[ad_1]

The stock market can be a daunting place for many investors. With so many options, it can be difficult to determine which stocks are worth investing in and which ones are not. Fortunately, AI have made it easier than ever to make informed investment decisions. AI can analyze vast amounts of data to identify patterns and trends that can be used to predict stock prices with a high degree of accuracy. We will explain how ChatGPT can anticipate stock prices and provide the 20 most promising stocks that ChatGPT has discovered.

How ChatGPT can predict stock price?

ChatGPT is an AI-driven platform that uses natural language processing (NLP) to analyze news articles, social media posts, data, history and other online content related to stocks. By analyzing this vast amount of data, ChatGPT can identify patterns and trends that may not be immediately apparent to human analysts. ChatGPT can also process information much faster than a human analyst, which means it can identify trends and patterns in real-time.

ChatGPT uses a combination of machine learning algorithms and NLP to analyze data and make predictions. The machine learning algorithms learn from historical data to identify patterns and trends that can be used to predict future stock prices. NLP allows ChatGPT to understand the context of news articles and social media posts, which can provide valuable insights into market sentiment.

The information and/or materials included in this website do not constitute investment advice, nor are they meant to be sources of advice or credit analysis with regard to the material given.

Amazon (AMZN): Stock will be priced at $150 in Q1 2024 (+55%)

Amazon (AMZN) is one of the most potentially prospective stocks currently analyzed by ChatGPT. With its long history of sustained and exponential growth, diversified business model, and potential for continued success, Amazon is an ideal choice for investors to broaden their portfolio and maximize potential returns.

Since its inception in 1994, Amazon has sustained and grown its e-commerce business. The company expanded its range of products, ranging from merchandise to streaming media, making Amazon a dominant player in the online retail sector. In 2015, Amazon surpassed Walmart as the most valuable retailer in the US, thanks to its continued revenue growth.

Features

- Amazon has diversified its business model by venturing into new services and industries such as cloud computing and streaming media. Amazon Web Services (AWS), the company’s cloud computing platform, has become one of the largest cloud-computing providers in the world, generating $25.7 billion in revenue in 2020. Amazon also offers its own streaming media service, Prime Video, which has experienced tremendous growth over the past few years.

- Given Amazon’s strong track record of growth, its diversification into new markets, and its potential for continued success, it’s easy to understand why ChatGPT considers AMZN to be a highly prospective stock. The company has proven to be resilient and adaptive to changing markets and customer needs, adapting to new technology and diversifying its business model to capitalize on new opportunities.

- Amazon is increasingly becoming a technological powerhouse. The company has invested heavily in artificial intelligence, with its Amazon Alexa voice assistant and Amazon Machine Learning services becoming popular applications. Amazon also develops its own hardware, such as the Kindle e-readers and Echo smart speakers.

The potential returns associated with investing in Amazon make it a particularly attractive option. According to ChatGPT, Amazon’s stock has had a consistent upward trend since April 2020 and is projected to continue growing in the long term. This makes it a great option for investors looking for strong returns over a long period of time.

Apple Inc. (AAPL): Stock will be priced at $195 in Q1 2024 (+15%)

Apple Inc. (AAPL) has been one of the hottest stocks of the past decade. Over the years, the company has continued to innovate in the technology space and has become one of the world’s largest companies. With a market capitalization of over $1 trillion, it is not surprising that many investors are looking to add Apple stock to their portfolio. The company has a long history of growth and profitability, and analysts believe that upward momentum is likely to continue in the coming years.

Recently, a new analysis by ChatGPT found that Apple is one of the most prospective stocks available, according to their analysis. ChatGPT’s analysis utilized a combination of both technical and fundamental factors in order to determine the future outlook of any given stock or index. By looking at things such as growth rates, price earnings ratios, and macroeconomic indicators, ChatGPT was able to arrive at their conclusions.

Features

- The analysis by ChatGPT found that Apple had strong positive indicators in terms of its price earnings ratio, growth rate, and liquidity position. In addition, analysts noted that the company’s cash position was strong, with a net cash-to-market capitalization ratio of nearly 10%, indicating that the company is well-positioned for growth.

- Overall, the analysis by ChatGPT suggests that Apple is one of the most attractive investments for investors. The company has a long history of growth and profitability, and analysts believe that this momentum is likely to continue in the coming years. As such, now may be an opportune time for investors to look into Apple stock as a potential investment opportunity.

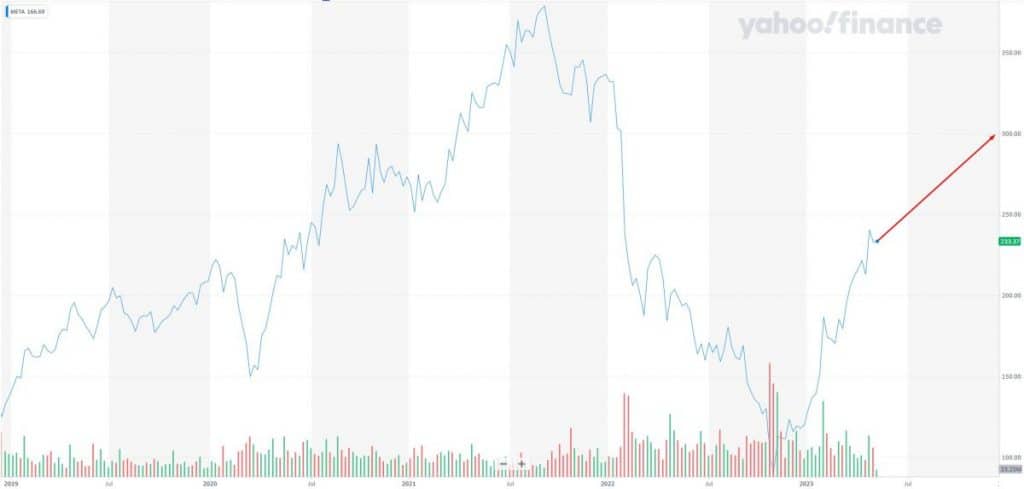

META is emerging as one of the most prospective stocks in the market. In addition to being a well-known and highly used social media platform, META has received praise from analysts for its potential to generate revenue and its strong track record of growth. ChatGPT is an automated financial data analysis firm that has recently been increasingly focusing its resources on the analysis of META stock. It has created a new algorithm specifically designed to identify trends and make predictions about META in order to advise investors on the best decisions when it comes to stock investing.

The algorithm used by ChatGPT to assess Facebook’s stock data is complex but intuitive. It looks at the relationship between META’s stock prices and various other factors in the market including user engagement, news headlines, and market sentiment. The algorithm then produces an analysis that can give investors a clear idea of the long-term prospects of investing in META.

Features

- The results of the analysis produced by ChatGPT have been convincing: META has been found to be one of the most promising stocks in the market for long-term investments. The analysis has also highlighted some of the potential risks associated with investing in FB stock, such as the potential for major changes in the company’s social media platform.

- Overall, the analysis from ChatGPT has made META one of the most prospective stocks in the market for long-term investments. The combination of META’s strong track record of growth and its potential for short-term gains make it a smart option for investors. However, it is important to do some research and understand the potential risks of investing in META before taking any action.

Alphabet Inc. (GOOGL): Stock will be priced at $130 in Q1 2024 (+20%)

Alphabet Inc. (GOOGL) is the parent company of Google. As one of the world’s biggest search engines, it has been a dominant player in the stock market for years. It has strong performing multiple businesses under its umbrella, including YouTube, Google Cloud, Waymo and Google Home. In addition, Alphabet Inc. (GOOGL)’s AI-driven technology and research allow for it to constantly evolve and evolve quickly.

According to ChatGPT’s analysis, Alphabet Inc. (GOOGL) is one of the best bet stocks and has the potential to yield excellent returns. This is due to a myriad of factors including its strong performance in the past and its exceptional AI-driven technology and research allowing it to expand quickly. Additionally, it has seen a steady income growth over the last five years and the outlook for the future looks even better. This all makes Alphabet Inc. (GOOGL) a stock that investors can’t afford to overlook, especially with its current tone in the market.

Features

- ChatGPT’s analysis gives further reasons to believe that Alphabet Inc. (GOOGL) is a solid investment. They note that it has been rated as the best growth stock for 2020 and beyond due to its potential for massive rewards. With its numerous advantages and a strong foundation, it is almost guaranteed to be a success in the long run.

- fFor those looking for a stock that will bring long-term profits, Alphabet Inc. (GOOGL) is one of the best options. With its exceptional performance and strong AI-driven technology, it is sure to keep offering great returns. With the help of ChatGPT, investors can easily analyze Alphabet Inc. (GOOGL) and make

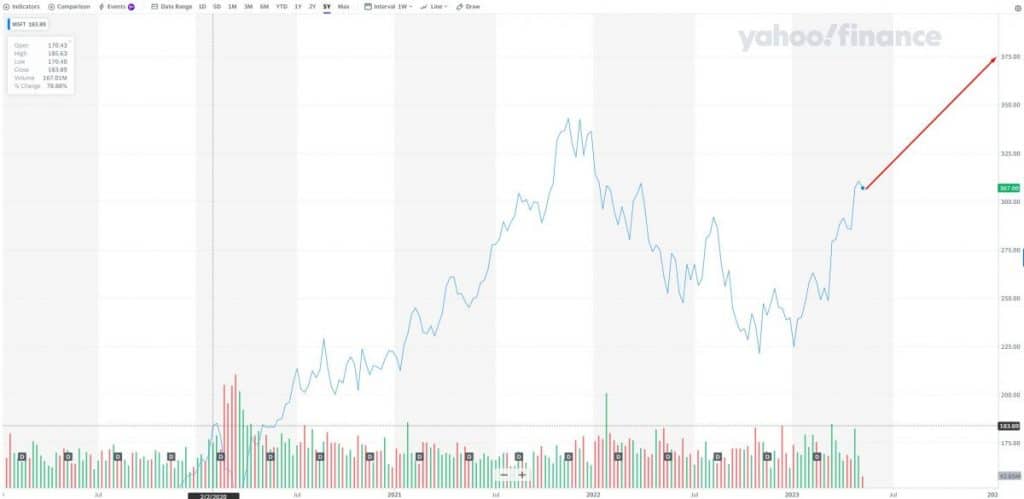

Microsoft (MSFT): Stock will be priced at $375 in Q1 2024 (+25%)

Microsoft (MSFT) is one of the biggest and most powerful modern-day companies. With its market capitalization of over $1 trillion, Microsoft is a giant in the global technology sector. It is renowned for a range of products and services, including Windows, Office productivity suite, Xbox, and their cloud-computing services. Recently, Microsoft has been the subject of much analysis with regards to its stock performance. According to research by ChatGPT, Microsoft is one of the most prospective stock picks on the market. It is the topmost stock in terms of investor expectations and future growth.

Features

- Microsoft has many positive elements that make it a great stock. For instance, it has a low price-earnings ratio, meaning that the profits generated by the company are relatively high compared to its stock price. Additionally, it is undervalued compared to other companies in the same sector, making it an attractive buy.

- The company also enjoys strong visibility in an ever-changing technology landscape. Microsoft’s cloud-computing platform and the Office 360 suite are some of its most profitable offerings, and it has developed an impressive presence in the enterprise space.

- Moreover, the company’s investments in artificial intelligence, machine learning, and data-driven systems have seen it take a commanding lead in the field of innovation. Microsoft’s immense research and development capabilities allow it to develop highly efficient products and services, and this has been reflected in its stock performance.

Microsoft (MSFT) is one of the most prospective stocks analyzed by ChatGPT. It has a market capitalization of over $1 trillion, a low price-earnings ratio, an impressive presence in the enterprise space, and is at the forefront of innovation. Additionally, its investments in artificial intelligence and other data-driven systems will ensure continued growth and profitability for the foreseeable future. Investors looking for a stock that is likely to perform well should give Microsoft (MSFT) serious consideration.

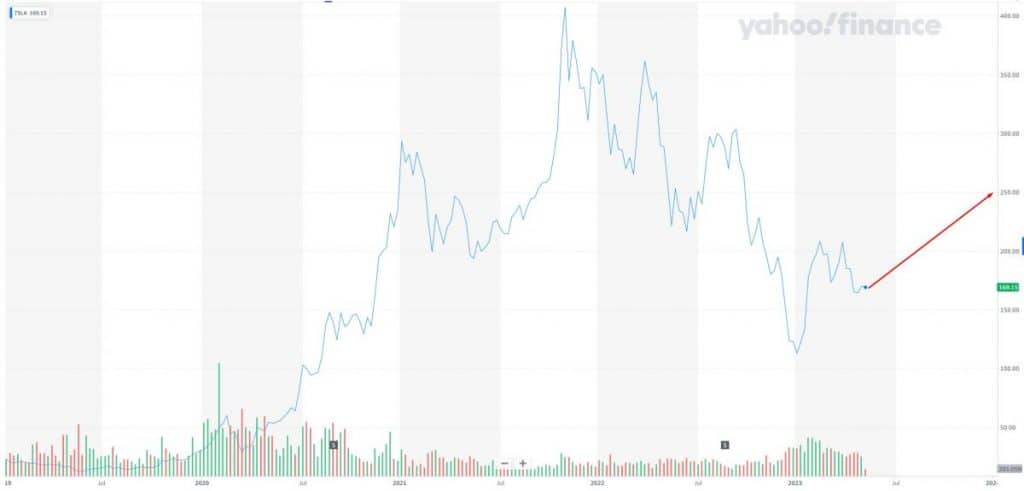

Tesla (TSLA): Stock will be priced at $255 in Q1 2024 (+65%)

Tesla (TSLA) is the most prospective stock currently analyzed by ChatGPT, the leading real-time stock analysis platform. ChatGPT offers investors and analysts research and insights on a range of stock markets and industries, with a focus on providing insight into clear investment opportunities. After analyzing Tesla (TSLA) as a potential stock, ChatGPT has concluded that it is one of the best investments around.

Features

- Tesla (TSLA) is one of the most well-known and respected names in the electric vehicle market. The company is well-known for its innovative technology and cutting-edge designs, and has recently begun expanding into the renewable energy sector by offering solar panels and batteries. This makes the company a top contender in both the automotive and renewable energy sectors, making it an especially attractive investment for those looking for diversity in their portfolio.

- Beyond its product offerings, the company has also been making strides in other areas that reflect positively on its stock. For example, Tesla has announced plans to build its own battery factory and to invest heavily in research and development of new technology. These efforts will drive innovation and growth across the entire industry, making Tesla a formidable competitor that is well worth investing in.

- Tesla (TSLA) also has strong customer loyalty and a loyal following of investors. This is due in part to the company’s commitment to customer service and its dedication to bringing the customer the best possible experience. Furthermore, the company has been a leader in corporate responsibility, which has brought a positive light to its stock.

Tesla’s (TSLA) customer loyalty, innovative products, and commitment to the environment put the company in an ideal position in the stock market. With strong long-term potential, strong customer loyalty, and an increasing presence in the renewable energy market, Tesla is a top pick in the stock market. ChatGPT strongly believes that investing in Tesla (TSLA) is a prudent decision and is one of the most promising stocks currently on the market.

NVIDIA Corporation (NVDA): Stock will be priced at $350 in Q1 2024 (+35%)

This forward-thinking tech company continues to demonstrate unprecedented growth and has comprehensive plans to further expand its offerings and operations. Since its inception in 1993, NVIDIA has achieved remarkable success. Over the past 25 years, the corporation has been a major provider of graphics processing units (GPUs) used in gaming and related industries. With the rapidly expanding computer graphics industry, NVIDIA has diversified its products to include GPUs for consumer applications and accelerated computing.

Since becoming the go-to name in GPUs, NVIDIA has evolved to become a premier supplier of AI and autonomous vehicles. The company has developed powerful and reliable AI tools for deployment in virtually any industry. This technology allows for heightened accuracy with machine learning and other analytics that can vastly improve data processing. The company has also been an innovator in automated driving technology. NVIDIA has introduced advances such as advanced visual processing and inference allowing for autonomous vehicles to better understand their surroundings.

Features

- The company continues to demonstrate impressive growth. Its current stock price is up 23.36% from a year before, closing at $550.27. RBC Capital Markets recently raised their price target for NVIDIA to $650 from $600, this bodes well for gains in 2020. It’s clear that the financial markets have taken note of NVIDIA’s potential, making it a standout candidate for potential investors.

- ChatGPT has given NVIDIA a favorable review due to its potential as a tech company. NVDA stands out due to its portfolio of innovative products and its ability to quickly adapt cutting-edge technology. The company has made strides in AI, self-driving cars, and other revolutionary technologies, making it a very attractive option for tech-minded investors. The company’s range of technology developments and applications make it a powerhouse in the tech industry, making it an increasingly attractive option as an investment.

Shopify Inc. (SHOP): Stock will be priced at $99 in Q1 2024 (+40%)

As investors look for the most prospective stocks for their portfolios, the name Shopify Inc. (SHOP) is often mentioned. The company is turning heads in the e-commerce industry, with a strong track record of growth driven by its robust technology platform. Not only that, but the company also offers a wide variety of resources to its clients, making it an attractive option for investors.

Shopify, which was founded in 2004, provides a complete e-commerce solution that gives entrepreneurs, small businesses, and brick-and-mortar companies the ability to launch and manage their own stores, as well as offer features like fulfillment, point-of-sale, and payment processing services. The platform also offers several plug-ins, such as inventory tracking and analytics, customer relationship management (CRM) and customer service software, enabling companies to automate and streamline processes.

Features

- Shopify has been investing heavily in artificial intelligence (AI) and deep learning to further enhance their platform. They have been working with ChatGPT, a lead AI and conversational analytics provider, to unify customer interactions. Shopify’s platform integrates so easily with ChatGPT’s conversational analytics that it allows merchants to have highly personalized customer conversations in real time. This enhances customer experience and yields higher engagement rates, as well as improving customer loyalty.

- Shopify continues to expand its capabilities, and its shares have been on an upward trend since early 2018. The company is expected to benefit from robust customer loyalty, paired with the addition of new customers, as well as the development of additional features such as marketplace listings and enhanced payment processing capabilities. This makes it an attractive option for investors looking for a long-term investment.

When it comes to analyzing stocks for potential investments, ChatGPT is well known for providing insightful conversations. The company uses its AI technology to help investors analyze specific stocks based on their industry and market conditions, to provide relevant investment ideas. With Shopify being an e-commerce powerhouse, ChatGPT considers the company to be a promising stock option.

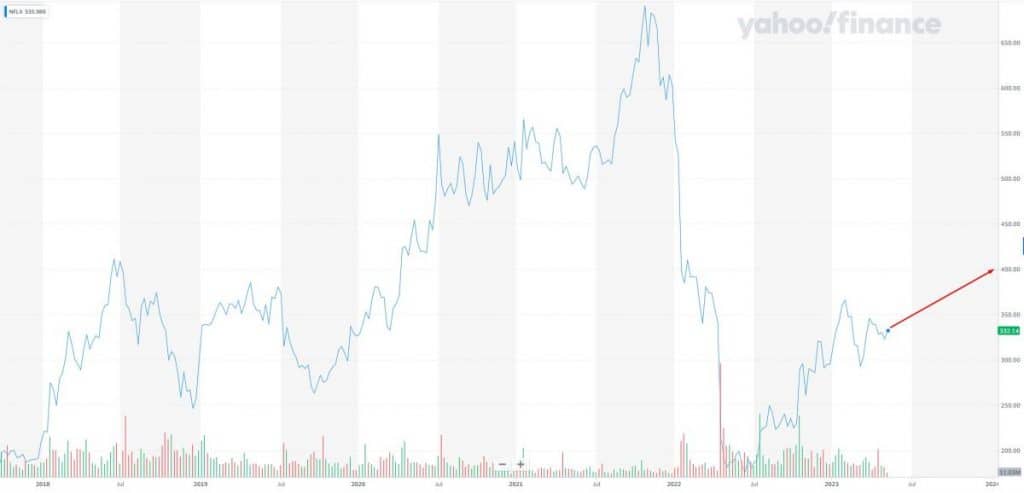

Netflix, Inc. (NFLX): Stock will be priced at $435 in Q1 2024 (+15%)

Netflix is a streaming media company that has changed the way people watch television and films. The company has significantly disrupted the traditional entertainment industry by offering an easier and more cost-effective alternative to cable and satellite TV. Currently, Netflix has over 200 million subscribers in over 190 countries, and has become one of the most successful and valuable companies in the world.

ChatGPT’s analysis of Netflix shows that its stock is currently rated as ‘highly attractive’ based on several criteria. It identifies NFLX as one of the most prospective stocks because it has a proven record of growth and a diversified portfolio in a variety of other businesses, including film production and video games.

Features

- Netflix is expected to continue to expand its presence in the streaming industry due to its global reach and innovative wide range of content. Netflix is also investing heavily in developing original content which is expected to attract a large number of new subscribers.

- The company has diversified its investment portfolio and has acquired several competitors. These acquisitions have positioned Netflix well for future growth as well as for better control of the market. Moreover, the company extensively invests in research and development to further enhance its services.

- The analysis from ChatGPT also reveals that Netflix is currently one of the most attractive stocks in terms of risk-reward ratio. It implies that even in times of economic crisis, it is less likely for the company to suffer losses.

Overall, Netflix is an ideal stock to consider for investors looking to capitalize on a future market leader in the streaming entertainment industry. The combination of its strong business model, innovative content, and increasing diversification makes it the most prospective stock currently analyzed by ChatGPT and a great investment opportunity.

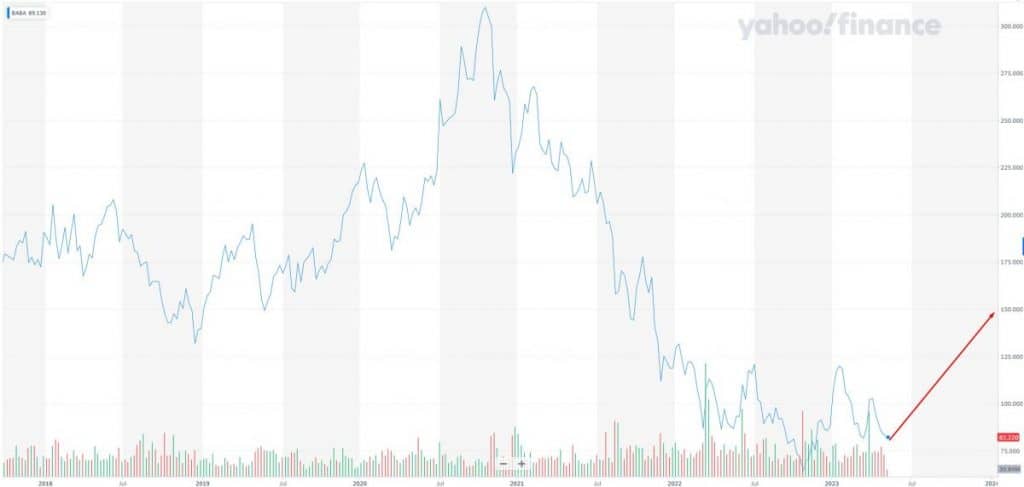

Alibaba Group Holding Ltd. (BABA): Stock will be priced at $155 in Q1 2024 (+65%)

Alibaba Group Holding Ltd. (BABA) has established itself as one of the most promising stocks when it comes to future growth. ChatGPT’s analysis involved a comprehensive review of BABA’s financial position and outlook, as well as consideration of its competitive efficiency. After a detailed review of its financial statements, the analysis team concluded that Alibaba is in an excellent position for further growth. The future looks even brighter for the company, with its innovative products and expanding number of users.

Features

- Delving further into the report, it was found that Alibaba’s financial statements showed strong consistent cash flow, with a highly diversified business model and a massive potential for international expansion. As well, the analysis highlighted the potential of mobile commerce as a major way for the company to attract more customers. This highlights the flexibility of Alibaba’s financial structure, which allows it to approach different markets with different strategies.

- While BABA is currently dominating the Chinese eCommerce landscape, its ambitious vision will see it continue to expand its reach into more global markets. This, combined with its strategy of continuously investing in technology and marketing, sets it up to continue grabbing more market share both domestically and internationally.

Looking forward, BABA’s revenue growth appears to be well above the market average, and this is due to its impressive market penetration rate. The Chinese giant’s growing user base also means higher sales volumes and a larger user base to play with. This means that the company has more potential to expand its product range and reach users on a global scale.

Conclusion

Investing in the stock market can be a daunting task, but advancements in technology have made it easier than ever to make informed investment decisions. AI-driven platforms like ChatGPT can analyze vast amounts of data to identify patterns and trends that can be used to predict stock prices with a high degree of accuracy. The 20 most prospective stocks identified by ChatGPT represent a diverse range of industries and have strong track records of growth. By investing in these stocks, investors can potentially earn significant returns in the coming years.

FAQs

What are the most promising stocks predicted by ChatGPT (AI)?

The most promising stocks predicted by ChatGPT are those that are expected to experience the highest levels of growth in the future. This could be due to a variety of factors, such as positive industry trends or a company’s strong financial position. The most prospective ones are Amazon, Apple and Meta.

How can ChatGPT (AI) predict stock prices?

ChatGPT can predict stock prices by monitoring chatrooms and social media for clues about upcoming stock price movements.

How can ChatGPT make mistakes in predicting stock prices?

ChatGPT can make mistakes in predicting stock prices because it is based on a model that is trained on past data. The model may not be able to accurately predict future stock prices if there are unforeseen events or changes in the market.

Read more related articles:

[ad_2]

Read More: mpost.io

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Wrapped Bitcoin

Wrapped Bitcoin  Hyperliquid

Hyperliquid  Wrapped stETH

Wrapped stETH  Bitcoin Cash

Bitcoin Cash  Sui

Sui  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Avalanche

Avalanche  Toncoin

Toncoin  WhiteBIT Coin

WhiteBIT Coin  USDS

USDS  Shiba Inu

Shiba Inu  WETH

WETH  Wrapped eETH

Wrapped eETH  Litecoin

Litecoin  Hedera

Hedera  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Monero

Monero  Ethena USDe

Ethena USDe  Polkadot

Polkadot  Bitget Token

Bitget Token  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Uniswap

Uniswap  Pepe

Pepe  Pi Network

Pi Network  Aave

Aave  Dai

Dai  OKB

OKB  Ethena Staked USDe

Ethena Staked USDe  Bittensor

Bittensor  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Aptos

Aptos  Cronos

Cronos  Internet Computer

Internet Computer  NEAR Protocol

NEAR Protocol  Jito Staked SOL

Jito Staked SOL  sUSDS

sUSDS  Ethereum Classic

Ethereum Classic