It’s been 6 years since the Winklevoss Twins’ Bitcoin ETF (exchange-traded fund) application was rejected by the SEC, but now Blackrock, Fidelity, WisdomTree, VanEck and Invesco have also submitted applications. Whilst sentiment toward crypto and web3 is not great, it does seem like we may be on the cusp of finally getting a Bitcoin ETF approved.

It’s natural to postulate that once we have a Bitcoin ETF, a tokenised on-chain version of it will appear to bring things full circle.

make it possible to own a tokenised version of Blackrock’s S&P 500 ETF.

A proven track record?

Ironies aside, I do believe it’s safe to say that Bitcoin, Ether and the other major cryptocurrencies have been proven as sound technologies that work. They may not have found mainstream use cases apart from financial speculation, but the underlying networks have remained sound.

When the Winklevoss Twins first proposed their Bitcoin ETF back in 2017 Bitcoin and Ethereum were not considered mainstream assets in the financial sphere. We hadn’t had the DeFi summer of 2020 and the NFT mania of 2021 which really drove these technology-driven digital assets into the mainstream consciousness.

stablecoins

,

exchanges

and

hedge funds

fail, but these were not technology-driven failures.

With custody platforms and major exchanges such as Coinbase and Kraken having proven their competency during this period, the vulnerability of crypto venues being hacked is less of a concern to the average crypto holder.

Having a proven track record as far as custody of crypto assets is concerned alongside the resilience of public blockchain networks should be the two major factors beyond customer demand that dictate whether a Bitcoin ETF should exist or not.

Given the structural soundness of the Bitcoin and Ethereum networks, I believe it is irresponsible not to make such as product available to the public. There are a number of far more risky ways in which investors are getting exposure to Bitcoin via our regulated markets, and an ETF underpinned by some of the best-known asset managers is a far safer way for the average person to access the digital asset class.

Bitcoin ETF alternatives

Instead, right now investors are getting exposure to Bitcoin via other publicly listed vehicles, such as:

- Shares in Microstrategy which has roughly $4.6bn in bitcoin on its balance sheet, of its $5.7bn total market capitalisation.

- The Greyscale Bitcoin Trust, which until recently spent most of the past year trading at a discount of 40-50% of its net asset value (NAV) based on its Bitcoin holdings.

- Bitcoin mining companies such as Riot Blockchain, Marathon Digital Holdings and Hut 8 Mining that have experienced significant price volatility (even compared with bitcoin) during these past few years.

- Bitcoin Future ETFs that provide exposure to the price movements of bitcoin futures contracts. These come with additional management costs such as roll premiums and don’t perfectly track the price of bitcoin.

Assuming you’re using Coinbase or Kraken or know how to store bitcoin, all of the above vehicles are far riskier than holding bitcoin directly. However, if you want to hold it in a retirement or tax-free saving account such as an ISA here in the UK, they’re the only route you have without a real ETF.

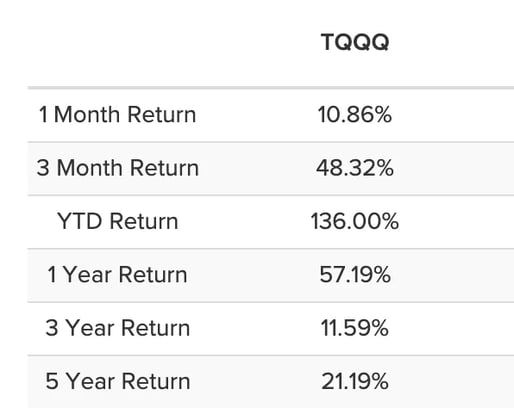

Returns of ProShares UltraPro QQQ ETF which provides 3x leverage exposure to the NASDAQ 100

Outside of the domain of ETFs, we’ve seen many companies share values go to zero over the years, Silicon Valley Bank being the most recent example that comes to mind.

Tokens > ETFs

ETFs as a financial product are great for providing access to certain types of products that would be cumbersome for investors to own directly such as index trackers and commodities.

Similar parallels can be drawn with tokenised assets, except that the applicable landscape of products that can be tokenised and the access to them is far wider. They are underpinned by globally accessible blockchain networks, instead of existing rails that are provided by centralised brokers, fintechs and exchanges. Plus their programmable nature makes the surface area for innovation far greater.

Tokenised assets are the universal financial product in this respect.

Opening the floodgates

Once a Bitcoin ETF is approved, it’s inevitable that Ether will follow suit. Beyond this, it may take time for other crypto tokens to follow, especially as at the current time, the majority of leading currencies following Ether are being labelled securities by the SEC.

CoinMarketCap

or

Coindesk

. These could be weighted by the market cap of their assets, or other factors such as yield potential, or sector.

Having something with the variety of sector (crypto, DeFi, NFTs), segment (small, medium, large cap), geography and staking yield potential of existing indices provided by Blackrock, Vanguard and others would really open up the crypto industry to meet the needs of investors.

I have little doubt that we will reach this point in due course. Hopefully, this time around we will see the Bitcoin ETF finally come into being. The hard yards have been trodden by the digital assets industry, and it’s about time that the asset that started off this entire revolution gets its opportunity to be accessible to all.

Read More: blog.web3labs.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Wrapped Bitcoin

Wrapped Bitcoin  Sui

Sui  Chainlink

Chainlink  Wrapped stETH

Wrapped stETH  Avalanche

Avalanche  Stellar

Stellar  Shiba Inu

Shiba Inu  Hedera

Hedera  Toncoin

Toncoin  Bitcoin Cash

Bitcoin Cash  Hyperliquid

Hyperliquid  USDS

USDS  LEO Token

LEO Token  Polkadot

Polkadot  Pi Network

Pi Network  Litecoin

Litecoin  WETH

WETH  Monero

Monero  Wrapped eETH

Wrapped eETH  Bitget Token

Bitget Token  Pepe

Pepe  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Ethena USDe

Ethena USDe  WhiteBIT Coin

WhiteBIT Coin  Uniswap

Uniswap  Bittensor

Bittensor  NEAR Protocol

NEAR Protocol  Aptos

Aptos  Dai

Dai  OKB

OKB  Aave

Aave  Ondo

Ondo  Internet Computer

Internet Computer  Ethereum Classic

Ethereum Classic  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  sUSDS

sUSDS  Cronos

Cronos