Summary:

- Stablecoin supply dropped by the end of the second quarter of 2022.

- Arcane Research data showed that the total supply was about $151 billion by Q2 of this year.

- The figure revealed an 18.8% drop over the last quarter, worth around $35 billion.

- It’s so far the largest supply drop in stablecoin history, per the report.

- Arcane’s data also showed that Circle’s USDC token could Flippen Tether’s USDT in market value before 2022 is over.

- USDC is currently the second largest stablecoin in crypto, topped only by USDT.

Global total stablecoin supply saw a drawdown at the end of Q2 2022 by some 18.8% as the equity markets and risk assets face turbulent periods due to rising inflation and other macro factors.

Stablecoins are digital tokens pegged to fiat currencies like the U.S. dollar. Such tokens leverage blockchain technology and are backed by a mix of cash reserves, commercial holdings, and other real-world assets.

The supply pattern was revealed in a report published by Arcane Research this week. Arcane’s report studied supply data for major tokens like USDT, USDC, BUSD, DAI, MIM, USTC, and others.

Data showed that around May 2022, the total supply was north of $180 billion. That number fell to $151.3 billion by end of the second quarter and signaled an 18.8% drop in global supply.

The hefty drop is worth around $35.1 billion and according to the report, marks the largest quarterly supply drop in stablecoin history. This comes at a time when crypto markets are in a slump and market leaders like Bitcoin have experienced massive drops in asset prices.

Circle’s USDC Poised To Surpass Tether’s USDT In Stablecoin Market Value

Notably, Arcane’s report expects a leap from USDC to the top. Indeed, the report said that USDC will climb about USDT in market value sometime in October 2022.

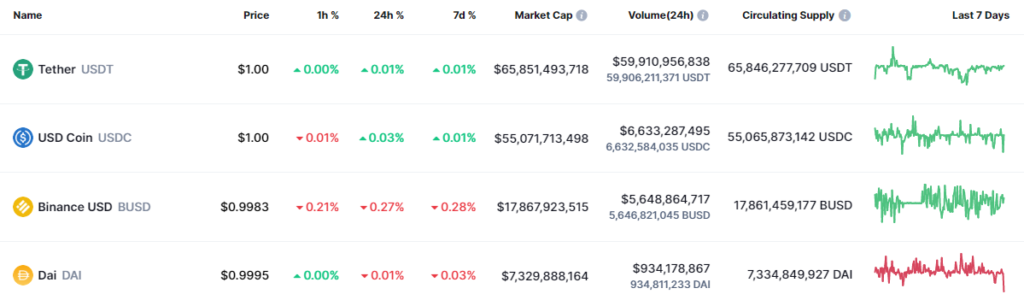

At press time, USDT and USDC are the top two stablecoins in cryptocurrency. Both tokens boast a market cap north of $50 billion. The closest competitor, Binance USD (BUSD) comes third with around $17.83 billion in market cap.

Read More: en.ethereumworldnews.com

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Avalanche

Avalanche  Wrapped stETH

Wrapped stETH  Sui

Sui  Chainlink

Chainlink  Toncoin

Toncoin  Shiba Inu

Shiba Inu  Stellar

Stellar  Wrapped Bitcoin

Wrapped Bitcoin  Hedera

Hedera  Polkadot

Polkadot  WETH

WETH  Bitcoin Cash

Bitcoin Cash  Uniswap

Uniswap  Pepe

Pepe  Litecoin

Litecoin  Hyperliquid

Hyperliquid  LEO Token

LEO Token  Wrapped eETH

Wrapped eETH  NEAR Protocol

NEAR Protocol  Ethena USDe

Ethena USDe  USDS

USDS  Internet Computer

Internet Computer  Aptos

Aptos  Aave

Aave  Mantle

Mantle  Render

Render  Bittensor

Bittensor  Cronos

Cronos  POL (ex-MATIC)

POL (ex-MATIC)  Ethereum Classic

Ethereum Classic  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Virtuals Protocol

Virtuals Protocol  WhiteBIT Coin

WhiteBIT Coin  Arbitrum

Arbitrum  MANTRA

MANTRA  Monero

Monero  Tokenize Xchange

Tokenize Xchange