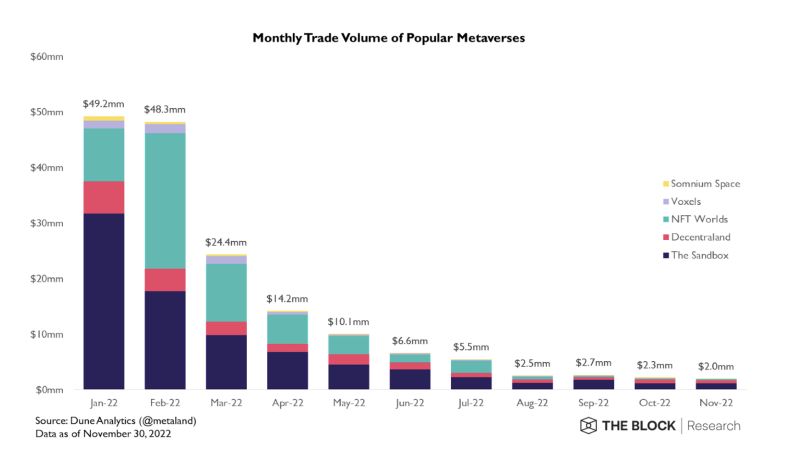

A report by The Block indicates that the metaverse market this year has been collapsing. In January 2022, metaverse platforms raised $49.2 million in monthly trading volume. By November, the number dropped to $2 million, showing a 96% decrease. The data includes the following metaverses: The Sandbox, Decentraland, NFT Worlds, Voxels, and Somnium Space.

The Block’s data dashboard also shows that metaverse land sales have dropped by 90% since the beginning of the year.

The Sandbox maintained the highest number of unique users (17,019) compared to other metaverses. The second most popular virtual world, Decentraland, had 6,529 unique users, followed by NFT Worlds (4,403), Voxels with 2,431, and Somnium Space with 899 users.

The average land price has also plummeted. NFT Worlds’ digital land has the highest value in 2022, reaching a peak of $44.07K on February 26. Currently, a land parcel in the metaverse costs around $782. At the beginning of the year, Somnium Space recorded an average land sale of $25.86K. Now, the price stands at $1,000.

Centralized metaverses, such as the one Meta is building, have also shown some downward trends. Meta’s metaverse division, Reality Labs, experienced financial losses in Q3 2022, reporting a $3.67 billion loss. The second quarter of 2022 wasn’t successful for the company either. However, the company is still positive about the metaverse and has set plans to keep building it in 2023. Similarly, a recent report by Huawei indicates that the metaverse will keep growing over the years and will be the first to be massively adopted in the gaming industry.

The 2023 Digital Assets Outlook by The Block also indicated that the metaverse “struggled to find the right product-market fit in 2022” but will continue to expand in 2023. The Sandbox’s full launch next year might shift the market toward a more upward trend.

Read More: mpost.io

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Wrapped Bitcoin

Wrapped Bitcoin  Sui

Sui  Hyperliquid

Hyperliquid  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Avalanche

Avalanche  Stellar

Stellar  Shiba Inu

Shiba Inu  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Hedera

Hedera  Monero

Monero  Toncoin

Toncoin  Litecoin

Litecoin  WETH

WETH  Polkadot

Polkadot  USDS

USDS  Bitget Token

Bitget Token  Wrapped eETH

Wrapped eETH  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Pepe

Pepe  Pi Network

Pi Network  Ethena USDe

Ethena USDe  WhiteBIT Coin

WhiteBIT Coin  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Aave

Aave  Bittensor

Bittensor  Dai

Dai  Uniswap

Uniswap  NEAR Protocol

NEAR Protocol  Aptos

Aptos  Jito Staked SOL

Jito Staked SOL  OKB

OKB  Ondo

Ondo  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Internet Computer

Internet Computer