It’s been a year since the demise of the FTX exchange — an event that’s now increasingly looking like it was the Bitcoin (BTC) bottom, which is up roughly 120% from a year ago.

In November 2022, the FTX collapse wiped nearly $300 billion off the market cap, impacting several cryptocurrencies. The ones that suffered the most were tokens with deep financial ties to FTX, including Solana’s (SOL), Serum (SRM) and the exchange’s native FTX Token (FTT).

But a year later, things have improved for BTC and most cryptocurrencies impacted by the FTX collapse.

Here are the top gainers (from the top 30 by market capitalization) that would have yielded the biggest profit if bought in November 2022.

Solana up 660% from FTX crash bottom

Solana’s price plummeted by over 50% to $8 after the FTX collapse. The sell-off occurred primarily because FTX and its sister firm, Alameda Research, held about 55 million SOL, triggering fears of a dump to plug liquidity holes.

Nonetheless, buying SOL a year ago would have produced a profit of over 660% today.

Solana’s gains have primarily stemmed from an upside sentiment in the crypto market, led by hopes for a spot Bitcoin exchange-traded fund approval in the United States. At the same time, SOL’s price has also benefited from subsiding fears about a potential dump by FTX.

FTX has sold 6,986,554 $SOL in the past few weeks, for ~$280.2M $USD.

They are completely OUT of unlocked $SOL.

The only $SOL they have exposure to is locked up, most until 2027-2028, just in time to sell the bottom of the next bear market.#SOLANA can commence UP ONLY. pic.twitter.com/Qu2z843oxS

— Curb◎ (@CryptoCurb) November 14, 2023

FTX Token rival OKB is up 275%

OKX crypto exchange’s token OKB was among the least-affected tokens by the FTX fiasco. Moreover, it has significantly benefited in price after its top rival went bust.

Buying OKB at the FTX bottom of $17.20 a year ago would have yielded investors a 275% profit today.

OKB’s price gains were Binance’s loss, and its BNB (BNB) token has underperformed the market significantly as the exchange faces legal pressure in the United States.

BNB has underperformed many of the top 30 cryptocurrencies over the past year, rising only 16% from the FTX bottom.

Chainlink

Chainlink’s (LINK) had fallen by as much as 40% following the FTX collapse. However, its lower exposure to the crypto exchange, coupled with development updates, has resulted in a sharp price recovery since the event.

Notably, buying LINK in November 2022 at $5.68 would have produced over 180% profits today.

Factors that helped the LINK price rally in recent months include launching a new proof-of-reserve product, growing adoption, and increasing demand among professional investors, as suggested by Grayscale’s Chainlink Trust trading at a 170% premium to LINK’s spot price.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Read More: cointelegraph.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

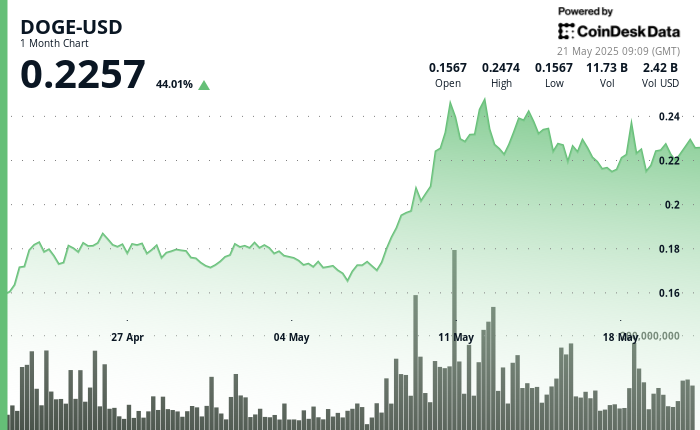

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Wrapped Bitcoin

Wrapped Bitcoin  Sui

Sui  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Avalanche

Avalanche  Stellar

Stellar  Hyperliquid

Hyperliquid  Shiba Inu

Shiba Inu  Hedera

Hedera  LEO Token

LEO Token  Bitcoin Cash

Bitcoin Cash  Toncoin

Toncoin  Litecoin

Litecoin  Polkadot

Polkadot  USDS

USDS  WETH

WETH  Monero

Monero  Wrapped eETH

Wrapped eETH  Bitget Token

Bitget Token  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Pi Network

Pi Network  Pepe

Pepe  Ethena USDe

Ethena USDe  Coinbase Wrapped BTC

Coinbase Wrapped BTC  WhiteBIT Coin

WhiteBIT Coin  Aave

Aave  Uniswap

Uniswap  Dai

Dai  Bittensor

Bittensor  NEAR Protocol

NEAR Protocol  Aptos

Aptos  OKB

OKB  Jito Staked SOL

Jito Staked SOL  Ondo

Ondo  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Tokenize Xchange

Tokenize Xchange  Official Trump

Official Trump  Cronos

Cronos