In case you weren’t aware, I wrote a piece two weeks ago about how Arbitrum effectively paid $2,175/user to acquire a single address. You can read the full piece over here:

What I didn’t realise is just how popular and how much of a debate it’d really spark amongst various people in the broader community. I wanted to write this piece to manually go through each response since I think everyone raised valid points that are worth addressing.

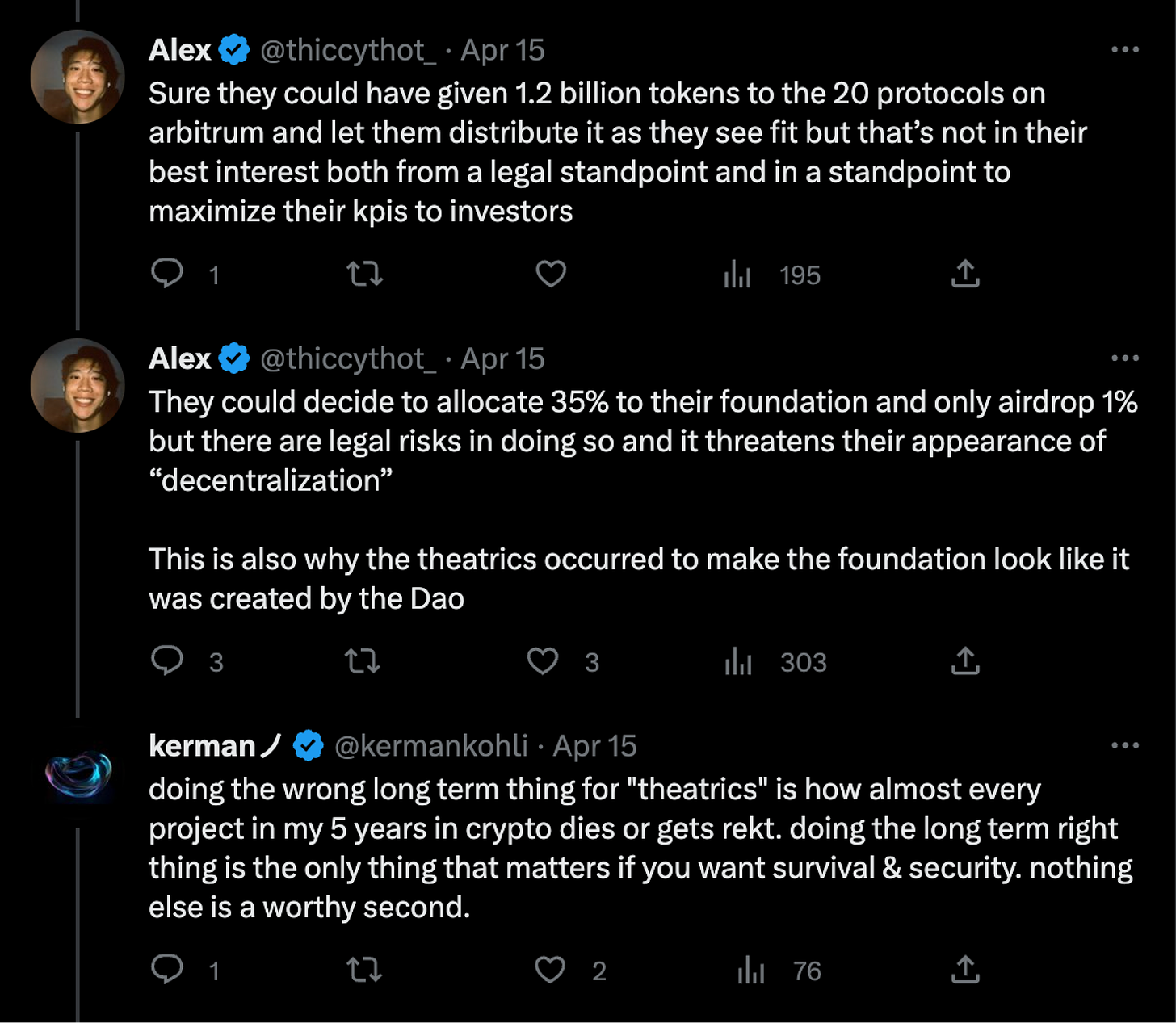

This was quite a common response and came up quite often. The logic goes that by distributing tokens to a very large group of users you’re avoiding securities laws because the network is supposedly decentralized. I mean I’m not a lawyer by any means but I think we can also confidently say that we don’t know what the actual regulations around airdrops and tokens even properly are. In a world where the SEC has said that Coinbase is offering a securitised product through staking do you really think your airdrop is going to pass the test because it was distributed to 1% of your users versus 50% of your users? That’s delusional thinking. People or firms that believe that there’s some magical criteria that keeps you out of trouble are being dishonest because there is no guidance for anyone on what to do here.

Second of all, as we saw in Arbitrum’s case, insider’s over-ruled the first vote of the DAO so any potential decentralized laws that they may have satisfied they completely nullified through their next set of actions. You sure as hell can’t say that you did a wide token distribution to “decentralize” your network only to pass a change in the network unanimously without your “governors”. These two actions are not congruent with each other and we can say they aren’t for many other protocols that are DAOs. Okay so what else could be going on here? That leads us to our next point.

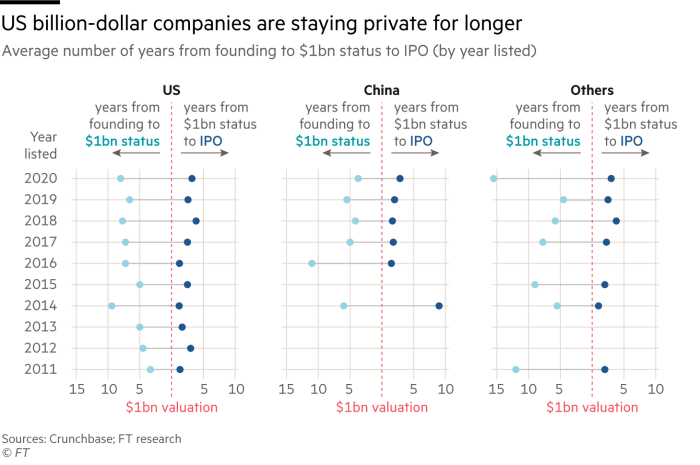

Airdrops can heavily serve the interests of team members and early investors by providing fuck-you rich levels of liquidity and valuations. I’d like to break down the two individually since I do think they deserve their own individual talking points. Let’s start off with liquidity. In traditional web2 startup land, liquidity is on the magnitude of ~10 years, and that’s still optimistic assuming the startup in question does decide to do it. Here’s a chart that shows some data on this phenomena.

Fortunately, in crypto we don’t need to wait that long for liquidity on assets since we have programatic, always-on, global markets. Unfortunately, we skip a bit too many steps and enable full liquidity for assets that don’t deserve it and create very skewed incentive structures in the process. If you want to know my full thoughts on this, read this below:

The TLDR of it is that it doesn’t really matter what you fund as an early stage crypto investor. As long as your brand is good enough to get you into the hottest deals at a somewhat good valuation ($10m-$25m) you can flip the bag to retail at a post $1b valuation pretty easily in a bull market. This basically means a ton of trash is funded and will be heavily marketed because investors have the loudest voices (most number of Twitter followers and media connections). Teams are happy to go along with this because why bother working hard if you can exit your equity/tokens at a valuation of what you would be if you were to fully succeed in the mission 10 years from now?

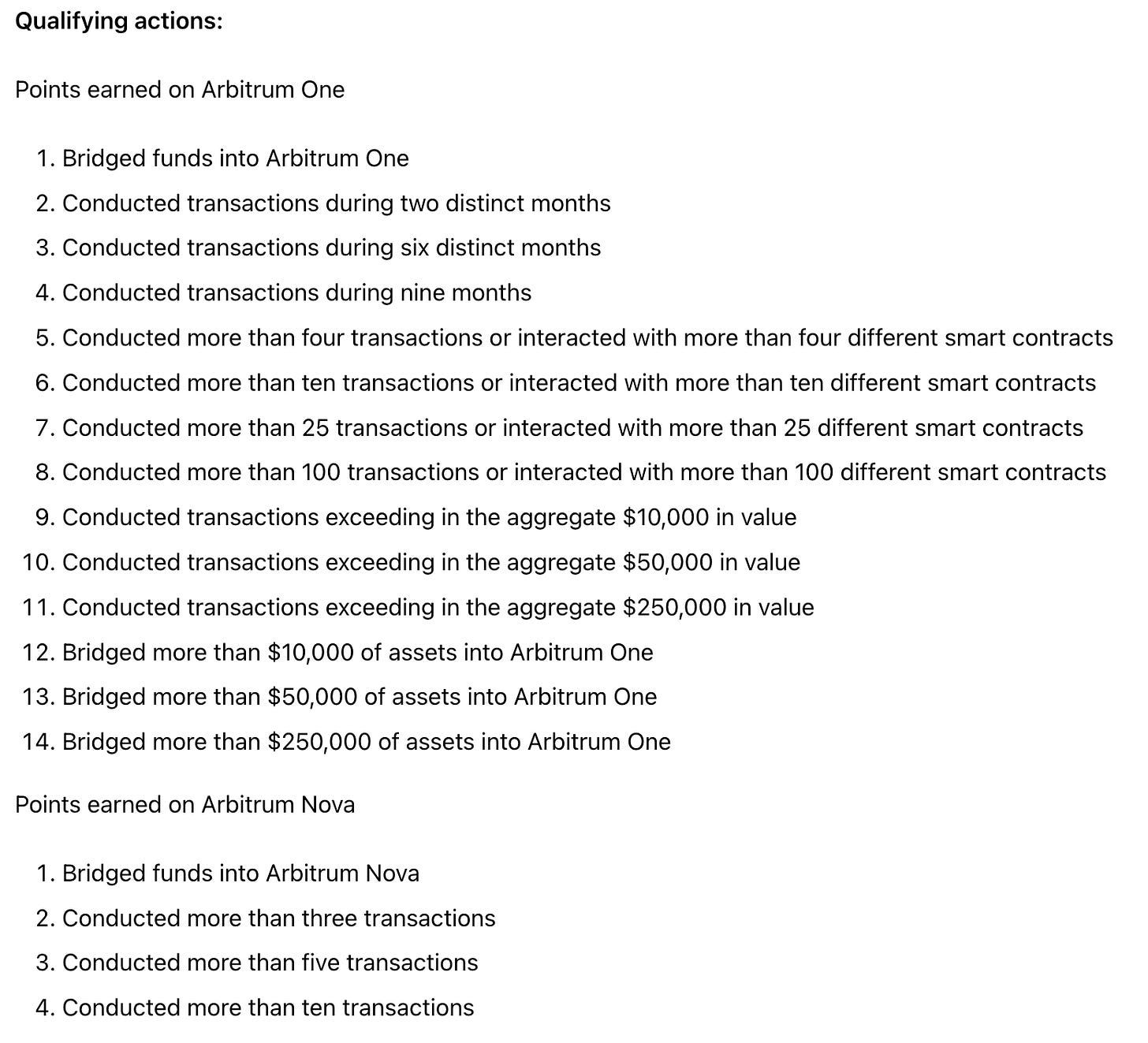

Let’s start by saying this, the valuations of most things in crypto are pretty blotched. Whenever you see “Project X has gained Y many users”, literally think to yourself it means absolutely and certainly nothing. Because the cost to spin up new accounts is close to 0, believing raw user numbers at face value is an extremely illogical intellectual fallacy. In my last post about Arbitrum, I posted about the criteria they used for the airdrop. You can find it here: https://docs.arbitrum.foundation/airdrop-eligibility-distribution. I’ve posted it below because I wanted to step through the actual mechanics of how flawed things are in this system.

Given that the average token swap on Arbitrum costs $0.28 (https://l2fees.info), you can infer that a wallet that has:

-

$15.00: Bridged to Ethereum from Arbitrum (using this tx as an example: https://etherscan.io/tx/0x1641c1446380ce17956ea3a5a4d119edb43a8327fea345dcca3740a99bc37788)

-

$2.80: Used some sort of DEX to swap 5 different tokens (approval + swap = 10 total transactions @ $0.28). This would mean you’ve interacted with 6 contracts.

-

$4.20: Lend 5 different assets on Aave for a few days (approval + deposit + withdraw = 15 transactions). This would also mean you’ve interacted with at least 6 contracts since each asset pool is it’s own contract in Aave’s contract architecture).

This is a fairly basic example but shows that spending ~$22 would yield the lowest tier airdrop for Arbitrum. I do think there are cheaper networks you could bridge from which would drastically reduce this cost but I’m just writing an article at the moment. That lowest tier airdrops would give you 625 tokens which is worth $800. Now this becomes weird because there’s a few assumption baked into this model:

-

How does an airdrop farmer know what to do versus what not to do?

-

How do they estimate the valuation of the network when it goes live to figure out their investment?

-

What other things can they do to hedge them not being eligible (use other dApps on the network that will give you airdrops which effectively builds you a good fake reputation to reuse)?

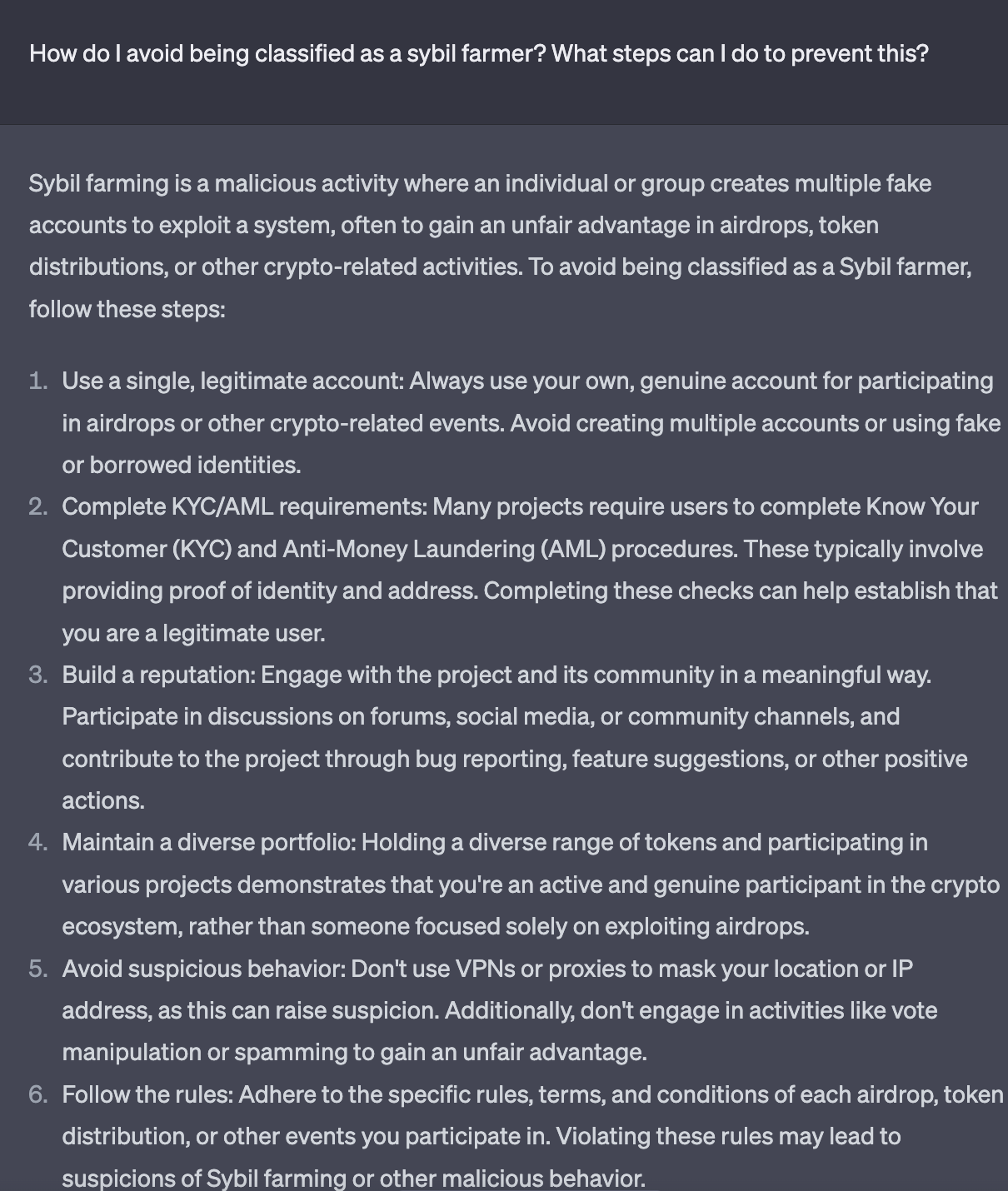

As you can see, at some point this basically becomes a very simple profit/cost equation. If you want to be extra safe, just ask ChatGPT to help you out and even write the scripts to execute on it!

The worst part is, that everyone knows this and we’re all willing to play this collective delusional game together. A comment from a conversation online described the sentiment pretty well

I guess my point is that without those people Arbitrum equity would rather be valued around 100M than at the current 10B+

So imo those teams don’t really give anything away by doing those airdrops. Quite on the contrary they are pumping their own bags multiples by doing it.

Why bother finding the real number when higher inflated user counts means you can command a premium on your valuation. Investors and builders seem aligned that finding the real number of users in their ecosystem isn’t really a priority so will happily play the game as long as the rest of the ecosystem can believe the numbers that are obviously fake. Even though the real numbers aren’t high, if we continue to incentivise fake numbers we’re skewing the incentives of the entire industry collectively.

It tells builders that as long as you build something that attracts bot builders, investors will fund your project and you are guaranteed to make a *ton* of money at your multi-billion dollar valuation.

This is similar to the first point although it strikes a different chord. You can give ownership of your product/protocol to your users and still be centralised — the two are different in my view. Although they can sometimes go hand-in-hand. Now the argument or thinking here is that crypto is a unique technology where we can empower those who use our products to reap the rewards of the value they create by using the service. This is the dream of:

I get it and to be completely clear, I fully support it as well. The ability to give users ownership in your product is magical and is game-changing. However, there’s one thing that people keep missing or just turn a blind eye to. Everyone who interacts with your contracts on-chain isn’t a genuine user! Most of them, statistically speaking, have added very little value to you or your product. It’s like running a coffee shop and saying everyone who walked into your store, spat on the ground, used a table for 10 hours and purchased nothing is a “loyal customer you highly value”. I’m sorry but if you believe that you deserve for the free markets to shut down your business and make way for sharper/better owners to utilise that real estate.

The example I described above is exactly what’s happening in most crypto networks at the moment. You have bot farmers coming in, providing close to no value except inflated metrics, getting tokens and dumping them. Now I thought this would be an obviously terrible thing but I received some rather interesting responses to this that baffled me but thought I’d explicitly call out to make sure we’re on the same page.

-

“Fake users are good because they generate hype for real users to come along”. Sure, although that’s just called a very expensive marketing campaign where being abused and taken advantage of is part of your built-in cost.

-

“Fake users are good because they let people try things out and provide feedback”. False, as someone who has built in the space the best feedback these people give are “the staking APY number on the farms page is broken, devs pls fix”. They are absolutely parasitic.

-

“Fake users are good because they dump their tokens to people willing to buy instead”. Um, you do know the project could just sell tokens directly to the people who care or that buy-side demand can be used to push the price higher? Wasting buy-side demand on airdrop farmers is just doing the bare minimum to keep your price afloat. You want number to go up, not sideways.

-

“Fake users are good because without them the token float would be 1%”. False once again, if you identify enough worthy users I promise you won’t have this issue. The second rebuttal is you don’t need to distribute all your tokens away at once!! This feels so obvious to say but here we are.

-

“Fake users are good because they enable wide token distribution”. No, this is objectively false once again. Your network’s ownership is being concentrated into the hands of sophisticated/extractive bot farmers or institutional buyers of your network — not the end users who genuinely provide value.

I’m sorry I had to spell that out so clearly. But, the amount of bullshit that gets spewed by people to justify objectively terrible business practises is truly mind-boggling.

All of what I’ve written has been from years of closely observing lots of airdrops, behaviour of various actors in the space but more importantly — seeing the raw data.

I have so much more that I could write about and share but we’ll leave that for another post. There are clear ways that we can start to fix these issues but it starts off as a collective mindset change that data accuracy is something that we prioritise since what’s worse than having no data is fake data used to justify dishonest narratives.

Customer acquisition is one of the biggest bottle necks holding the entire industry back and we’re in a state of crony capitalism where the wrong incentives are being rewarded at scale.

Until next time, I hope this provides you with plenty to think about and provide your thoughts on!

If you’re keen to chat about this more, join the Telegram group here: https://t.me/+T-XpBMSS1ylUz0ej

Read More: kermankohli.substack.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Wrapped Bitcoin

Wrapped Bitcoin  Sui

Sui  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Avalanche

Avalanche  Stellar

Stellar  Hyperliquid

Hyperliquid  Shiba Inu

Shiba Inu  Hedera

Hedera  LEO Token

LEO Token  Bitcoin Cash

Bitcoin Cash  Toncoin

Toncoin  Litecoin

Litecoin  Polkadot

Polkadot  USDS

USDS  WETH

WETH  Monero

Monero  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Wrapped eETH

Wrapped eETH  Bitget Token

Bitget Token  Pi Network

Pi Network  Pepe

Pepe  Ethena USDe

Ethena USDe  Coinbase Wrapped BTC

Coinbase Wrapped BTC  WhiteBIT Coin

WhiteBIT Coin  Bittensor

Bittensor  Dai

Dai  Uniswap

Uniswap  Aave

Aave  NEAR Protocol

NEAR Protocol  Aptos

Aptos  OKB

OKB  Jito Staked SOL

Jito Staked SOL  Cronos

Cronos  Ondo

Ondo  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Tokenize Xchange

Tokenize Xchange  Internet Computer

Internet Computer