Have you read the latest Token Report?

If you haven’t, you’re missing out on:

-

The team’s verdict on DPX, IMV and ILV

-

Our updated thoughts on ATOM

-

How we think dYdX V4 will impact token price

-

And much more.

As always, the first token is available to everyone, but you’ll need to upgrade to Bankless Premium to get access to the rest.

Dear Bankless Nation,

Undercollateralized lending is risky business.

In TradFi, these loans typically come from the federal funds market. The Fed can’t default, so they become “secured”. If issued by commercial banks, they rely on rating agencies like Moodys or S&P to determine borrower creditworthiness.

DeFi has neither of these tools in their arsenal.

Yet, a whole slew of protocols like Maple Finance, Gearbox and TrueFi are already doing it.

Even TradFi institutions like FTX & Alameda were huge borrowers in this DeFi market!

How does the world of DeFi govern this risky sector through blockchains and smart contracts?

Today’s newsletter is everything you need to know about DeFi undercollateralized lending in one read, brought to you by Bankless analysts Ben and Jack.

– Bankless team

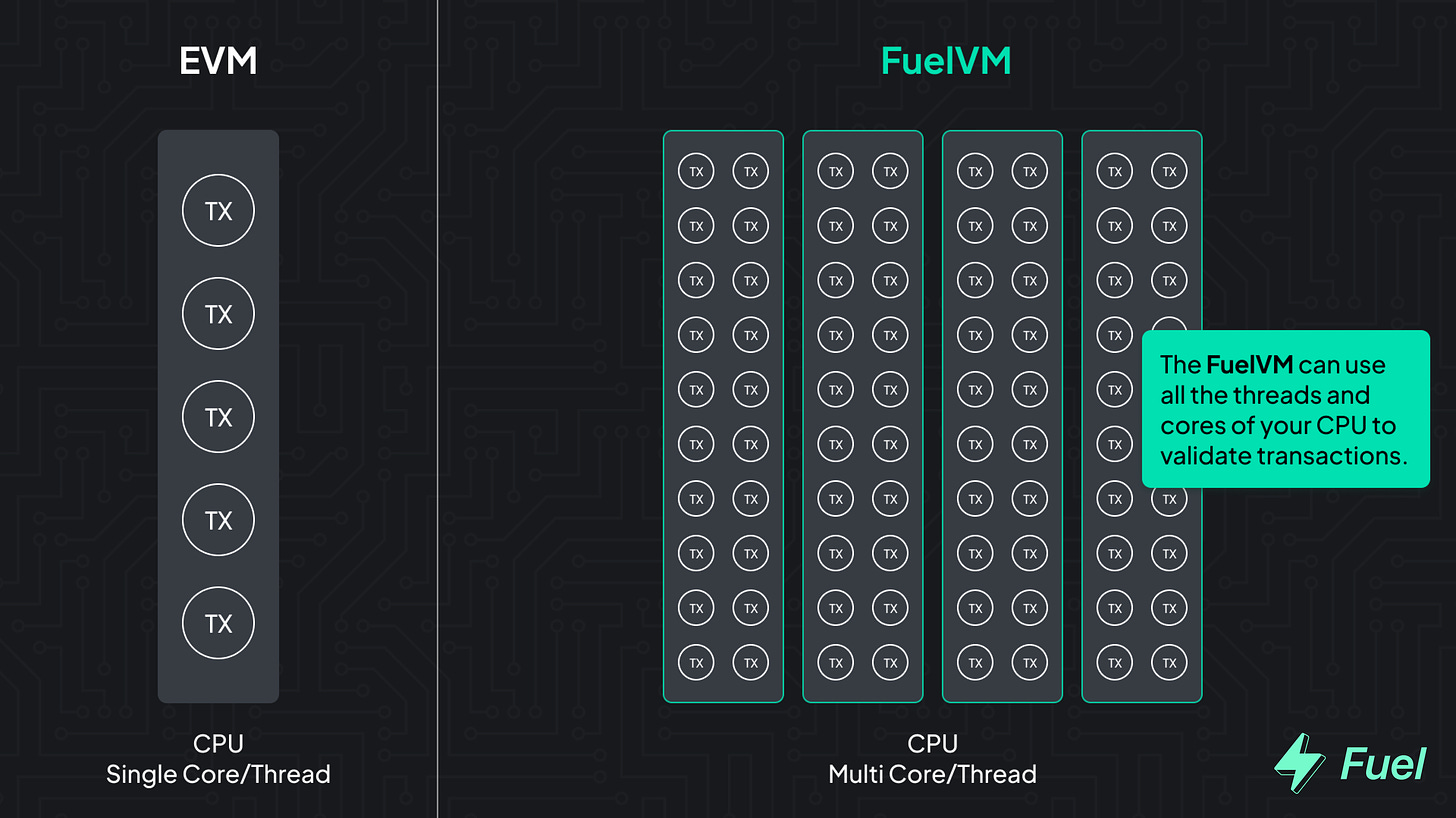

Modular blockchains are the future. L2s alone won’t solve the scaling problem; for this, we need to move toward a modular architecture. Fuel is the fastest execution layer for the modular blockchain stack, enabling maximum security and the highest flexible throughput.

Bankless Writers: Ben Giove, Bankless Analyst; Jack Inabinet, Bankless Intern

“Undercollateralized” is a dirty phrase in the crypto industry.

From Voyager and Celsius to FTX, this common practice among TradFi institutions has left a wake of insolvency and devastation in its path. Centralized crypto lenders recklessly extended credit to various crypto funds (3AC, Alameda, and others), with the promise of a nice yield that they could pass along to their users, in return.

Unfortunately, as these crypto banks have recently learned, the vision for a trade or investment that you lay out in a nice pro forma doesn’t always materialize.

We recognize your hesitance to embrace this form of lending, anon, and I hope that this guide may serve in your venture to find the light at the end of a very, very dark unsecured lending tunnel.

This article is broken into four main sections:

-

(Un)collateralized Lending 101

-

Why CeFi Lenders Failed

-

The Market of Undercollateralized DeFi

-

Individual Solutions

-

Institutional Solutions

-

Trust-based loans (Maple Finance, TrueFi, Clearpool, Goldfinch, Atlendis, and Ribbon Lend)

-

Diversified trust-based loans (dAMM)

-

DeFi bonds (Debt DAO)

-

-

-

An Optimistic Look Into A Undercollateralized Future

First, let’s speak about the OG: collateralized lending.

Everybody knows collateralized lending, a core DeFi primitive offered by various projects like Aave and Compound.

Amidst recent market drawdowns, both have continued to liquidate users failing to manage collateral requirements. Despite a torrent of CeFi and neo-bank implosions, blue-chip DeFi lenders have remained solvent.

Both Aave and Compound – as well as stablecoin issuers like MakerDAO – require users to fully collateralize their positions. For every $1 borrowed, at least $1 must be deposited as collateral to ensure lenders can be made whole in the event of default.

If the value of a user’s collateral falls below the collateralization requirement for their position, the user is automatically liquidated by smart contracts.

While these primitives empower a trustless lending and borrowing experience that allows any DeFi user to borrow capital or leverage positions, they suck from a capital efficiency standpoint.

Undercollateralized (or unsecured) lending solves this problem.

Have you ever taken out a massive student loan or purchased an $8 coffee on a credit card?

Congratulations! You are an unsecured debtor! Borrowers of unsecured loans remain current on outstanding debt obligations, despite not pledging any collateral, as their reputation (credit score) is negatively impacted by events such as missed interest payments or loan defaults.

The institutional version of a credit card is known as a line of credit (LOC) — a legally binding agreement between two or more counterparties establishing the conditions that must be met for the borrower to draw on the line and remain in compliance.

This style of instrument allows the recipient to borrow without pledging any collateral to the lender. LOCs enable financial institutions to meet short-term cash needs without calling capital from investors or losing control of assets.

What purpose do undercollateralized lending protocols in crypto serve?

They allow TradFi institutions to borrow directly from DeFi users, instead of financial institutions or banks. The borrower and DeFi protocol work together to establish terms for the line. Users can then assess the pool’s risk/reward tradeoff and choose to deposit their own funds to the pool. At the maturity of the loan, the institution pays back any outstanding principal or accrued interest to lenders.

Many different approaches exist to enable unsecured crypto lending. Some offer tiered cash flow repayment structures. Others aggregate lender funds, increasing portfolio diversification and reducing the impact of a given borrower’s default. Some allow borrowers to implement KYC/AML checks. All are attempt to satiate TradFi’s demand for undercollateralized loans.

Before we dive into the state of undercollateralized lending within DeFi, let’s touch on some of the issues with credit in CeFi. Some of these practices pushed many centralized lenders into (near) insolvency.

If I could summarize the failure of CeFi lending in one phrase, it would be this: They ran a lending business, rather than a crypto lending business.

CeFi lenders simply weren’t in the business of utilizing the underlying technology rails on which they operated (blockchains) within their lending and business processes.

Here are a few reasons why CeFi lenders failed.

Many CeFi lenders had a poor underwriting process. For instance, in the height of the bull run, many lenders would determine a borrower’s creditworthiness based on things like questionnaires or even social capital. These are incredibly shaky foundations on which to originate a loan in any industry, let alone in crypto where many institutions are unregulated and do not have audited financials.

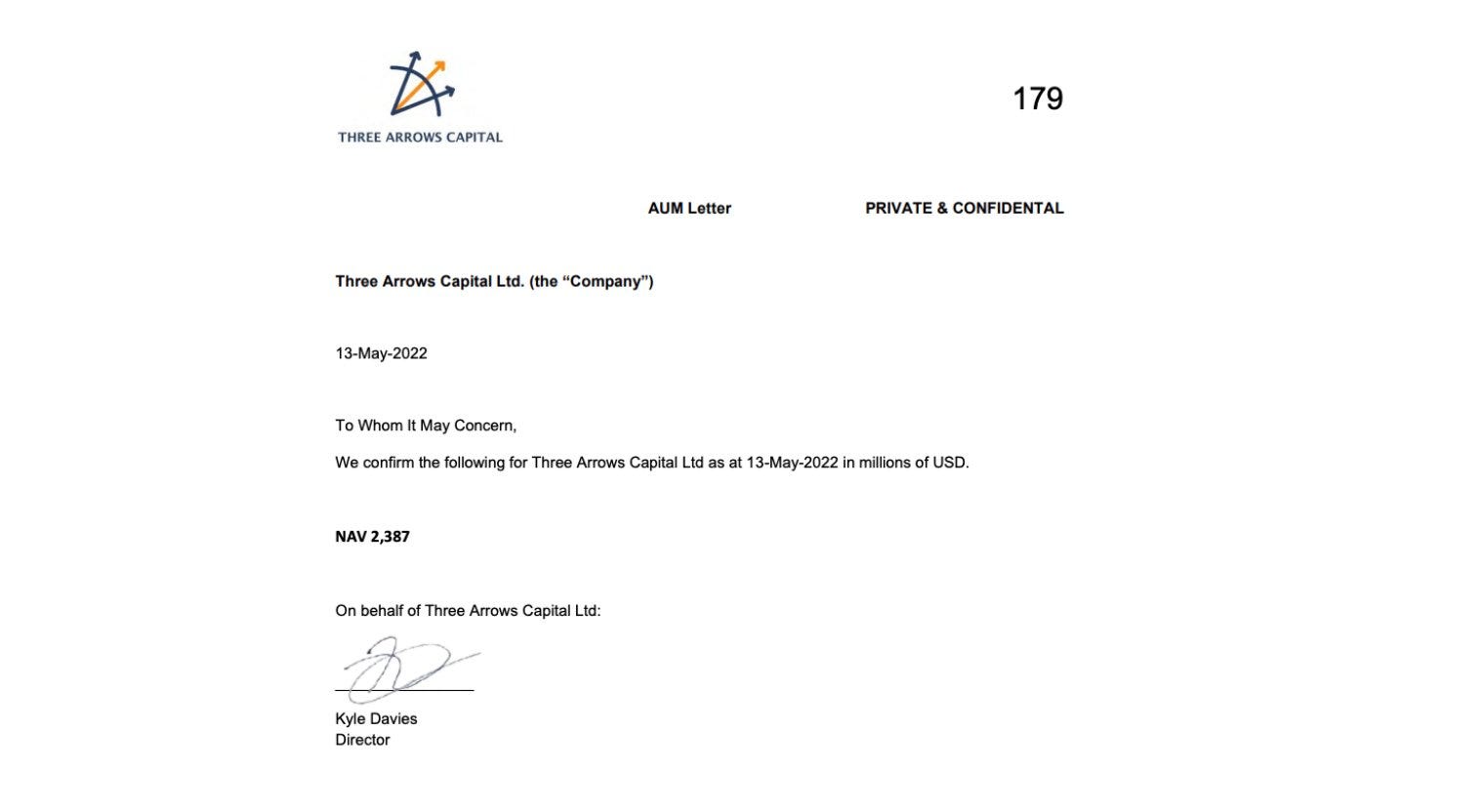

A prime example of this is the infamous “AUM Letter” from 3AC after the collapse of Terra.

The transparency of blockchains would have helped tremendously with assessing counterparty risk. Rather than rely on a letter from Kyle Davies, these firms could have demanded that 3AC provide cryptographically signed messages from wallet addresses to prove they had possession of a requisite amount of funds. These firms could have also implemented covenants to restrict how funds were used, and could monitor these addresses in order to ascertain whether or not 3AC was adhering to the covenants laid out in the agreement.

This is an oversimplified example, but in doing this (or something along these lines) lenders would have much more insight into 3AC’s financial position and their use of funds. These lenders could use blockchains to verify that 3AC wasn’t acting in bad faith, rather than trust their word on it.

Another critical issue faced by CeFi lenders was the acceptance of poor and illiquid assets as collateral.

We don’t need to look any further for evidence of this than the FTX collapse last week. Alameda Research would pledge tokens such as FTT and SRM as collateral for loans. These assets had artificially inflated fully-diluted valuations due to predatory design, as these tokens would have a very low percentage of their float circulating, which allowed Alameda to increase their borrowing capacity.

In reality, these high FDVs were a complete mirage, as there was nowhere near enough liquidity in the market to support these valuations during a mass-liquidation event. That is exactly why (along with a general exodus from Sam coins) assets like FTT and SRM sold off so dramatically last week as Alameda’s collateral was liquidated and FTX imploded.

But collateral quality only tells half the story. The other half are archaic liquidation processes. In CeFi, liquidations are manual (not smart contract based), meaning that lenders are at risk of taking on underwater debt positions from failing to sell depreciating collateral in a timely manner.

These issues could have been somewhat mitigated were lenders to have implemented stricter standards for collateral. For instance, many DeFi protocols also utilized “bad” illiquid assets as collateral. On November 3, just days before FTX and Alameda went under, 35% of the total supply of the decentralized MIM stablecoin by Abracadabra was backed by FTT.

While MIM briefly de-pegged, the protocol has survived in large part because of its robust liquidation process. Alameda repaid all of its MIM debt, because it knew that should it fail to, their collateral liquidated without prejudice.

Centralized lenders should have taken a similar approach. For example, there’s no reason why lenders could not have created a programmatic loan agreement via a smart contract that would originate a loan and liquidate a borrower’s collateral should it fall below a certain LTV.

Finally, along with poor underwriting and liquidation processes, CeFi lending platforms suffer from a grievous lack of transparency.

These platforms were black boxes.

Users who deposited assets into lenders like BlockFi or Celsius were given scant details about who their funds were being lent out to and where the yield they earned was derived from. When community members discovered how returns were being generated, the results were often not pretty.

For instance, savvy-on-chain analysts were able to determine that Celsius deployed customer funds into risky yield farming strategies, losing tens of millions in the process due to falling victim to exploits.

Users of these crypto services could not protect themselves from losses as a result of these strategies, as deposits were completely uninsured.

Banks suck. It’s in our name, in case you haven’t noticed. But at least banks offer FDIC insurance to depositors. Even DeFi lenders of all ilk such as Aave, Compound, Maple, offer some sort of protection, whether it be via a token backstop or accumulated protocol reserves.

Maple Finance and Gearbox currently dominate the undercollateralized lending space, composing 84% of the sector’s TVL. The protocols examined in this guide represent an aggregate TVL of $303M, at the time of analysis.

Broadly speaking, undercollateralized lending protocols can be categorized by two defining features: market niche and design.

Undercollateralized lending protocols built for individual users enforce repayment via immutable smart contracts utilized to interact with whitelisted protocols. Anyone can borrow from these protocols and interact with pre-authorized dApps.

Institutions, however, frequently deploy funds for market making on CEXs and may wish to use protocols that weren’t whitelisted for individual markets. This is so they can optimize the borrowing process to closely align with TradFi standards by making use of trust assumptions, giving rise to a separate category of primitives, in which underwriting serves as the basis for extending credit and is less permissionless.

Let’s explore how some of the most popular protocols in the sector operate.

Traditional DeFi loans from Aave and Compound enable users to leverage positions via recursive borrowing: users supply ETH to borrow USDC, purchase more ETH, and borrow more USDC against their ETH loan. This process leverages the user’s position by continually borrowing against a diminishing amount of collateral.

Gearbox and Sentiment give users the ability to leverage positions in a novel fashion.

Instead of requiring each loan made to be overcollateralized, these protocols require users to fund an initial margin amount, after which users may borrow with up to 10x leverage (Gearbox) or up to 5x leverage (Sentiment).

Minimum collateralization ratios for volatile assets of 150% or greater are common for money market and stablecoin protocols. That’s bad capital-inefficiency. Minimum collateralization ratios for Gearbox and Sentiment are 10% and 20%, respectively. Much better.

But how do these protocols ensure borrowers do not simply abscond with these borrowed funds?

Both require users to create an escrow wallet with the protocol. These wallets do not allow users to withdraw enough collateral to fall below collateralization requirements.

Additionally, wallets are only able to interact with smart contracts specifically approved by the protocols. A hack or exploit of third-party smart contracts used for lending or yield farming activities risks leaving Gearbox or Sentiment with bad debt. To avoid this, the protocols whitelist only the most established dApps for use.

These protocols represent the simplest solution to unsecured lending in DeFi and essentially duplicate trusted TradFi LOC environments on-chain.

Potential borrowers are required to navigate a credit approval process to borrow. This process varies based on the dApp.

After the completion of the credit approval process, an off-chain legally binding agreement is made between entities representing the borrower and protocol.

-

Maple Finance has professional credit analysts stake its native token, MPL, to underwrite, negotiate, and approve loans.

-

TrueFi expands on Maple’s approach, requiring an 80% approval of proposed loans by TRU stakers.

-

Clearpool, Goldfinch, Atlendis, and Ribbon Lend outsource their credit checks and risk assessment processes to preapproved, third-party auditors.

This relatively mature model dominates the unsecured lending sector, comprising over 60% of the TVL in this sector (95% if excluding Gearbox!).

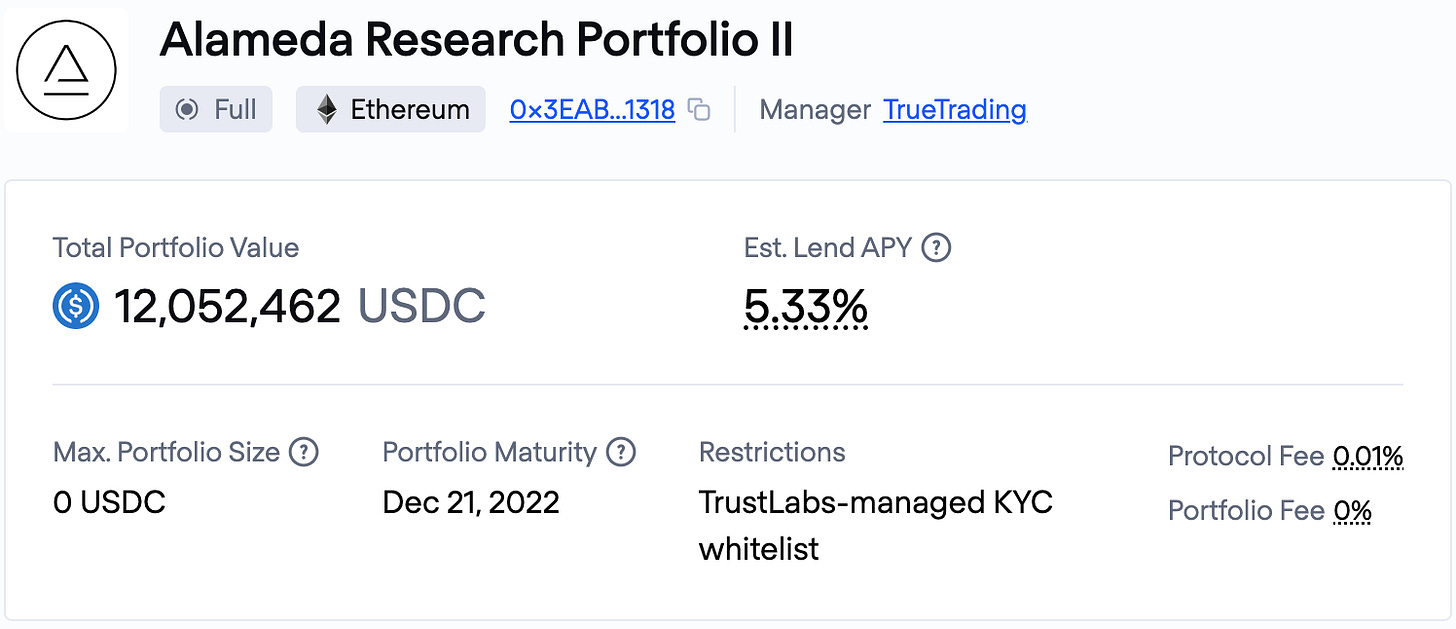

Institutions such as Alameda Research and Wintermute represented the primary demand source for this category of borrowing. In September, Alameda paid down over $280M in outstanding loans on Maple Finance.

Orthogonal Capital, a major lender to Alameda via Maple, terminated its relation with the firm shortly after the maturity of its outstanding loans, citing declining asset quality, unclear capital policies, less than robust operational and business practices, and an increasingly byzantine corporate structure.

The implosion of Alameda rocked DeFi users’ faith in unsecured lending, with undercollateralized lending protocols seeing massive drawdowns in TVL in the immediate aftermath.

If the borrower becomes bankrupt, your claim to repayment is lumped in with every other claim to the entity’s assets. Bankruptcy proceedings, especially for highly sophisticated and extremely complex financial entities such as prop trading firms and hedge funds, are notoriously arduous and time consuming, often taking years to settle (Mt. Gox’s trustee recently notified creditors to register for repayment in July).

As seen in the below image, Alameda currently has over $12M in outstanding debts on TrueFi. We believe that lenders to this fund will not be made whole and most certainly will not receive a 5.33% yield. While the impairment to value of this pool is unknown at this time, it will likely be significant.

Launched in September, dAMM looks to empower unsecured borrowing and lending markets for volatile assets. Prior to dAMM, institutions (specifically professional market makers) struggled to borrow the majority of crypto assets because:

-

Existing DeFi unsecured lending primitives primarily offer stablecoin-denominated loans

-

Institutional lenders are wary to stray beyond mainstream assets

-

DeFi collateralized lending primitives require full collateralization and pose liquidation risk

-

Lending markets for small cap tokens are susceptible to flash loan exploits

Similar to trust-based lending protocols like Maple Finance, dAMM engages a third-party auditor to underwrite potential borrowers. After successful completion of the credit assessment process, the borrower and the dAMM Foundation enter into a legally-binding loan agreement.

Where dAMM differs from the trust-based lending model popularized by Maple is how it reduces risk through diversification, by aggregating lending supply and borrowing demand in pools.

Any borrower can borrow any asset at the interest rate algorithmically determined by dAMM. This implies that lenders have proportional exposure to all parties borrowing their assets, based on that party’s utilization rate. By aggregating supply, lenders receive benefits from diversification: the default or bankruptcy of one borrower only jeopardizes a portion of the pool’s funds.

Borrower diversification also presents a downside for dAMM lenders.

Lending in aggregate eliminates users’ ability to select individual borrowers, forcing users to greater amounts of trust in the credit assessor and their evaluation of borrower risk. Additionally diversification benefits are negligible if a single entity comprises an outsized fraction of borrowing activity for a specific asset pool.

TradFi companies raise money through two sources: equity and debt financing. Equity-like financing is commonplace for DAOs and protocols, with a seemingly endless number of venture capitalists and individual investors jockey to get in on the next hottest project’s funding round or token sale (Bitcoiners don’t like this!).

Debt financing for DAOs, however, is practically non-existent. It’s not hard to see why. If you can’t hold a DAO legally liable, their debt is not much assurance to a potential investor.

Porter Finance previously facilitated a $3.1M convertible bond issuance for Ribbon Finance. The notes mature on December 4, 2022, with a minimum yield of 7.1%, and 384% collateralized by Ribbon Finance’s RBN token.

On July 4th, less than one month after the launch of the Ribbon offering, Porter Finance announced it was shutting down its platform after the maturity of the issuance, citing a lack of confidence in the potential for “large inflows of lending demand for fixed income DeFi products, like the ones offered through Porter Finance.” The founder also noted the competitive financing rates offered by TradFi firms and a lack of institutional DeFi adoption, in addition potential underlying legal risks, as factors of the decision.

The withdrawal of Porter Finance leaves Debt DAO as the major player in the DeFi-native bond issuance space. Debt DAO aims to enable protocols to raise funds for operations without liquidating treasury assets or diluting token holders.

To ensure borrowers remain current on obligations, Debt DAO has pioneered the spigot, a unique smart contract which escrows a fixed percentage of protocol revenue for debt service.

This contract serves the same role as “lockbox” accounts required by a traditional lender, where operating revenues flow to a designated bank account, from which the lender deducts interest or retains funds prior to receipt by the borrower.

As Debt DAO underwrites borrower credit, similar to protocols in the trust-based lending category, and the spigot directly taps into protocol revenue streams, the Project can offer under or uncollateralized loans to riskier decentralized borrowers.

If crypto is to go mainstream, the industry must provide institutional access to credit in order to onboard trillions in capital. TradFi institutions will not enter into crypto if they need to fully collateralize everything, or will do so with capital generated off-chain.

However, if the events of the past several months are any indication, the under-collateralized lending space remains a major work in progress.

CeFi lenders across the industry have gone belly-up because of poor risk management. These problems could have been mitigated had they utilized and incorporate the technology rails on which they operate (blockchains) into their business and underwriting processes.

The state of undercollateralized lending in DeFi is a step in the right direction but still leaves much to be desired.

The protocols which have gotten the most traction, lenders like Maple, TruFi, and Clearpool offer improved transparency relative to their centralized incumbents but still fail to provide lenders with strong repayment guarantees and insight into finances of counterparties whose books reside off-chain.

Protocols like Gearbox and Sentiment improve on this model by enforcing loan covenants via smart contracts, as borrowers must maintain a minimum collateral ratio while only being able to utilize funds in whitelisted protocols.

DeFi bond protocols which offer more traditional forms of credit like Debt DAO represent a step in the right direction as well, as like Gearbox and Sentiment, they enforce repayment via smart contracts while providing credit to on-chain entities (DAOs) whose financial position can be audited 24/7/365.

If you provide credit, there will be defaults. Over the next few cycles, there will be more FTX-sized entities that will become over-leveraged and go under. It’s a part of the game, and lenders are compensated for this risk by being able to charge higher borrow rates.

However, by utilizing crypto-rails to increase transparency, minimize counterparty risk, automate repayment and liquidations, and enforce covenants via smart contracts, it will become far easier to identify and mitigate risks before they become systemic.

-

Ben Giove is an analyst for Bankless. He’s the former President of Chapman Crypto and an analyst for the Blockchain Education Network (BEN) Crypto Fund, a student-managed crypto fund built on Set Protocol. He’s also a proud member of the Bankless DAO and methodologist behind the GMI index.

-

Jack Inabinet is an intern at Bankless. Prior to working at Bankless, Jack was a Commercial Real Estate Analyst at HAL Real Estate. He’s currently studying Business & Finance at the University of Washington and has been involved in crypto for 2+ years.

Subscribe to Bankless. $22 per mo. Includes archive access, Inner Circle & Badge.

Want to get featured on Bankless? Send your article to submissions@banklesshq.com

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. Additionally, the Bankless writers hold crypto assets. See our investment disclosures here.

Read More: newsletter.banklesshq.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  Wrapped Bitcoin

Wrapped Bitcoin  Chainlink

Chainlink  LEO Token

LEO Token  Avalanche

Avalanche  Stellar

Stellar  Toncoin

Toncoin  Shiba Inu

Shiba Inu  USDS

USDS  Hedera

Hedera  Sui

Sui  Wrapped stETH

Wrapped stETH  Bitcoin Cash

Bitcoin Cash  Polkadot

Polkadot  Litecoin

Litecoin  Hyperliquid

Hyperliquid  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Bitget Token

Bitget Token  Ethena USDe

Ethena USDe  Pi Network

Pi Network  WETH

WETH  WhiteBIT Coin

WhiteBIT Coin  Monero

Monero  Wrapped eETH

Wrapped eETH  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Uniswap

Uniswap  Pepe

Pepe  Dai

Dai  Aptos

Aptos  OKB

OKB  Gate

Gate  Bittensor

Bittensor  NEAR Protocol

NEAR Protocol  Ondo

Ondo  Tokenize Xchange

Tokenize Xchange  sUSDS

sUSDS  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Ethereum Classic

Ethereum Classic  Internet Computer

Internet Computer  Cronos

Cronos