Arman Shirinyan

Q3, 2023, brought pivotal shifts in crypto landscape marked by regulatory decisions and institutional moves

Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

In the third quarter of 2023, the cryptocurrency market presented a complex interplay of challenges and growth, as detailed in Binance Research’s Q3 State of Crypto. This analytical piece delves into the key sectors of the cryptocurrency market, highlighting significant trends, institutional movements and major legal events that have shaped the landscape.

The Q3 report delineates an 8.6% quarter-over-quarter contraction in the cryptocurrency market capitalization. Despite this, certain cryptocurrencies like Bitcoin (BTC) demonstrated resilience, appreciating 63.1% year-to-date, partially buoyed by anticipation surrounding spot BTC ETF filings. However, the broader altcoin market experienced varied trajectories, underscoring the sector’s volatility and diverse investor sentiment.

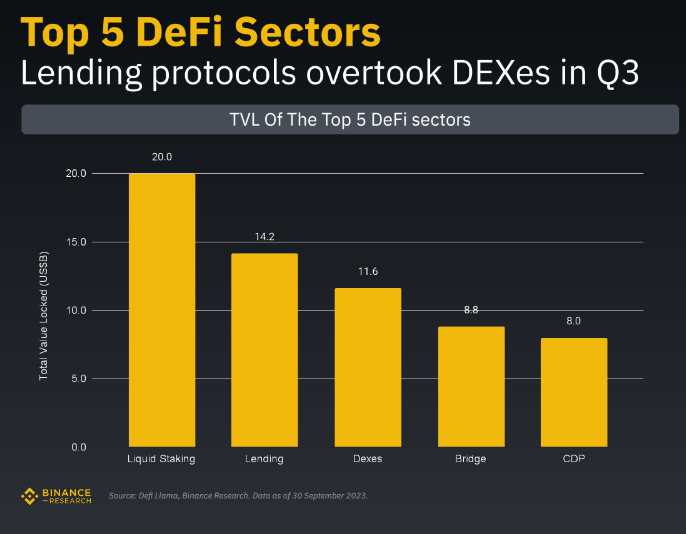

DeFi sector

The DeFi space witnessed a contract in, with a 13.1% decline in total value locked (TVL), attributed to factors including diminished DeFi yields, a risk-averse environment and a depreciating ETH price. However, it was not a uniform decline. Layer-1 protocol Near showed promising growth, and Ethereum’s Layer-2 solutions, particularly “Base,” experienced rejuvenation, highlighting the market’s persistent demand for innovation in scalability and transaction efficiency.

Institutional adoption

Institutional engagement showed notable resilience. Despite market headwinds, institutional interest remained robust, with significant movements from major entities like Deutsche Bank and PayPal. A pivotal moment was Grayscale’s legal victory over the SEC, signaling the growing integration and legitimacy of cryptocurrency in traditional investment circles and potentially influencing future regulatory standards.

Regulatory landscape

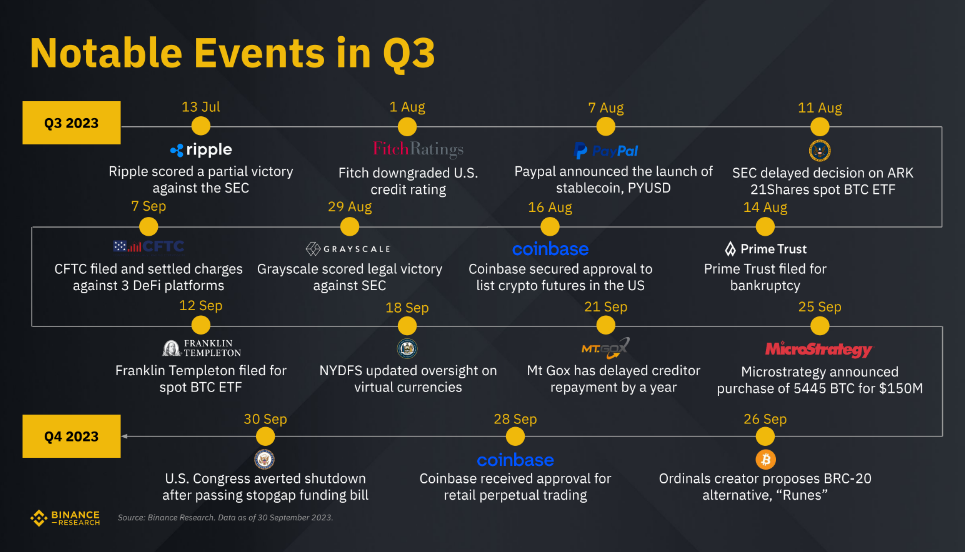

The quarter was marked by significant regulatory events. The cryptocurrency space saw enforcement actions from the SEC, with consequential legal victories for companies like Ripple and Grayscale. These events suggest a gradual maturation of the regulatory environment, providing a semblance of clarity and confidence in an area known for its ambiguity.

Additionally, in Q3, 2023, we witnessed several pivotal events. Ripple secured a partial victory against the SEC, marking a significant juncture in their ongoing legal saga. Meanwhile, Fitch’s downgrade of the U.S. credit rating and the U.S. Congress averting a shutdown with a stopgap funding bill highlighted economic uncertainties.

On the cryptocurrency front, PayPal launched its stablecoin PYUSD, and Coinbase expanded its services, obtaining approval to list crypto futures and offer retail perpetual trading.

Regulatory bodies were also active, with the CFTC settling charges against three DeFi platforms and the SEC delaying its decision on the ARK 21Shares spot BTC ETF. Institutional interest was underscored by Franklin Templeton’s BTC ETF filing and Microstrategy’s substantial Bitcoin purchase. The quarter concluded with a mix of optimism and caution, showcasing the evolving dynamics of the crypto and financial sectors.

Q3, 2023, underscored the cryptocurrency market’s multifaceted nature. The insights from Binance Research’s report highlight not just areas of decline but also sectors showing resilience, innovation and growth. As the market evolves, these trends underscore the necessity for continuous, in-depth and nuanced analysis, reminding stakeholders that the crypto space remains a complex, dynamic and ever-evolving landscape.

Read More: u.today

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  Wrapped Bitcoin

Wrapped Bitcoin  Hyperliquid

Hyperliquid  Sui

Sui  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Avalanche

Avalanche  Bitcoin Cash

Bitcoin Cash  Stellar

Stellar  LEO Token

LEO Token  Toncoin

Toncoin  Shiba Inu

Shiba Inu  USDS

USDS  Hedera

Hedera  WETH

WETH  Litecoin

Litecoin  Wrapped eETH

Wrapped eETH  Polkadot

Polkadot  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Monero

Monero  Bitget Token

Bitget Token  Ethena USDe

Ethena USDe  Pepe

Pepe  Pi Network

Pi Network  Coinbase Wrapped BTC

Coinbase Wrapped BTC  WhiteBIT Coin

WhiteBIT Coin  Dai

Dai  Aave

Aave  Bittensor

Bittensor  Uniswap

Uniswap  Cronos

Cronos  Ethena Staked USDe

Ethena Staked USDe  OKB

OKB  Aptos

Aptos  Jito Staked SOL

Jito Staked SOL  NEAR Protocol

NEAR Protocol  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Ondo

Ondo  Tokenize Xchange

Tokenize Xchange  Internet Computer

Internet Computer