Are you interested in the market for cryptocurrencies and searching for profitable investment opportunities? In that case, you’ve found the right place! Investors are increasingly focusing on stocks of cryptocurrency companies as a result of the meteoric rise in popularity of cryptos. These stocks offer a special chance to profit from the expanding cryptocurrency market without actually purchasing any digital assets.

This extensive guide will examine 20 stocks of cryptocurrency companies that are available for under $100 in 2023. Let’s learn more about the cryptocurrency industry and its enormous growth potential before getting into the specifics.

1. BITK – Blockchaink2 Corp.

- Stock Price: $0.17

- Market Cap: $7,013.00

- 24h Volume: 45.833

Blockchaink2 Corp. is a leading player in blockchain technology, focusing on innovative solutions for various industries. Their diverse product offerings and strategic partnerships make them a formidable competitor in the market.

According to Google Finance, the stock price of BITK as of today, 7/19/2023, is $0.17 CAD per share, which is 42.86% above the 52-week low of $0.7 set on June 19, 2023. The company has a market cap of $2.68 million CAD and 16.78 million shares outstanding.

The company reported a net income of $141.35K for the fiscal quarter ending on March 31, 2023, a 146.90% increase from last year. The company’s net profit margin was 1.50K CAD, a 223.53% increase from last year. The company’s earnings per share (EPS) and effective tax rate are unavailable.

2. DMGI – DMG Blockchain Solutions Inc.

- Stock Price: $0.53

- Market Cap: $246,419.00

- 24h Volume: 33.333

DMG Blockchain Solutions Inc. is a Canada-based company specializing in providing enterprise-level blockchain solutions to businesses. Their expertise lies in managing, operating, and developing end-to-end digital solutions to monetize the blockchain ecosystem. DMG Blockchain Solutions is positioned as a prominent player in the blockchain and cryptocurrency industry with a focus on security and scalability.

DMGI reported its quarterly financials for the period ending in March 2023. During this period, the company’s total revenue amounted to 7.62 million CAD, showing a year-over-year increase of 35.94%. However, the company’s net income for the same period was -3.84 million CAD, representing a substantial decline compared to the previous year. The net profit margin was also negative at -50.36%, indicating that the company’s expenses exceeded its revenue during that quarter.

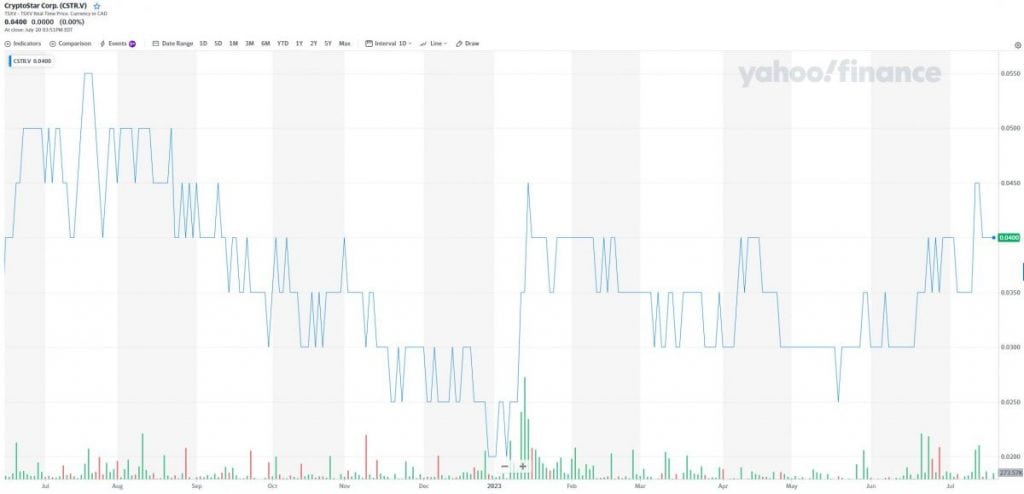

3. CSTR – Cryptostar Corp.

Cryptostar Corp. (CSTR) is a notable player in the digital asset trading domain, providing a secure and efficient platform for trading cryptocurrencies. As of the latest available information, the stock price of CSTR was 0.040 CAD, with a market capitalization of approximately 17.13 million CAD. The company has seen a 52-week high of 0.060 CAD and a 52-week low of 0.020 CAD.

In terms of financial performance, CSTR has stable figures. The company reported revenue of 874.09K USD for the quarter ending in March 2023, showing a notable increase of 27.48% year over year. However, it’s essential to note that the net income was -1.56M USD, which indicates a net loss during that period. The diluted EPS information was unavailable, and the net profit margin stood at -178.95%, suggesting the company faced challenges in maintaining profitability.

Despite the financial challenges, Cryptostar Corp. remains strategically positioned in the digital asset trading market. Given the increasing popularity of cryptocurrencies and the broader blockchain industry, CSTR is poised for potential growth in the coming years. Investors and bullish traders on the cryptocurrency market may find CSTR’s stock intriguing due to its involvement in the sector.

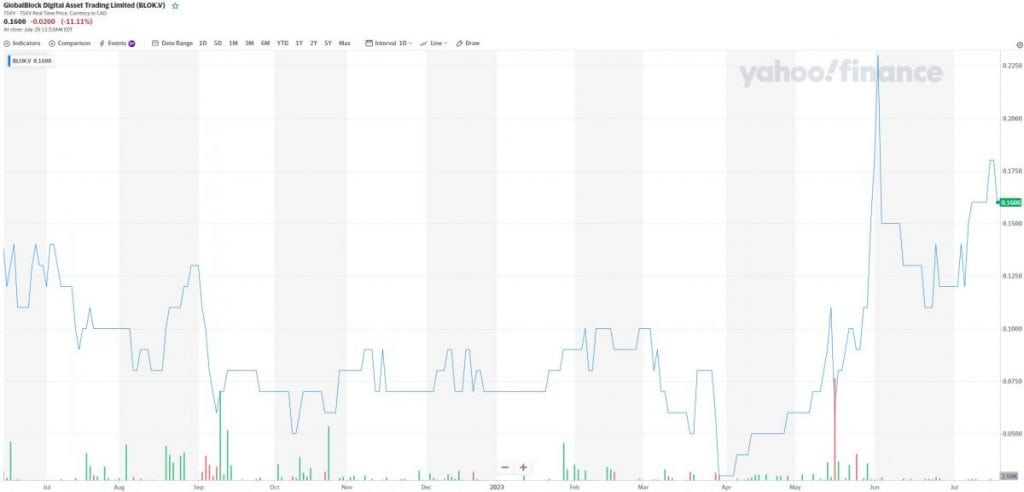

4. BLOK – GlobalBlock Digital Asset Trading Limited

GlobalBlock Digital Asset Trading Limited is a prominent company in the digital asset trading sector. It operates as a platform that facilitates the buying and selling various cryptocurrencies. The company is listed on the Canadian Venture Exchange (CVE) under the ticker symbol BLOK. While limited information on the company’s background and operations is available, it is recognized as a significant player in the cryptocurrency market.

Regarding financial metrics, GlobalBlock Digital Asset Trading Limited had a market capitalization of approximately $22.47 million. The company has a beta value of 0.66, reflecting its sensitivity to market movements relative to the broader market. The price-to-earnings ratio (P/E) for the trailing twelve months (TTM) was 18.00, indicating the valuation of the stock in relation to its earnings during that period. The earnings per share (EPS) for the TTM was $0.0100.

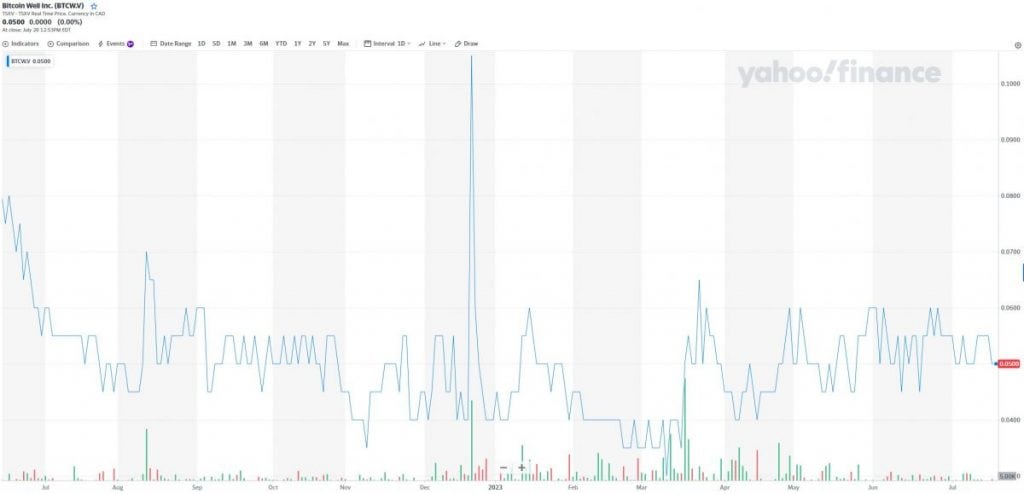

5. BTCW – Bitcoin Well Inc.

Bitcoin Well Inc. (BTCW) is a Canadian company based in Edmonton. It operates as a non-custodial fintech business, aiming to make Bitcoin more accessible and useful to everyday people. The company provides secure online and in-person solutions for buying and selling Bitcoin and other cryptocurrencies through Bitcoin automated teller machines (ATMs) across Canada.

BTCW is listed on the Canadian stock exchange under the ticker symbol BTCW.V. As of the latest available data; the stock price was around 0.050 CAD. The company’s market capitalization was approximately 9.65 million CAD.

In addition to its core services, Bitcoin Well Inc. has expanded its operations through acquisitions. The company acquired Paradime Ltd, Ghostlab Inc., and Entreprises Equibytes Inc., which have likely contributed to its growth and market presence.

6. DGHI – Digihost Technology Inc.

- Stock Price: $2.91

- Market Cap: $7,969.00

- 24h Volume: 8.614

Digihost Technology Inc. (DGHI) is an innovative U.S.-based blockchain technology and computer infrastructure company that operates in the blockchain mining industry. The company is involved in cryptocurrency mining, validating transactions, and adding them to the blockchain. Digihost utilizes sustainable energy solutions for its mining operations, making it stand out in the mining sector.

Digihost Technology Inc. has demonstrated significant growth in its financial performance. The company’s stock price has experienced fluctuations, with a previous close at 2.2900 USD and an opening price of 2.2000 USD. The day’s trading range has been between 2.1600 USD and 2.3199 USD. The 52-week field indicates a significant growth potential, with a low of 0.3100 USD and a high of 2.5400 USD.

7. LQWD – LQwD FinTech Corp.

- Stock Price: $0.61

- Market Cap: $18,000.00

- 24h Volume: 8.333

LQwD FinTech Corp. (TSXV: LQWD) is a notable player in the financial technology sector, focusing on leveraging blockchain solutions to enable seamless transactions. The company is actively developing payment infrastructure and solutions, mainly centered around the Lightning Network. As a Lightning Network Service Provider (LSP), LQwD is contributing to advancing this second-layer technology for the Bitcoin blockchain to facilitate faster and more cost-effective transactions.

Regarding financial performance, LQwD FinTech Corp.’s stock has shown promise, although it experienced a decline of 6.15% at the close of trading on July 19, 2023. The company’s stock price has ranged between CAD 0.4000 to CAD 1.3000 over the past 52 weeks, indicating fluctuations in market value. The current market cap of the company is approximately CAD 7.078 million.

LQwD’s commitment to enhancing financial services through innovative fintech solutions sets them apart. Their involvement in cryptocurrency mining and the development of the Lightning Network platform positions them at the forefront of blockchain-based financial systems.

As of now, there have been several positive developments within the company. Notably, LQwD recently closed an upsized non-brokered private placement financing of $882,000. Additionally, they have become the first third-party Lightning Network service provider, further solidifying their position as a critical player in the Lightning Network ecosystem.

8. SATO – SATO Technologies Corp.

- Stock Price: $0.42

- Market Cap: $23,710.00

- 24h Volume: 6.757

SATO Technologies Corp. (SATO.V) specializes in developing blockchain-based solutions for supply chain management. Their focus on blockchain technology indicates that they aim to bring transparency, security, and efficiency to supply chain processes through decentralized and immutable ledger systems.

In terms of financial performance, SATO Technologies Corp. has shown consistent growth. As of the time of writing, their stock price on the TSX Venture Exchange (TSXV) was approximately 0.4250 CAD, with a market cap of 31.244 million CAD. They have achieved positive operating cash flow and net profit, improving their financial results.

9. QETH.U – The Ether Fund

The Ether Fund (QETH-U.TO) is designed to expose investors to Ethereum (ETH), one of the market’s most prominent and widely used cryptocurrencies. Ethereum is a decentralized blockchain platform that allows developers to build and deploy smart contracts and decentralized applications (DApps). As Ethereum’s value and usage have increased, The Ether Fund aims to enable investors to participate in its growth and potential returns.

The performance of The Ether Fund (QETH-U.TO) is directly tied to the implementation of Ethereum. As the price of Ethereum fluctuates in the cryptocurrency market, the value of The Ether Fund’s holdings will also experience similar fluctuations. Investors should know that cryptocurrencies, including Ethereum, can be highly volatile and may undergo significant price swings over short periods.

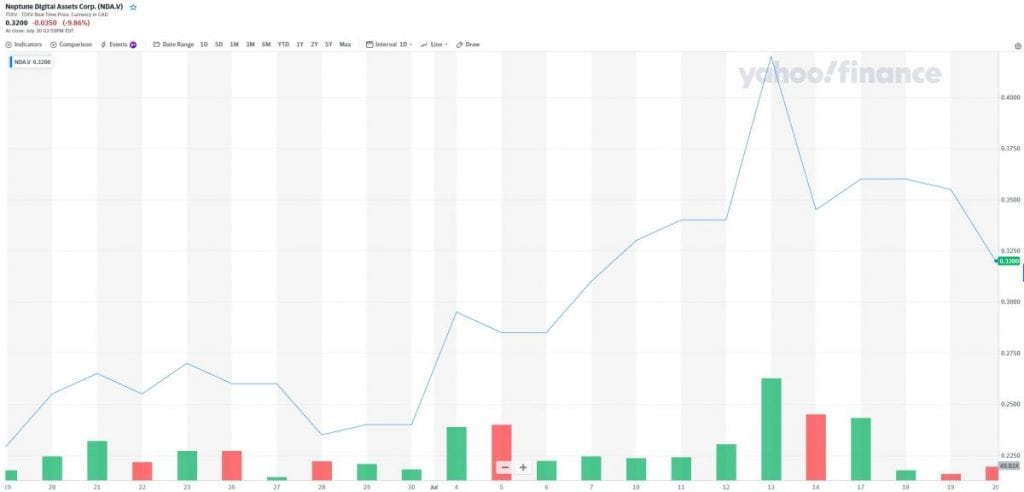

10. NDA – Neptune Digital Assets Corp.

- Stock Price: $0.34

- Market Cap: $22,673.00

- 24h Volume: 5.882

Neptune Digital Assets Corp. (NDA.V) is a company that specializes in providing blockchain technology solutions and digital asset management. As a publicly traded blockchain company based in Canada, Neptune has been at the forefront of the rapidly evolving digital asset space.

Neptune’s financial performance is on a positive trajectory. The company reported a comprehensive net income of $2.7 million in Q2, indicating steady progress and growth in its operations. Additionally, they have seen a significant increase in total revenues, with a reported 1069% increase over the prior year in their audited financial statements.

11. DELX – DelphX Capital Markets Inc.

- Stock Price: $0.09

- Market Cap: $11.80 million

- 24h Volume: 5.882

DelphX Capital Markets Inc. is a technology and financial services company that brings new and exciting alternatives to structured product and credit markets. They specialize in providing blockchain solutions for capital markets. As of the last available data, the company’s stock was traded on the Canadian Venture Exchange (CVE) under the ticker symbol DELX, with a stock price of 0.085 CAD and a market capitalization of 11.80 million CAD.

While specific financial details might be private due to the company’s privacy policy, their emphasis on capital market solutions and financial technology makes them an attractive investment option for those interested in innovative approaches to the financial sector.

12. QETH.UN – The Ether Fund

- Stock Price: $39.81

- Market Cap: $170.41M

- 24h Volume: 5.34 M

The Ether Fund (QETH.UN) is an investment fund listed on the Toronto Stock Exchange (TSX) that provides investors with exposure to the price movements of the cryptocurrency Ethereum (ETH). As an investment vehicle, QETH.UN’s financial performance is closely tied to the version of Ethereum itself. This means that when the price of Ethereum rises, the value of the fund’s assets increases, and vice versa.

Investing in QETH.UN can be attractive for investors who are bullish on the potential growth of Ethereum and believe in its long-term prospects. By purchasing units of The Ether Fund, investors can indirectly hold and benefit from the price appreciation of Ethereum without having to manage and store the cryptocurrency themselves.

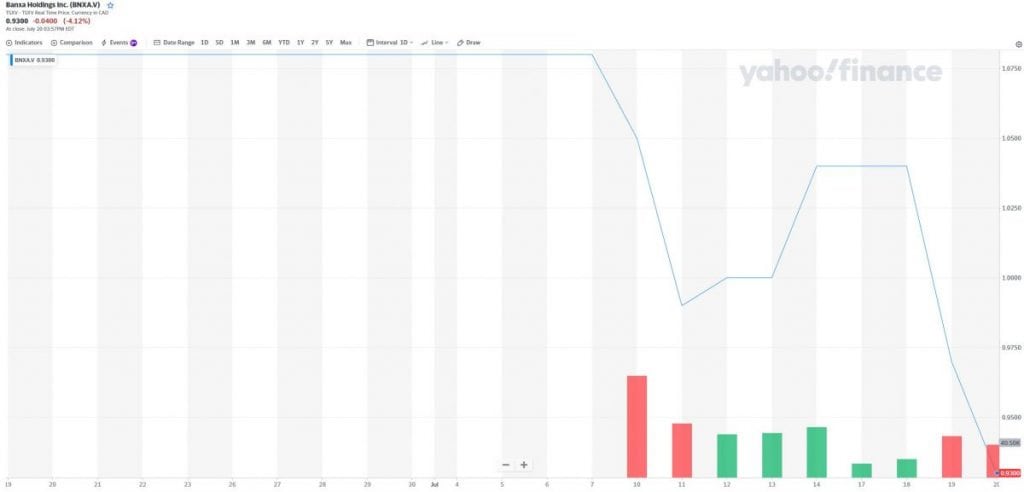

13. BNXA – Banxa Holdings Inc.

- Stock Price: $0.96

- Market Cap: $45.5 M

- 24h Volume: 5.051 M

Banxa Holdings Inc. is a payment service provider that facilitates cryptocurrency transactions. It operates as an on and off-ramp for individuals and businesses looking to interact with cryptocurrencies, providing a seamless bridge between traditional fiat currencies and the digital asset world.

The company’s financials suggest a positive trajectory driven by the increasing adoption of cryptocurrencies. It reported a Total Transaction Volume (TTV) of $167 million (approximately $109 million), indicating significant demand for its services. However, it’s worth noting that the company reported a comprehensive loss of $16.6 million (about $11.5 million) due to strategic investments in expansion plans.

14. CBIT – Cathedra Bitcoin Inc.

Cathedra Bitcoin Inc. (CBIT.V) is a Bitcoin company that specializes in developing and operating world-class Bitcoin mining infrastructure. The company is listed on the TSX Venture Exchange (TSXV) and is involved in various Bitcoin mining operations. The latest data shows that the company’s stock price closed at $0.1900 on July 19, 2023. It has a 52-week trading range of $0.0350 to $0.2500 and a market capitalization of approximately $26.129 million.

CBIT has been actively providing updates on its operations and financial performance. In June 2023, the company announced updates on its Bitcoin mining operations, highlighting its commitment to expanding and enhancing its mining capabilities. Additionally, CBIT announced a strategic partnership with 360 Mining, Inc, a Delaware-incorporated off-grid bitcoin mining company, aiming to bolster its mining infrastructure further.

15. Block Inc. (SQ)

- Stock Price: $78.19

- Market Cap: 47.30B USD

- 24h Volume: 9.32M

Block Inc. (SQ) is a financial services conglomerate and technology company that operates through its segments, Square and Cash App. The company provides payment solutions to merchants, including small businesses, through Square, which offers point-of-sale hardware and software, payment processing, and related services. Cash App is a person-to-person payment app that allows users to send and receive money quickly.

The stock price of Block Inc. (SQ) is $78.19, with a market capitalization of approximately $47.884 billion. The stock’s 52-week range is between $51.34 and $93.19. The company’s previous close was $79.03.

Block Inc. has been known for its innovative approach to digital payments and has become a significant player in the financial services industry. Investors are monitoring its performance, including the upcoming earnings date, which is scheduled for August 3, 2023.

16. BITI – BetaPro Inverse Bitcoin ETF

- Stock Price: $11.47

- Market Cap: $21.84M

- 24h Volume: 2.114M

The BetaPro Inverse Bitcoin ETF (BITI.TO) is designed to offer investors inverse exposure to Bitcoin’s daily performance. In simple terms, when the price of Bitcoin goes up, the value of BITI.TO is expected to go down, and vice versa. This ETF is specifically structured to move in the opposite direction of Bitcoin’s daily price changes.

As an inverse ETF, the performance of BITI.TO is inversely correlated with Bitcoin’s daily price movements. If Bitcoin’s price experiences a positive change on a particular day, BITI.TO will likely show a negative change for that day and vice versa.

BITI.TO can be an attractive option for investors looking to hedge their exposure to Bitcoin or those who believe that Bitcoin’s price will likely decline by holding BITI.TO, investors can potentially offset some of the losses they may experience in their Bitcoin holdings if the price decreases.

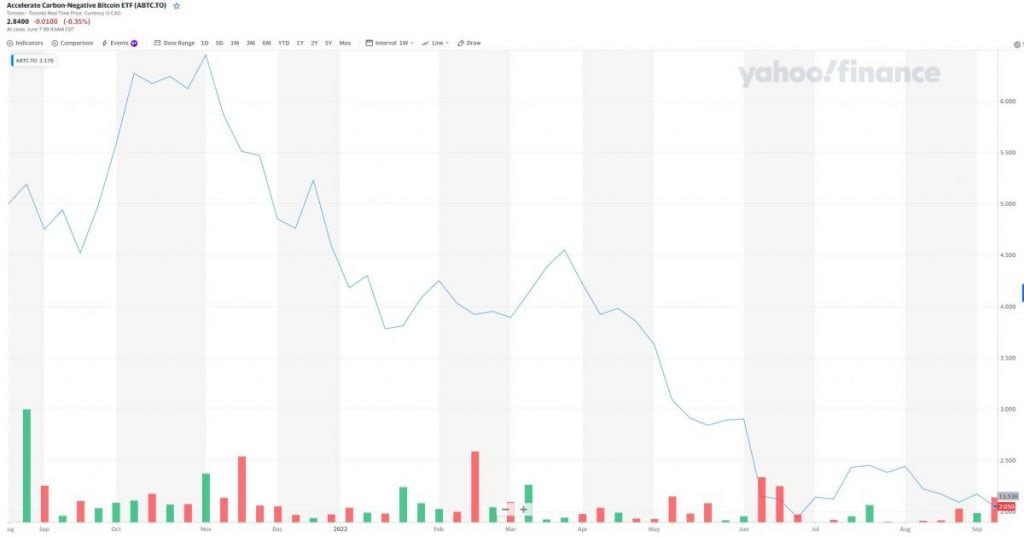

17. ABTC.U – Accelerate Carbon-Negative Bitcoin ETF

The Accelerate Carbon-Negative Bitcoin ETF (ABTC.U) is designed to provide investors with exposure to the performance of Bitcoin through its investment in CME bitcoin futures. As an exchange-traded fund (ETF), ABTC.U’s financial performance is directly linked to the price movements of bitcoin and the success of carbon-negative bitcoin mining operations.

Unlike traditional Bitcoin mining, often associated with high energy consumption and carbon emissions, carbon-negative mining aims to offset its carbon footprint through various environmental initiatives. By investing in ABTC.U, environmentally-conscious investors can support and participate in sustainable Bitcoin mining practices.

As of the most recent data, the ETF’s net assets are approximately 1.47 million CAD, with a net asset value (NAV) of 5.08 CAD per unit. The ETF has a 52-week range of 1.9400 CAD to 2.8400 CAD, indicating the price fluctuations experienced over the past year. The expense ratio for the fund is currently listed as 0.00%, implying that the fund may have no direct management fees. Investors must consider expense ratios and past performance before making investment decisions.

18. Hut 8 Mining Corp.

- Stock Price: $3.84

- Market Cap: -852.185M

- 24h Volume: -12,093,125

Hut 8 Mining Corp. (HUT) is a publicly traded company with a stock price of $3.84 and a market cap of approximately $852.185 million. The company is a prominent player in the digital asset mining industry, focusing on Bitcoin mining and high-performance computing infrastructure.

The Accelerate Carbon-Negative Bitcoin ETF (ABTC) is similar to ABTC.U and offers exposure to carbon-negative Bitcoin mining. ABTC aims to invest in sustainable mining practices, meaning that the mining operations it supports aim to offset more carbon emissions than they produce during the mining process.

Since ABTC is an ETF, its financial performance is closely tied to the success of carbon-negative Bitcoin mining operations. As the mining operations achieve sustainable and profitable outcomes, the ETF’s performance will likely reflect that success.

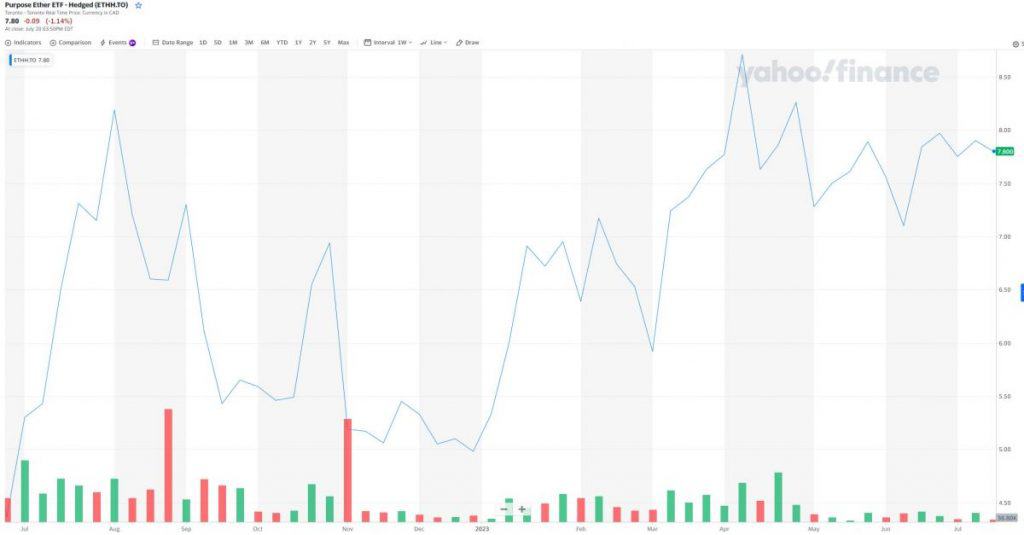

19. ETHH – Purpose Ether ETF

- Stock Price: $7.84

- Market Cap: $9,751.00

- 24h Volume: 1.036

Purpose Ether ETF – Hedged (ETHH.TO) is an investment product that exposes investors to Ethereum, the cryptocurrency, through an ETF (Exchange-Traded Fund) structure. As an ETF, its performance is closely tied to the price movements of Ethereum. This means that as the price of Ethereum increases or decreases, the value of the ETHH ETF is likely to follow suit.

Since ETHH is an ETF, its performance reflects the underlying asset’s performance, Ethereum. If the price of Ethereum experiences growth, the value of the ETF is expected to rise, allowing investors to benefit from Ethereum’s potential upside. Similarly, if the price of Ethereum declines, the value of the ETF is likely to decrease as well.

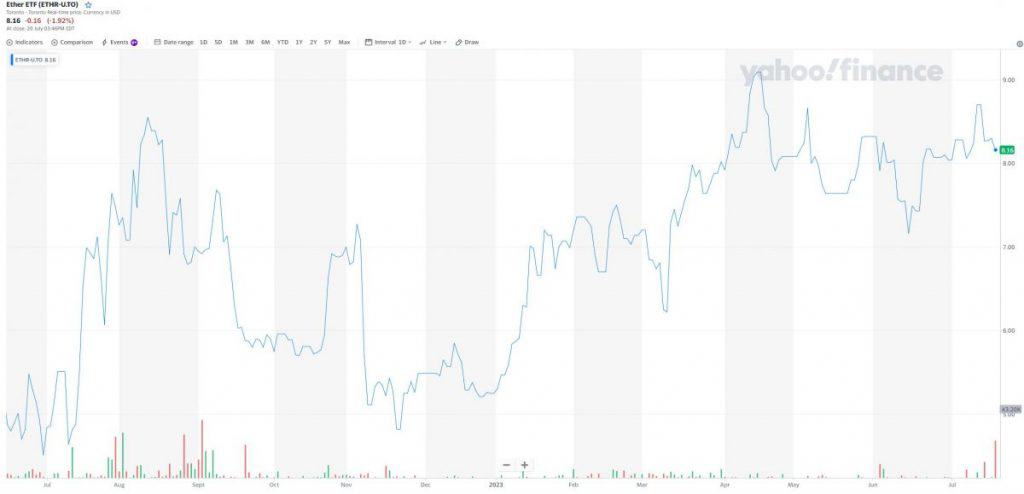

20. ETHR.U – Ether ETF

- Stock Price: $8.30

- Market Cap: $1,285.00

- 24h Volume: 0.857

The Ether ETF (ETHR.U) is an exchange-traded fund listed on the Toronto Stock Exchange (TSE) that seeks to track the price movements of Ethereum (ETH) through an ETF format. As an ETF, its performance directly reflects the price changes of Ethereum, the popular cryptocurrency.

As of the latest available data, the ETHR.U ETF had a closing price of 8.30 USD on July 19, with a day’s range of 8.30 to 8.30 USD. The ETF’s 52-week range shows fluctuations between 4.82 USD and 12.93 USD over the past year. The net assets and expense ratio for the ETF is listed as “N/A,” indicating that this specific information might not be readily available.

Investing in the ETHR.U ETF can be an attractive option for investors who want exposure to Ethereum without directly owning the cryptocurrency. As an ETF, it provides a convenient and regulated way to participate in the potential growth of Ethereum’s price movements.

Comparison sheet of the 20 crypto company stocks

| No. | Stock Ticker | Company Name | Stock Price | Market Cap | 24h Volume |

|---|---|---|---|---|---|

| 1 | BITK | Blockchaink2 Corp. | $0.17 | $7,013.00 | 45.833 |

| 2 | DMGI | DMG Blockchain Solutions Inc. | $0.53 | $246,419.00 | 33.333 |

| 3 | CSTR | Cryptostar Corp. | $0.04 | $6,330.00 | 14.286 |

| 4 | BLOK | GlobalBlock Digital Asset Trading Limited | $0.18 | – | – |

| 5 | BTCW | Bitcoin Well Inc. | $0.05 | $8.71 | 10.00 |

| 6 | DGHI | Digihost Technology Inc. | $2.91 | $7,969.00 | 8.614 |

| 7 | LQWD | LQwD FinTech Corp. | $0.61 | $18,000.00 | 8.333 |

| 8 | SATO | SATO Technologies Corp. | $0.42 | $23,710.00 | 6.757 |

| 9 | QETH.U | The Ether Fund | $30.12 | $18.00 | 6.469 |

| 10 | NDA | Neptune Digital Assets Corp. | $0.34 | $22,673.00 | 5.882 |

| 11 | DELX | DelphX Capital Markets Inc. | $0.09 | $11.80 million | 5.882 |

| 12 | QETH.UN | The Ether Fund | $39.81 | $170.41M | 5.34 M |

| 13 | BNXA | Banxa Holdings Inc. | $0.96 | $45.5 M | 5.051 M |

| 14 | CBIT | Cathedra Bitcoin Inc. | $0.195 | $26.09M | 2.7M |

| 15 | SQ | Block Inc. | $78.19 | $47.30B | 9.32M |

| 16 | BITI | BetaPro Inverse Bitcoin ETF | $11.47 | $21.84M | 2.114M |

| 17 | ABTC.U | Accelerate Carbon-Negative Bitcoin ETF | $2.10 | – | – |

| 18 | HUT | Hut 8 Mining Corp. | $3.84 | $852.185M | -12,093,125 |

| 19 | ETHH | Purpose Ether ETF – Hedged | $7.84 | $9,751.00 | 1.036 |

| 20 | ETHR.U | Ether ETF | $8.30 | $1,285.00 | 0.857 |

Conclusion

The crypto market’s growth trajectory and the increasing interest in cryptocurrency-based investments present an exciting opportunity for investors. This article explores 20 crypto company stocks you can consider buying under $100 in 2023. These stocks offer diverse ways to participate in the crypto market’s growth, from blockchain technology providers to ETFs providing exposure to cryptocurrencies.

Read more about crypto:

Read More: mpost.io

Linear

Linear  Stride Staked DYDX

Stride Staked DYDX  TROY

TROY  Arc

Arc  Acolyte by Virtuals

Acolyte by Virtuals  Pirate Chain

Pirate Chain  Biswap

Biswap  Infinitar Governance Token

Infinitar Governance Token  Sturdy

Sturdy  A Hunters Dream

A Hunters Dream  Klever

Klever  Boson Protocol

Boson Protocol  GOUT

GOUT  Tranchess

Tranchess  Giko Cat

Giko Cat  GoGoPool ggAVAX

GoGoPool ggAVAX  Spectra [OLD]

Spectra [OLD]  Grok

Grok  Mossland

Mossland  Joe Coin

Joe Coin  PHNIX

PHNIX  Ekubo Protocol

Ekubo Protocol  Luce

Luce  Cloud

Cloud  Streamr

Streamr  Shardus

Shardus  Ribbon Finance

Ribbon Finance  Spectre AI

Spectre AI  Steem Dollars

Steem Dollars  Vertex

Vertex  GameFi.org

GameFi.org  Concordium

Concordium  DexTools

DexTools  cBAT

cBAT  Zefi

Zefi  AMATERASU OMIKAMI

AMATERASU OMIKAMI  REVOX

REVOX  Nexera

Nexera  ParaSwap

ParaSwap  ORBIT

ORBIT  TriasLab

TriasLab  district0x

district0x  Strawberry AI

Strawberry AI  PYTHIA

PYTHIA  Synternet

Synternet  Rich Quack

Rich Quack  Ultra

Ultra  Streamr XDATA

Streamr XDATA  XSGD

XSGD