[ad_1]

Metaverse Post introduces the Fundraising Report for the first quarter of 2023. In this report, we explore the trends in the crypto and web3 sectors and identify the most notable industries and key players of the first quarter of 2023.

In Q1, several events shook the state of the crypto industry to the core, especially the collapse of several banks, including Silicon Valley Bank, Silvergate Bank, Signature Bank, and Credit Suisse, and we are still yet to see the full impact it will have on the industry long term. Undoubtedly, the boom of AI and OpenAI’s release of the new pre-trained model, GPT-4, also impacted the state of crypto fundraisers.

Overall, in the first quarter of 2023, a total of 108 web3 companies raised a total of $814,287,823. The startups are divided into several subcategories: metaverse, gaming, AI, social, AR and VR, and others. Out of these, nine metaverse projects raised $56,301,000. Twenty-five NFT-related companies raised a total of $79,040,000 in the first three months of 2023.

Notably, in 2022, 348 companies specializing in NFT, metaverse, gaming, AI, VR, and AR, raised a total of $7,164,997,888. The result was $4.8 billion higher than in 2021.

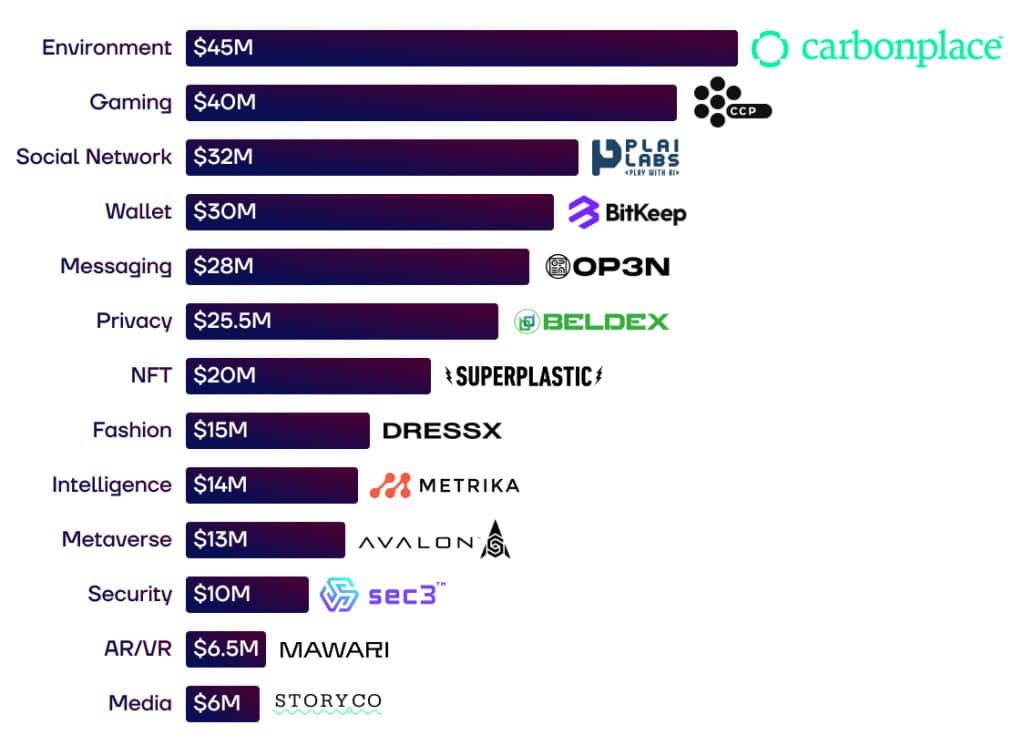

Trends in web3 – top projects by category

In the first quarter of 2023, 95 web3 startups raised a total of $727,287,823.95. Gaming and environment industries are the leading ones in Q1 2023.

Environment

Environmental startup Carbonplace received $45 million from nine banks. BBVA, BNP Paribas, Standard Chartered, CIBC, Itaú Unibanco, NatWest, National Australia Bank, SMBC, and UBS participated in the company’s strategic round.

GrainChain, an agricultural transaction platform with blockchain and IOT-powered solutions, raised $29 million in a round backed by Overstock, Pelion Venture Partners, and Brigham Young University.

Gaming

Overall, the gaming category saw 23 startups raise $201,720,473. The number is not as impressive as last year when the industry received $4,487.3 million.

The creators of sci-fi spacefaring MMO EVE Online, CCP Games is the lead, having raised $40 million in a seed round led by Andreessen Horowitz. Makers Fund, BITKRAFT, HASHED, Kingsway Capital, and Nexon are among the participants.

Web3 soccer gaming platform Matchday received $21 million in a seed round backed by Courtside Ventures, Capricorn Investment Group, Greylock, HackVC, and Horizons Ventures.

Indian web3 gaming studio Kratos Studio raised $20 million in a seed round led by Accel. Other participants include Prosus Ventures, Courtside Ventures, Nexus Venture Partners, and Nazara Technologies. The company also acquired a sub-DAO of Yield Guild Games DAO, IndiGG.

Metaverse

Metaverse-focused gaming studio Avalon Corp. raised $13 million in a round led by Bitkraft Ventures, Hashed, Delphi Digital, and Mechanism Capital. Coinbase Ventures, Yield Guild Games, Merit Circle, Avocado Guild, and Morningstar Ventures are among the backers.

User-generated content metaverse engine Createra raised $10 million in a Series A round led by Andreessen Horowitz.

Ethereum-based MMORG NFT game Worldwide Webb received $10 million in a Series A round led by Pantera Capital.

Messaging

Web3 messaging platform OP3N received $28 million in a Series A round led by the entertainment giant Animoca Brands. The other participants include Dragonfly Capital, SuperScrypt, Connect Ventures, Republic Crypto, Blizzard Fund, Galaxy Digital, and Warner Music Interactive.

A group chat protocol and app Towns received $25.5 million in a Series A round led by Andreessen Horowitz.

Privacy

Beldex, a company that provides privacy solutions for decentralized applications, received $25.5 million from web3 investment firm DWF Labs.

Wallet

Crypto wallet BitKeep received $30 million from Bitget.

San Francisco-based web3 mobile app and wallet company Kresus raised $25 million in a Series A round led by Liberty City Ventures, JetBlue Ventures, Franklin Templeton Investments, Marc Benioff, Cameron and Tyler Winklevoss, Craft Ventures, and others.

Social Network

Plai Labs raised $32 million in a seed round. The AI-focused startup is developing the next generation of social platforms.

The Easy Company, which develops a “social” crypto wallet, raised $14.2 million in a seed round. Lobby Capital, 6th Man Ventures, Relay Ventures, Tapestry VC, Upside, and Scribble Ventures are among the participants.

Fashion

Digital fashion store DressX raised $15 million in a Series A round led by Greenfield. Slow Ventures, the Artemis Fund, Red Dao, and Warner Music backed the round.

Intelligence

Analytics platform Metrika received $14 million in an extended Series A round led by Neotribe Ventures. Coinbase Ventures, Samsung NEXT, and Nyca Partners are among the other backers.

Security

Sec3, a security firm that provides security launch audits and automated solutions, raised $10 million in a seed round led by Multicoin Capital. Among the other participants are Sanctor Capital and Essence Venture Capital.

AR/VR

Mawari, an AR and VR startup that works on 3D content for the metaverse, received $6.5 million in a round led by Blockchange Ventures and Decasonic. Among the other participants are Abies Ventures, Accord Ventures, Anfield, Outlier Ventures, and Primal Capital.

Media

StoryCo, a platform for fans to connect, raised $6 million in a seed round co-led by Collab + Currency and Patron. Blockchange Ventures, Floodgate Ventures, Sfermion, and Flamingo DAO are among the other participants.

Trends in artificial intelligence

In the fourth quarter of 2022, investors shifted their attention to artificial intelligence startups. This year, the trend is still on point, with major corporations implementing AI into their products. As a side note, startups started using the artificial intelligence narrative to attract more funds.

In the first quarter of 2023, four web3 artificial intelligence-powered companies received $48,550,000. Plai Labs, which has received $32 million in a seed round, is followed by Sortium, which raised $7,750,000 in a seed round led by Arca.

Trends in NFT

In the first quarter of 2023, 17 NFT-related projects received $78,040,000.

Superplastic is among the leaders, having raised $20 million in an Extended Series A round led by Amazon’s Alexa Fund. Among the investors are Google Ventures, Galaxy Digital, Kering, Sony Japan, and Animoca Brands.

NFT-centric custodial wallet Gryfyn received $7.5 million from Liberty City Ventures, GameFi Ventures, Lavender Hill Capital Partners, Mind Fund, Animoca Ventures, LeadBlock Partners, Angel Hub, Brinc, and several angel investors.

Fungify raised $6 million in a round led by Citizen X. Among the other participants are Distributed Global, Anagram, Taureon Capital, Infinity Ventures Crypto, Flow Ventures, and several angel investors.

NFT management application Metalink received $6 million in a seed round backed by Guy Oseary, Gary Vaynerchuk, Ivan Soto-Wright, and other noted angel investors.

Fantasy sports game platform Unagi raised $5 million in an equity-based seed round led by Sisu Game Ventures. Sfermion, 2B Ventures, UOB Ventures, Signum Capital, and Machame are among the investors.

3D virtual human avatar editor Lifeform raised $5 million in a Series A round led by Geek Cartel. Among the other investors are KuCoin Labs, Foresight Ventures, DHVC, K24 Ventures, and Another Worlds.

Web3 virtual pet game Neopets Metaverse received $4 million in a round backed by Polygon Ventures, Hashkey Capital, Blizzard Avalanche Ecosystem Fund, IDG Capital, and NetDragon Websoft.

Customer engagement platform Cohort raised $3,490,000 in a seed round led by Axle Capital and IRIS. Among other participants are Kima Ventures, 3founders, and several angel investors.

Marketplace for metaverse land sales, Metahood received $3 million from 1confirmation. Among the other participants are Volt Capital, Neon DAO, Flamingo DAO, and several angel investors.

NFT lending protocol PaprMeme received $3 million from Coinbase Ventures.

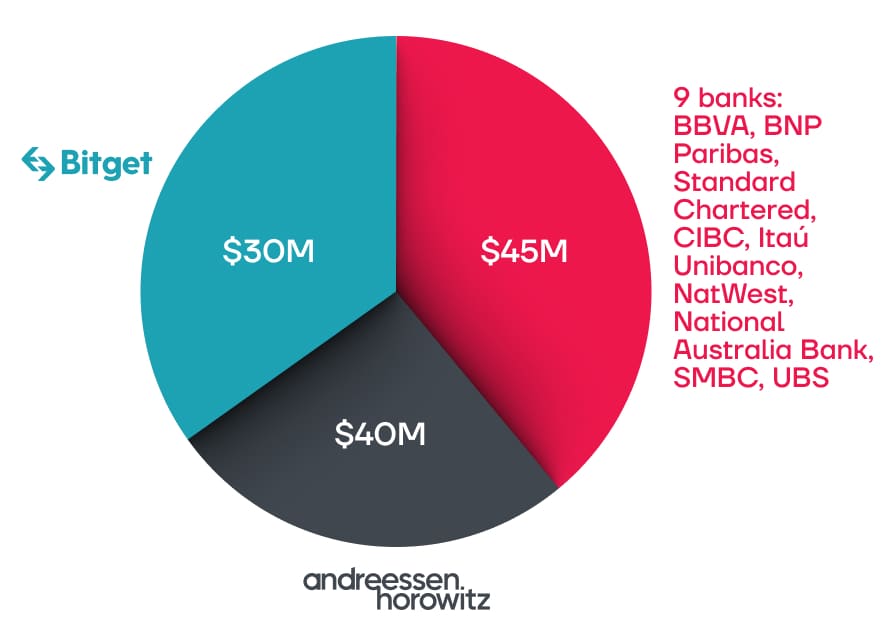

Noted investors

Among the most active investors in the first quarter of 2023 are Andreessen Horowitz, Bitget, and nine institutional banks.

Environmental startup Carbonplace received $45 million from nine traditional banks: BBVA, BNP Paribas, Standard Chartered, CIBC, Itaú Unibanco, NatWest, National Australia Bank, SMBC, and UBS. Out of this list, only three institutional banks have previously invested in crypto companies.

BNP Paribas invested in the Series B round of financial technology innovation firm HQLAᵡ. Standard Chartered Bank’s portfolio includes blockchain-powered startups Metaco and Ripple. SMBC Nikko Securities previously invested in the Series D of Kyash, which provides mobile-first banking services from Japan.

The Silicon Valley-based venture capital firm Andreessen Horowitz invested $40 million in the seed round of massively multiplayer role-playing game developers CCP Games. The latter has developed the sci-fi-styled game Eve Online.

In the previous three months, a16z also led the Series A round of group chat protocol Towns and the Series A round of Createra.

Crypto exchange Bitget invested $30 million in the crypto wallet BitKeep and acquired a controlling stake in the platform.

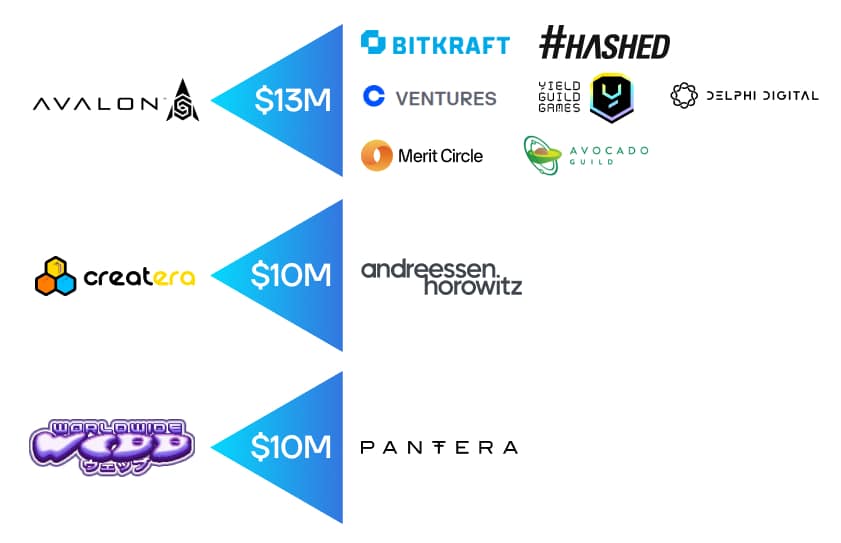

Most active metaverse investors

In the first quarter of 2023, the metaverse category received $51,301,000. The industry is not as trendy as in 2022 – only 46 VC funds and angels invested in it in three months. In comparison, in 2022, the category saw the participation of 340 unique investors, with a total result of $776.58 million in investments.

Bitkraft Ventures, Hashed, Delphi Digital, and Mechanism Capital invested $13 million in Avalon Corp. Coinbase Ventures, Yield Guild Games, Merit Circle, Avocado Guild, and Morningstar Ventures were among the backers.

Bitkraft Ventures is a global investment platform focused on gaming, web3, and immersive technology. Its portfolio includes such noted companies as Discord, Epic Games, Immutable, and Avalon. The fund focuses on seed, Series A, and Series B gaming-related startups.

Hashed is a team of blockchain experts and builders based in Seoul and Silicon Valley. The VC fund aims to empower mass adoption of the decentralized future through network building in the protocol economy. Hashed has previously invested in Ethereum, Decentraland, Axie Infinity, and other noted companies.

Delphi Digital is an independent research firm. The company aims to build the best institutional-grade research firm focused on crypto and digital assets. Delphi Digital’s portfolio includes Illuvium, Yield Guild Games, Axie Infinity, and other startups.

Mechanism Capital is a crypto- and web3-focused investment firm based in Liberty Hill, Texas. The fund has previously invested in NEAR Protocol, PleasrDAO, and Yield Guild Games, among others.

Andreessen Horowitz has invested $10 million in the Series A round of Createra. The VC firm is one of the leading tech and crypto-focused investors. Its portfolio includes Airbnb, Pinterest, Facebook, and Slack.

The crypto-focused VC fund Pantera Capital invested $10 million in the strategic round of Worldwide Webb. Launched in 2013, the fund has invested in Circle, Arbitrum, Brave, Coinbase, and other well-known companies.

Fails

In the first quarter of 2023, four crypto-friendly banks collapsed due to the unprofessional management of traditional assets and general panic in the sector.

California-based crypto-focused Silvergate Bank shut down operations and liquidated on March 8. The bank had faced several lawsuits and was questioned for its role in the business practices of FTX, which held its assets in Silvergate.

“In light of recent industry and regulatory developments, Silvergate believes that an orderly wind-down of Bank operations and a voluntary liquidation of the Bank is the best path forward,”

wrote the bank in a statement.

On March 10, the California Department of Financial Protection closed Silicon Valley Bank. A day before, approximately $42 billion was withdrawn by VC funds and their clients.

On March 11, Circle, the issuer of stablecoin USDC, announced that it had $3.3 billion out of $40 billion of its reserves in Silicon Valley Bank. After the announcement, USDC “depegged” from the fiat dollar. The incident caused panic and additional speculation within the crypto market. At the moment of writing, 1 USDC equals 1 US dollar.

New York-based Signature Bank was closed by United States regulators on March 12. Many cryptocurrency businesses held their assets in the bank – however, after the collapse of SVB, companies withdrew billions from Signature Bank, which led to the bank’s collapse. Following the failure, Flagstar Bank bought the majority of its deposits.

Switzerland-based Credit Suisse collapsed because its clients had been pulling funds out for months. Over $100 billion was taken out throughout the year. After the failure, the bank was purchased by UBS.

Conclusion

The first quarter of 2023 concludes with the collapse of four crypto-friendly banks and the rise of AI. Artificial intelligence is the new “hot” topic, and blockchain-backed startups use the narrative to attract more investment. While it seems VCs are less interested in metaverse projects, nine startups still managed to attract $56,301,000 to build virtual experiences. The gaming category, as usual, has raised a significant amount; VCs have paid attention to 23 startups, which raised a total of $201,720,473. The NFT category is not as trending as before. Still, companies continue building non-fungible token platforms and finding new applications for this technology.

Overall, the web3 sector has made an impressive performance, and industry players continue building and attracting funds despite the ongoing bear market and the “fails” of the year. The first quarter closes with 108 web3 companies raising $814,287,823 from venture capital funds and angel investors, including 25 NFT startups receiving $79,040,00.

Read more:

[ad_2]

Read More: mpost.io

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Wrapped Bitcoin

Wrapped Bitcoin  Hyperliquid

Hyperliquid  Wrapped stETH

Wrapped stETH  Sui

Sui  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Avalanche

Avalanche  Toncoin

Toncoin  WhiteBIT Coin

WhiteBIT Coin  USDS

USDS  Shiba Inu

Shiba Inu  WETH

WETH  Wrapped eETH

Wrapped eETH  Litecoin

Litecoin  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Hedera

Hedera  Monero

Monero  Ethena USDe

Ethena USDe  Polkadot

Polkadot  Bitget Token

Bitget Token  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Uniswap

Uniswap  Pepe

Pepe  Pi Network

Pi Network  Aave

Aave  Dai

Dai  Ethena Staked USDe

Ethena Staked USDe  Bittensor

Bittensor  OKB

OKB  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Aptos

Aptos  Cronos

Cronos  Internet Computer

Internet Computer  NEAR Protocol

NEAR Protocol  Jito Staked SOL

Jito Staked SOL  sUSDS

sUSDS  Ethereum Classic

Ethereum Classic