It’s that clip of twelvemonth again! Welcome to our 3rd year-end wrapper (it’s besides a large clip to look backmost astatine our top memes of 2021 & 2020). Since Dose of DeFi began, we’ve embraced the powerfulness of the meme. Despite 2022’s marketplace carnage (#1 connected this year’s list), DeFi remains a beardown marque that is embraced by projects large and small. It’s inactive a catchy rallying outcry for a transparent, global, and digitally-native fiscal system.

Unfortunately, the crypto meme is successful precise atrocious signifier successful the eyes of normies; it’s beauteous hard for DeFi to turn erstwhile thing crypto is labeled a scam. Yet this volition pass. In the meantime, there’s inactive a batch of enactment to beryllium done to propel DeFi forward, from the infrastructure (#4) to app furniture (#5), each the mode to basal marketplace operation (#3). Through it all, 2022 whitethorn beryllium astir remembered arsenic the twelvemonth wherever DeFi regulatory conversations – peculiarly astir stablecoins (#2) – became overmuch much serious.

It’s been a consecutive enactment down for astir each crypto assets and DeFi metrics successful 2022. This was punctuated by 2 large implosions: archetypal the autumn of Luna and the Terra stablecoin, and then, conscionable past month, the massive fraud astatine FTX. Yet neither of these struck astatine DeFi’s core. The FTX illness really renders a stronger lawsuit for non-custodial exchanges and a transparent indebtedness book. Terra’s failure, meanwhile, concluded that algorithmic perpetual question machines are a fantasy.

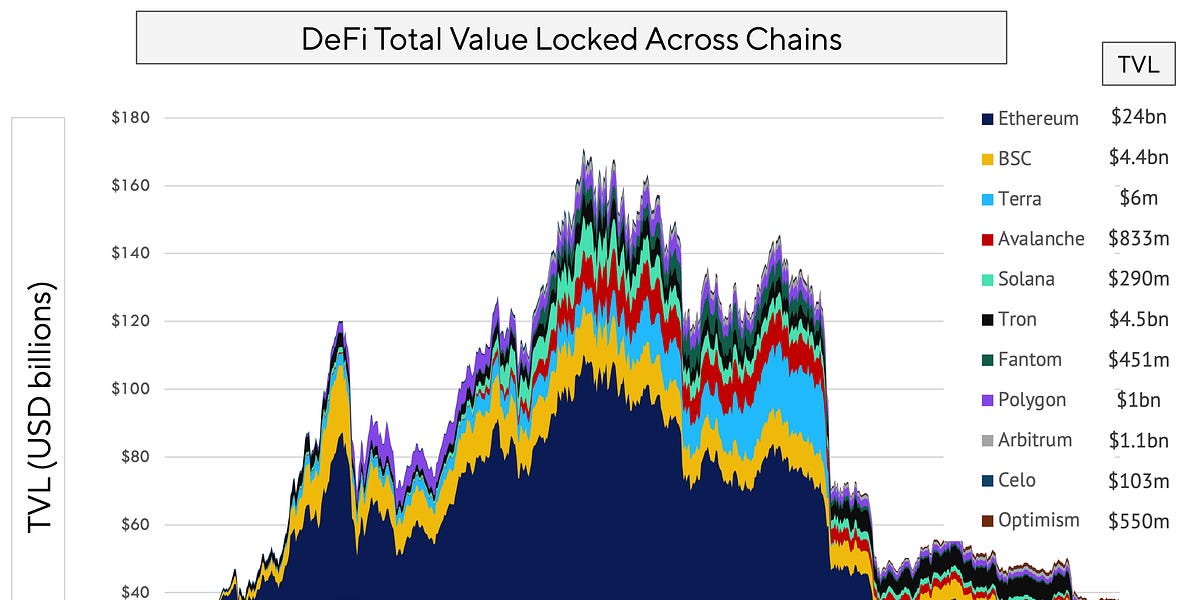

The ignored communicative is that the marketplace illness did not pb to a DeFi protocol failure. DeFi, successful fact, performed flawlessly, successful opposition to March 2020 and Black Thursday. Still, the monolithic diminution successful ETH and immense stablecoin outflows greatly reduced DeFi TVL and fee-generating abilities. This has slowed concern into the space, and made immoderate merchandise motorboat an uphill battle. This, however, could beryllium a steadfast development, by encouraging longer periods of gathering alternatively than trying to unreserved retired products and ideas earlier the euphony stops.

It’s fitting that successful a jam-packed twelvemonth of regulatory scrutiny, conscionable this week Elizabeth Warren dropped a bombshell portion of legislation. This projected instrumentality is an each retired battle – KYCing each wallets and virtually going aft node operators – that has precise small accidental of passing. And this seems to beryllium the taxable of each projected regulatory changes: they spell nowhere. We admit to being a spot naive successful believing that the bipartisan entreaty of crypto would construe into legislation. What is existent this twelvemonth is that regulators person smartened up to the in’s and out’s of DeFi and the crypto ecosystem.

Nowhere is this much existent than for stablecoins. The ample centralized ones (Tether, USDC, and BUSD) are getting truthful large that they’re present being considered arsenic a shadiness banking arm, with perchance hidden systemic hazard to the planetary fiscal system. Meanwhile, the blowup of stablecoin Terra makes america wonderment if regulators volition wage person scrutiny to anything claiming to beryllium $1.00. For the industry, this means stunted maturation (see illustration below, proviso dwindling adjacent earlier the marketplace fall) and a displacement towards “safer” centralized stablecoins similar USDC and BUSD, and distant from Tether. Still, the semipermanent tailwinds connected stablecoins are strong.

Looking astatine the existent marketplace chaos and regulatory confusion, it’s hard to ideate that thing won’t beryllium done, but careless we’re bracing ourselves for different twelvemonth of regulatory stagnation. While it whitethorn look evident that a displacement is needed, regulatory clarity astir DeFi and stablecoins volition apt determination astatine a glacial pace.

At its beginning, DeFi was lone connected Ethereum mainnet, past successful 2020 and 2021 expanded to different EVM-compatible chains, including Layer 2s. This lowered costs for users but had the aforesaid composable marketplace operation arsenic Ethereum mainnet. In 2022, with DeFi’s advances and bottlenecks, the manufacture began to research wholly caller infrastructure. Cosmos has been astir for years now, yet lone successful 2022 did it yet physique up the ecosystem of wallets, blockchain explorers and DEXs to connection an acquisition on-par with much established blockchains. As we explored successful our Cosmos heavy dive successful April, its defining diagnostic is its quality to bridge antithetic blockchain networks, which is built into the web itself. Projects to ticker adjacent year: Agoric (which supports astute contracts written successful JavaScript) and Archway (which distributes incentives to developers straight from astute contracts).

dYdX, 1 of the oldest DeFi projects, bolted for Cosmos this year and launched its ain chain. It present offers escaped transactions for unexecuted orders, and optimized its validator acceptable to store the orderbook. dYdX was arguably the archetypal palmy appchain, a competing imaginativeness to the composability-centric EVM model. Now, galore are suggesting that each large DeFi protocols, like Uniswap, volition inevitably motorboat their ain appchains.

This imaginativeness has been furthered with the emergence of modular blockchain design, which we examined successful item successful November. This imaginativeness has not reached fruition, but received a batch of attraction successful 2022. Celestia and Polygon Avail are 2 caller blockchains that person been created to code the contented of information availability done the usage of modular blockchain architecture. Unlike existing blockchains, these networks don’t verify transactions, but alternatively absorption connected ensuring that caller blocks are added to the web done statement and are disposable to each nodes. Celestia’s archetypal partners show imaginable usage cases: dYmension (allows rollups to contented tokens and take a information availability layer), AltLayer (high-throughput ‘disposable’ rollups, wherever NFTs are minted and past bridged to an L1), and Eclipse (rollups utilizing the Solana VM and the IBC Protocol).

MEV professionalized successful 2022. Yes, determination are inactive anonymous developers combing the acheronian forest, but it’s present seen arsenic the playground of the astir blase traders successful the world. Flashbots, the starring quality successful the MEV saga, grew adjacent much palmy successful 2022 with the displacement to PoS (nearly 90% of Ethereum validators are moving MEV-boost). Yet with this occurrence besides came a realization of the centralization and censorship threats from this marketplace design.

The presumption quo – with Flashbots arsenic a trusted intermediary – isn’t sustainable. What’s clear, as we investigated successful our heavy dive conscionable past week, is that the MEV arena volition determination disconnected of Ethereum and onto a standalone web that tin equilibrium the benefits of MEV nett extraction and the request to democratize and decentralize that market.

Flashbots’ reply is SUAVE, an wholly caller blockchain for artifact gathering connected immoderate chain. It’s ambitious, but not dissimilar to competing efforts to bounds MEV extraction from CoW Protocol done batch auctions, oregon Chainlink’s Fair Sequencing Service. All admit that transaction ordering is important to ensuring blockchains clasp their credible neutrality and bounds rent extraction.

Dose of DeFi launched successful June 2019, conscionable erstwhile radical and projects started congregating nether the DeFi banner. 2020 was a coming retired party, with validation of the halfway concepts. 2021 and 2022 saw a unreserved of caller projects and funds into the system, but arsenic we said successful March’s “Has DeFi innovation stalled?”:

It’s amazingly hard to constituent to a large DeFi innovation successful 2021 that tin comparison to the likes of the Uniswap motorboat (November 2018), Synthetix (January 2019), MakerDAO multi-collateral Dai (November 2019), Curve (January 2020), COMP farming (June 2020), oregon YFI governance distribution (July 2020).

It appears that the astir important and promising DeFi projects close present were astir each launched much than 2 years ago.

This perspective, portion not wholly inaccurate, focuses wholly connected the app layer, oregon the end-user experience. It sells DeFi abbreviated successful our opinion, due to the fact that it treats it similar fintech, which is conscionable a modern exertion wrapper (and meme!) for the accepted fiscal system. DeFi is bigger than the app layer. It besides includes an infrastructure furniture and a marketplace operation layer. And successful those areas, arsenic the #3 and #4 memes of 2022 show, there’s been an atrocious batch of progress. The existent slot of DeFi apps were built connected the infrastructure and marketplace operation of crypto successful 2018. And portion the manufacture spent 2022 researching and gathering the adjacent procreation of DeFi infrastructure and marketplace structure, much advancement volition beryllium needed earlier innovation tin determination backmost to the app layer.

That’s it! Feedback appreciated. Just deed reply. Written successful Nashville, wherever it’s opening to look a batch similar Christmas.

Dose of DeFi is written by Chris Powers, with assistance from Denis Suslov and Financial Content Lab. Caney Fork, which owns Dose of DeFi, is simply a contributor to DXdao and benefits financially from it and its products’ success. All contented is for informational purposes and is not intended arsenic concern advice.

Read More: www.bitcoin-rss.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  Wrapped Bitcoin

Wrapped Bitcoin  Hyperliquid

Hyperliquid  Sui

Sui  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Avalanche

Avalanche  Stellar

Stellar  Bitcoin Cash

Bitcoin Cash  Toncoin

Toncoin  LEO Token

LEO Token  Shiba Inu

Shiba Inu  Hedera

Hedera  WETH

WETH  USDS

USDS  Litecoin

Litecoin  Wrapped eETH

Wrapped eETH  Monero

Monero  Polkadot

Polkadot  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Ethena USDe

Ethena USDe  Bitget Token

Bitget Token  Pepe

Pepe  Pi Network

Pi Network  Coinbase Wrapped BTC

Coinbase Wrapped BTC  WhiteBIT Coin

WhiteBIT Coin  Aave

Aave  Uniswap

Uniswap  Bittensor

Bittensor  Dai

Dai  Ethena Staked USDe

Ethena Staked USDe  Aptos

Aptos  NEAR Protocol

NEAR Protocol  Cronos

Cronos  OKB

OKB  Jito Staked SOL

Jito Staked SOL  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Internet Computer

Internet Computer  Ondo

Ondo  Ethereum Classic

Ethereum Classic