The core feature of the Ordinal system is the ability to inscribe arbitrary data onto satoshis. This reality is why the phrase “Inscriptions” has recently become synonymous with “![]() Bitcoin L1Bitcoin is the first and most well-known cryptocurrency introducing a new payment network and a kind of money. View Profile” class=”stubHighlight”>Bitcoin NFTs” or “Ordinals-style NFTs.”

Bitcoin L1Bitcoin is the first and most well-known cryptocurrency introducing a new payment network and a kind of money. View Profile” class=”stubHighlight”>Bitcoin NFTs” or “Ordinals-style NFTs.”

This inscription process is completed by including data within a Bitcoin transaction. Specifically, the data is placed in the transaction witness, a part of a Bitcoin transaction that normally contains signatures and other authorization proofs.

The data inscribed here can be diverse, ranging from simple text to images, SVGs, or even HTML. Once satoshis are inscribed with data and the transaction is mined, the inscription becomes permanent. It’s as secure, immutable, and decentralized as any other data on the Bitcoin blockchain. This means that once inscribed, a satoshi carries its data forever, always distinguishable from other satoshis.

Additionally, thanks to Ordinal theory it’s possible to track the movement and ownership of an inscribed satoshi across different transactions and over time. This makes it feasible to trade, gift, or sell these inscribed satoshis like any other Bitcoin transaction. However, special care (sat control) must be taken in transactions to ensure that the specific inscribed satoshi is correctly transferred, as Bitcoin transactions normally don’t differentiate between individual satoshis.

Ordinals are onchain

For the sake of flexibility and practicality, many NFTs on  Ethereum L1Ethereum is the largest smart contact blockchain platform with an expensive decentralized ecosystem.View Profile” class=”stubHighlight”>Ethereum store their art and metadata offchain, e.g., on a storage network like IPFS rather than on Ethereum directly. This is because, besides its narrow data limitations, onchain storage on Ethereum faces high storage costs, too.

Ethereum L1Ethereum is the largest smart contact blockchain platform with an expensive decentralized ecosystem.View Profile” class=”stubHighlight”>Ethereum store their art and metadata offchain, e.g., on a storage network like IPFS rather than on Ethereum directly. This is because, besides its narrow data limitations, onchain storage on Ethereum faces high storage costs, too.

In contrast, every Ordinals mint is completely onchain on Bitcoin thanks to the way the underlying data is stored within transactions, and with much cheaper storage costs compared to onchain Ethereum NFTs. And what they lack in advanced smart contract functionalities, they make up for with the best permanence-to-cost ratio in the NFT space today.

BRC-20s explained

The Ordinals approach has popularized the creation of 1/1 NFTs and collections of NFTs atop Bitcoin. Yet atop Ordinals itself has also arrived BRC-20s, an experimental and unofficial fungible token standard built via Inscriptions.

BRC-20s are not smart contract-based tokens like Ethereum’s ERC-20s are, and they’re not completely fungible either. They’re created by inscribing a snippet of JavaScript Object Notation (JSON) text into a Bitcoin NFT. This JSON contains a token’s basic information, like max supply and the token ticker. For transfers or buys/sells, additional NFTs are inscribed that can be used to track balance adjustments in batches, e.g., 100 tokens, 500 tokens, 1,000 tokens, etc.

BRC-20 tokens have exploded in popularity in recent months, with $ORDI having become the first in the cryptoeconomy to breach the $1 billion market cap mark.

Rare sats explained

Rare Sats, emerging from the Ordinals protocol, have introduced a new dimension to the perception of satoshis.

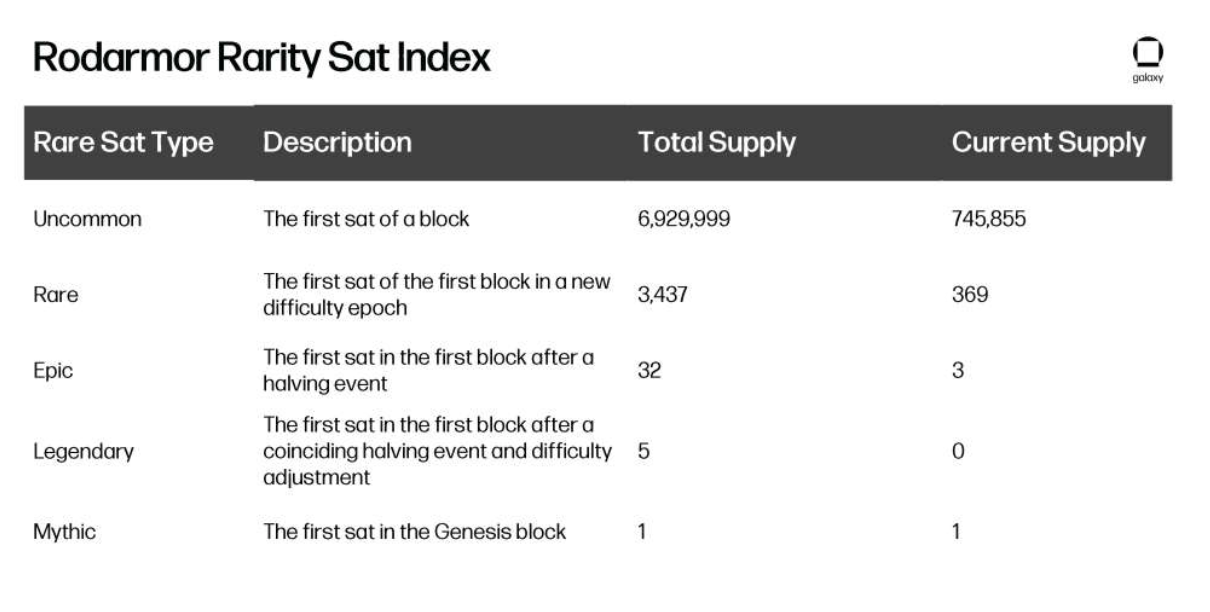

Central to understanding Rare Sats is the Rodarmor Rarity Index, named after Casey Rodarmor, the creator of Ordinals. This index classifies satoshis into various categories based on their uniqueness and rarity. The categories range from the most common, which form the bulk of Bitcoin’s supply, to the mythic, which includes the first-ever satoshi mined in Bitcoin’s genesis block.

The index also recognizes other significant categories like uncommon, rare, epic, and legendary sats, each with its defining characteristics and maximum supply, often linked to pivotal moments in Bitcoin’s timeline, like mining difficulty adjustments and halving events.

In addition to these categories, other unique types of sats hold historical significance, such as Pizza Sats, Palindrome Sats, Block 9 Sats, and others, each commemorating special moments or patterns in Bitcoin’s history. For instance, Pizza Sats commemorate the first known Bitcoin transaction for tangible goods, while Palindrome Sats have a numerical symmetry that makes them intriguing.

The growing fascination with Rare Sats has given rise to the practice of “Sat Hunting,” transforming ordinary satoshis into sought-after collectibles and creating one of the latest niches within the NFT ecosystem.

Top Ordinals marketplaces and wallets

To make and transfer Ordinals and BRC-20s, you’ll need a wallet capable of recognizing and managing inscribed satoshis. Some wallets that have become popular on this front include:

- Xverse — “The Bitcoin wallet for everyone”

- Leather — “Tap into the Bitcoin economy”

- OKX — “Your portal to Web3”

Once you have a wallet ready to go, you can start surfing popular Ordinals marketplaces to see if any NFT listings or BRC-20s catch your eye. Some of the biggest of these marketplaces include OKX’s Ordinals Market, Magic Eden, and Gamma.

Ordinals adoption

In 2023, the Bitcoin community started grappling with a surge in Bitcoin NFT mints upon Casey Rodarmor’s introduction of Ordinals, a protocol that has popularized a method for converting individual satoshis—the smallest bitcoin denomination—into non-fungible digital artifacts.

Notably, Ordinals has been met with derision by some “old guard” hardliner Bitcoiners, not unlike how some of these very same people argued against Bitcoin-based Counterparty NFTs as spam back in 2014. Their argument? Bitcoin should only be used for payments, always and forevermore.

In contrast, Counterparty veterans and newer creative experimenters are hailing Ordinals’s approach as potentially revolutionary for Bitcoin’s NFT scene going forward. Most importantly, these new NFTs are driving up transaction fee revenues for Bitcoin miners, pointing the way to a future in which NFT activity helps to replace the ever-decreasing block subsidy on Bitcoin.

Zooming out

The introduction of Ordinals has not only diversified Bitcoin’s use cases but has also sparked a debate about the fundamental nature of Bitcoin. While some traditionalists argue for the preservation of Bitcoin’s original purpose as a payment system, a growing faction sees these developments as a natural evolution of the network’s capabilities, offering new avenues for creativity and financial opportunity.

The Ordinals protocol, by enabling onchain storage of diverse data types at relatively lower costs compared to Ethereum, has proven to be a legitimate game-changer in the NFT space. It challenges the preconceived notions of what can be achieved on the Bitcoin blockchain, extending its utility beyond simple monetary transactions.

However, this innovation does not come without its challenges. The surge in Bitcoin NFT minting, particularly with the popularity of BRC-20 tokens and the practice of “Sat Hunting,” has led to increased network congestion. This phenomenon raises concerns about the scalability and efficiency of the Bitcoin L1 as it ventures into new territories of digital asset creation and management.

Looking ahead, this ongoing conversation around network congestion, transaction fees, and the role of NFTs within the Bitcoin ecosystem will likely shape the future direction of the network. As such, the Ordinals space is worth watching both for its advances and its influence on Bitcoin and the wider cryptoeconomy.

Read More: www.bankless.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Wrapped Bitcoin

Wrapped Bitcoin  Sui

Sui  Chainlink

Chainlink  Avalanche

Avalanche  Stellar

Stellar  LEO Token

LEO Token  Toncoin

Toncoin  Hedera

Hedera  Shiba Inu

Shiba Inu  USDS

USDS  Wrapped stETH

Wrapped stETH  Bitcoin Cash

Bitcoin Cash  Litecoin

Litecoin  Polkadot

Polkadot  Hyperliquid

Hyperliquid  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Bitget Token

Bitget Token  WETH

WETH  Ethena USDe

Ethena USDe  Monero

Monero  Pi Network

Pi Network  WhiteBIT Coin

WhiteBIT Coin  Wrapped eETH

Wrapped eETH  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Pepe

Pepe  Aptos

Aptos  Dai

Dai  Uniswap

Uniswap  OKB

OKB  Bittensor

Bittensor  NEAR Protocol

NEAR Protocol  Ondo

Ondo  Official Trump

Official Trump  Gate

Gate  Internet Computer

Internet Computer  sUSDS

sUSDS  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Tokenize Xchange

Tokenize Xchange  Ethereum Classic

Ethereum Classic