[ad_1]

- The number of retail and large TON investors increased, triggering a notable price jump.

- Open Interest climbed, indicating strength for the uptrend.

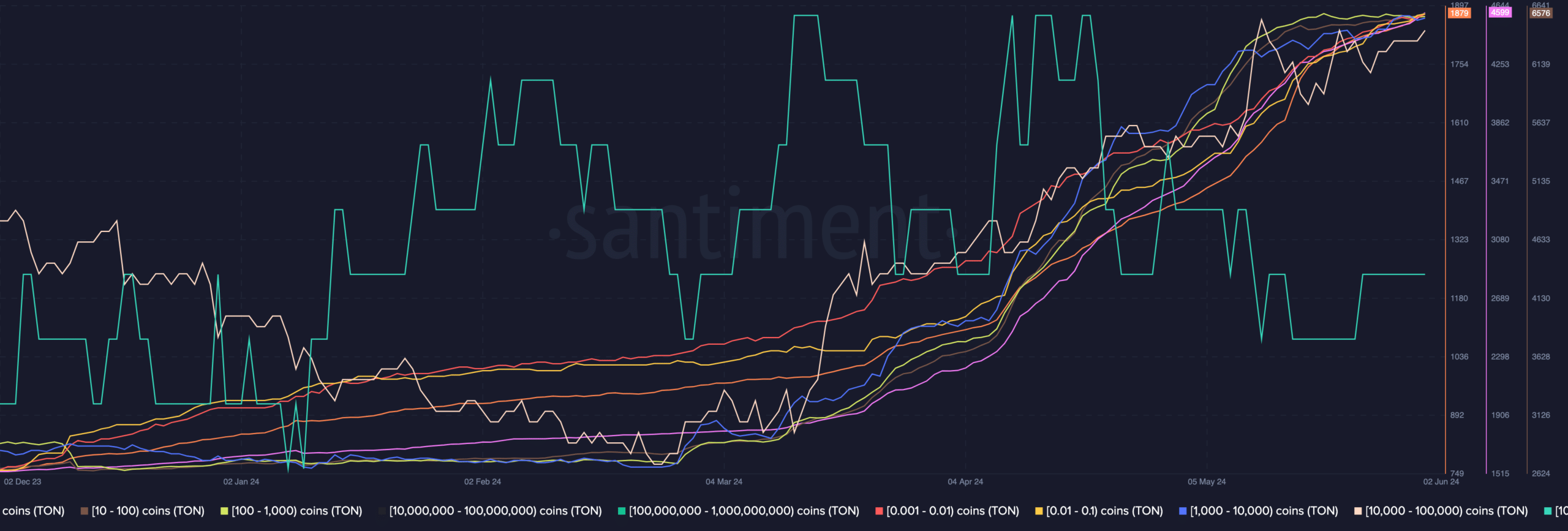

A renewed round of increases has hit Toncoin [TON], and this time it was not limited to the price or market cap. Instead, AMBCrypto found that the number of addresses holding TON across every group increased.

According to on-chain data from Santiment, the number of holders with 0.01 to 1 TON in their portfolio jumped. The same goes for the whales who own 100,000 to 1 million tokens.

This is a rare sight to behold for any project. For Toncoin, it is good news and indicates there are more participants with the belief that TON’s price could trade higher.

All hands on deck in TON support

Three days ago, AMBCrypto reported how whales had flocked to the Toncoin network. Little did anyone know that the retail cohort was also looking to the cryptocurrency as a haven.

Interestingly, TON seemed to be in the mood to reward this loyalty. At press time, the price of the token was $ 6.59, representing an impressive 5.01% increase in the last 24 hours.

As a result, the total supply in profit jumped. As of this writing, the percentage of TON in profit was 79.04%. A few weeks back, almost 100% of the Toncoin holders were in the green.

The selling pressure the token experienced was one of the reasons the ratio declined. But with the recent uptrend, TON could be walking its way back to $7.65.

However, there is a chance that Toncoin could trade higher as speculation of an altcoin season continues to spread.

The term “altcoin season” refers to the period when non-Bitcoin [BTC] cryptocurrencies experience a notable price surge more than BTC.

Can the price hit $15?

In this instance, at least 75% of the top 50 altcoins should outperform the king coin. If this is the case, TON’s return to $7 could be child’s play as the price might head for a double-digit value.

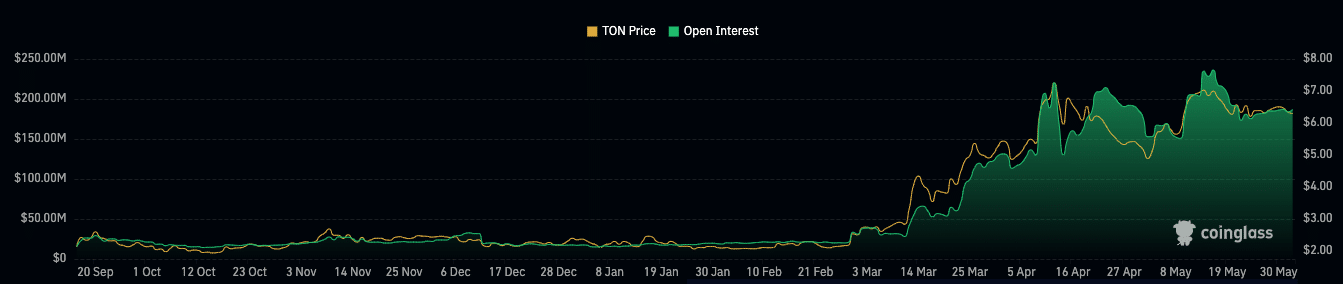

In addition to the metric above, AMBCrypto looked at TON’s Open Interest (OI). Open Interest is the value of all open contracts in the market

When the OI decreases, it means that a lot of traders are closing their existing positions. This takes money out of the market and could be bearish for the cryptocurrency.

For Toncoin, Coinglass data showed that the OI increased by 11.70% in the last 24 hours. This increase implied that new money was entering the market, and could be bullish for the token.

Is your portfolio green? Check the Toncoin Profit Calculator

Should the indicator continue to move higher, TON’s price could surpass its all-time high, and a possible increase to $15 could be possible in the mid-term.

However, holders of the toke might need to watch out. If the OI grows too high, it could be a sign that a change is coming into the market, and selling off at that point could be a good option.

[ad_2]

Read More: ambcrypto.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Wrapped Bitcoin

Wrapped Bitcoin  Hyperliquid

Hyperliquid  Wrapped stETH

Wrapped stETH  Bitcoin Cash

Bitcoin Cash  Sui

Sui  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Avalanche

Avalanche  Toncoin

Toncoin  USDS

USDS  WhiteBIT Coin

WhiteBIT Coin  Shiba Inu

Shiba Inu  WETH

WETH  Wrapped eETH

Wrapped eETH  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Litecoin

Litecoin  Hedera

Hedera  Monero

Monero  Ethena USDe

Ethena USDe  Polkadot

Polkadot  Bitget Token

Bitget Token  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Uniswap

Uniswap  Pepe

Pepe  Pi Network

Pi Network  Dai

Dai  Aave

Aave  Ethena Staked USDe

Ethena Staked USDe  OKB

OKB  Bittensor

Bittensor  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Aptos

Aptos  Cronos

Cronos  Internet Computer

Internet Computer  sUSDS

sUSDS  Jito Staked SOL

Jito Staked SOL  NEAR Protocol

NEAR Protocol  Ethereum Classic

Ethereum Classic