Disclaimer: The datasets shared in the following article have been compiled from a set of online resources and do not reflect AMBCrypto’s own research on the subject.

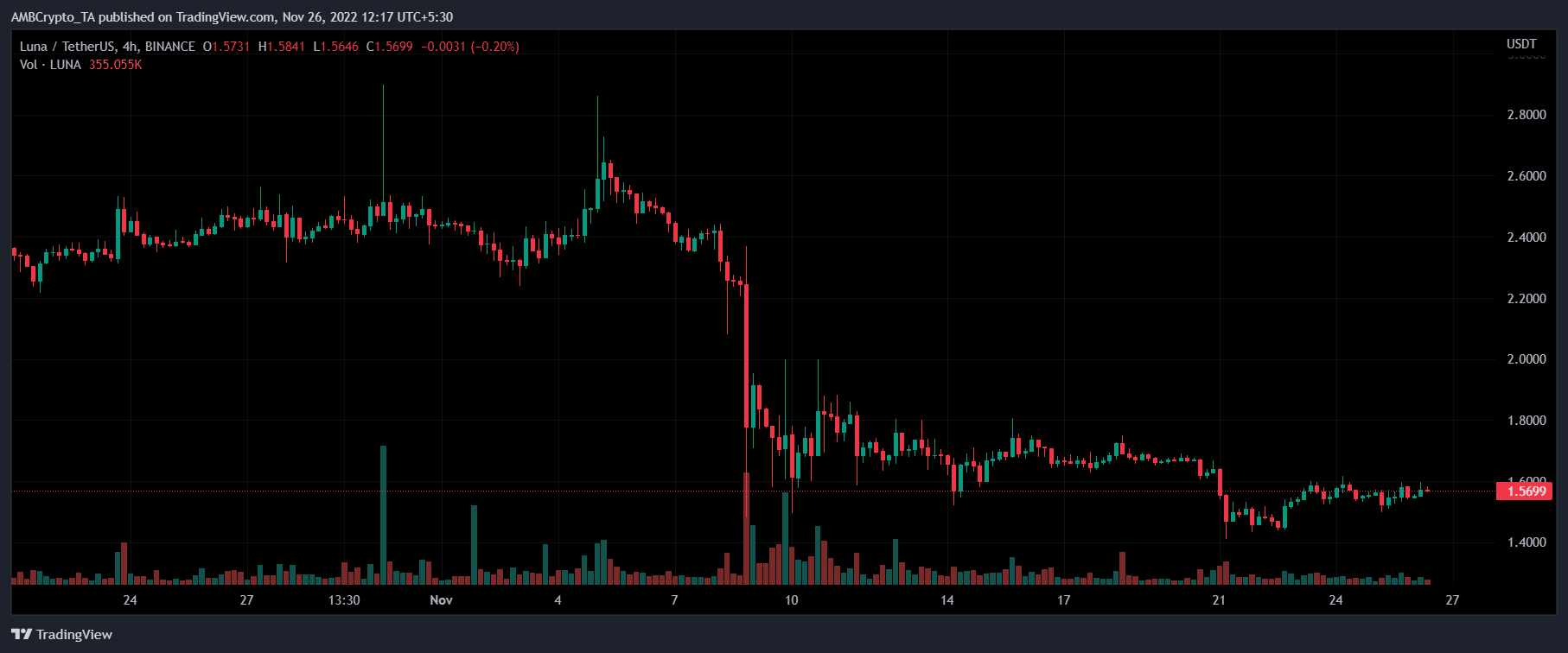

The Luna (LUNA) token has been showing some resistance for the last two days, showing a rise of 10%. Before the collapse of the now-bankrupt cryptocurrency exchange FTX, LUNA was trading at $2.4189 on 8 November and quickly collapsed to $1.61 on 9 November.

Early this month, a New York-based consultancy firm JS Held conducted a third-party audit. It revealed that in May, the entity behind the defunct Terra ecosystem, Luna Foundation Guard (LFG), spent crypto worth $2.8 billion to defend the peg of algorithmic stablecoin TerraUSD (UST). In addition, Terraform Labs (TFL), the developer of the Terra blockchain, spent $613 million defending the peg.

Here’s AMBCrypto’s Price Prediction for LUNA for 2023-24

According to a recent third-party audit by JS Held, a New York-based consultancy firm, Luna Foundation Guard (LFG), the entity behind the defunct Terra ecosystem, spent $2.8 billion in crypto trying to defend the peg of algorithmic stablecoin TerraUSD (UST) in May. The audit also claims that Terraform Labs (TFL), the Terra blockchain’s developer, spent $613 million defending the peg.

Terraform Labs created the Terra USD stablecoin and the Luna coin, both of which were released in 2019. To ensure price stability, the TerraUSD (UST) stablecoin was linked to LUNC. This pair of coins’ journey, UST and LUNC, is fraught with ups and downs. The collapse of these twin coins in May 2022, which led to the cryptocurrency crash in the second quarter of 2022, is well-known in the industry.

Stablecoins, such as UST, was created to protect investors from the extreme price volatility of popular cryptocurrencies such as Bitcoin.

As fiat currency is pegged to reserves such as gold, a stablecoin is pegged to either a fiat currency (e.g. USD) or a supporting cryptocurrency. In this case, TerraUSD was pegged to Luna. But herein lies the conflict. A cryptocurrency isn’t equivalent to gold reserves. As Luna prices got destabilized, it had an impact on UST prices too, and the entire stablecoin system collapsed in the second quarter of 2022.

The stablecoin project was aimed at complementing the price stability and wide adoption of fiat currencies with the decentralized model of cryptocurrency.

Even those who are only vaguely familiar with the cryptocurrency industry know of the apocalyptic collapse of LUNA and UST in May 2022. This collapse was crucial in instigating the cryptocurrency crisis thereafter.

LUNA was one of the market’s top performers once, with the altcoin once among the top 10 cryptocurrencies by market value towards the end of 2021.

A Bloomberg report from May 2022 sheds light on the further developments that transpired. It was in early May 2022 that the Terra system collapsed as large investors began selling their tokens. The move caused a huge drop in the price of the coins. While the price of UST fell to $0.10, LUNA’s price fell to almost zilch.

The cryptocurrency market lost around $45 billion within a week in the ensuing bloodbath, leading to a global crash in the market. The leadership of the Terra system hoped to buy Bitcoin reserves to buy more UST and LUNA coins so that their prices can be stabilized, but the plan didn’t work.

Thousands of investors across the globe lost significant amounts due to the mishap. In the immediate aftermath, the Korean National Tax Service imposed $78.4 million in corporate and income tax on Do Kwon and Terraform Labs after a Terra investor filed a police complaint against the co-founder.

In fact, an affected investor even broke into Kwon’s house in South Korea. His wife then sought security from the police.

In July 2022, News1 Korea reported that South Korean prosecutors raided 15 firms, including seven cryptocurrency exchanges in relation to the investigation around the Terraform collapse. More than 100 people who filed complaints with the prosecutors’ office reportedly had losses totaling roughly $8 million.

Only a few days back, Financial Times reported that South Korean prosecutors have reportedly asked Interpol to issue a Red Notice against Kwon. Kwon, however, tweeted that he is not on the run from any interested government agency. He added that the company is in full cooperation and it doesn’t have anything to hide.

Many from the industry had been warning the cryptocurrency community about the upcoming doom. Kevin Zhou, CEO of Galois Capital, was one such individual. He said that the result was inevitable as the “mechanism was flawed, and it didn’t play out as expected” However, most people didn’t pay any heed.

On May 25, Bloomberg reported that a new version of LUNA was launched following a hard fork, with the new LUNA coin no longer associated with the devalued UST coin. The older currency is called Luna Classic (LUNC) and the newer one is called Luna 2.0 (LUNA). Though the older cryptocurrency has not been entirely replaced, its community might slowly dissolve as more and more users move to LUNA 2.0.

The new initiative included an airdrop of new LUNA tokens to those who held Luna Classic (LUNC) and UST tokens and suffered. A significant portion of the minted currency is to be reserved for development and mining operations. Currently, there is a supply of 1 billion LUNA tokens.

Recently, the 1.2% tax burn proposal, dubbed proposal #4661, passed the governance vote, as confirmed in a tweet by proposal author Edward Kim. The move was confirmed by Terra Rebels who tweeted that out of 96% cast votes, 99% favored the 1.2% tax burns.

The collapse of the twin coins proved to be a harbinger of increased government regulations, if not downright opposition, in the cryptocurrency industry. The anonymous model of the industry, much touted to be the foundation of the decentralized cryptocurrency market, was once embraced by all. However, the moment people lost their investments, they rushed to government authorities for redressal.

This is when government financial authorities found the opportunity to push for implementing rules and regulations in the crypto industry to tackle price volatility, money laundering etc.

The entry of corporate institutions with government oversight into the industry had already set the tone for what was to come. But this collapse furthered this trend. Now, cryptocurrency entities, whether large or small, will likely be overseen by central banks across the globe. In such scenarios, it will be critical to observe how the industry manages to uphold its anonymous and decentralized nature.

A recent Bloomberg report says that upcoming legislation would ban algorithmic stablecoins such as TerraUSD the collapse of which led to a global crypto crash. The said bill is currently being drafted in the U.S. House. The bill would make it illegal to develop or issue new “endogenously collateralized stablecoins.”

In a recent interview, Kwon said that his confidence at that time was justified as the market success of his Terra ecosystem was inching close to $100 billion, but his faith now “seems super irrational.” He admitted the possibility of a mole being there in the organization, but added, “I, and I alone, am responsible for any weaknesses that could have been presented for a short seller to start to take profit.”

Why these projections matter

The future of LUNA is a very critical matter for the entire cryptocurrency industry. Launched as a part of the regeneration strategy, its performance so far has not exactly been celebratory.

Transactions on the Terra 2.0 blockchain are validated through the proof-of-stake (PoS) consensus mechanism. The network has 130 validators working at a given point of time. As a PoS platform, the power of the validator is linked to the number of tokens staked.

How LUNA trades will determine the course of not only this particular cryptocurrency but a number of stablecoins in the market. If it succeeds in gaining the trust of investors, the venture will go a long way in furthering the cause of the asset class of stablecoins.

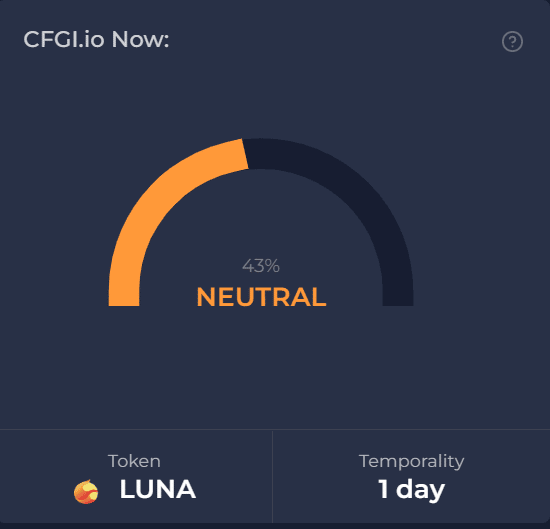

In this article, we will lay down the key performance metrics of LUNA such as its price and market capitalization. We will then summarize what the most prominent crypto-influencers and analysts have to say about LUNA’s performance, along with its Fear & Greed Index. We will also briefly talk about whether you should invest in stablecoin or not.

LUNA’s price, volume, and everything in between

Beginning its journey at around $19 on 28 May 2022, LUNA quickly dropped below $5 the next day. By the end of May 2022, its value was just above $11, but it soon spiraled south as June began.

Over the next few months, the value of LUNA kept oscillating between $1.7 and $2.5. At press time, it was trading at $1.56.

Similarly, its market capitalization isn’t as high as it once was. Back in June 2022, its market cap was over $300 million, but it kept oscillating between $210 and $300 million during much of July. At press time, it was again down to $271 million.

The crisis that unfolded following the collapse of the twin coins impacted the course of the entire market. LUNA has particularly been vulnerable to volatile market conditions. The Russia-Ukraine crisis and increasing crypto-regulations across the globe have also curtailed the movement of the market.

LUNA’s 2025 Predictions

Before reading further, readers should understand that the market prediction of different cryptocurrency analysts can widely vary. And, a good number of times, these predictions prove wrong. Different analysts choose different sets of parameters to arrive at their forecasts. Also, nobody can foresee unpredictable socio-political events that ultimately end up affecting the market.

Let us now have a look at what different analysts have to say about the future of LUNA in 2025.

A Changelly blog post claimed that experts, after analyzing the previous performance of Terra, have predicted that the price of LUNA will oscillate between $7.26 and $8.62. Its average trading cost during the said year will be around $7.46, with a potential ROI of 384%, they added.

Telegaon too is very bullish in its assessment of the future of LUNA, with its maximum and minimum prices in 2025 being $52.39 and $69.18. It predicts its average price in the said year to be $61.72.

LUNA’s 2030 Predictions

The aforementioned Changelly blog post stated that the maximum and minimum prices of LUNA in 2030 will be $48.54 and $57.68. The average price of LUNA in the said year will be $50.24, with a potential ROI of 3,140%.

Disclaimer

Now, the aforementioned are more recent predictions. Before the events of the last few months, analysts were way more optimistic about the fortunes of LUNA.

Consider Finder’s panel of experts, for instance. In fact, they forecasted a price of $390 by 2025 and $997 by 2030.

“The likes of Digital Capital Management’s Ben Ritchie claimed, The LUNA token will continue to gain traction as long as there are no clear regulations in stablecoins. We believe that LUNA and UST will have an advantage and be adopted as a major stablecoin across the crypto space. LUNA is burnt to mint a UST, so if the adoption of UST grows, the LUNA will benefit greatly. Having Bitcoin as a reserve asset is a great decision by the Terra governance.”

There were contrary opinions too. According to Dimitrios Salampasis,

“Algorithmic stablecoins are considered as being inherently fragile and are not stable at all. In my opinion, LUNA will be existing in a state of perpetual vulnerability.”

That’s not all. In fact, at one point of time, there was also talk of Terra emerging as the most staked asset.

Source: Finder

Fear & Greed Index

Conclusion

If you are considering investing in LUNA, you should understand that it has entered the market following a significant crisis. It is still not listed on a lot of exchanges due to market fear.

As we are witnessing a massive market slump due to the FTX episode, we are witnessing massive withdrawals. LUNA remains among the worst-hit tokens in this ongoing crisis. It has fallen by over 30% following the crash of FTX. In the meantime, FTX has filed for bankruptcy.

We will also have to see how the community of LUNA developers and investors acts in the next few weeks. If they burn enough tokens so as to drive up its price, it can prove to be beneficial for its future. A sustained effort on the part of the cryptocurrency industry, in particular the LUNA community, can go a long way in restoring the trust of investors in the market.

In an interview with Laura Shin on the “Unchained” podcast, Kwon said that he moved to Singapore from South Korea before the collapse of the Terra ecosystem. So, it should not be assumed that he ran away to escape the authorities. He denied claims that he is on the run from law enforcement.

Recent news has now emerged that Kwon is also facing a class-action lawsuit filed on behalf of more than 350 international investors in a Singaporean court. They claim to have lost about $57 million in the collapse of the algorithmic stablecoin TerraUSD (UST) and its ecosystem

Well, last month, the New York Times interviewed Ethereum co-founder Vitalik Buterin who claimed that the Terra Luna team attempted to manipulate the market in order to prop up the value of the native cryptocurrency. He also recalled that plenty of “smart people” were saying that Terra was “fundamentally bad.”

We must again reiterate that market forecasts aren’t set in stone and can go wildly wrong, particularly in a market as volatile as that of cryptocurrency. Investors should therefore take due caution before investing in LUNA.

In an interview with Laura Shin on the “Unchained” podcast on 29 October, Kwon claimed that he migrated from South Korea to Singapore before the demise of the Terra environment. He also refuted reports that he is eluding law authorities.

As a massive market slump due to the FTX debacle is going on, we are witnessing massive withdrawals. LUNA remains among the worst-hit tokens in this ongoing crisis. It has fallen by around 30% over the last 2-3 days.

Kwon said, “Whatever issues existed in Terra’s design, its weakness [in responding] to the cruelty of the markets, it’s my responsibility and my responsibility alone.”

We are witnessing the second crash in the crypto market this year following the FTX debacle. As the primary token responsible for the first crash in May, LUNA has been among the worst-hit tokens in the second crash too. Its price has fallen by 35% since FTX filed for bankruptcy.

Read More: ambcrypto.com

Ripple USD

Ripple USD  NKN

NKN  Thena

Thena  BakerySwap

BakerySwap  ParallelAI

ParallelAI  M3M3

M3M3  Hippocrat

Hippocrat  Keep Network

Keep Network  Renzo

Renzo  QuarkChain

QuarkChain  aixCB by Virtuals

aixCB by Virtuals  Lista DAO

Lista DAO  Catizen

Catizen  SynFutures

SynFutures  Milady Cult Coin

Milady Cult Coin  Rekt

Rekt  OpenServ

OpenServ  APF coin

APF coin  We Love Tits

We Love Tits  Solend

Solend  Neon

Neon  AVA (Travala)

AVA (Travala)  Toshi

Toshi  Radiant Capital

Radiant Capital  Resolv RLP

Resolv RLP  Wagmi

Wagmi  Islamic Coin

Islamic Coin  Orchid Protocol

Orchid Protocol  Gods Unchained

Gods Unchained  Cortex

Cortex  Pangolin

Pangolin  XPLA

XPLA  LUKSO

LUKSO  Cobak

Cobak  Stafi

Stafi  Skey Network

Skey Network  Wojak

Wojak  Minswap

Minswap  Marblex

Marblex  Koma Inu

Koma Inu  ALEX Lab

ALEX Lab  Radworks

Radworks  michi

michi  Milady Meme Coin

Milady Meme Coin  KIKICat

KIKICat  Masa

Masa  Zebec Network

Zebec Network  XBorg

XBorg