- Everlend recently announced that it is shutting down its operations.

- Assessing the potential impact of Solana’s new loss.

Every blockchain network aims to achieve healthy growth and the same goes for dApps and projects operating within those networks.

But, success is not always guaranteed especially in unfavorable market conditions. Solana’s Everlend yield and lending aggregator is the latest protocol to suffer such a fate.

Realistic or not, here’s Solana’s market cap in BTC’s terms

Everlend recently announced that it is shutting down its operations. This is a loss for Solana because the protocol is among the first of its coin to operate on the blockchain network.

According to the announcement, Everlend has opted to shut down its operations after failing to achieve enough liquidity.

We are deeply saddened to announce that as of today our team has decided to close down https://t.co/UiTuuSdyrB and won’t continue its development

— Everlend (@EverlendFinance) February 1, 2023

An interesting case study

Everlend praised Solana for being one of the most efficient networks despite its unfortunate fate. Liquidity is the lifeline of every lending and borrowing protocol in the crypto market.

There are many protocols that fail and few that succeed. Perhaps an autopsy of its premature demise may offer some interesting insights into the DeFi segment.

There are other reasons why it failed aside from its inability to secure enough operational liquidity. The bear market may have exasperated the situation towards the end of 2021 and all of 2022.

This resulted in a rough investment landscape, hence investment taps dried up. Also, DeFi lending has become more saturated in the last few years, hence Everlend faced stiff competition.

In most cases, the failure of a dApp or crypto project results in losses for investors who had already locked their funds in the protocol. However, Everlend aims to be the exception by exiting quietly while allowing investors to withdraw their funds.

5/

All the deposits from the underlying protocols are now in Everlend vaults and we suggest our users withdraw their funds asap. The app is now in withdrawal-only mode and will run until the funds are fully withdrawn.

The team will be in Everlend discord should you need any help— Everlend (@EverlendFinance) February 1, 2023

A setback for Solana?

Everlend’s exit is certainly a loss of potential value for Solana. However, the fact that it was not successful makes it a minor inconvenience for the network.

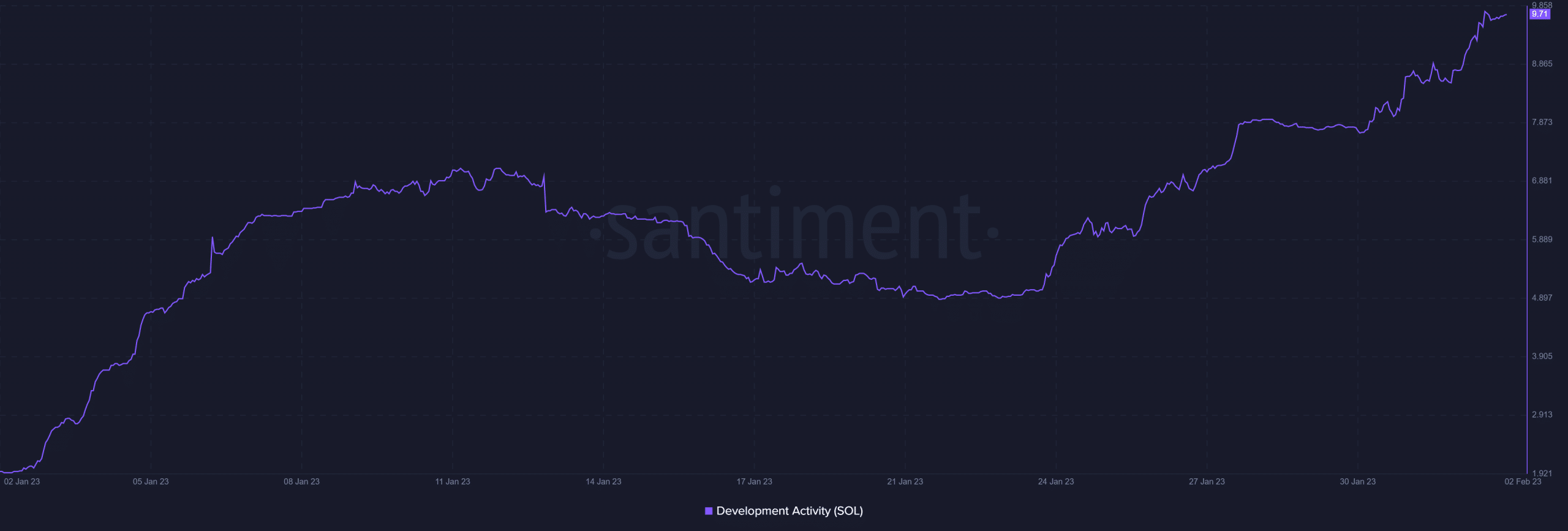

Solana’s operation continues as normal and some metrics already support positive expectations. For example, the network continues to uphold healthy development activity.

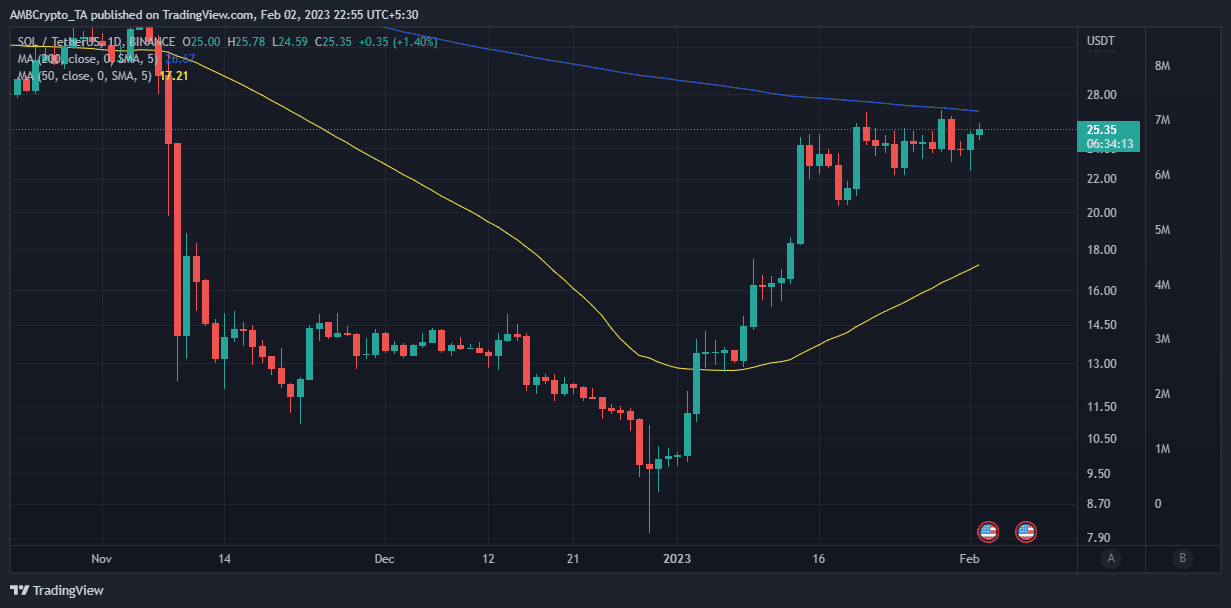

Furthermore, Solana’s development activity has been growing strong since the start of 2023. So far we have not observed a tangible negative impact on SOL’s price action since the announcement. The price did however manage to avoid many downsides after plateauing toward the end of January.

Is your portfolio green? Check out the Solana Profit Calculator

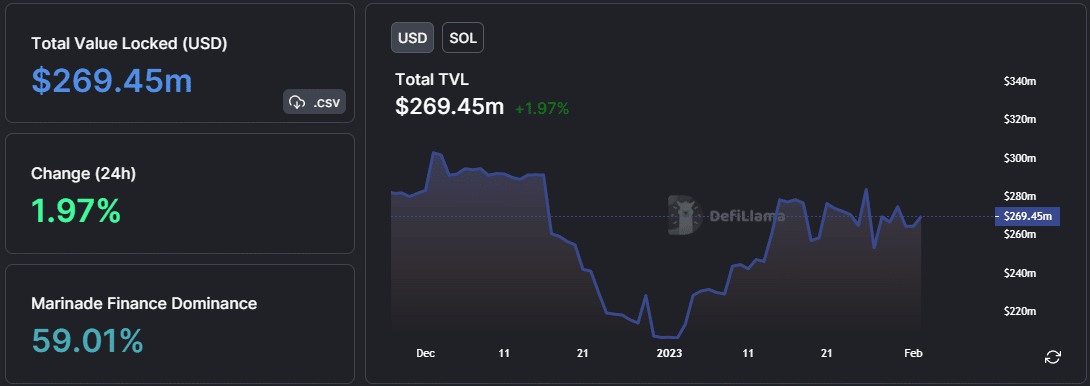

SOL’s price action seems to be more in tune with the overall crypto market’s performance. Finally, we can look into the total value locked since it touches on liquidity.

Solana’s TVL tanked heavily in 2022, but the network experienced an increase in January. Solana had a $269.45 million TVL at press time after gaining by roughly $63 million from its 12-month lows.

The fact that Solana’s TVL is starting to grow confirms that investor funds are flowing back into the network.

Read More: ambcrypto.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Wrapped Bitcoin

Wrapped Bitcoin  Sui

Sui  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Avalanche

Avalanche  Stellar

Stellar  Hyperliquid

Hyperliquid  Shiba Inu

Shiba Inu  LEO Token

LEO Token  Hedera

Hedera  Bitcoin Cash

Bitcoin Cash  Toncoin

Toncoin  Litecoin

Litecoin  USDS

USDS  Polkadot

Polkadot  WETH

WETH  Monero

Monero  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Bitget Token

Bitget Token  Wrapped eETH

Wrapped eETH  Pepe

Pepe  Pi Network

Pi Network  Ethena USDe

Ethena USDe  Coinbase Wrapped BTC

Coinbase Wrapped BTC  WhiteBIT Coin

WhiteBIT Coin  Dai

Dai  Bittensor

Bittensor  Uniswap

Uniswap  Aave

Aave  NEAR Protocol

NEAR Protocol  Aptos

Aptos  OKB

OKB  Jito Staked SOL

Jito Staked SOL  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Tokenize Xchange

Tokenize Xchange  Ondo

Ondo  Cronos

Cronos  Ethereum Classic

Ethereum Classic