[ad_1]

Alternatives to Wrapped Bitcoin (WBTC) including tBTC have witnessed a recent surge in interest, following a weekend announcement that WBTC custodian BitGo will be forming a joint venture involving controversial figure Justin Sun.

MakerDAO is already testing the waters for a removal of WBTC as a collateral asset for its DAI stablecoin, while tBTC provider Threshold Network has seen its native token “T” rally as much as 50% since the news.

What’s Going On With WBTC?

BitGo, the custodian and administrator of WBTC, recently announced a joint venture with BiT Global to enhance the security of WBTC, by diversifying its custody operations across multiple jurisdictions, including Hong Kong and Singapore.

The move aims to improve trust through multi-jurisdictional custody while maintaining the quality service that WBTC users have experienced for the past five years. The partnership involves Justin Sun and the Tron ecosystem, which will continue to offer real-time proof-of-reserves.

However, the announcement has sparked concerns within the crypto community, particularly regarding the involvement of Justin Sun. Sun has faced criticism for past issues with projects like TUSD, which some claim has experienced operational and transparency problems since his involvement.

MakerDAO Proposal Looks To Drop WBTC As Collateral

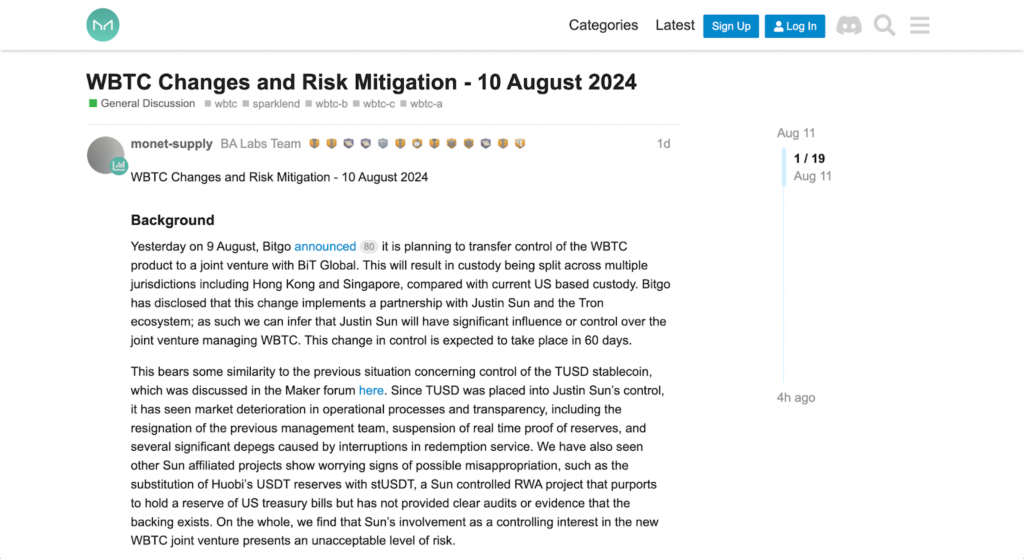

BA Labs has wasted no time in formally proposing a reduction of WBTC exposure in Maker and SparkLend, to mitigate potential risks associated with the new control structure.

MakerDAO proposal seeking WBTC removal | Source: forum.makerdao.com

Notably, WBTC makes up around 10% of DAI’s backing, highlighting its significance in the DeFi ecosystem.

Addressing Concerns

In response to widespread concerns, Justin Sun assured the community via social media that “no changes will be made to WBTC.”

Meanwhile, “Meow,” founder of Solana’s Jupiter and a co-founder of WBTC, has emphasized the need for transparency and clarity regarding multisig control and the benefits of multi-jurisdictional operations.

Meow has called for open communication and reassurance to maintain trust in WBTC, stressing that any mishaps could significantly impact the entire DeFi ecosystem.

BitGo CEO Mike Belshe has acknowledged the concerns and agreed to discuss logistics for a meeting with stakeholders, including Meow and Justin Sun, to address these issues later this week.

tBTC As A WBTC Alternative

As the community evaluates the potential risks of this new arrangement, alternative options are being considered.

tBTC, in particular, is a decentralized system that allows Bitcoin holders to use their Bitcoin on Ethereum without relying on a central authority, instead using a group of operators to secure Bitcoin deposits.

While some believe that WBTC was preferred because of possible bridge risks on tBTC, the recent changes have highlighted counterparty risks on WBTC. This has led to discussions about whether it might be time to consider a move to more decentralized BTC tokens.

However, some voices, like that of @hasufl, have argued against tBTC being ready for use in MakerDAO/DAI:

It’s worth noting that only $181 million worth of tBTC is currently utilized within the DeFi ecosystem across all supported chains – more than 50 times less than WBTC, which has cemented itself in position across the industry.

Conclusion

WBTC’s recent structural changes have left the DeFi community with several unanswered questions, particularly regarding BiT Global’s ownership and company details, as well as a clear rationale for partnering with Justin Sun and Tron.

With a market cap exceeding $9 billion, WBTC is a major asset within the DeFi space, and finding a replacement will not be easy. Although tBTC is a technically viable competitor to WBTC, it is currently only one-fiftieth of its size and lacks the necessary ecosystem integrations to take its place.

[ad_2]

Read More: defirate.com

(@hasufl)

(@hasufl)

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Wrapped Bitcoin

Wrapped Bitcoin  Hyperliquid

Hyperliquid  Wrapped stETH

Wrapped stETH  Bitcoin Cash

Bitcoin Cash  Sui

Sui  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Avalanche

Avalanche  Toncoin

Toncoin  USDS

USDS  WhiteBIT Coin

WhiteBIT Coin  Shiba Inu

Shiba Inu  WETH

WETH  Litecoin

Litecoin  Wrapped eETH

Wrapped eETH  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Hedera

Hedera  Monero

Monero  Bitget Token

Bitget Token  Ethena USDe

Ethena USDe  Polkadot

Polkadot  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Pi Network

Pi Network  Uniswap

Uniswap  Pepe

Pepe  Aave

Aave  Dai

Dai  Ethena Staked USDe

Ethena Staked USDe  Aptos

Aptos  OKB

OKB  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Bittensor

Bittensor  Internet Computer

Internet Computer  NEAR Protocol

NEAR Protocol  Jito Staked SOL

Jito Staked SOL  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Ondo

Ondo