[ad_1]

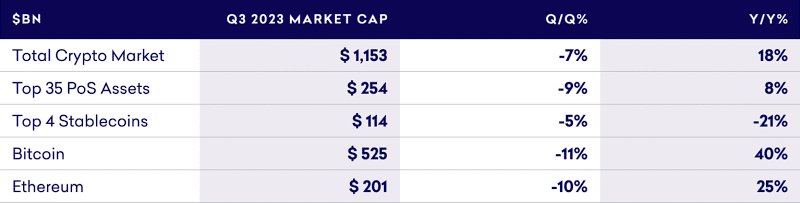

As proof of stake networks see a surge in stake rates, a consequent plummet in staking yields is concerning investors and market watchers. According to a third-quarter report from Staked, a subsidiary of the Kraken exchange, the average staking yield for the top 35 stakable cryptocurrencies has dwindled to a record-breaking low. Staking crypto has often been touted as a way to generate passive income, but the declining yields have raised questions about its long-term viability and potential regulatory implications.

The Metrics That Baffle the Market

The average staking yield across proof of stake networks has sagged to a meager 10.2%, attributed to a rising average stake rate of 52.4% among investors. Ethereum, the largest network that employs proof of stake, displayed a particularly noticeable drop. Its Consensus layer yield sank to 3.2%, and the total supply of staked assets in the network rose to an unprecedented 22%. As for Ethereum’s Execution layer, it plummeted to a mere 1.3%.

“The combination of a high stake rate, and transaction activity shifting from Mainnet (L1) to the various Ethereum Layer 2 networks (L2), resulted in a Q3 staking yield of 4.5%, ETH’s lowest on record,” the report stated.

Why Staking Crypto Yields Matter

Staking crypto

is not just a method for investors to earn; it also forms a crucial part of the blockchain ecosystem. Staking enhances the network’s overall security and stability by locking a certain amount of cryptocurrency for a specific period.

Crypto staking hits new highs in Q3 2023!

Aptos and Sui lead the charge with 84.1% and 80.5% staked. Despite the surge, average yield dips to 10.2%. Polkadot and Cosmos shine with yields above 7.5%, while Ethereum hits a low at 4.5% .#CryptoNews #StakingSurge #EthereumUpdate

— Market Movers (@MarketMovers_1) October 26, 2023

As staking yields decline, the attractiveness of this type of investment could wane. Even with its bankruptcy proceedings, FTX staked $150 million in Ethereum and Solana tokens, a move with a goal of generating additional revenue to compensate its clients, highlighting the draw that staking crypto has had even for institutional players.

Regulatory Attention and Its Effects

Staking activities haven’t escaped regulatory notice. In February, the U.S. Securities and Exchange Commission (SEC) slapped Kraken with a $30 million fine for failing to register its staking product as a securities offering. Additionally, the SEC’s ongoing legal action against Coinbase has also categorized staking as securities. This heightened regulatory scrutiny could be a factor influencing the staking yields and stake rates in the market, as companies might become more cautious in offering such services.

While the decline in staking yields has been a steady trend since peaking at 15.4% in March of last year, Polkadot and Cosmos stand as outliers, currently offering yields higher than 7.5%. These exceptions aside, the downward trajectory of staking yields and the complexities introduced by regulatory oversight present an evolving challenge for both individual investors and the broader cryptocurrency market.

The diminishing returns from staking in the cryptocurrency market signal a maturing, yet increasingly complicated, investment landscape. As the market adjusts to new norms, both individual and institutional investors are faced with recalibrating their expectations and strategies. The decline in staking yields is not an isolated issue; it intersects with broader themes of market saturation, technological shifts, and regulatory scrutiny.

[ad_2]

Read More: cryptonews.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Wrapped Bitcoin

Wrapped Bitcoin  Hyperliquid

Hyperliquid  Wrapped stETH

Wrapped stETH  Bitcoin Cash

Bitcoin Cash  Sui

Sui  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Avalanche

Avalanche  Toncoin

Toncoin  USDS

USDS  WhiteBIT Coin

WhiteBIT Coin  Shiba Inu

Shiba Inu  WETH

WETH  Litecoin

Litecoin  Hedera

Hedera  Wrapped eETH

Wrapped eETH  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Monero

Monero  Ethena USDe

Ethena USDe  Bitget Token

Bitget Token  Polkadot

Polkadot  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Pi Network

Pi Network  Uniswap

Uniswap  Pepe

Pepe  Aave

Aave  Dai

Dai  Ethena Staked USDe

Ethena Staked USDe  Aptos

Aptos  OKB

OKB  Bittensor

Bittensor  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  NEAR Protocol

NEAR Protocol  Jito Staked SOL

Jito Staked SOL  Internet Computer

Internet Computer  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Ondo

Ondo