Web3 project raised more funds last year than in 2021, despite bear market pressures. So what opportunities are in store for 2023?

2022 saw growing interest in Web3 investment, broken down into four key areas. There’s interest from commercial banks, namely Morgan Stanley and Goldman Sachs, then successful Web3 ventures funding with global VCs joining the game.

Meanwhile, other trends included Tier 1 digital asset institutions like Binance Labs, Coinbase Ventures, and Kraken Ventures were driving or instead pooling in funds. Lastly are network-specific funds as mentioned in the screenshot below.

But despite the crypto downturn and general bearish sentiment, 348 startups collected or raised a total of $7.16 billion in investment last year. This was more than $4.5 billion compared to the previous year according to the Metaverse Post.

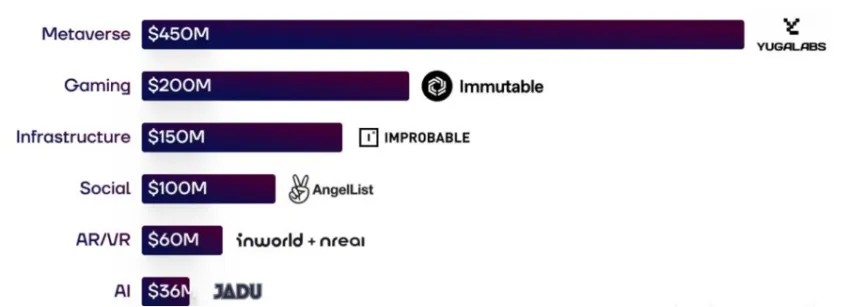

The report segregated the amounts under Gaming, Metaverse, Social Networks, Infrastructure, Artificial Reality and Virtual Reality (AR and VR), and Artificial Intelligence (AI). Although, with the growing innovation and demand, various categories made headlines throughout 2022.

Q2 2022 saw metaverse and gaming projects attract funds worth millions of dollars. Further, VCs maintained their allocations to play-to-earn projects, “paying particular attention to blockchain casinos, collectibles, loot boxes, and football-themed games,” said the report.

But Q4 saw some diversion.

Change in Investment Strategy

In the last quarter, investors shifted their attention to augmented, virtual, and mixed-reality startups. Artificial intelligence, such as the AI chatbot ChatGPT, also received much interest from VC firms. For instance, InworldAI collected $50 million in a Series A round, followed by SEED with $41 million. SingularityDAO raised $25 million, and MarqVision saw around $20 million raised in a Series A game.

Adding more support, the spokesperson said: “VCs are unlikely to lose interest in Artificial Intelligence (AI) in 2023, and more AI startups will likely get funding.”

BeInCrypto reported the surge in AI Farming to AI-written books that surfaced the previous year.

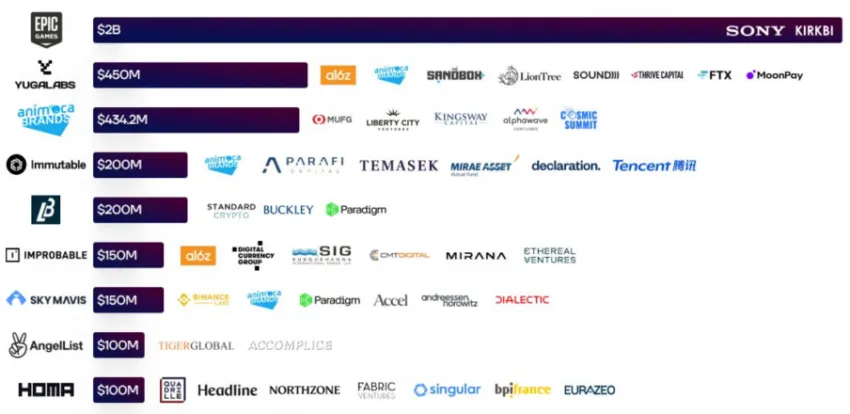

Moving on to another change in the narrative around investments. Given the rising hacks and other illicit operations, investors focus on the importance of security in Web3, leading to greater investment in infrastructure startups. Here’s a list of the top projects under the mentioned categories that raised the most funds.

List of Top Projects by Category

Moving on to individual entities within categories, Epic Games, the gaming giant, closed $2 billion of investment money from Sony and LEGO owner KIRKBI. Fortnite’s creator would use funds to”‘advance its vision of the metaverse and support its continued growth.” At the time of writing, the company is valued at $31.50 billion.

Moving on to Yuga Labs, the creator of Bored Ape Yacht Club (BAYC), raised more than $400 million to construct the Otherside metaverse. Of late, Yuga Labs released the “First Trip” of the Otherside experience and teased BAYC fans with the upcoming Second Trip.

Another big name that made it to the top three list was the Venture capital Animoca Brands, a metaverse-focused startup. Immutable, a Sydney-based Layer 2 NFT firm, followed next in line. The report further sheds some focus on the investors with deep pockets, namely four spenders with a total spend of over $7 billion.

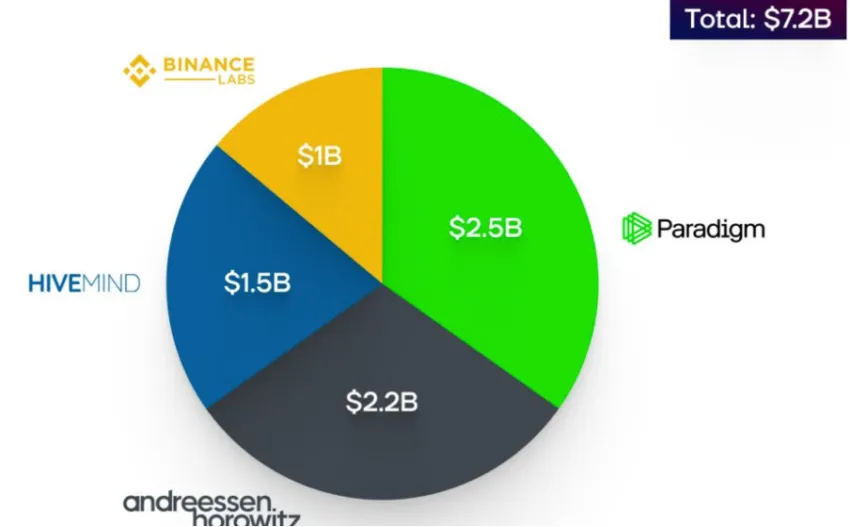

Biggest Investors

Leading the charge is Paradigm, a crypto-focused investment firm based in San Fransisco. The famed firm spent $2.50 billion in 2022 as it backed 31 projects, such as Coinbase, Uniswap, Magic Eden, and Optimism.

Next, Andreessen Horowitz, or a16z, became the second most active investor after Paradigm with a sum of $2.20 billion. Meanwhile, HiveMind Capital Partners invested $1.5 billion in Web3 startups, whereas Binance Labs stood at #4 with a spending spree of $1B in 2022.

Next, Andreessen Horowitz, or a16z, became the second most active investor after Paradigm with a sum of $2.20 billion. Meanwhile, HiveMind Capital Partners invested $1.5 billion in web3 startups, whereas Binance Labs stood at #4 with a spending spree of $1B in 2022.

While investing within this cohort may sound assuring and lucrative, failures are an integral part of it. The first exchange would be the Singapore-based cryptocurrency hedge fund Three Arrows Capital, also known as 3AC. Millions of dollars saw were lost following the collapse. This list continues to expand as extensively covered by BeInCrypto.

Overall, investors must maintain extreme caution when dealing with technologies that continue to develop and mature over the years.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.

Read More: news.google.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Wrapped Bitcoin

Wrapped Bitcoin  Sui

Sui  Hyperliquid

Hyperliquid  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Avalanche

Avalanche  Stellar

Stellar  Bitcoin Cash

Bitcoin Cash  Shiba Inu

Shiba Inu  LEO Token

LEO Token  Hedera

Hedera  Toncoin

Toncoin  Litecoin

Litecoin  Monero

Monero  WETH

WETH  Polkadot

Polkadot  USDS

USDS  Bitget Token

Bitget Token  Wrapped eETH

Wrapped eETH  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Pepe

Pepe  Pi Network

Pi Network  Ethena USDe

Ethena USDe  WhiteBIT Coin

WhiteBIT Coin  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Aave

Aave  Bittensor

Bittensor  Uniswap

Uniswap  Dai

Dai  NEAR Protocol

NEAR Protocol  Aptos

Aptos  Jito Staked SOL

Jito Staked SOL  OKB

OKB  Ondo

Ondo  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Internet Computer

Internet Computer