Never miss a Web3 opportunity. Search for unclaimed airdrops, POAPs, NFTs with Earnifi.

Dear Bankless nation,

Here’s a recap of the biggest crypto news in the second week of November.

Goodbye FTX

What a week.

If you haven’t followed the events around FTX at all, I recapped a play-by-play in The Shocking Collapse of the FTX Empire this past Wednesday on how the chaos has transpired. But crypto moves at the speed of sound, and this week has been moving at Star-Wars-level lightspeed, so there have been plenty of updates since.

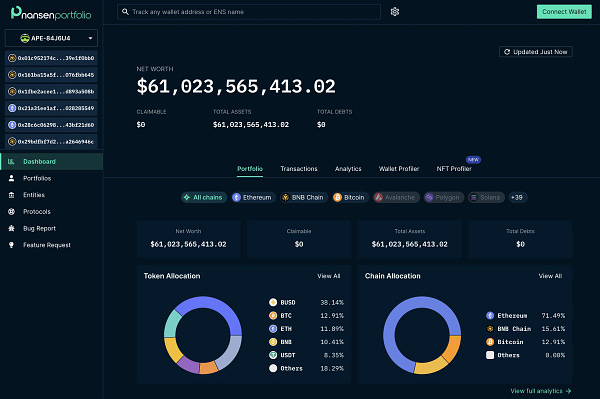

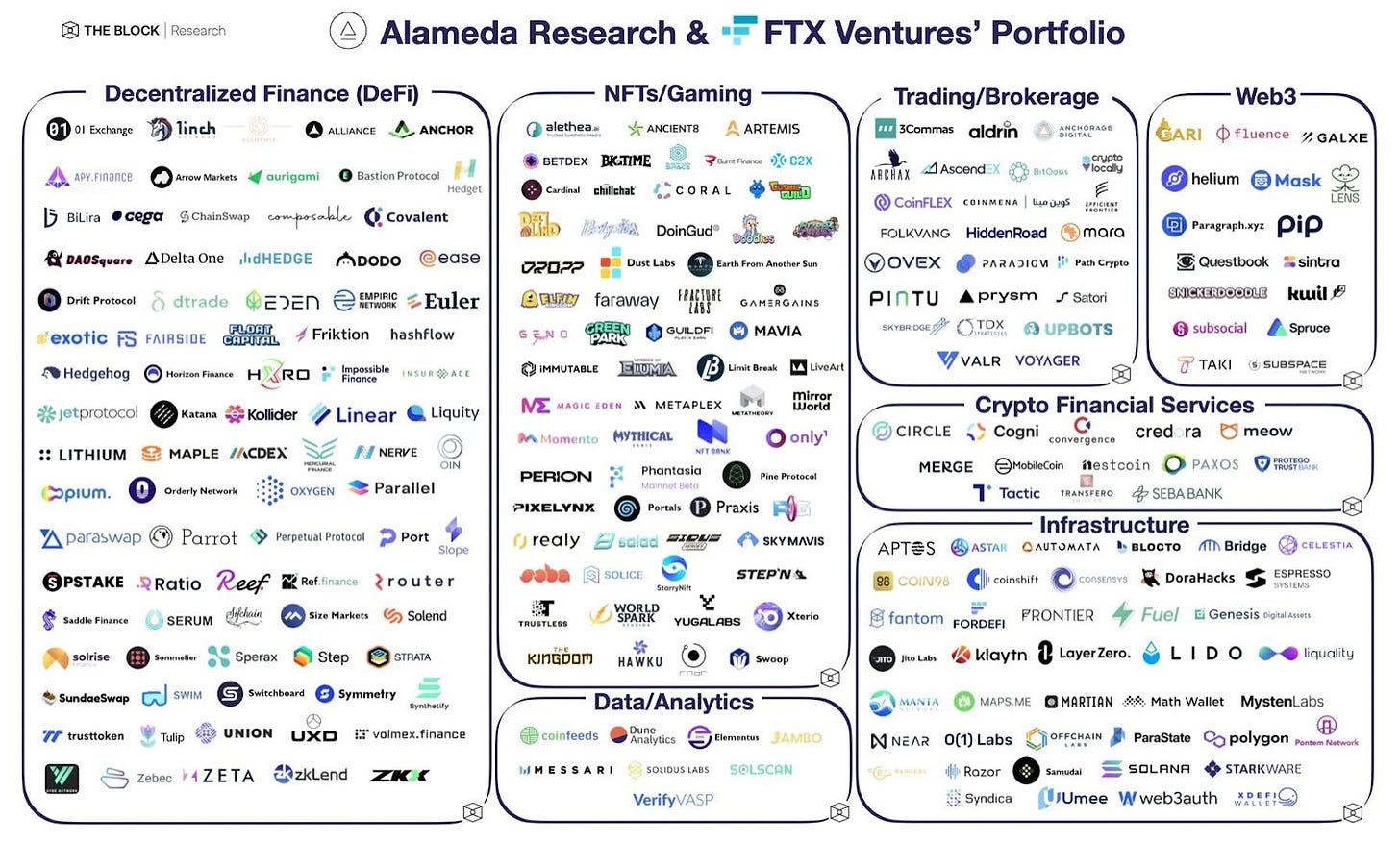

A tldr: A CoinDesk article on November 2nd alleged that FTX’s sister hedge fund Alameda Research over-levered in holding way too much of FTX’s illiquid FTT token, and people got scared. Binance CEO CZ subsequently announced he was selling $2.1B FTT, so people got more scared and things escalated to a full-blown panic over the weekend with record withdrawals of ~$8.6B from FTX since the 10th. (See Bankless’s previous article for insight into how users and institutions rushed for the exit.)

If you’d like a more visual recap in the language of The Office:

Where does that leave us?

Binance has pulled out of a potential purchase of FTX, citing reasons of “mishandled customer funds”. SBF confirmed that he lent ~$10B of funds (out of $16B) to sister hedge fund Alameda Research with the use of customer deposits, despite previous claims in a now-deleted tweet that “FTX has enough to cover all client holdings. We don’t invest client assets.”

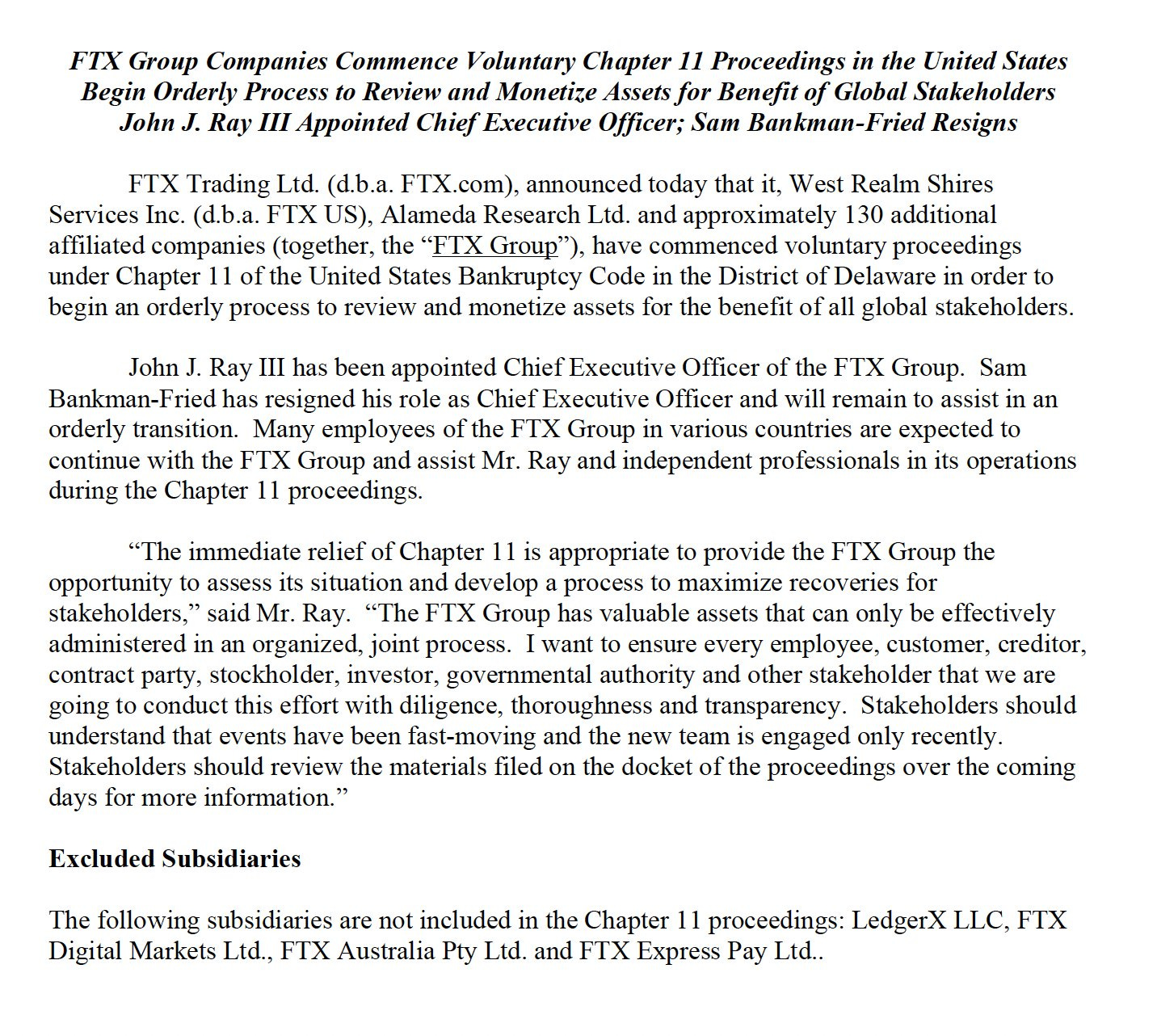

SBF filed for chapter 11 bankruptcy and resigned as FTX CEO yesterday, but not before apologizing profusely for fucking up.

In response to law enforcement, Tether has frozen $46.2 million USDT on an FTX account.

Justin Sun is offering a 1:1 redemption for all Tron-based assets on FTX (and no, he’s not seriously bailing out FTX).

Due to regulatory pressure, FTX is also resuming withdrawals for users in the Bahamas where it’s based. Because trading on FTX hasn’t been halted, this has produced a million-dollar opportunity for users to indirectly cash out of FTX by “buying” an NFT on FTX’s NFT marketplace with their stuck funds from a KYC’d Bahamas user, which they can then off-ramp from FTX.

Looks like NFTs are finally getting some of the “utility” that users were clamoring for.

Tens of millions of Tether taken so far

Regulatory backlash

Regulators already don’t love crypto, and this week’s events didn’t help much.

The regulatory hawks of the SEC and CFTC are already circling the fresh carcass of FTX, as reported by Bloomberg.

Contrary to initial expectations, American regulators are still unfortunately committed to pushing forth the SBF-championed Digital Commodities Consumer Protection Act (DCCPA) bill.

Washington’s resident anti-crypto senator, Elizabeth Warren, tried to capitalize politically on FTX and got shut down by Brian Armstrong.

<div class="tweet" data-attrs="{"url":"https://twitter.com/brian_armstrong/status/1590511022104010753","full_text":"@SenWarren @SECGov FTX.com was an offshore exchange not regulated by the SEC.\n\nThe problem is that the SEC failed to create regulatory clarity here in the US, so many American investors (and 95% of trading activity) went offshore.\n\nPunishing US companies for this makes no sense.","username":"brian_armstrong","name":"Brian Armstrong","date":"Thu Nov 10 01:05:52 +0000 2022","photos":[],"quoted_tweet":{},"retweet_count":4530,"like_count":24755,"expanded_url":{},"video_url":null,"belowTheFold":true}”>

The problem is that the SEC failed to create regulatory clarity here in the US, so many American investors (and 95% of trading activity) went offshore.

Punishing US companies for this makes no sense.

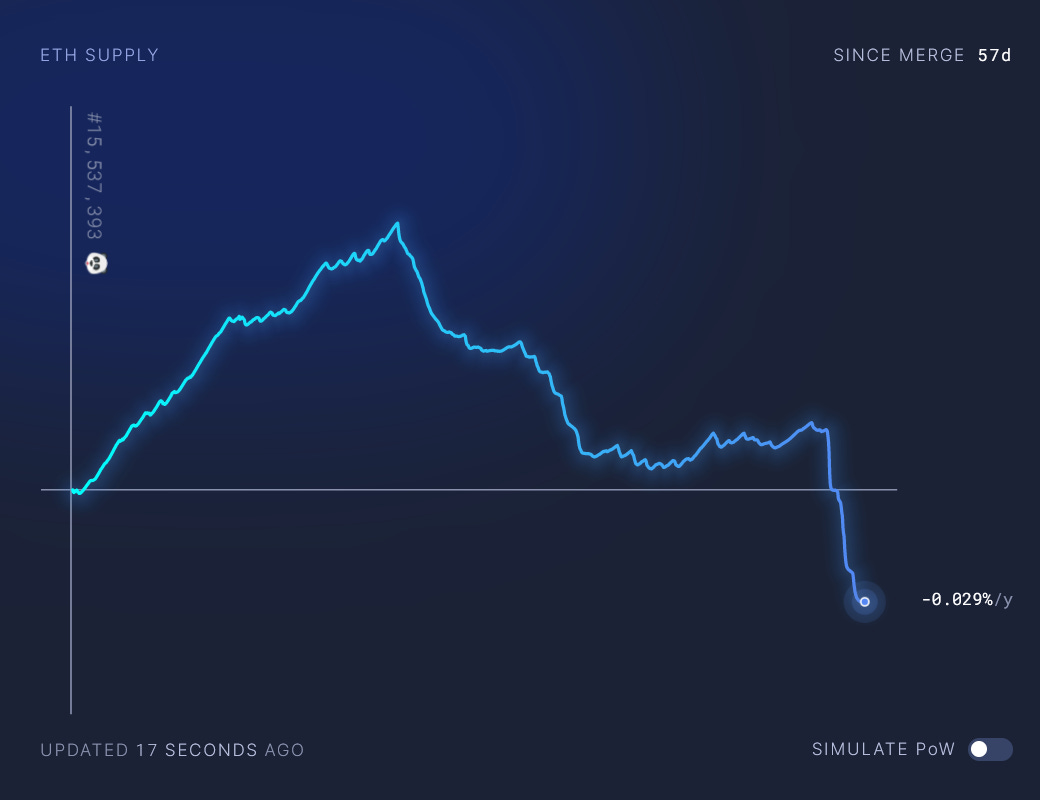

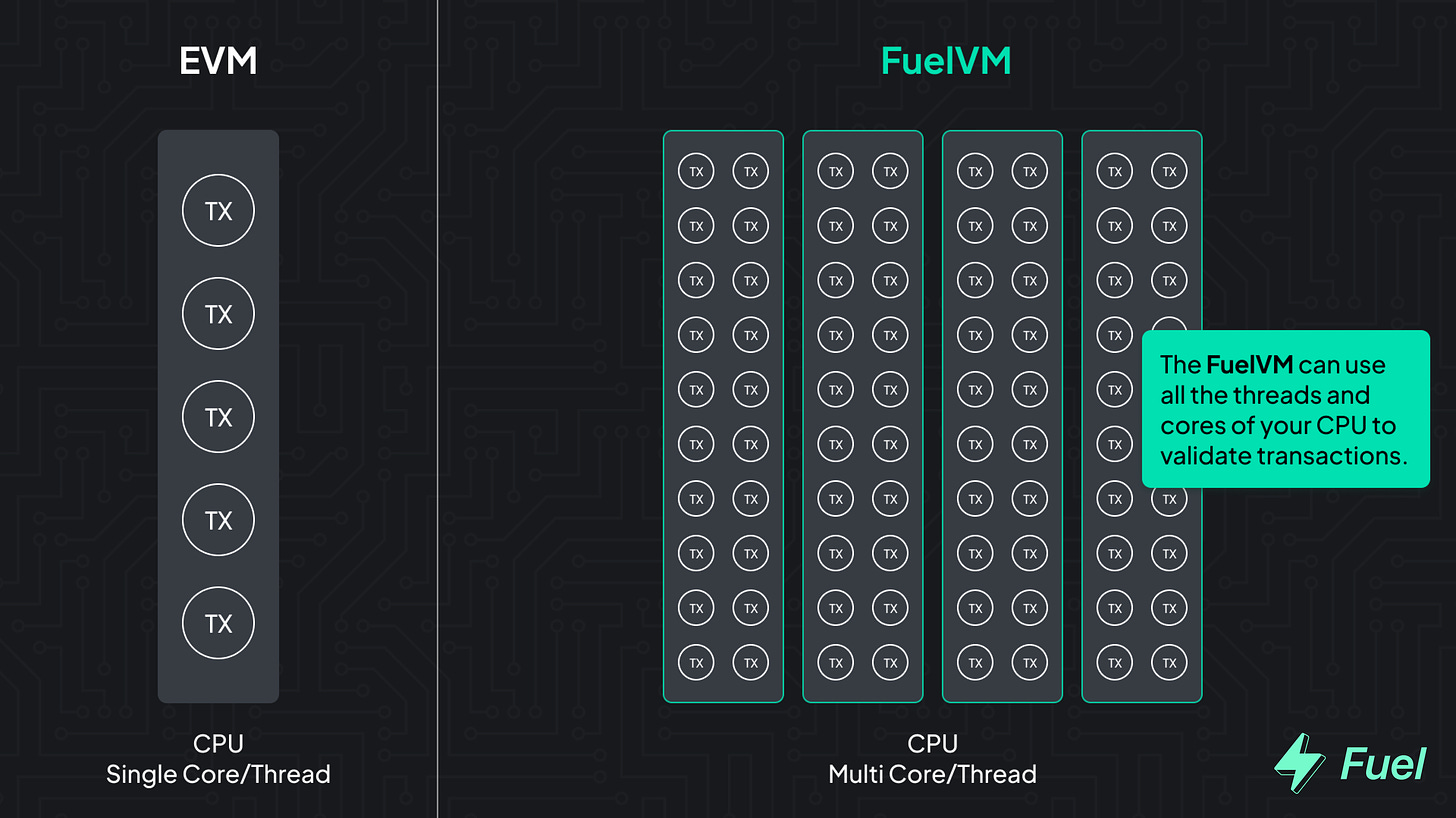

The problem of course with Warren’s line of thinking is that the entire fiasco demonstrates more of a failure with the mechanics of traditional finance, rather than crypto. FTX had a giant hole in their balance sheets for as long as they did because their balance sheets were precisely that: a balance sheet that didn’t exist on a publicly verifiable blockchain.

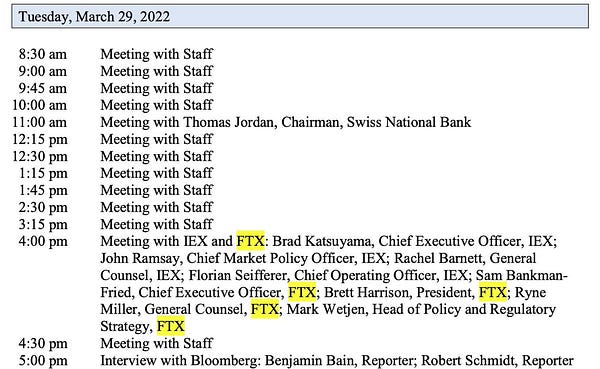

When SEC chair Gary Gensler was asked in a CNBC interview about why they had focused crypto enforcement efforts on smaller targets like Kim Kardashian and small DAOs rather than big players like FTX, he responded, “Building the evidence, building the facts, often takes time.”

I guess Gensler is free to take all the time he needs now.

<div class="tweet" data-attrs="{"url":"https://twitter.com/collins_belton/status/1590686389511028737?s=20&t=k067JXRWLnulZ7nvAkGolA","full_text":"@GaryGensler @andrewrsorkin @SquawkCNBC Ideally you’ll spend some time to explain how, once again, the commission’s enforcement priorities focused on entities trying to deploy technology to prevent these market failures & asymmetries while you were meeting with the perpetrators or overlooking their malfeasance? ","username":"collins_belton","name":"Collins Belton","date":"Thu Nov 10 12:42:43 +0000 2022","photos":[{"img_url":"https://pbs.substack.com/media/FhNA1i0WAAAnLU9.jpg","link_url":"https://t.co/q88u5kQxNM","alt_text":null}],"quoted_tweet":{},"retweet_count":135,"like_count":680,"expanded_url":{},"video_url":null,"belowTheFold":true}”>

","username":"nansen_ai","name":"Nansen

","username":"nansen_ai","name":"Nansen  ","date":"Fri Nov 11 12:26:56 +0000 2022","photos":[],"quoted_tweet":{},"retweet_count":171,"like_count":559,"expanded_url":{},"video_url":null,"belowTheFold":true}”>

","date":"Fri Nov 11 12:26:56 +0000 2022","photos":[],"quoted_tweet":{},"retweet_count":171,"like_count":559,"expanded_url":{},"video_url":null,"belowTheFold":true}”>

","date":"Fri Nov 11 02:56:03 +0000 2022","photos":[{"img_url":"https://pbs.substack.com/media/FhQEEnkacAATaWJ.jpg","link_url":"https://t.co/vlfH1hrzeP","alt_text":null}],"quoted_tweet":{},"retweet_count":549,"like_count":3515,"expanded_url":{},"video_url":null,"belowTheFold":true}”>

","date":"Fri Nov 11 02:56:03 +0000 2022","photos":[{"img_url":"https://pbs.substack.com/media/FhQEEnkacAATaWJ.jpg","link_url":"https://t.co/vlfH1hrzeP","alt_text":null}],"quoted_tweet":{},"retweet_count":549,"like_count":3515,"expanded_url":{},"video_url":null,"belowTheFold":true}”>

Thanks to our sponsor

Thanks to our sponsor

Recap for the week of November 7th, 2022

Recap for the week of November 7th, 2022

See all listings on the

See all listings on the

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Wrapped Bitcoin

Wrapped Bitcoin  Sui

Sui  Chainlink

Chainlink  Avalanche

Avalanche  Stellar

Stellar  LEO Token

LEO Token  Shiba Inu

Shiba Inu  Toncoin

Toncoin  Hedera

Hedera  Wrapped stETH

Wrapped stETH  USDS

USDS  Bitcoin Cash

Bitcoin Cash  Polkadot

Polkadot  Litecoin

Litecoin  Hyperliquid

Hyperliquid  Bitget Token

Bitget Token  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  WETH

WETH  Ethena USDe

Ethena USDe  Pi Network

Pi Network  Monero

Monero  WhiteBIT Coin

WhiteBIT Coin  Wrapped eETH

Wrapped eETH  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Pepe

Pepe  Uniswap

Uniswap  Aptos

Aptos  Dai

Dai  OKB

OKB  Ondo

Ondo  NEAR Protocol

NEAR Protocol  Bittensor

Bittensor  Gate

Gate  Internet Computer

Internet Computer  Ethereum Classic

Ethereum Classic  sUSDS

sUSDS  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Tokenize Xchange

Tokenize Xchange