[ad_1]

Dear Bankless Nation,

This has been a whirlwind June. Regulators attempted a deathblow against the industry a couple weeks ago and now Bitcoin is posting new 2023 highs while altcoins mount steady recoveries. Today, we dig into the institutional embrace of BTC that’s prompting much of this broader comeback.

– Bankless team

Over a dozen asset managers have sought the SEC’s regulatory blessing to launch some form of spot Bitcoin exchange-traded fund (ETF) over the years, but thus far, applicants have been met with little more than silence or rejection.

Just last week, however, BlackRock, the world’s largest asset management firm with over $9 trillion in AUM and a nearly impeccable ETF approval record, added its name to this list. Renewed hope has emerged that the spot BTC ETF status quo may be about to change and BlackRock’s proposed ETF is viewed by many as having a legitimate chance of gaining the SEC’s approval.

Markets are now signaling that BlackRock’s application has increased the likelihood of other spot BTC ETF approvals. The market discount to net asset value (NAV) of the Grayscale Bitcoin Trust (GBTC) serves as a barometer for the likelihood of spot BTC ETF approval for them. Currently, this discount sits at a 2023 low of 33.5%.

Today, we’re exploring the SEC concern that has held up every previous spot Bitcoin ETF application, discussing whether we just saw the next chapter of Operation Choke Point 2.0 play out, and answering the one question every degen is asking.

The Fine Print

The Fine Print

The first BTC futures ETF received regulatory approval from the SEC in October 2021, but the agency has long dragged its feet on approving a BTC spot ETF.

Present in any of the SEC’s numerous rejection letters of spot Bitcoin ETF applications is a similar passage citing the listing exchange’s failure to meet its burden under the Exchange Act through an inability to prevent fraud and market manipulation as the reason for disapproval.

To demonstrate that an exchange listing shares of a proposed spot Bitcoin ETF can meet its obligations under the Exchange Act, the SEC prescribes a “comprehensive surveillance-sharing agreement with a regulated market of significant size related to the underlying or reference bitcoin assets.”

Getting in the way of a potential comprehensive surveillance-sharing agreement is the lack of U.S.-regulated Bitcoin spot markets. Applicants have long detested this framework, claiming that if regulators are comfortable with ETFs holding derivatives of an asset, they should logically be comfortable with an ETF holding that underlying.

Further, the SEC frequently accepts surveillance-sharing agreements with regulated futures exchanges in commodity and currency markets where unregulated spot exchanges are the norm (i.e.; soybeans and USD).

So why have these rules been applied differently to the granddaddy of all crypto currencies with commodity-like properties so strong not even the SEC dares stake its reputation detesting them? Perhaps, the SEC’s decision making has been compelled by the hidden hand of Operation Choke Point 2.0…

Regulator Red Carpet?

Regulator Red Carpet?

Do you too find it just a little suspicious that during a June filled with nothing other than Gary Gensler attacking crypto exchanges and labeling tokens as securities, BlackRock chose to apply for a Bitcoin spot ETF?

Is BlackRock’s ETF application just part of a greater government effort to instill TradFi institutions at the helm of the crypto landscape? Or has BlackRock just seen the writing on the wall and is timing its entrance to fill a vacuum of institutional trust triggered by the SEC crackdown?

Either way, Nic Carter first sounded the alarm on “Operation Choke Point 2.0” in February, and over the subsequent four and a half months, we’ve witnessed a continued regulatory crackdown on crypto-related banking, exchange, and staking service providers.

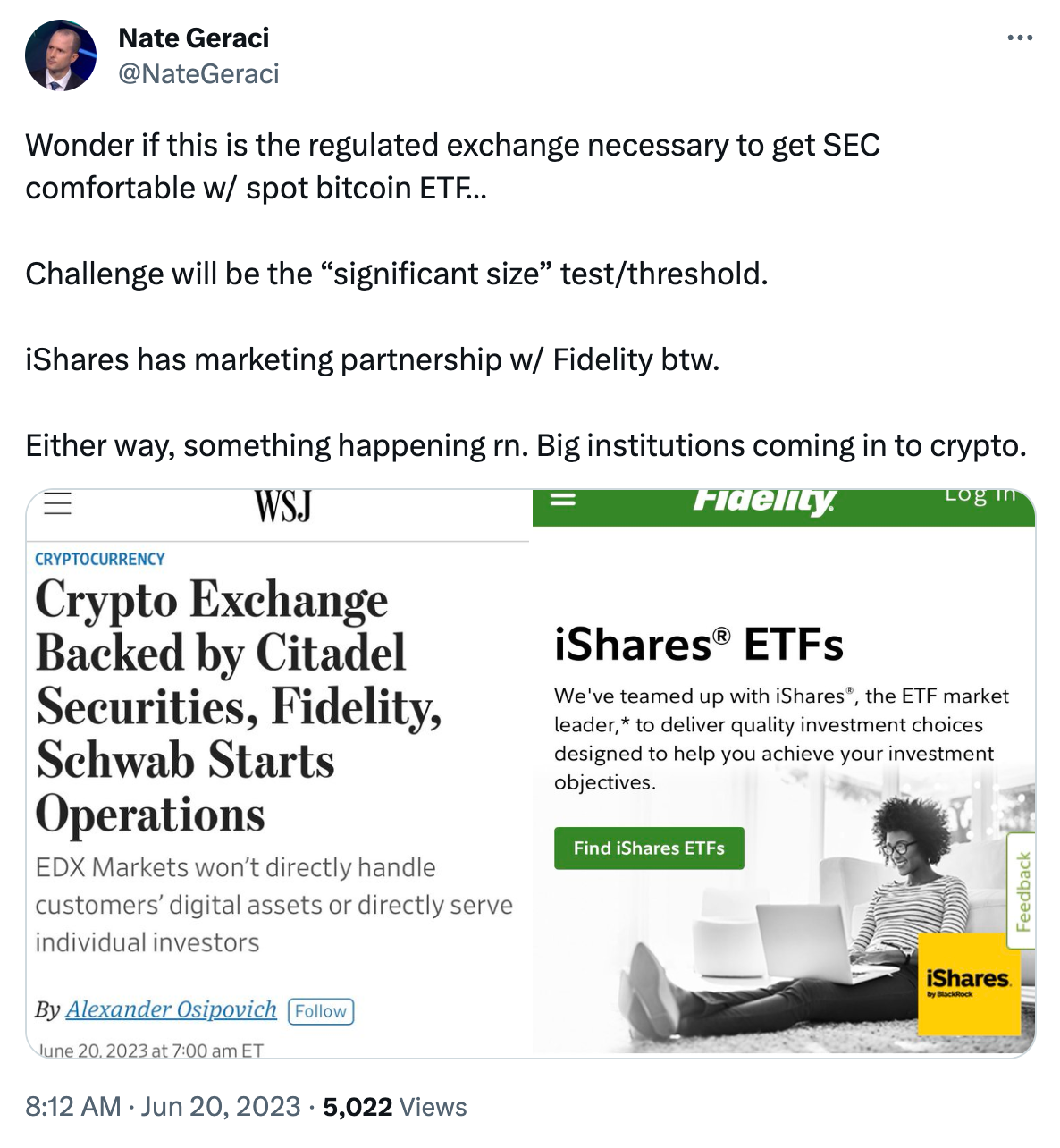

First, BlackRock. Now, enter EDX: an institution-tailored crypto exchange and the brainchild of TradFi titans like Charles Schwab, Citadel Securities, and Fidelity that formed in September 2022 but launched its first four digital asset markets on Tuesday, June 20.

Like any “exchange” in traditional finance, EDX will only serve as a marketplace, matching buyers with sellers and separating exchange functionality from brokerage and custody services. While unlike the all-in-one models offered by CEXs like Coinbase and Binance, EDX’s approach appears compliant with the SEC’s calls for separation of core trading functions.

Furthermore, EDX will constrain its initial markets to Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), and Bitcoin Cash (BCH). TradFi’s incumbents appear to be working within the bounds of an unwritten SEC rulebook and it’s plausible that EDX’s unique structure will meet the agency’s definition of a “regulated” Bitcoin spot market.

Whether there is a bonafide conspiracy here or just a flurry of regulators defaulting to the devil they know, it’s clear that the government is spending an outsized amount of effort punishing builders in the crypto space while simultaneously showing TradFi speculators the red carpet.

Bull SZN?

Bull SZN?

Rumors of BlackRock’s filing proved the only thing needed to mark the bottom for crypto markets pummeled by an endless regulatory onslaught, and out of them, the world’s asset management firms emerged as future sellers of Bitcoin investment products.

Traders are now betting that the institutions piling into crypto will inevitably realign their narratives to sell BTC products to customers over the coming years, meaning your crypto bags may soon receive the giga-bid!

Tokens across the board have rallied since BlackRock’s announcement, but Bitcoin has been the primary beneficiary, dominating alts and riding the week-long wave of subsequent bullish price action to touch above 2023 highs at $31.3k

While it is always unknown where asset prices are headed in the short term, especially in volatility-filled crypto markets, the calculated decisions made by America’s preeminent financial institutions to bolster their position in the industry is evidence that crypto is here to stay.

The titans of TradFi get paid to seek out opportunity – and right now, the major players are visibly committing corporate resources towards establishing footholds in the industry. BlackRock began the hunt for Digital Assets Associates two weeks ago

With prices pressed against heavy resistance, crypto’s institution-induced rally may largely be over with (for now), but allow this chapter in history to strengthen your long-term resolve in crypto and make sure to remember it the next time the industry is confronted with hardship! Just don’t forget to thank BlackRock for reaffirming your faith in crypto.

Action steps

[ad_2]

Read More: www.bankless.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Wrapped Bitcoin

Wrapped Bitcoin  Hyperliquid

Hyperliquid  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  Sui

Sui  Chainlink

Chainlink  LEO Token

LEO Token  Avalanche

Avalanche  Stellar

Stellar  USDS

USDS  Toncoin

Toncoin  Shiba Inu

Shiba Inu  WhiteBIT Coin

WhiteBIT Coin  WETH

WETH  Litecoin

Litecoin  Wrapped eETH

Wrapped eETH  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Hedera

Hedera  Monero

Monero  Bitget Token

Bitget Token  Ethena USDe

Ethena USDe  Polkadot

Polkadot  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Pi Network

Pi Network  Uniswap

Uniswap  Aave

Aave  Pepe

Pepe  Dai

Dai  Ethena Staked USDe

Ethena Staked USDe  Aptos

Aptos  OKB

OKB  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Bittensor

Bittensor  NEAR Protocol

NEAR Protocol  Jito Staked SOL

Jito Staked SOL  Internet Computer

Internet Computer  Cronos

Cronos  Ethereum Classic

Ethereum Classic  sUSDS

sUSDS