Dear Bankless Nation,

It’s hard to believe it’s been a year since the death spiral of Terra. Since evaporating tens of billions of dollars in wealth, the impact of UST still looms large.

Today, we look at the state of stablecoins, 1 year after the UST collapse.

– Bankless team

Bankless Writer: 563

The death spiral of Terra USD (UST) and the corresponding collapse of LUNA squashed hopes of 2022 all-time highs in the crypto markets, toppling the first (of many) leverage dominos scaffolded by cheap money, hype, and outright fraud. Billions of dollars and countless fortunes were wiped out in a matter of days from users that placed their hopes in UST’s idealistic algorithmic design.

Many early supporters of the Terra ecosystem were enthralled with the notion of a completely decentralized stablecoin. And while UST’s architecture was ultimately shown to be unsustainable, some would argue that the idea that DeFi users should completely segregate themselves from traditional systems is a very worthwhile goal.

So as we reflect, one year later, we ask ourselves, “What have we learned?” and “Where are we now?”

While algorithmic (“algo”) stables have lost favor (though USTC, at one-and-a-half cents, still commands a $150M market cap), the broader stablecoin sector has gone on to cement its product-market fit. Whether that is to represent a medium of exchange or just a store of value during bearish periods, today’s DeFi market is awash with stables.

The only problem? We’re trending in the wrong direction.

Though many felt comfortable relishing in their USDC and laughing at the Terra bagholders, all of DeFi got a reality check in March when USDC de-pegged below 90 cents after it was discovered Circle had funds tied up in the now-defunct Silicon Valley Bank. Users flocked to the relative “safety” of USDT (and just saying this feels wrong).

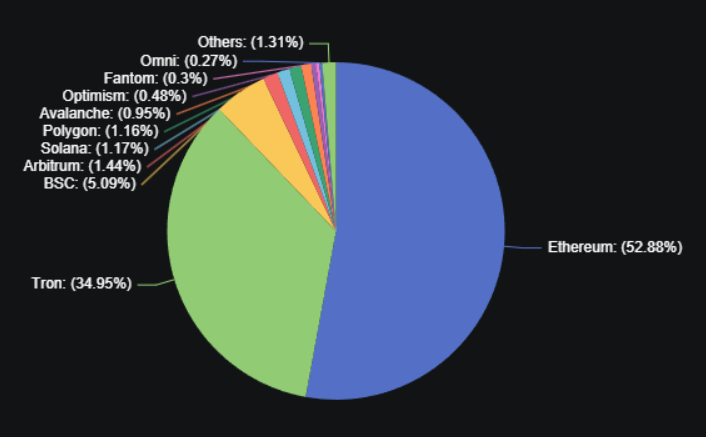

For a point of comparison, in April of 2022, the market cap of stables was roughly 82% centralized (major culprits being USDT, USDC, BUSD, and TUSD). Today – we’re at about 95% centralization. Tether (USDT) alone has ballooned from making up 44% of total stablecoins to over 63% today, following the USDC de-peg. Not a great look.

So, on one side of the spectrum, we have algo stables, which (while decentralized) are vulnerable to death spirals. And on the other, we have centralized fiat-backed stables, which are open to both bank failures and censorship. How do we reconcile this?

Lucky for us, these bearish times have been the ideal environment for buildoors to hunker down and do what they do best – innovate.

In today’s article, we’re going to walk through a few of the new decentralized stablecoin projects that excite us. And these new projects aren’t just improving the anti-fragility of token designs – novel mechanisms and truly innovative use cases for stablecoins are around the corner as well, threatening to chip away at Tether’s dominance and provide some much-needed decentralization to the market.

1. Curve’s crvUSD

Curve Finance is DeFi’s go-to platform for stablecoin trading.

It’s difficult to overstate the market impact that Curve has imposed since entering the space. Whether it is innovating on the AMM model with their stable pools or reinventing tokenomic design with their vote-escrow architecture and subsequent gauge mechanics, there is a good reason why entire ecosystems are built on top of this mainstay.

In the same way that users can mint DAI against their ETH using Maker, Curve users will soon be able to mint crvUSD against assets on Curve (such as ETH and its derivatives). With their new Lending-Liquidating AMM Algorithm, or LLAMMA, Curve intends to improve upon DAI’s tried-and-true Collateralized Debt Position (CDP = “a loan”) stablecoin design.

Here is the ELI5 version on why crvUSD liquidations could be a big improvement over legacy designs:

- Collateral is liquidated gradually over a range of prices, instead of instantaneously when the liquidation price is reached. This reduces the chance of market volatility from large-scale liquidation.

- The design of crvUSD aims to offer lower prices on Curve’s AMM, which incentivizes liquidators to arbitrage the difference on external DEXs. Additionally, the strategy of gradual liquidations reduces the need for external DEX liquidity and, consequently, the likelihood of bad debt accumulation.

- Liquidations can be reversed if prices rebound back above the liquidation price. This means that “scam wicks” won’t be a major worry for borrowers.

2. TapiocaDAO’s USDO

Liquidity is the lifeblood of financial markets — without it, incentives dry up and economic activity limps.

Today, stablecoin liquidity resides in its own little bubbles scattered around DeFi. While we can say that $130B of stablecoins exist, not all ecosystems are created equally. And if your protocol exists in a market with a low allocation of capital, you’re fighting against gravity.

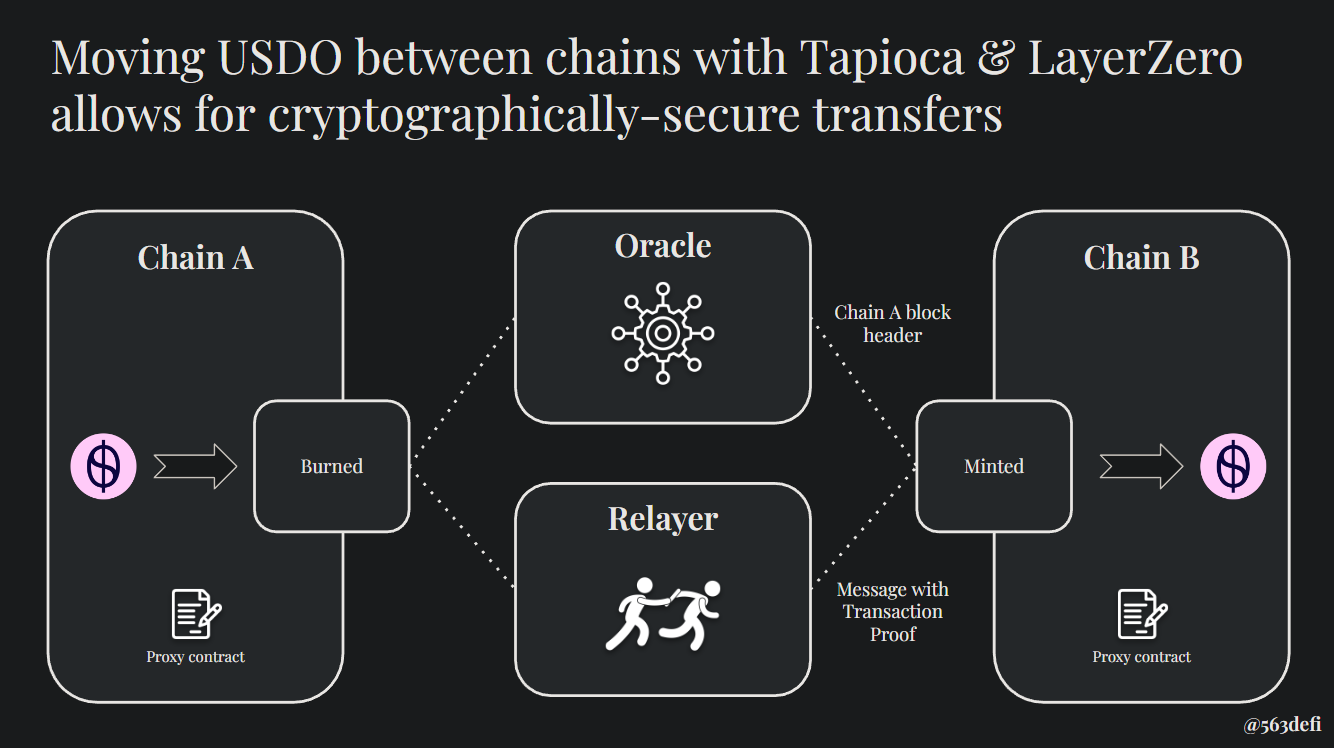

TapiocaDAO is building an omnichain decentralized bank — where users can borrow, lend, and mint their stablecoin (USDO) seamlessly across ~17 EVM and non-EVM chains (and counting) — all with no bridges involved. Tapioca does this by utilizing LayerZero’s generalized messaging network as its omnichain infrastructure, with the goal being to build a robust stablecoin for our multi-chain future.

USDO is another CDP design that uses network gas tokens (like ETH, MATIC, etc.) and their LSDs as collateral. Beyond simple transfers of funds, omnichain lending, borrowing, and leveraging is possible. For example, you could:

- Mint USDO on Berachain by opening up a Collateralized Debt Position (CDP = “a loan”) against your stMATIC on Polygon, which can be leveraged up to 5x with a single click

- Borrow USDO on Starknet by using your yield-bearing jGLP on Arbitrum as collateral, where your yield will help pay off your loan

- Lend out your USDO from zkSync to users on any of the ~17 chains supported by LayerZero — a massive improvement in capital efficiency over legacy lending platforms

DeFi’s liquidity fragmentation problem has been the bane of established and budding protocols alike. With Tapioca’s use of LayerZero, we might soon see the day where new projects are not forced to default to the liquidity market leader.

3. Redacted Cartel’s DINERO

Redacted Cartel, famous for their establishment of meta-governance and their unrivaled bribe marketplace, Hidden Hand, is now peering into the world of stablecoins and LSDs with their much-anticipated announcement of the Dinero project.

The initial litepaper released in April revealed the basic design and motivation behind Dinero. In essence, Dinero aims to provide users with premium Ethereum blockspace via a private RPC (remote procedure call), called the Redacted Relayer. RPCs are what send transaction data from dApps/wallets to a blockchain.

Instead of using a default RPC for transactions, using the Redacted Relayer offers up some advantages:

- Protection against malicious actors looking to exploit MEV opportunities (hi Jared!)

- Meta transactions – the ability to use the DINERO stablecoin for gas payments instead of ETH

- Once a certain scale is reached, private transactions and additional use cases such as payment for order flow become a possibility

The DINERO stablecoin itself is a CDP that is overcollateralized by a combination of USDC and Redacted’s own LSD, pxETH; where the ETH that is used to mint pxETH is used to run Redacted’s validators. This closed-loop system allows Redacted to carve out a cozy ecosystem of blockspace in which to operate. By marketing DINERO as the medium of exchange and gas token on their blockspace island, Redacted is flipping the script – offering up a novel use case that is unique to their stablecoin.

The trend going forward – on-chain and overcollateralized

For the decentralization-maxis among us (myself included), 2023 is shaping up to be an exciting year for stablecoin innovation.

With most projects shying away from algorithmic designs and veering towards overcollateralization, the likelihood of a UST-esque death spiral is diminishing with every subsequent code commit.

Even Frax, who’s own moniker refers to its fractionalized architecture, has decided to become fully collateralized – showing that the market’s appetite for “unstable stables” is at a new all-time low. We’re also observing experiments with non-pegged DeFi-native assets such as Reflexer’s RAI in the works, pushing the boundaries of the centralization/decentralization dichotomy.

In total, we see that DeFi users are excited about having decentralized stablecoins that are fully-backed by on-chain assets. And whether the future is dominated by crvUSD, USDO, DINERO, FRAX, RAI, or something new, at least we can all agree, it’d be better than Tether dominance.

Special thanks to Albert Lin, twMatt and Figgy for their fact-checking help

Action steps:

Read More: www.bankless.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Wrapped Bitcoin

Wrapped Bitcoin  Sui

Sui  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Avalanche

Avalanche  Stellar

Stellar  Hyperliquid

Hyperliquid  Shiba Inu

Shiba Inu  Hedera

Hedera  LEO Token

LEO Token  Bitcoin Cash

Bitcoin Cash  Toncoin

Toncoin  Litecoin

Litecoin  Polkadot

Polkadot  USDS

USDS  WETH

WETH  Monero

Monero  Wrapped eETH

Wrapped eETH  Bitget Token

Bitget Token  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Pi Network

Pi Network  Pepe

Pepe  Ethena USDe

Ethena USDe  Coinbase Wrapped BTC

Coinbase Wrapped BTC  WhiteBIT Coin

WhiteBIT Coin  Aave

Aave  Uniswap

Uniswap  Dai

Dai  Bittensor

Bittensor  NEAR Protocol

NEAR Protocol  Aptos

Aptos  OKB

OKB  Jito Staked SOL

Jito Staked SOL  Ondo

Ondo  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Tokenize Xchange

Tokenize Xchange  Official Trump

Official Trump  Cronos

Cronos