Even as the regulatory environment in the United States looks increasingly hostile for crypto projects, investors are piling into tokenized versions of the nation’s debt.

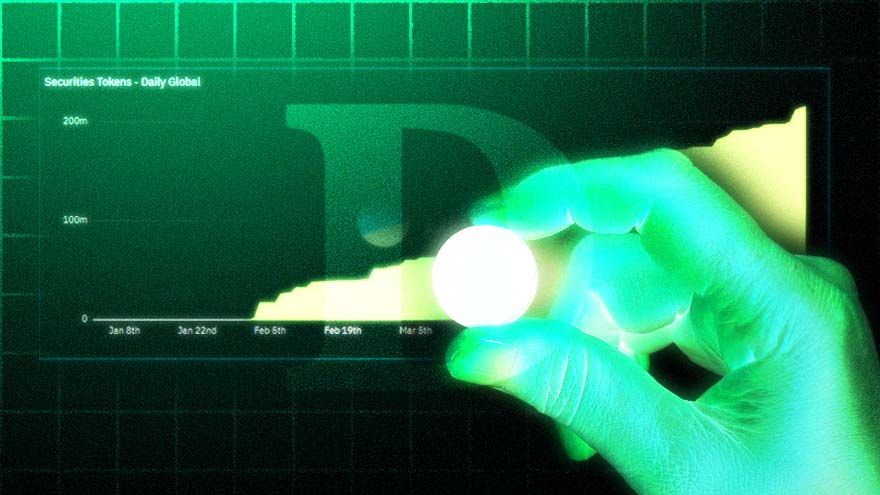

Tokenized versions of publicly traded securities crossed a market capitalization of $200M this week, according to a Dune Analytics dashboard. All of that growth came this year, as numerous projects launched tokenized securities.

OUSG, a tokenized version of Blackrock’s short-term U.S. treasury bond ETF (SHV), leads the market with a market share of over 60%. Ondo Finance launched OUSG in January.

Rising U.S. interest rates coupled with lower yields on stablecoins in DeFi have made tokenized treasuries more appealing in 2023. Overall, the growth of tokenized securities suggests that at long last, the premise of putting traditional assets on the blockchain is starting to achieve product-market fit.

Nathan Allman, the founder and CEO of Ondo, told The Defiant that most of the interest is coming from crypto startups and high-net-worth individuals. “It’s still almost entirely inbound, but we’ll get the outbound sales engine going shortly,” he said.

Allman added that the main advantage of Ondo’s products is the ease with which projects can convert their stablecoins into assets which represent yield-accruing treasuries. Projects can tap into OUSG “24/7,” he said.

At $72M, the second highest tokenized security by market capitalization is SBTB, which also represents short-term treasury bills. The token is issued by a project called Matrixdock and like Ondo’s OUSG, only accredited investors can mint SBTB.

Ever since blockchain technology began to be taken seriously by the business world, the tokenization of traditional securities popped up as a prime use case. Despite this, blockchain-based securities hadn’t really taken off until this year.

SEC Compliance

With success comes compliance hurdles. Allman said that once the project has over $150M in assets under management, it will need to register with the SEC as a registered investment advisor.

This means Ondo will have to report information like its types of clients, fees, and ownership structure to the government agency. Allman thinks Ondo will cross $140M in total assets under management next week, prompting the company to register.

It’s interesting to note that while fixed-income offerings are gaining traction, equities are yet to see the same interest.

Swarm, which launched compliant and tokenized versions of Tesla and Apple stock this year, as well as other offerings, has issued just around $25,000 combined of swAAPL and swTESLA.

Leveraged Farming

A major driver of demand for OUSG is Flux Finance, a lending protocol deployed by the Ondo team in February.

Flux allows OUSG holders to borrow stablecoins against their holdings, allowing them to potentially leverage up the yield by selling the stablecoins for more OUSG to collateralize. Roughly 31% of the OUSG supply, worth $41M, has been collateralized on Flux as of May 19.

fUSDC on Aave

Looking forward, Allman is excited about a proposal to enable fUSDC to be enabled as collateral on major lending protocol Aave. fUSDC is a token which represents yield-bearing USDC lent to institutions through Flux. “[It] would be enormous if [the proposal] passed,” the CEO said.

As with liquid staking tokens like stETH, which represent staked ETH yield, tokens like fUSDC have the potential to proliferate through DeFi as they represent a yield-bearing version of an already well-known asset.

Read More: thedefiant.io

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  Wrapped Bitcoin

Wrapped Bitcoin  Hyperliquid

Hyperliquid  Sui

Sui  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Avalanche

Avalanche  Stellar

Stellar  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Toncoin

Toncoin  Shiba Inu

Shiba Inu  USDS

USDS  Hedera

Hedera  Litecoin

Litecoin  WETH

WETH  Wrapped eETH

Wrapped eETH  Monero

Monero  Polkadot

Polkadot  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Bitget Token

Bitget Token  Ethena USDe

Ethena USDe  Pepe

Pepe  Pi Network

Pi Network  Coinbase Wrapped BTC

Coinbase Wrapped BTC  WhiteBIT Coin

WhiteBIT Coin  Dai

Dai  Uniswap

Uniswap  Aave

Aave  Bittensor

Bittensor  Ethena Staked USDe

Ethena Staked USDe  Cronos

Cronos  OKB

OKB  Aptos

Aptos  NEAR Protocol

NEAR Protocol  Jito Staked SOL

Jito Staked SOL  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Ondo

Ondo  Internet Computer

Internet Computer  Ethereum Classic

Ethereum Classic