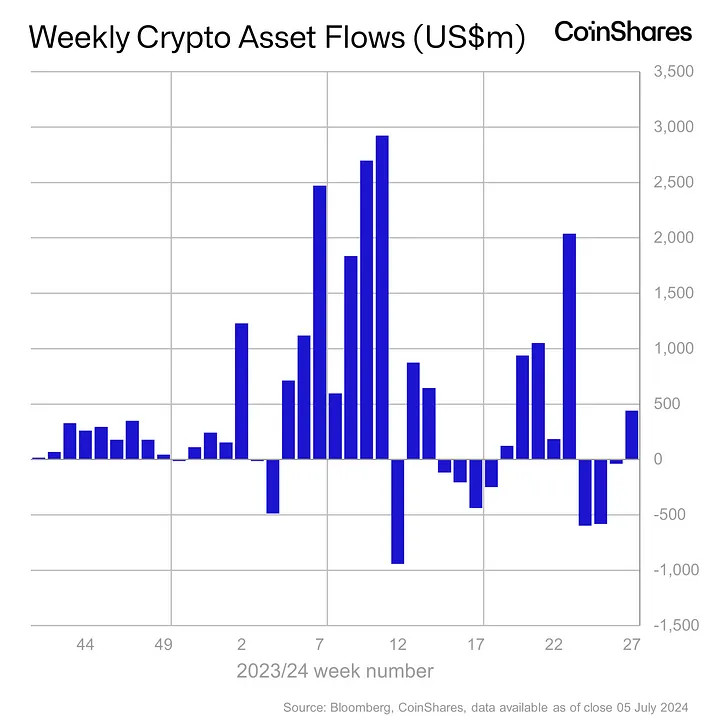

Source: CoinShares

Interestingly, this pressure saw $441 million in digital asset inflows as investors bought the dip.

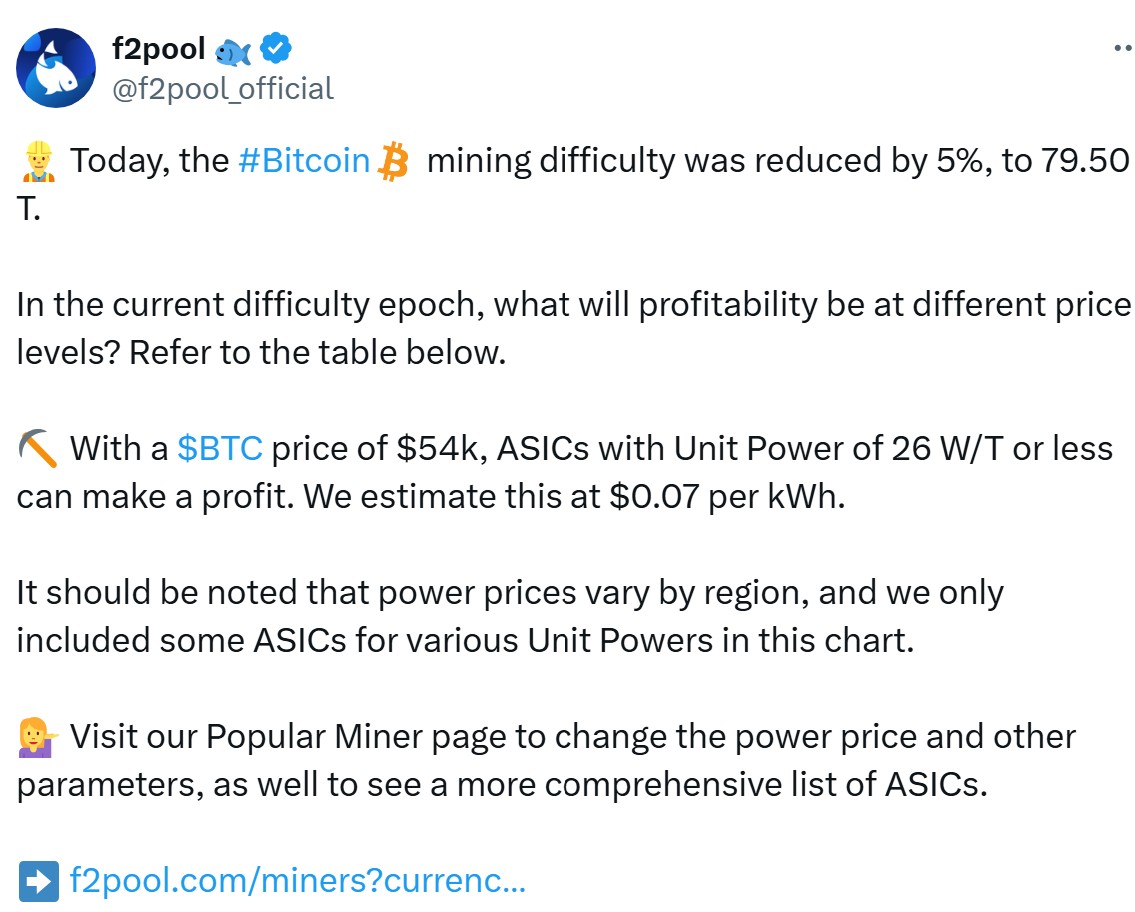

Source: F2Pool

Mining difficulty hit its lowest since March, giving miners some relief. Meanwhile, Metaplanet’s $2.5 million Bitcoin purchase showed continued corporate interest.

Adding to the volatility, Mt. Gox repayments began, stirring uncertainty. Germany’s relentless BTC sell-off kept weighing on prices, even with robust institutional buying, as seen from substantial Bitcoin ETF inflows.

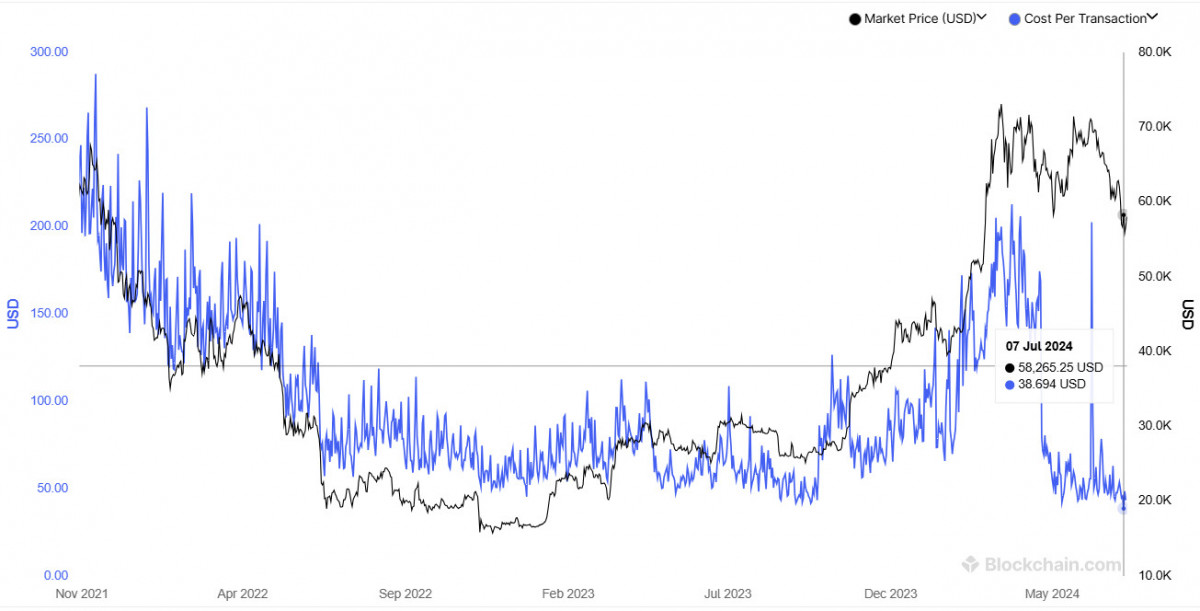

Source: Blockchain.com

Transaction fees hit 2020 lows, signaling network challenges, while traders’ profit margins echoed the 2022 bear market. Yet, Bitcoin whales used the slump to accumulate more BTC.

In a dramatic twist, Bitcoin surged to $62K, leading analysts to suggest the worst might be over. Despite this renewed optimism, high volatility remains, leaving the market cautiously optimistic about the future. Despite bearish trends, some analysts thought Bitcoin might have bottomed out at $53K. However, resistance at $58,500 and $60,000 is still strong.

BTC Price Analysis

Starting with the daily chart, Bitcoin saw a solid rally around July 10th, jumping from about $54,000 to $63,000 by July 15th, a hefty 23% surge. The $54,000 mark acted as strong support, halting the downtrend.

Source: TradingView

The rally broke through several resistance levels, with $60,000 being a major hurdle. Once past this, $60,000 turned into a new support. Historically, breaking this level suggests a sentiment shift, making $65,000 the next target. Should the 20-EMA and 50-EMA converge, this could indicate a golden cross, another positive sign.

Source: TradingView

On the 4-hour chart, after hitting $54,000, Bitcoin entered an accumulation phase. The momentum turned bullish once the price broke above 50-EMA, which was confirmed by the RSI as moving into overbought territory at 79.38.

A strong weekly close above $60,000 indicates steady bullish interest, while daily closes above this level suggest readiness for higher prices. Key levels to watch are $60,000 as support and $65,000 as the next major resistance. If bullish momentum holds and the price stays above key moving averages, Bitcoin could retest and possibly break previous highs.

Ethereum News & Macro

The Ethereum camp has been buzzing with excitement, ignited by Invesco’s Ether ETF introducing competitive fees, sparking institutional interest, and echoing Bitcoin’s recent buzz around ETF approvals.

MetaMask unveiled a new toolkit for Web3, while Ethereum prepped a $2 million ‘Attackathon’ to boost security. Talk of a rally above $3,400 gained traction with bullish metrics, similar to Bitcoin’s struggle with key price levels.

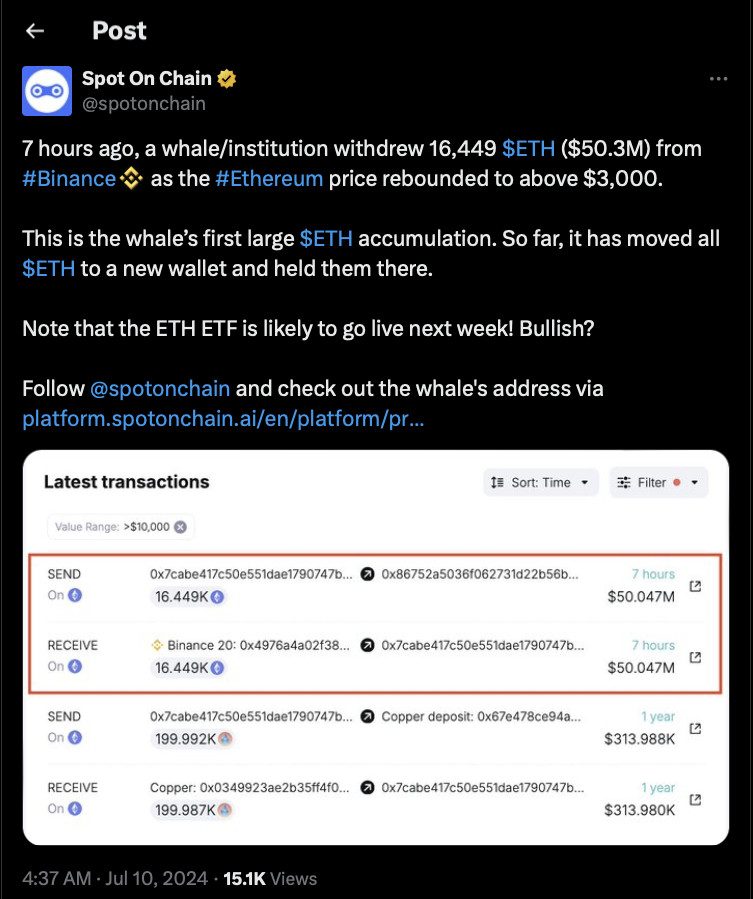

Source: @spotonchain

Whale transfers of $50 million in ETH ahead of ETF approvals showed strong investor confidence, much like Bitcoin whales buying during price dips. Despite hiccups like the Inferno Drainer’s failed heist, Ethereum’s momentum remained strong.

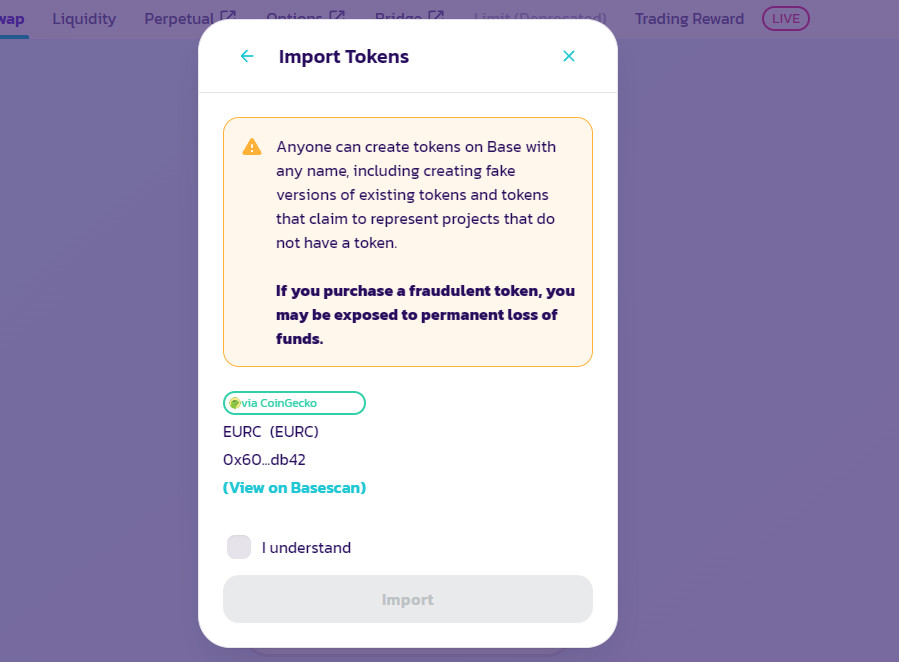

Source: PancakeSwap

Circle’s euro-backed stablecoin EURC launch on Base and Starknet’s staking rollout further boosted Ethereum’s clout. Analysts predict ETF approvals could bring $10 billion in ETH inflows, setting the stage for new price heights, paralleling Bitcoin’s ETF-driven optimism.

ETH Price Analysis

Now, let’s talk price action, starting with the daily chart. Ethereum launched a solid rally around July 10th, bouncing off the $2,800 support level. By July 15th, ETH surged to around $3,350, mirroring Bitcoin’s impressive run.

Source: TradingView

The $2,800 mark held firm as support, stopping the downtrend cold and setting the stage for the rally. As ETH surged, it blasted through several resistance levels, especially around $3,150. This breakout turned old resistance into new support, a classic bullish sign. Now, with $3,150 as a new floor, future gains seem likely. Historically, breaking above this level shifts market sentiment, similar to Bitcoin’s break above $60,000. The convergence of the 20-EMA and 50-EMA could even suggest a golden cross, just like what we’ve seen in Bitcoin.

Source: TradingView

Zooming into the 4-hour chart, the price action also closely mirrors Bitcoin’s. After hitting $2,800, ETH entered accumulation. But once it broke above the 50-EMA on the 4-hour chart, momentum turned sharply bullish. The RSI shot into the overbought zone at 79.93, signaling strong buying pressure.

A strong weekly close above $3,150 shows steady bullish interest, while daily closes above this level suggest the market is ready for higher prices. These levels line up with Bitcoin’s broader bullish trend, boosting the overall market sentiment.

Traders should watch $3,150 as support and $3,400 as the next major resistance. If the bullish momentum holds and the price stays above key moving averages, Ethereum could retest and possibly break previous highs.

Toncoin News & Macro

Let us now move over to the Toncoin camp. On July 9, the Ton Application Chain joined forces with Polygon to launch a new layer-2 integration. This move is set to flood the TON ecosystem with new apps, including DeFi and GameFi. Can never have too many hamsters, can we?

Source: Unknown

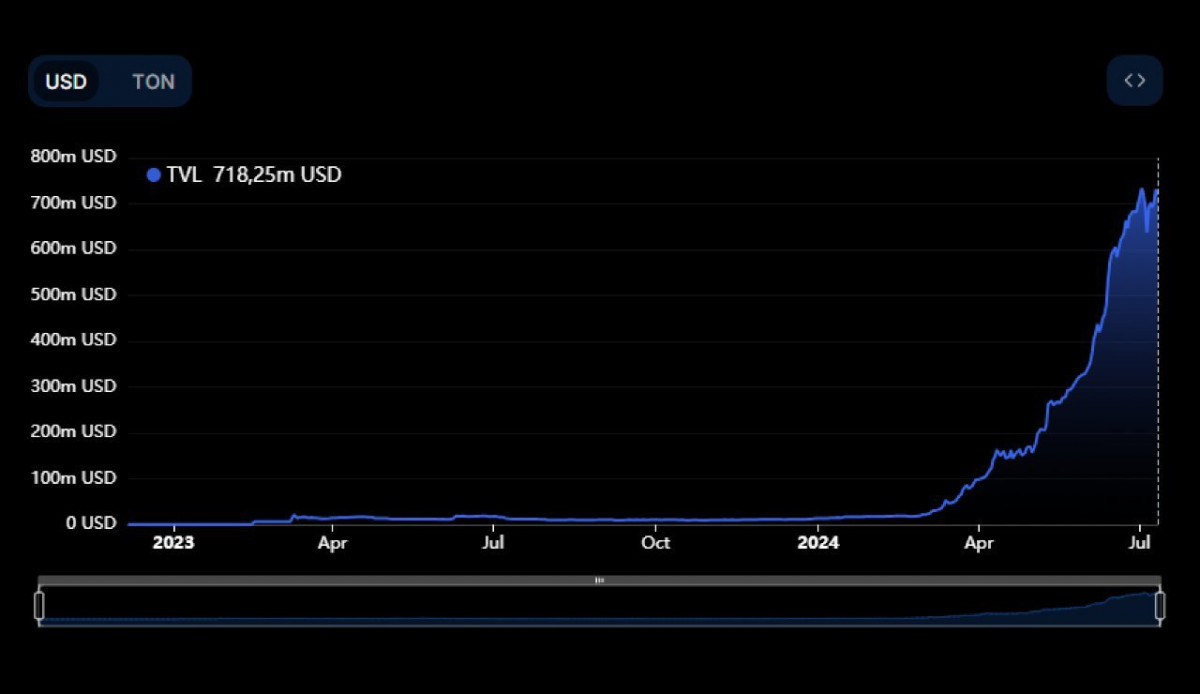

The total value locked (TVL) in TON rocketed past $700 million, a massive leap from $13 million at the start of the year – a clear sign of growing institutional interest.

Adding to the buzz, 1inch and the TON Foundation unveiled a startup accelerator to boost user experience in the TON network, focusing on projects linking Web2 and Web3.

Source: @ByBit_Official

On the market front, Bybit showcased TON’s rising traction by listing Hamster Kombat on the premarket.

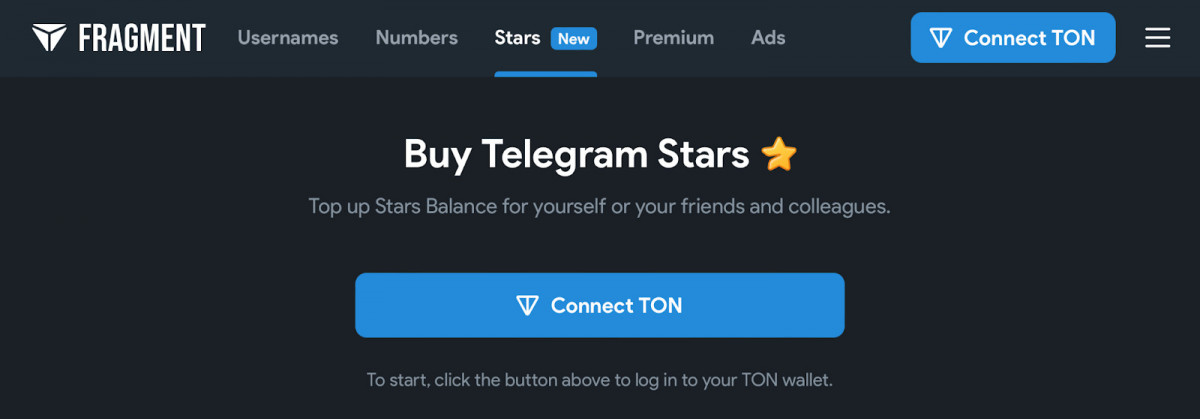

Source: Fragment

Meanwhile, the launch of Telegram Stars, which can be bought with TON, highlighted the coin’s growing sway in digital payments. Does Ethereum’s new euro-backed stablecoin have a competitor now? Only time will tell.

Now, let’s move over to the TON price chart.

TON Price Analysis

Echoing the bullish vibes from Bitcoin and Ethereum, Toncoin’s price also had an action-packed week. On the daily chart, TON picked up steam around July 6th, bouncing off support at $6.30 and climbing to about $7.50 by July 15th.

Source: TradingView

The $6.30 mark held firm, stopping the downtrend. As TON surged, it smashed through the $7.15 resistance, flipping it into new support. With $7.15 as a floor, TON looks set for more gains. TON crossed above the 20-EMA and is now around the 50-EMA at $7.18. A close above this would be a strong bullish signal. If the 20-EMA crosses above the 50-EMA, we could see a golden cross, similar to Bitcoin and Ethereum.

Source: TradingView

After hitting $6.30, TON also entered an accumulation phase. Breaking above the 50-EMA turned momentum bullish, confirmed by the RSI moving into the overbought zone at 65.27. An ascending triangle with resistance at $7.15 and rising lows led to a breakout around July 12th.

A strong weekly close above $7.15 indicates steady bullish interest, while daily closes above this level suggest higher prices. These levels align with bullish trends in Bitcoin and Ethereum. Key levels to watch are $7.15 as support and $8.00 as the next major resistance. If the bullish momentum holds and prices stay above key moving averages, TON could retest and possibly break previous highs. This ongoing momentum, alongside Bitcoin and Ethereum’s moves, signals a potential bullish turn for the crypto market.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Viktoriia is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.

Viktoriia is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.

Read More: mpost.io

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  Wrapped Bitcoin

Wrapped Bitcoin  Hyperliquid

Hyperliquid  Sui

Sui  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Avalanche

Avalanche  LEO Token

LEO Token  Stellar

Stellar  Bitcoin Cash

Bitcoin Cash  Toncoin

Toncoin  Shiba Inu

Shiba Inu  Hedera

Hedera  USDS

USDS  Litecoin

Litecoin  WETH

WETH  Wrapped eETH

Wrapped eETH  Polkadot

Polkadot  Monero

Monero  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Ethena USDe

Ethena USDe  Bitget Token

Bitget Token  Pepe

Pepe  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Pi Network

Pi Network  WhiteBIT Coin

WhiteBIT Coin  Aave

Aave  Uniswap

Uniswap  Dai

Dai  Ethena Staked USDe

Ethena Staked USDe  Bittensor

Bittensor  OKB

OKB  Aptos

Aptos  NEAR Protocol

NEAR Protocol  Cronos

Cronos  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Jito Staked SOL

Jito Staked SOL  Internet Computer

Internet Computer  Ondo

Ondo  Ethereum Classic

Ethereum Classic