Arbitrum is the most active and exciting community to be at the moment! Aside from TVL growth, the level of innovation and the vibes of Arbitrum are immaculate.

The majority of Arbitrum success can be attributed to GMX, the revolutionary perpetual DEX — accounting for 38% of TVL.

Driving on the initial success of GMX and leveraging the speed and low transaction fees there are a lot of projects building….

This short piece helps you stay ahead of what’s happening by providing an overview of 5 exciting projects who are either releasing their testnet or launching their tokens soon.

Having a functioning perpetual exchange, Arbitrum now needs to complement its ecosystem with several other pillars, including Lending platforms, native DEXes, and further building blocks for DeFi.

1. VELA Exchange (by @Cryptoalpharian)

Vela Exchange ($VELA) is a Dex with advanced perpetual futures trading capabilities, community-focused incentives, and scalable infrastructure.

Compared to centralized exchanges, VELA offers advantages in terms of:

- Equitable access to platform rewards;

- Self-custody of assets;

- Absence of a centralized clearing house.

The token model is similar to GMX, with a dual model where:

1. $VELA is the utility token that can be staked to earn a share of trading fees. Further benefits include discounted trading fees, earning eVELA from buybacks, and ecosystem rewards.

2. $VLP is the Liquidity provider token for Vela. It’s based on USDC Staking and can be redeemed for USDC. $VLP provides Liquidity for perpetual traders allowing them to take positions with leverage.

$VLP holders benefit when traders make a loss, while they make a loss to $VLP holders when traders take a profit.

It’s also healthy to see how they are putting a strong focus on security.

Another novel and interesting feature about Vela is the possibility of trading TVL & market cap.

You finally will be able to permalong the TVL on Arbitrum!

For those interested in trying Vela Exchange, the public beta will open on January 18, 2023.

Crypto Volatility Index (CVI) is a decentralized VIX that enables you to hedge or protect yourself from volatility. I have already written a short introduction to CVI last week.

The vision of CVI has been to introduce to crypto markets not only an index but a full-fledged ecosystem of volatility trading products. Such as the Volatility tokens, which allow taking a tokenized position (long volatility) in the form of an ERC20 token.

CVI Index is a “market fear index” for crypto. It tracks the 30-day implied volatility of $BTC and $ETH. The range of the index is between 0 and 200 and is produced by using Black-Scholes option pricing model.

CVI sources data off-chain, using Chainlink External Adapters. External Adapters connect smart contracts with Chainlink nodes. The smart contracts can dictate to the nodes what tasks have to be carried out and at what time intervals.

Users can take advantage of CVI 2 main features:

- CVI Platform AMM: allowing users to trade the index directly and hedge the market volatility.

- Volatility Tokens: allowing users to trade volatility. Their unique technology enables these tokens to trade on different DEXes and CEXes without de-pegging to their respective indices. This makes CVI more accessible to other protocols.

Volatility Tokens have 3 features:

1. Peg to the Index: if a token depegs, arbitrageurs can take the opportunity and ultimately restore the peg.

2. Hedge and exposure to index: a way to hedge as ETFs do with VIX.

3. Elastic supply: everyday at 00:00 UTC the tokens are rebased or their supply is adjusted to maintain the peg and protect it from time decay and the actions of arbitrageurs.

Theta Vault

The latest innovation of CVI is the creation of their Theta Vault, a liquidity pool that protects Volatility Tokens from time decay and is the only way to add or remove liquidity on CVI AMM. The liquidity is used as collateral to mint or burn Volatility Tokens and to move them on DEXs.

- The vault is the only gateway for adding and removing liquidity from the CVI AMM

- It utilizes liquidity by depositing it as collateral to the CVI AMM vis-a-vis minting/burning volatility tokens and placing them on DEXs

- As the vault owns both the AMM liquidity and the DEX liquidity, it is the sole beneficiary of time decay fees, and thus has no exposure to Theta for the DEX liquidity. This can allow the volatility tokens’ DEX liquidity to scale up.

$GOVI Token is the governance token of the protocol, distributed initially to initial Coti users, as shown:

As mentioned by @ChadCaff, CVI will benefit from some upcoming catalysts:

- $GOVI tokenomics will be switching to an escrowed model esGOVI

- Theta vault for a Concentrated Liquidity DEX + PoL (Proof of Liquidity)

- UCVOL: Ultra CVOL with leverage

Gamma is an Oracle Free decentralized platform for volatility trading and commission-free token trading.

GammaSwap is a protocol for going long gamma through constant function market makers (CFMMs) such as Uniswap, Sushiswap, Balancer, etc.

GammaSwap enables users to purchase not just long straddles but also expose themselves to payoff functions — similar to call-and-put options.

This opens up a whole new world of investment opportunities for users and allows them to diversify their portfolios in ways that were previously not possible.

Being a DEX, Gammaswap allows feeless trading.

OxDanr on Twitter explains it perfectly:

Liquidity providers will provide liquidity to CFMMs just as they currently do with the distinction that they’ll provide it through GammaSwap. That is, LPs will send their tokens to GammaSwap which will deposit them into a CFMM (e.g. Uniswap, Pancakeswap, etc.) in exchange for LP tokens.

These LP tokens from other CFMMs, however, will not be provided to the liquidity provider shorting Gamma. Instead, they will remain in GammaSwap. GammaSwap will issue its own GammaSwap liquidity pool tokens, identical to the liquidity pool tokens in CFMMs such as Uniswap issue (e.g. ERC-20 tokens), that represent a liquidity provider’s stake in the CFMM’s liquidity pool.

Why would users choose GammaSwap?

The incentive to provide liquidity on GammaSwap is that you will earn a boosted yield from your LP positions. The only additional risk is the additional smart contract risk that the LP incurs for using GammaSwap, which can be mitigated through audits and bug bounties.

GammaSwap included interest rate in their profit equation:

Profit = Trading fees — IL + Interest rate

The interest rate is determined be the fees paid by the long gamma side. As a result, yield is always be greater than the underlying AMM i.e. Uniswap.

The long gamma position enables users to:

- Trade on volatility of any token pair;

- Create hedging strategies (i.e. against rug pull or IL).

Flywheel has recently done a great episode with a Gammaswap Dev, where they explain everything about the platform.

The network is currently in Testnet.

Users can try using GammaSwap: provide (short gamma) / borrow (long gamma) liquidity, i n order to explore how you can make profit from “Impermanent Gains”.

FactorDAO is a decentralized asset manager and treasury management platform, launching their token $FCTR on Arbitrum in February.

I have written a short piece about them last week:

FactorDAO aims to be a single hub to connect markets directly to its participants and make it easy to access any digital asset class, thanks to its modular asset management framework.

How does FactorDAO provide value?

The Asset / Treasury management market will be a $16 trillion dollar market in 2030 and is still highly illiquid. Building the infrastructure to onboard institutional liquidity and tokenize illiquid assets is a one-of-a-kind opportunity.

The current investment solutions are:

1. Centralized: most asset markets are #centralized, and deeply regulated, thus non-flexible and not able to accommodate different investment needs.

2. Information asymmetry: most of them are not transparent and often rely on information asymmetry between different market participants (and low transparency)

3. Tokenization of assets can provide great benefits such as the ability to fractionize assets, allowing smaller tier investors to benefit from what would otherwise be unsustainable investments, contributing to the democratization of these investment vehicles.

4. All these roadblocks and intricacies make for a very complex User Experience, filled with technical and informational inefficiencies. This makes such an investment category elitist and not open to the majority of investors who eventually give up, faced with the complex journey and high ticket necessary for this market.

It’s very hard for most of them to find the right investment for their treasury. As such, most DAOs are restricted in the way they can capitalize on their treasuries and assets.

To solve this problem, FactorDAO proposes:

1. Modular and customizable infrastructure for digital asset management.

2. Flexibility and permissionless vault creation allowing full customization and strategy deployment.

3. Permissioned vaults that can give specific rights and can act as a bridge between traditional finance and Defi> increasing liquidity and streamlining compliance.

Last but not least, the features provided by FactorDAO contribute to democratize access to asset and treasury management in a decentralized manner, contributing to creating scalable liquidity and adoption across markets.

Dice is an on-chain casino where users can gamble using $DICE, the native currency. $DICE is burned or minted based on deflationary gambling mechanisms: when you roll dice, it burns them; if you lose, they are burned from the supply, if you win, double is minted.

An interesting feature introduced by DICE is Polystaking: where users are able to create a pool on $DICE and become the house. There will be whitelisted bluechip assets $BTC, $ETH, $GMX, $USDC or you can create a non-whitelisted pool using any coin.

Furthermore, Polytoken & $DICE stakers will be earning 100% of the revenue from the casino.

The game dynamics of Dice are secure and randomized, thanks to the use of Magic VRF Oracle: all numbers are randomized and generated on-chain.

Dice has had quite the rise in price, mostly from widespread usage and a teaser about Dice V2.

If you are interested you can try V2 on testnest already! The team said it will be on mainnet Arbitrum too in the upcoming month(s).

Read More: news.google.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  Wrapped Bitcoin

Wrapped Bitcoin  Hyperliquid

Hyperliquid  Sui

Sui  Wrapped stETH

Wrapped stETH  Chainlink

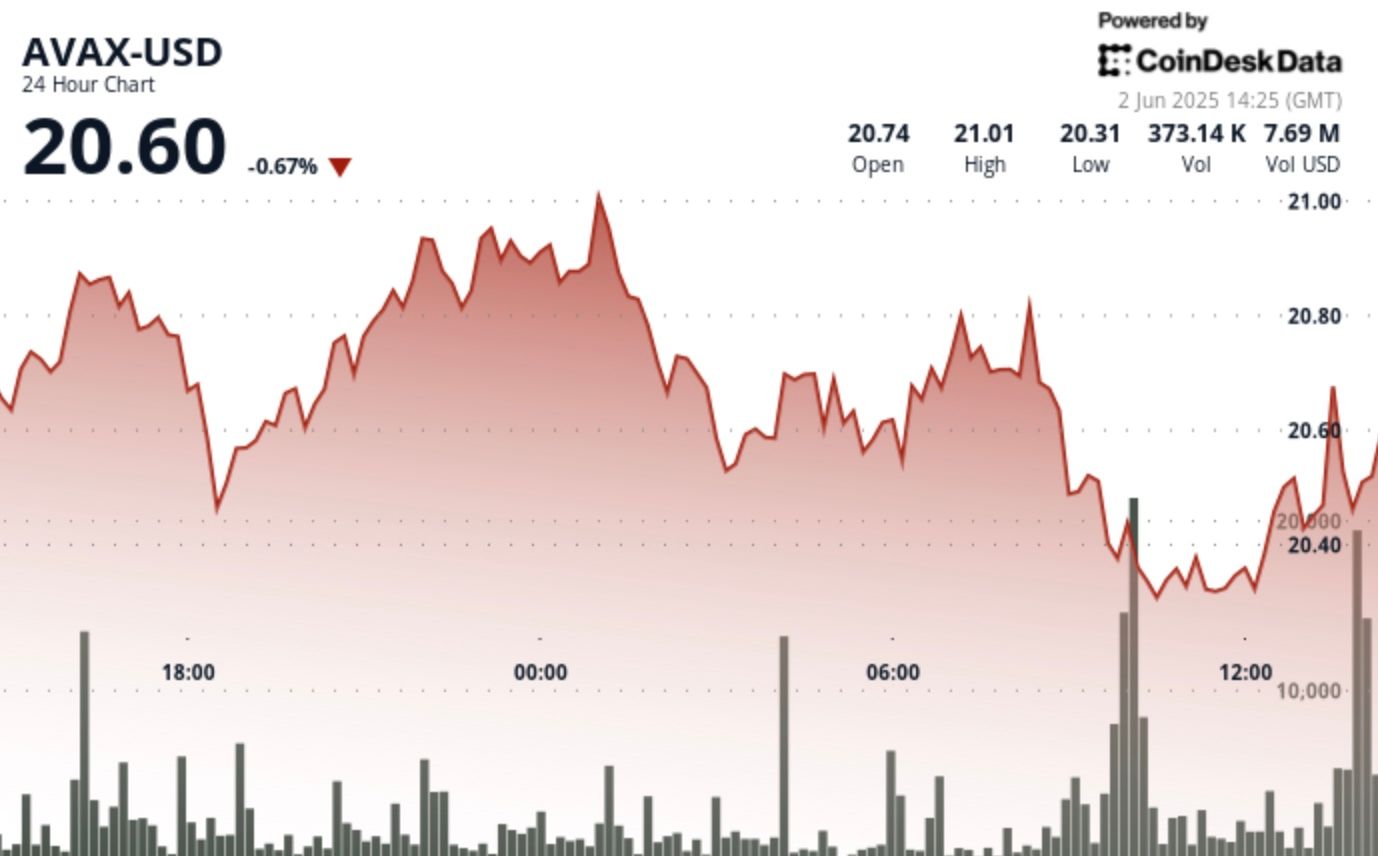

Chainlink  Avalanche

Avalanche  Stellar

Stellar  Bitcoin Cash

Bitcoin Cash  Toncoin

Toncoin  LEO Token

LEO Token  Shiba Inu

Shiba Inu  Hedera

Hedera  USDS

USDS  Litecoin

Litecoin  WETH

WETH  Monero

Monero  Wrapped eETH

Wrapped eETH  Polkadot

Polkadot  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Ethena USDe

Ethena USDe  Bitget Token

Bitget Token  Pepe

Pepe  Pi Network

Pi Network  Coinbase Wrapped BTC

Coinbase Wrapped BTC  WhiteBIT Coin

WhiteBIT Coin  Aave

Aave  Uniswap

Uniswap  Dai

Dai  Bittensor

Bittensor  Ethena Staked USDe

Ethena Staked USDe  Cronos

Cronos  Aptos

Aptos  NEAR Protocol

NEAR Protocol  OKB

OKB  Jito Staked SOL

Jito Staked SOL  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Internet Computer

Internet Computer  Ondo

Ondo  Ethereum Classic

Ethereum Classic