January 27 (Friday) morning market trends (compared to the previous day)

traditional finance

-

- NY Dow: $33,978 +0.08%

- Nasdaq: $11,621 +0.9%

- Nikkei Stock Average: ¥27,382 +0.07%

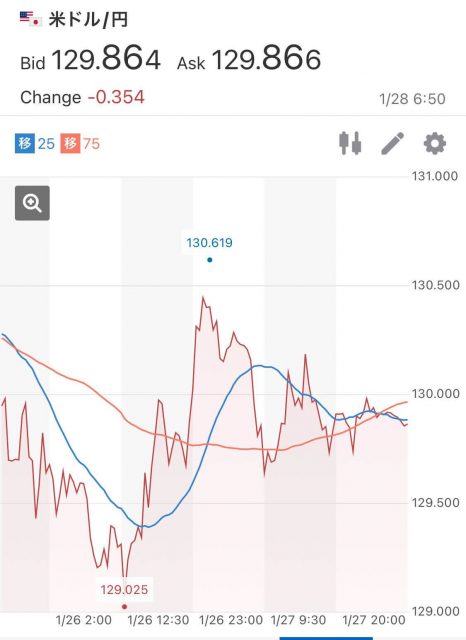

- USD/JPY: 129.85 -0.28%

- USD Index: 101.9 +0.09%

- 10-year US Treasury yield: 3.51 +0.6%

- Gold Futures: $1,928 -0.09%

crypto assets

- Bitcoin: $23,170 +0.5%

- Ethereum: $1,603 +0.1%

Today’s New York Dow and Nasdaq continue to rise for six business days. Did the latest data, such as the US price statistics, support the slowdown in inflation and the easing of US Fed rate hikes?

Last night’s US personal consumption expenditures (PCE) fell short of expectations at -0.2% m/m. Core PCE year-on-year growth rate was +4.4%, slowing from +4.7% in November. Both indexes have slowed down compared to the same month of the previous year, marking the lowest growth in more than a year. Other indicators of inflation, such as personal income and wages, have also slowed markedly.

Personal Consumption Expenditure (PCE) is an index that shows the price trend of personal consumption announced by the US Department of Commerce at the end of each month. US personal consumption expenditure, which accounts for nearly 70% of GDP, is drawing attention as a leading indicator of GDP. The PCE core deflator, which divides the nominal PCE by the real PCE, is known as the price index that the US FRB places the most importance on.

In addition to December’s weak CPI, the latest data have increased the likelihood that the Fed will decide to raise interest rates by 0.25 percentage points each in February and March. In addition, there is speculation that the interest rate hike will end soon and that interest rate cuts will begin in September. Meanwhile, Fed officials say they do not expect a rate cut this year.

deflator

-

- December Personal Consumption Expenditure (PCE): Current +5.0% Forecast +5.3% November +5.5% (YoY)

- December Personal Consumption Expenditure: This time -0.2% Forecast -0.1% November -0.1% (vs. previous month)

- December personal consumption core (other than food and energy): this time +4.4% forecast +4.4% November +4.7% (YoY)

- Dec Personal Consumption Expenditure Core: Current +0.3% Forecast +0.3% Nov +0.2% (MoM)

University of Michigan

- January University of Michigan Consumer Confidence Index (confirmed): 64.9 this time, preliminary 64.6, December 59.7

- January University of Michigan 1-year inflation expectations (confirmed figures): 3.9% this time, preliminary figure 4.5%, December 4.4%

- January University of Michigan 5-10 year inflation expectations (confirmed): 2.9% this time, 3.0% in December, 2.9% in December

Relation: Strong U.S. GDP is only a sign of economic slowdown

US stocks

Earnings results for Microsoft and Tesla were announced this week, but next week IT giants such as Apple (February 2), Amazon (same day), and Alphabet C (same day) will also announce their financial results.

Relation: NY Stock Exchange system failure, Microsoft settlement, etc. | 25th Financial

Buzzfeed +85%, Big Bear ai (AI-related) +7%, Tesla +11%, Microsoft +0.065%, Alphabet C +1.9%, Amazon +3%, Apple +1.3%, Meta +3%, Coinbase +15.7%. Algo Blockchain -7.5%.

The online media buzzfeed soared on the 27th. On the 26th (U.S. time), the stock price surged 120% at one point as information surfaced that AI technology developed by U.S. company OpenAI was used to generate and personalize content such as online quizzes. BuzzFeed later revealed that it would use a public API instead of ChatGPT, but it seems that the CEO’s announcement of plans for AI integration was also taken into account.

Relation: BuzzFeed stock soars 119% after OpenAI’s content enhancement measures

Relation: Recommended for cryptocurrency investors, advantageous shareholder benefits “10 selections”

Important economic indicators and events from next week onwards

- February 2 (Thursday 4:00): FOMC policy rate

- February 3 (Thursday 22:30-24:00): U.S. Unemployment Rate/Nonfarm Employment

Relation: What is “leveraged trading” practiced by virtual currency investors | Explanation for beginners

USD/JPY: 129.85 -0.28%

US dollar = 129.85 yen, down 0.28% from the previous day. The US consumer spending and other indicators indicated a slowdown in inflation, and expectations of the Fed’s interest rate hikes and easing are increasing, so the dollar fell back. The US long-term bond market continues to drop slightly due to selling ahead on expectations of a rise in the Bank of Japan’s long-term interest rates. On the other hand, it was bought back in response to the data of slowing US inflation and narrowed the decline.

Source: Yahoo! Finance

Relation: The background of the “strong dollar” that affects the virtual currency market also explains the correlation and factors of the weak yen

Virtual currency market

Bitcoin (BTC) and Ethereum (ETH), etc. are high as the NY Dow and NASDAQ continue to rise. Web3 game brand “MAGIC” increased by 30% from the previous day. The price has significantly renewed the high price since the beginning of the year, and has increased about 2.2 times since January 1st.

MAGIC is the native token of the blockchain game collection “TreasureDAO”. TreasureDAO is a project aiming to be a “decentralized Nintendo”, running on the L2 blockchain Arbitrum and hosting games such as The Beacon and Kuroro. On the 26th, they released a new AMM exchange called MagicSwap v2.

Announcing the new MagicSwap by @Treasure_DAO.

MagicSwap v2 will be the first AMM in crypto with universal token compatibility, supporting pools for both ERC-20s + NFTs through a single router and enabling trading of all items within game economies.https://t.co/JYLScglA1o

—MagicSwap (@MagicSwap_) January 25, 2023

In addition, some AI-related tokens are soaring against the backdrop of news such as Microsoft’s additional investment in OpenAI and the above-mentioned Buzzfeed adoption of AI.

Source: CoinGecko

Relation: There is also a change in the signal in the unrealized profit and loss (NUPL), which is struggling in the high price range of Bitcoin

Cryptocurrency/Blockchain-related Stocks (Year-on-Year Change/Year-to-Week Change)

- Coinbase Global | $61.3 (+15.7%/+11%)

- Algo Blockchain | $1.9 (-6.4%/+9.8%)

- MicroStrategy | $258 (+5.3%/+7.6%)

Coinbase was fined $3.6 million by the Dutch Central Bank on the 26th for providing services without proper registration, such as anti-money laundering measures. bottom.

Relation: Dutch central bank fines 470 million yen for coinbase

Relation: Stock investment recommended for virtual currency investors, representative virtual currency stocks of Japan and the United States “10 selections”

GM Radio “zkSync”

Here’s the first GM radio archive of the year that aired this week.

Don’t forget, #GMRadio with @zkSync‘s Head of Engineering, @anthonykrose is on in approx. 24 hours!

We’ll be talking about Ethereum scaling, pros/cons of ZK rollups, decentralization with/without a token, Anthony’s background at SpaceX, and much more!https://t.co/7B9Zj6UW4F

— CoinPost Global (@CoinPost_Global) January 25, 2023

Special guest this time is Mr. Anthony Rose, Head of Engineering at Matter Labs. The company is developing Ethereum (ETH) L2 solution “zkSync”. Matter Labs is developing a technology to improve the scalability of Ethereum by utilizing cryptographic technology called zero-knowledge proofs. On the radio, he talked about the strengths and challenges of ZK Rollup and the future prospects of zkSync.

Relation: This year’s first GM Radio will be held, guests will be Ethereum L2 “zkSync” development company executives

Click here to watch the archive of the previous episode, including Yat Siu, chairman of Animoka Brands.

Reminder: Our 2nd #GMRadio starts in 30 min (24:00 UTC / 19:00 EST / 9:00 JST)

Tune in to hear about “Leading The Open Metaverse With Innovative Blockchain Games” with @ysiuExecutive Chairman of @animocabrands and @Ben_CharbitCEO of @Darewise!https://t.co/nr8dNhMpBM

— CoinPost Global (@CoinPost_Global) December 22, 2022

Read More: bitcoinwarrior.net

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Wrapped Bitcoin

Wrapped Bitcoin  Sui

Sui  Hyperliquid

Hyperliquid  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Avalanche

Avalanche  Stellar

Stellar  Bitcoin Cash

Bitcoin Cash  Shiba Inu

Shiba Inu  LEO Token

LEO Token  Hedera

Hedera  Toncoin

Toncoin  Litecoin

Litecoin  WETH

WETH  Monero

Monero  Polkadot

Polkadot  USDS

USDS  Bitget Token

Bitget Token  Wrapped eETH

Wrapped eETH  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Pepe

Pepe  Pi Network

Pi Network  Ethena USDe

Ethena USDe  WhiteBIT Coin

WhiteBIT Coin  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Aave

Aave  Bittensor

Bittensor  Dai

Dai  Uniswap

Uniswap  NEAR Protocol

NEAR Protocol  Aptos

Aptos  Jito Staked SOL

Jito Staked SOL  OKB

OKB  Ondo

Ondo  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Internet Computer

Internet Computer