Disclaimer: The findings of the following analysis are the sole opinions of the writer and should not be considered investment advice

- Bullish order block on lower timeframe spotted

- Futures markets did not see another build-up in short positions

FTX filed for bankruptcy. Merely a week ago it was regarded as a giant in the industry, possibly too big to fail. These volatile conditions might be conducive to traders, but caution would remain extremely important. Solana has faced heavy selling pressure in the past week, and more might be headed its way.

Read Solana’s [SOL] price prediction for 2022-2023

FUD was strong in the market, and the recent Crypto.com screw-up saw many Twitterati question how 320k ETH is accidentally sent to another exchange address.

Technicals show bearish pressure has not eased up

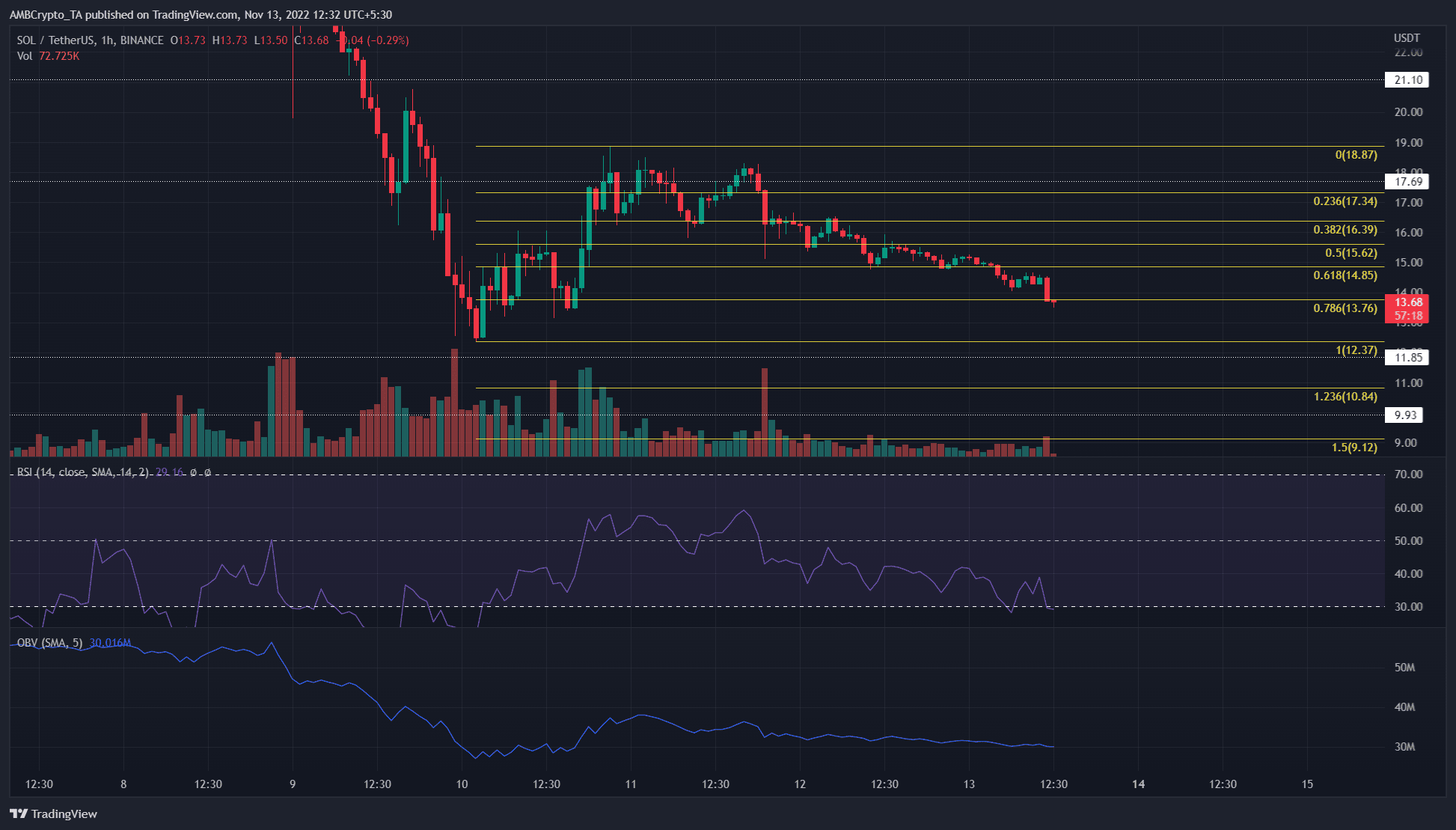

In bounce from $12.37 on 10 November was used as a swing low to plot a set of Fibonacci retracement levels. The bulls were able to push as far north as $18.87. The Fibonacci levels showed that the 61.8% and 78.6% retracement levels were hotly contested in the past couple of days.

The Relative Strength Index (RSI) was well below neutral 50 and has been so in recent days. Meanwhile, the On-Balance Volume (OBV) leaned downward. The inference was that momentum was in favor of the sellers.

On the one-hour chart itself, the $13.5-$14 area has a bullish order block. Hence, a positive reaction from this area could occur, especially as it has confluence from the 78.6% Fibonacci retracement level.

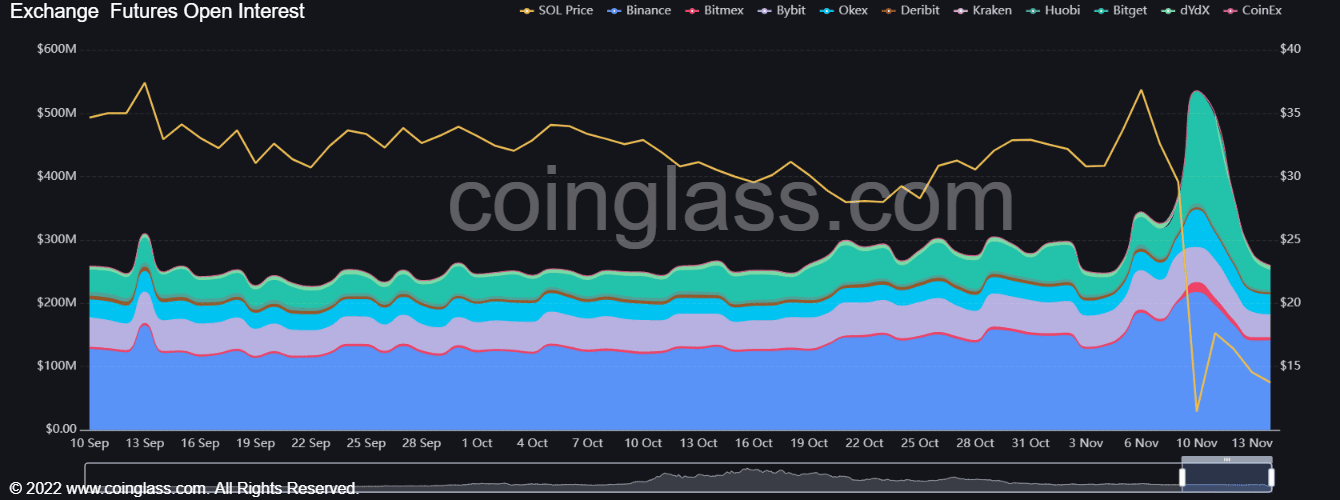

Open Interest deflates after short positions profited heavily on the drop to $12

Source: Coinglass

In the past week, the open interest metric posted steady gains, until it peaked on 10 November. The OI reached a figure of $535 million as Solana dropped to a low near $12. The price subsequently bounced from $12.4 to $18.8 on that very day, but the Open Interest figure began to tail off.

This suggested that market participants were wary of Solana’s volatility and have stepped away in the past few days. The lowered OI alongside a depression in the prices meant that long traders could be getting liquidated, and noted a lack of short positions being built up. The lack of strong short positions, by itself, does not suggest a possible bounce in prices.

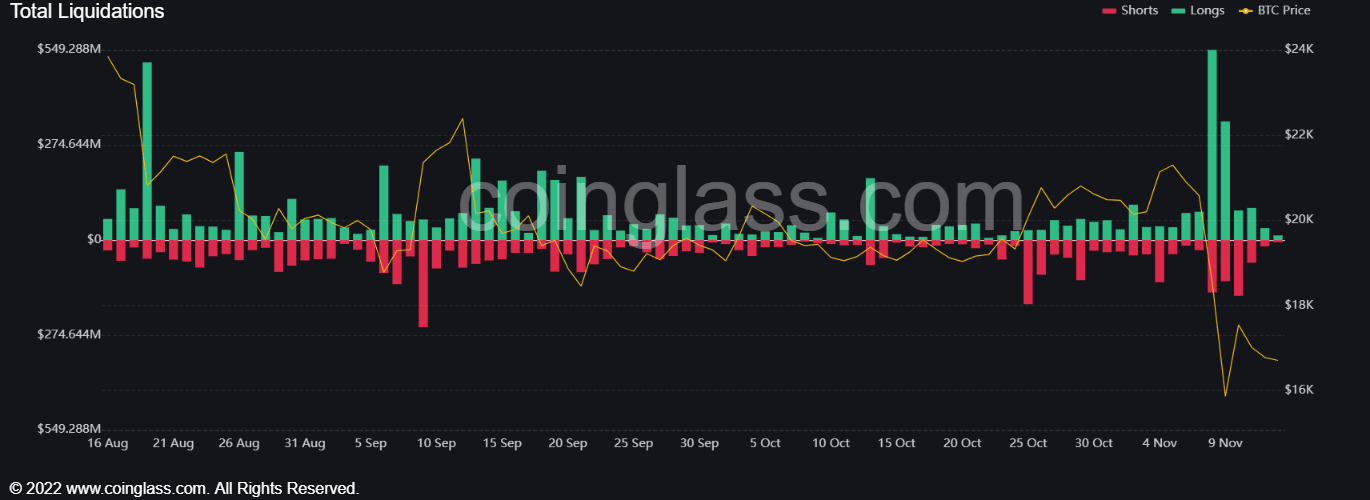

Source: Coinglass

Another data point from Coinglass showed that long liquidations were extremely high on 8 November, the day when Solana broke beneath the $26 range lows. $549 million of longs capitulated, which meant they added to the selling pressure in the futures market.

The past 24 hours saw $2.4 million worth of positions liquidated in total on Solana contracts. But this figure will grow higher over the next few days.

To the south, Solana has significant long-term support levels at $11.85 and $9.93 from 2021.

Read More: ambcrypto.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Wrapped Bitcoin

Wrapped Bitcoin  Sui

Sui  Chainlink

Chainlink  Avalanche

Avalanche  Stellar

Stellar  LEO Token

LEO Token  USDS

USDS  Toncoin

Toncoin  Shiba Inu

Shiba Inu  Hedera

Hedera  Wrapped stETH

Wrapped stETH  Bitcoin Cash

Bitcoin Cash  Hyperliquid

Hyperliquid  Litecoin

Litecoin  Polkadot

Polkadot  WETH

WETH  Monero

Monero  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Bitget Token

Bitget Token  Ethena USDe

Ethena USDe  WhiteBIT Coin

WhiteBIT Coin  Pi Network

Pi Network  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Wrapped eETH

Wrapped eETH  Pepe

Pepe  Dai

Dai  Aptos

Aptos  Bittensor

Bittensor  sUSDS

sUSDS  OKB

OKB  Uniswap

Uniswap  NEAR Protocol

NEAR Protocol  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Ondo

Ondo  Gate

Gate  Aave

Aave  Ethereum Classic

Ethereum Classic  Internet Computer

Internet Computer