As the globe’s second most valuable cryptocurrency, Ethereum has brought the idea of staking into the mainstream. This process enables token holders to secure the Ethereum network and in return, earn ETH rewards. With a growing range of staking options available, Rocket Pool has carved out its place among the most popular and innovative decentralized liquid staking solutions.

What is Rocket Pool

Rocket Pool is a decentralized Ethereum staking protocol that allows users to stake their ETH and earn rewards without locking up this ETH. When you stake ETH with Rocket Pool, you receive rETH tokens in return. These tokens represent your staked assets and the rewards they earn. The value of rETH is pegged to the value of ETH, and its value increases over time as staking rewards are accrued, leading to a dynamic exchange rate.

Today, there are 727,000 ETH staked through Rocket Pool, making it the third-largest ETH liquid staking solution behind only Lido and Coinbase Earn at the moment. This staked ETH is currently supported across roughly 2,900 Rocket Pool Node Operators and counting.

Why Rocket Pool?

Rocket Pool offers several benefits for stakers:

It eliminates the need to run your own node, which can be technically challenging and time-consuming; e.g. simply buy rETH to stake!

It also allows you to stake any amount of tokens, unlike Ethereum’s native staking system that requires 32 ETH. With Rocket Pool, you can stake with as little as 0.01 ETH.

Rocket Pool’s rETH tokens are usable in DeFi, e.g. as collateral in borrowing protocols, so you can stay liquid while earning passive staking income over time.

️ More advanced users can become Rocket Pool Node Operators, which can stake with as little as 8 ETH to create a “minipool” and thereby earn higher ETH staking rewards.

Maintaining Rocket Pool

Rocket Pool’s governance is facilitated by RPL, the Rocket Pool Token. This token is also used as a form of insurance when staked through a Rocket Pool node, i.e. node operators are required to stake a minimum of 10% of their ETH’s value in RPL as a security promise to the protocol. This collateral acts as insurance, compensating the protocol for any ETH loss due to poor node performance or heavy penalties. Node operators are incentivized to stake as much RPL as possible, up to a maximum of 150% of the staked ETH’s value, as they receive more RPL rewards from the protocol’s built-in inflation mechanism.

Additionally, the Oracle DAO, a select group of special node operators within Rocket Pool, performs key administrative tasks that are beyond the scope of smart contracts. This includes transferring data from the Beacon Chain to the Execution Layer, overseeing the creation of unique validator public keys for minipools, and beyond. They also have the authority to propose, vote on, and implement changes to the core protocol, manage their membership, and receive a 15% share of the total RPL inflation as compensation for their services.

How to stake ETH on Rocket Pool

Staking your ETH on Rocket Pool is a straightforward process that can be completed in a handful of steps. Here’s a step-by-step walkthrough on how to do it:

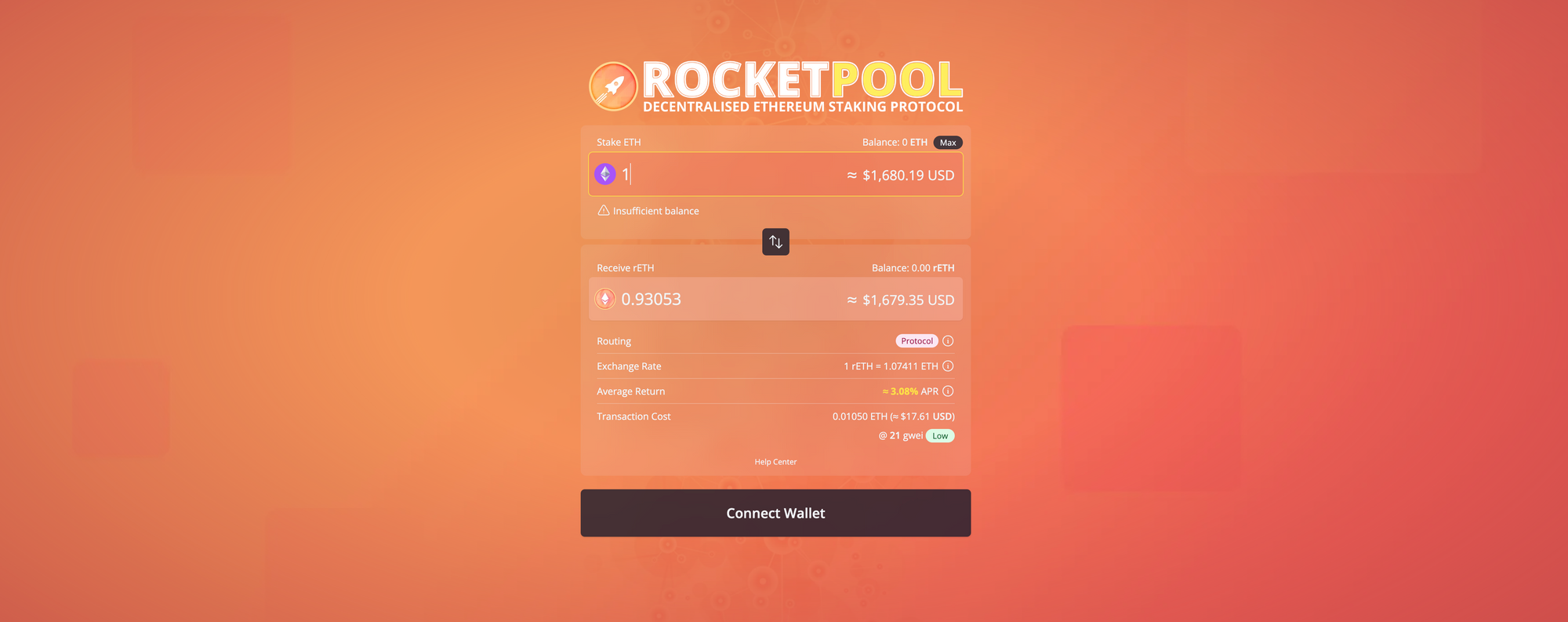

Connect Your Wallet: Visit the Rocket Pool staking app. Click on “Connect Wallet” at the top or middle of the page. You’ll need to connect a Web3 wallet, such as MetaMask, that contains the ETH you wish to stake.

Enter the Amount to Stake: Once your wallet is connected, you can enter the amount of ETH you want to stake in the “Stake ETH” field of the deposit interface.

Stake Your ETH: After entering your desired stake amount, click on the “Stake” button to initiate the staking process. You’ll need to confirm the transaction in your wallet.

Receive rETH: Once the transaction is confirmed, you’ll receive the appropriate amount of rETH tokens in your wallet. Remember, the ETH / rETH exchange rate is dynamic, so currently 1 ETH will fetch you ~0.93 rETH. These tokens represent your staked ETH and the rewards they earn.

Monitor Your Staking: You can monitor your staking rewards using the “Balance” tab on your Rocket Pool profile. Note that whenever you’re ready to unstake your rETH, you can use the same interface you used to stake in order to receive your ETH deposit back.

Risks of Rocket Pool

Engaging with Rocket Pool, like any DeFi project, carries its own unique set of potential risks. It’s crucial to understand these possible risks before deciding to stake your ETH:

Contract Vulnerability Risk: Rocket Pool’s operations are based on smart contracts. Despite the fact that the code is open-source, has undergone audits, and is protected by a bug bounty program to reduce risks, the possibility of bugs or vulnerabilities in the smart contracts always exists.

Governance Risk: While the possibility is remote, there remains the chance that the Oracle DAO gets compromised or tricked into implementing malicious protocol changes.

Additional Rocket Pool resources

To dive deeper into Rocket Pool, consider exploring the following resources:

Zooming out

For those intrigued by Ethereum staking, Rocket Pool presents an interesting option. It merges the advantage of accruing ETH staking rewards with the convenience of preserving liquidity, making it a desirable passive income avenue for both novice and seasoned stakers. Moreover, Rocket Pool’s dedication to the principles of decentralization, inclusivity, and safety distinguishes it within the contemporary Ethereum staking landscape.

Read More: www.bankless.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  Wrapped Bitcoin

Wrapped Bitcoin  Hyperliquid

Hyperliquid  Wrapped stETH

Wrapped stETH  Sui

Sui  Chainlink

Chainlink  Stellar

Stellar  Avalanche

Avalanche  LEO Token

LEO Token  Toncoin

Toncoin  Bitcoin Cash

Bitcoin Cash  Shiba Inu

Shiba Inu  USDS

USDS  Hedera

Hedera  WETH

WETH  Wrapped eETH

Wrapped eETH  Litecoin

Litecoin  Monero

Monero  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Polkadot

Polkadot  Ethena USDe

Ethena USDe  Bitget Token

Bitget Token  Pepe

Pepe  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Pi Network

Pi Network  WhiteBIT Coin

WhiteBIT Coin  Aave

Aave  Uniswap

Uniswap  Dai

Dai  Ethena Staked USDe

Ethena Staked USDe  Bittensor

Bittensor  OKB

OKB  Cronos

Cronos  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Aptos

Aptos  NEAR Protocol

NEAR Protocol  Jito Staked SOL

Jito Staked SOL  Internet Computer

Internet Computer  Ondo

Ondo  Ethereum Classic

Ethereum Classic