[ad_1]

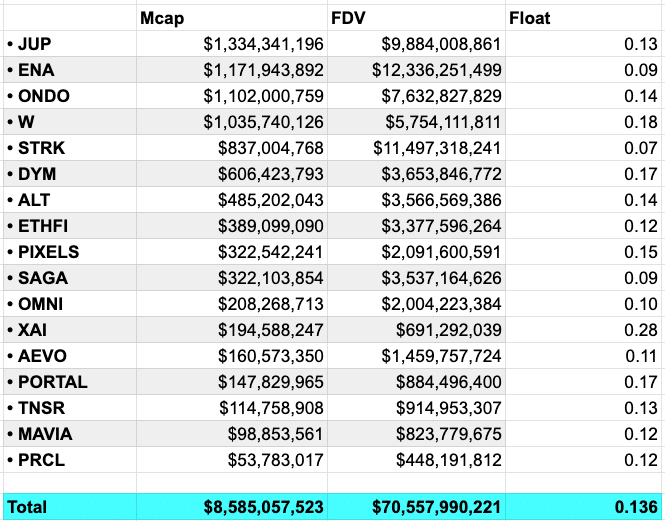

- The market cap of JUP, the native token for Jupiter, crossed $1 billion.

- Other protocols such as Jito also saw growth.

Solana [SOL] managed to attract a large number of users to its ecosystem over the last few months. But it isn’t just SOL that has benefited from the influx of new users on the network.

Decentralized exchanges (DEXes) such as Jupiter also witnessed immense growth, which translated into interest in the JUP token as well.

From Jupiter to the Moon

JUP was one of the top four newly issued tokens in 2024 with a market value exceeding $1 billion. Over the last 24 hours itself, the price of JUP has grown by 6.04%. At press time, the token was trading at $1.04.

The exchange also did really well in terms of overall transactions and activity, which surged significantly over the past month.

A flourishing ecosystem

But Jupiter Exchange wasn’t the only Solana protocol that was witnessing growth. Other protocols, such as Jito, also observed a spike in interest. Jito is a protocol that helps address stake their SOL.

At press time, JTO, the native token for the Jito protocol, was trading at $3.18 and its price had surged by 5.97% over the past month.

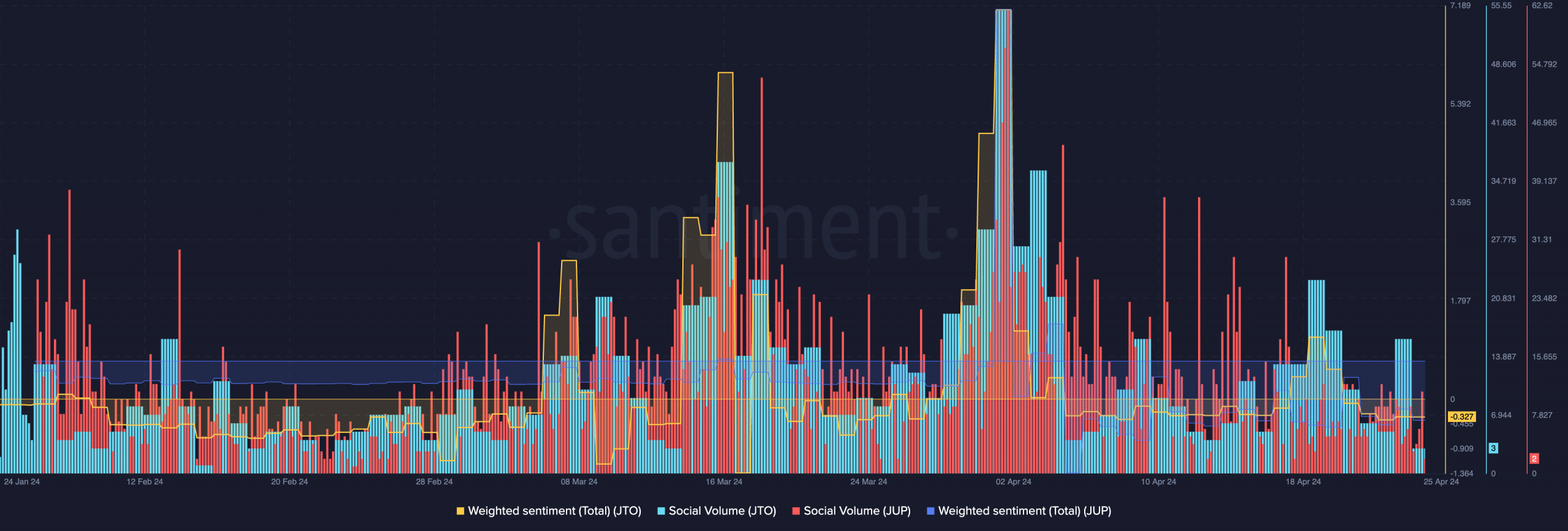

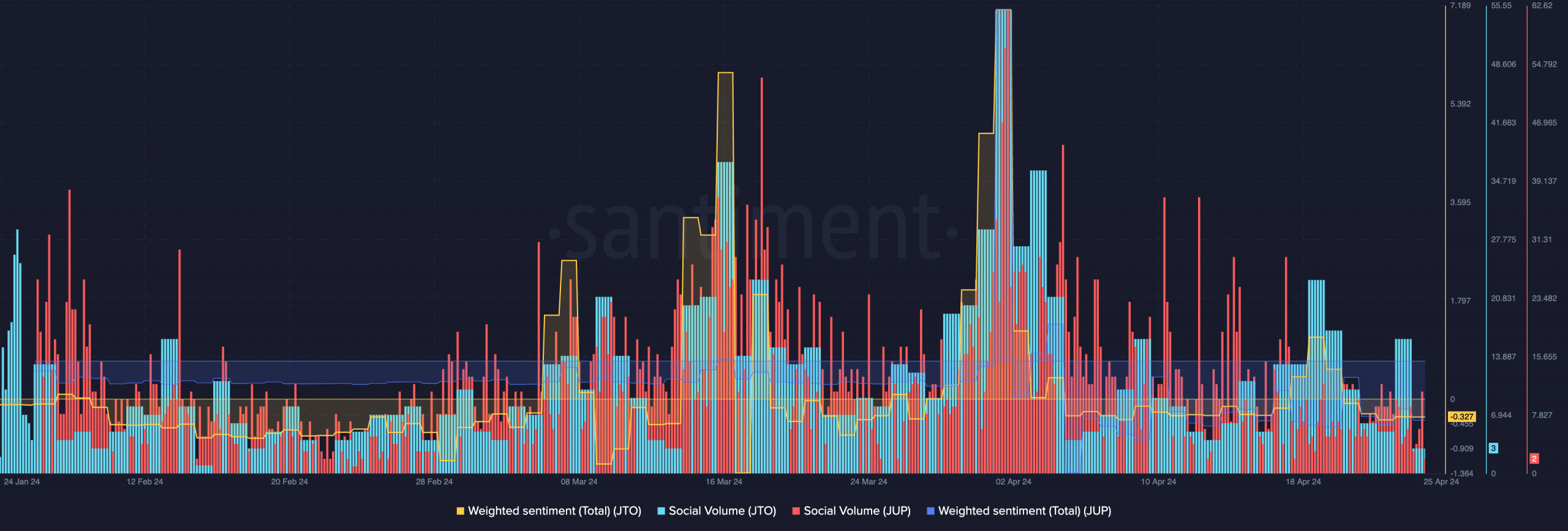

Despite the surge in price of both these tokens, the social activity around the tokens was showcasing negative signs over the last few weeks.

AMBCrypto’s data revealed that the Social Volume and Weighted Sentiment for both JTO and JUP had declined significantly.

This indicated that, despite the overall progress of these tokens, they had hit a bump in the road in terms of gaining popularity across social media platforms.

It may take some time for these protocols to regain interest of the crypto sector in the future.

Despite the waning popularity of both these protocols and tokens, its progress pointed to the fact that not only is the Solana network is benefitting from its popularity, but its overall ecosystem is growing as well.

Read Solana’s [SOL] Price Prediction 2024-25

At press time, SOL was trading at $142.72 and its price had grown by 4.67% in the last 24 hours. The volume at which SOL was trading at had also grown by 12.06% during this period.

It remains to be seen whether SOL manages to maintain this rally in the long run.

[ad_2]

Read More: ambcrypto.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Wrapped Bitcoin

Wrapped Bitcoin  Hyperliquid

Hyperliquid  Wrapped stETH

Wrapped stETH  Bitcoin Cash

Bitcoin Cash  Sui

Sui  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Avalanche

Avalanche  Toncoin

Toncoin  USDS

USDS  WhiteBIT Coin

WhiteBIT Coin  Shiba Inu

Shiba Inu  WETH

WETH  Wrapped eETH

Wrapped eETH  Litecoin

Litecoin  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Hedera

Hedera  Monero

Monero  Ethena USDe

Ethena USDe  Polkadot

Polkadot  Bitget Token

Bitget Token  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Uniswap

Uniswap  Pepe

Pepe  Pi Network

Pi Network  Aave

Aave  Dai

Dai  Ethena Staked USDe

Ethena Staked USDe  OKB

OKB  Bittensor

Bittensor  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Cronos

Cronos  Aptos

Aptos  Internet Computer

Internet Computer  NEAR Protocol

NEAR Protocol  Jito Staked SOL

Jito Staked SOL  sUSDS

sUSDS  Ethereum Classic

Ethereum Classic