SEC View on Cryptocurrency Services

U.S. Securities and Exchange Commission (SEC) Chairman Gary Gensler appeared on CNBC’s “Squawk Box” on the 10th and announced the staking-as-a-service of the cryptocurrency exchange Kraken. He explained what he considered to be a violation of the Securities Act.

Gensler points out that Kraken’s problem was that it did not comply with securities law rules to disclose information such as risks to general investors. Other platforms should follow the rules, register with the SEC and make appropriate disclosures before offering services in the U.S., he said.

connection: US SEC “Kraken’s virtual currency staking service violates securities law”

What is staking

A system in which rewards can be obtained by depositing a certain amount of virtual currency for a certain period of time. By contributing to the operation of the blockchain, you can get rewards as compensation.

Cryptocurrency Glossary

Cryptocurrency Glossary

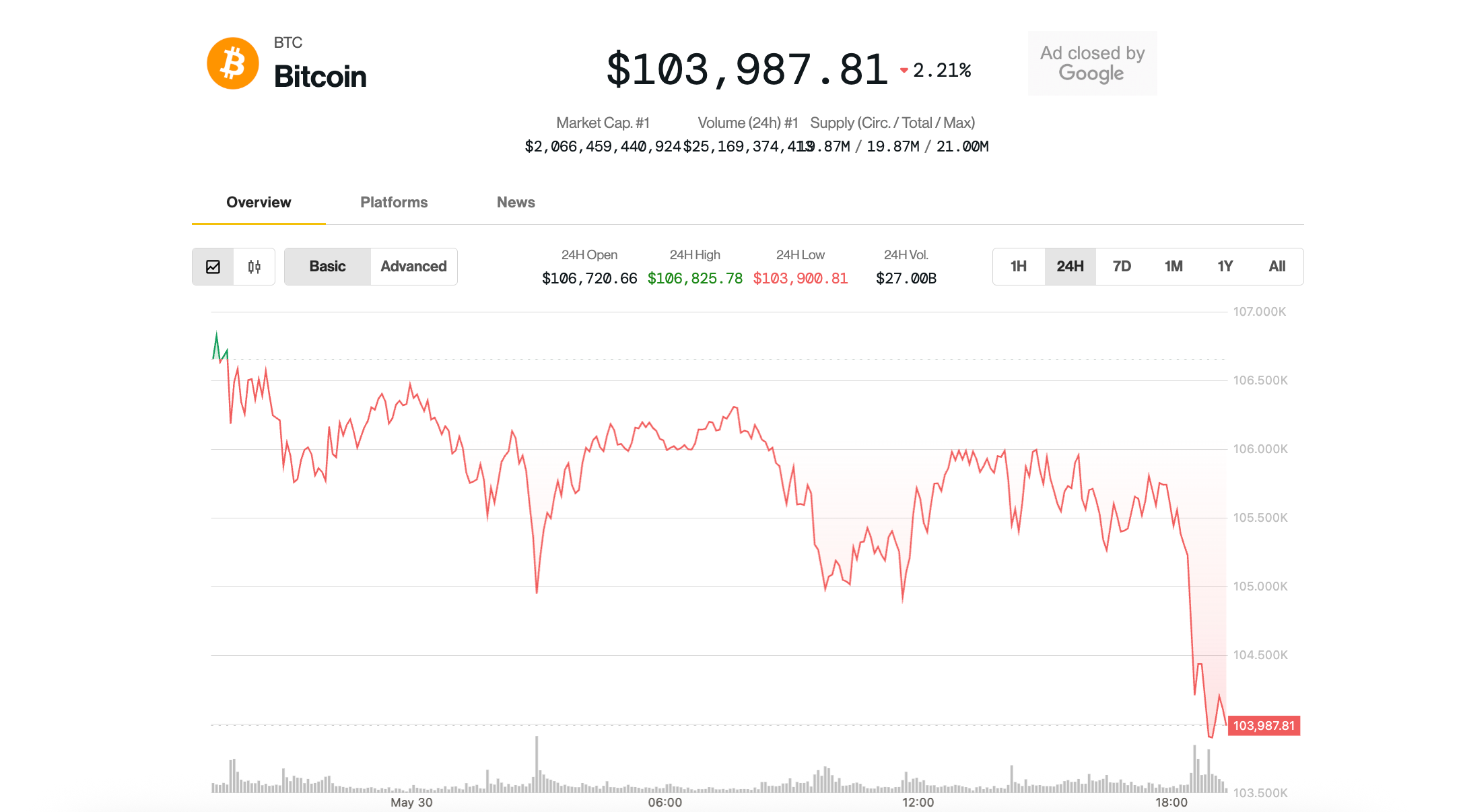

CNBC’s Andrew Ross Sorkin began by pointing out that the price of Bitcoin (BTC) and other cryptocurrencies fell after Kraken’s staking service was deemed to violate securities laws. Afterwards, he asked how services such as Coinbase, which offers interest rates, differed from Kraken’s staking service.

connection: Whether the Bitcoin plunge has entered an adjustment phase, or a new challenge for the PoS currency that can be staked

In response to this question, Gensler quoted a past U.S. Supreme Court judge saying, “It’s not how the service is called, it’s the underlying economics that matter.” He then said that differences in expressions such as lending and annual interest rates were not important, and explained the economic aspects and risks as follows.

Someone sends a token to a platform, and the platform manages their token. At this point, what if the platform goes bankrupt?

In cryptocurrencies, there is a saying, “If you don’t have the private key, you don’t own the coin.” If the platform goes bankrupt, those who have deposited their tokens will end up in bankruptcy court.

Gensler went on to argue that other platforms should comply with securities laws. The SEC, on the other hand, only focuses on investor protection and is neutral on technology, he said.

Investors can take risks as they please, and Kraken and others explain that if they want to offer investment contract services such as staking, they can register through a form on their website.

connection: U.S. SEC Chairman Gensler “Possibility of PoS-based virtual currency as securities”

Was it possible to register with the SEC?

In this way, Mr. Gensler said that he could register from the website form, claiming that Kraken and other companies knew how to register. He said he was able to file the application, hold discussions with members of the SEC, and communicate with the disclosure review team.

On the other hand, SEC’s Hester Peirce, known as a cryptocurrency advocate, questioned whether the Kraken could have been registered with the SEC in advance. He pointed out that there are many complicated questions about staking services, such as “Do I have to register for each stock?”

Peirce claims to be against dealing with the Kraken. The comments were posted on the SEC’s official website.

According to overseas media, Mr. Peirce took the stage at the University of Pennsylvania conference on the 10th. He also criticized the SEC’s response to continued regulation through enforcement, saying that “we, the SEC, did not try to talk to members of the industry in advance” about staking.

Asked about Peirce’s dissent on CNBC, Gensler explained, “We have a good relationship, we communicate regularly and we discuss things like staking.”

The post U.S. SEC Chairman “We are neutral on technology such as staking” appeared first on Our Bitcoin News.

Read More: bitcoinwarrior.net

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  Wrapped Bitcoin

Wrapped Bitcoin  Hyperliquid

Hyperliquid  Sui

Sui  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Avalanche

Avalanche  Stellar

Stellar  Toncoin

Toncoin  LEO Token

LEO Token  Bitcoin Cash

Bitcoin Cash  Shiba Inu

Shiba Inu  Hedera

Hedera  USDS

USDS  WETH

WETH  Litecoin

Litecoin  Wrapped eETH

Wrapped eETH  Polkadot

Polkadot  Monero

Monero  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Bitget Token

Bitget Token  Pepe

Pepe  Ethena USDe

Ethena USDe  Pi Network

Pi Network  WhiteBIT Coin

WhiteBIT Coin  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Dai

Dai  Uniswap

Uniswap  Aave

Aave  Bittensor

Bittensor  Aptos

Aptos  NEAR Protocol

NEAR Protocol  Cronos

Cronos  OKB

OKB  Jito Staked SOL

Jito Staked SOL  Ethena Staked USDe

Ethena Staked USDe  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Tokenize Xchange

Tokenize Xchange  Ondo

Ondo  Ethereum Classic

Ethereum Classic