Compound is a decentralized finance (DeFi) money markets protocol that allows users to 1) lend cryptocurrencies to earn interest on their holdings, or 2) lend crypto to then borrow more crypto against their holdings for do-it-yourself loans.

This non-custodial lending platform operates on Ethereum and uses smart contracts to enable seamless, secure, and transparent transactions between borrowers and lenders. By removing the need for middleman financial institutions, Compound has helped democratize access to financial services in the burgeoning cryptoeconomy.

History of Compound

Compound was originally founded in 2017 by Robert Leshner and Geoffrey Hayes. The team launched the first version of the protocol — the inaugural money market protocol on Ethereum — in 2018, followed by the release of its second iteration on the Ethereum network in May 2019. Then in August 2022, the latest “Comet” V3 protocol was launched.

Compared to its preceding deployment, the Compound V3 system is streamlined with fewer supported collateral types and is focused on capital efficiency and risk-mitigation. Additionally, in contrast to the V2 system the V3 moved away from the pooled-risk model through which the whole project could be drained through the introduction of one bad asset.

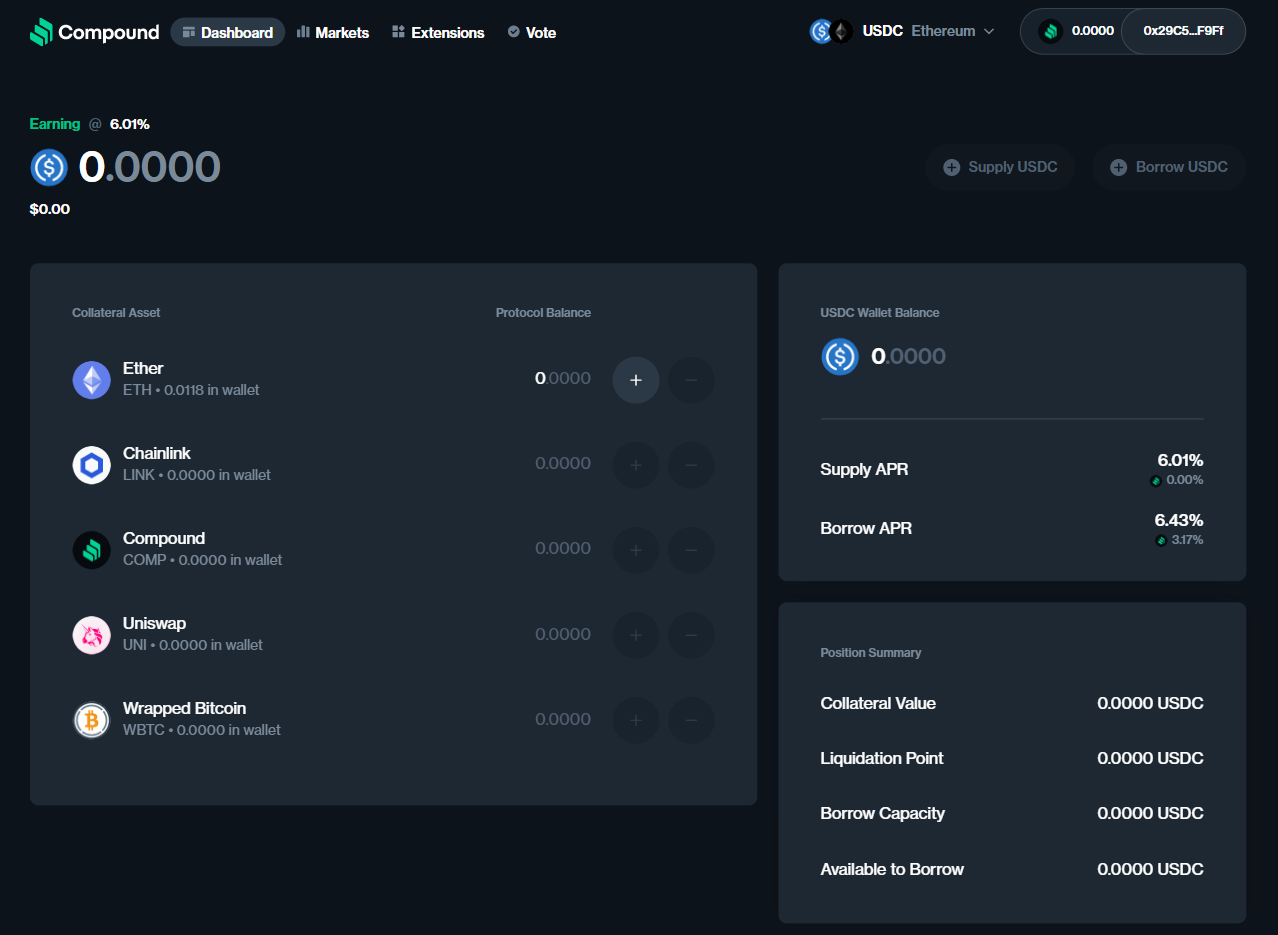

Accordingly, the first deployment of Compound V3 now lets users borrow the USDC stablecoin against deposits of ETH, WBTC, UNI, LINK, or COMP collateral. However, users that still prefer the V2 system can still readily navigate to it using the Compound website.

As far as other important historical milestones go, in June 2020 Compound introduced its native governance token, COMP, which allowed users to participate in the protocol’s decision-making processes. The COMP distribution method notably propelled the platform’s growth and pioneered the “yield farming” phenomenon in DeFi.

That same year the Compound team announced plans to launch Compound Chain, an independent Substrate-based Polkadot blockchain that would have served as the foundation for a reimagined cross-chain Compound protocol and a new native CASH token. However, in the years since the Compound Chain effort was announced the project has fallen by the wayside and is no longer being actively developed.

The pulse of Compound

Compound is the 11th-largest project in all of DeFi per the $1.85 billion USD worth of total value locked (TVL) currently deposited into the protocol.

Unlike Aave, a similar DeFi protocol that is now deployed across five different chains, the entirety of Compound’s present TVL comes from the project’s V2 and V3 deployments on Ethereum. However, it remains possible that Compound V3 will eventually be deployed and gain traction on additional chains.

The COMP token

Compound’s native token, COMP, serves two main purposes within the protocol.

First, the token allows holders to participate in the project’s governance, enabling them to vote on proposals and protocol upgrades. Secondly, COMP is distributed as rewards to users who interact with the protocol by lending or borrowing, incentivizing participation in the ecosystem.

As of May 2023, COMP was ranked as the 151st-largest crypto per its $246 million USD market capitalization according to CoinGecko.

What you need to use Compound

A wallet — since Compound is deployed on Ethereum, any Ethereum compatible wallet (e.g. MetaMask, Coinbase Wallet, etc.) should work fine for using with the protocol

Starter gas — you’ll need some ETH to cover the gas costs of transacting on Compound

How to use Compound

To use Compound, connect your Ethereum wallet to the platform at app.compound.finance.

Once connected, it’s possible to lend USDC using the “+ Supply USDC” button in the “Dashboards” tab of the website. By depositing USDC here, users receive cUSDC, a token that represents their share in the lending pool and that continuously accrues interest in real-time. Note, too, that the underlying deposited USDC can be withdrawn at any time.

As for borrowing USDC on Compound, this is only possible after first supplying an approved collateral asset to the protocol like ETH or WBTC. With collateral in place, users can then borrow up to a certain percentage of the value of their deposited assets. That said, it is very important for borrowers to monitor the value of their collateral and maintain a sufficient collateralization ratio to avoid liquidation, which entails a portion of collateral being sold to repay an outstanding underwater loan.

Risks of Compound

Using Compound, like other DeFi platforms, involves certain risks that users should be aware of before participating:

- Liquidation risk: If your collateral’s value drops significantly, your borrow position may be liquidated.

- Regulatory risk: The regulatory landscape for DeFi platforms like Compound is uncertain and subject to change.

- Smart contract risk: Compound’s smart contracts could be subject to hacks or exploits.

DeFi competitors to Compound

Compound competes with several prominent DeFi lending protocols in the space, such as:

Maker ($6.87B USD TVL)

Aave ($5.16B USD TVL)

Liquity ($721M USD TVL)

Additional Compound resources

For more information and resources about Compound, visit:

Zooming out

Compound has solidified its position as a leading DeFi money market protocol, offering users the ability to lend and borrow crypto in a secure, transparent, and decentralized manner. With its latest iteration, Compound V3, the platform has further streamlined its functionality and enhanced its focus on capital efficiency and risk mitigation. Despite facing competition from other DeFi lending protocols, Compound continues to be a prominent player in the DeFi ecosystem and is poised to be so for the foreseeable future.

Read More: www.bankless.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Wrapped Bitcoin

Wrapped Bitcoin  Sui

Sui  Chainlink

Chainlink  Avalanche

Avalanche  Wrapped stETH

Wrapped stETH  Stellar

Stellar  Shiba Inu

Shiba Inu  Hedera

Hedera  Bitcoin Cash

Bitcoin Cash  Toncoin

Toncoin  Hyperliquid

Hyperliquid  LEO Token

LEO Token  USDS

USDS  Litecoin

Litecoin  Polkadot

Polkadot  WETH

WETH  Monero

Monero  Bitget Token

Bitget Token  Wrapped eETH

Wrapped eETH  Pepe

Pepe  Pi Network

Pi Network  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Ethena USDe

Ethena USDe  WhiteBIT Coin

WhiteBIT Coin  Bittensor

Bittensor  Uniswap

Uniswap  NEAR Protocol

NEAR Protocol  Aptos

Aptos  Dai

Dai  OKB

OKB  Aave

Aave  Ondo

Ondo  sUSDS

sUSDS  Internet Computer

Internet Computer  Ethereum Classic

Ethereum Classic  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Cronos

Cronos  Official Trump

Official Trump