[ad_1]

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

- SOL saw increased development activity, but investors remained pessimistic

- A breakout above $11.49 will invalidate the bearish bias

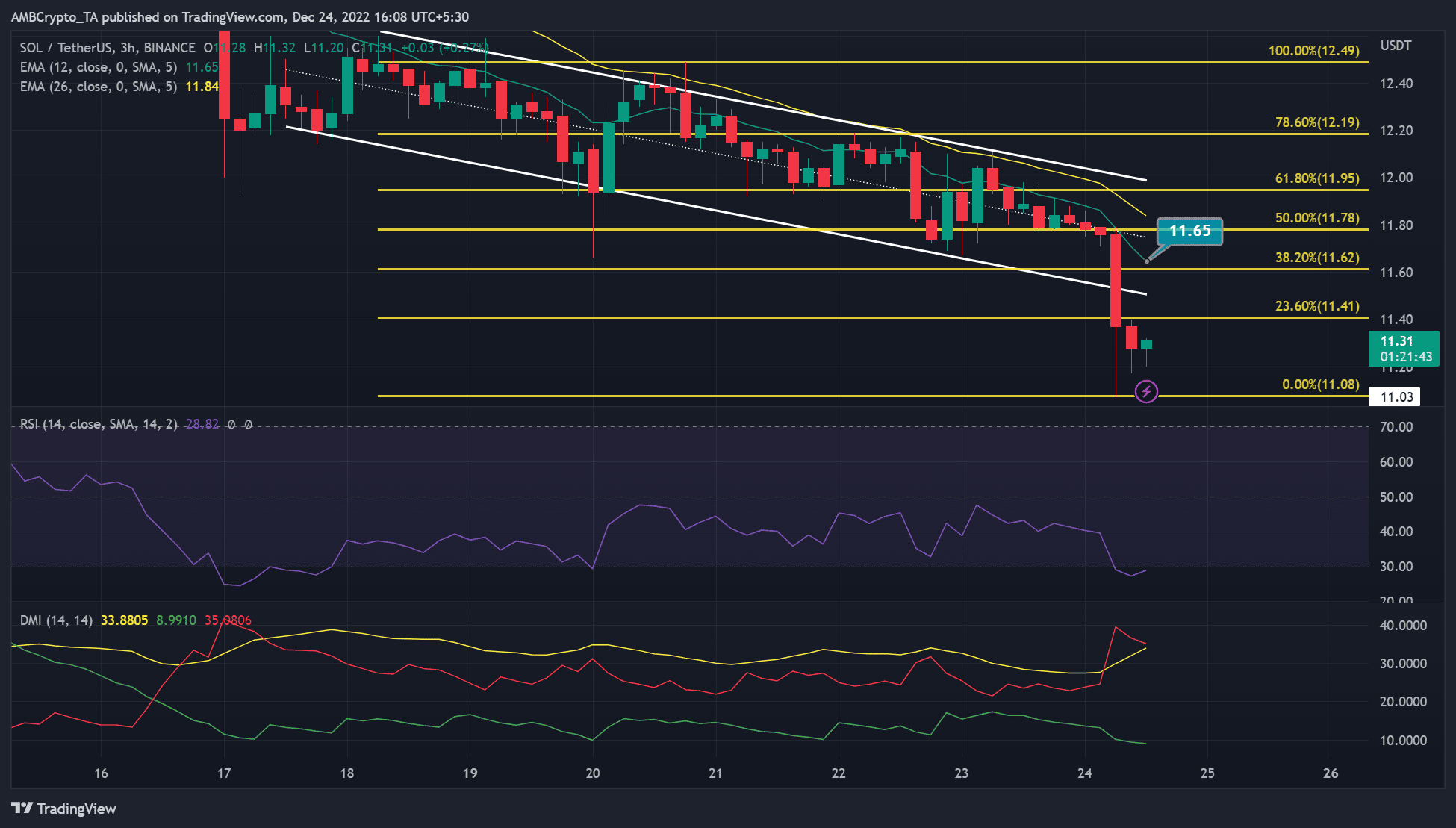

Solana [SOL] has been in a downtrend since 14 December. After another decline, the price formed a falling channel on the three-hour chart. At press time, SOL was trading at $11.31, a 5% decline in the last 24 hours.

There was also a green flare, showing that the discounted price of SOL is attracting some demand. Can the bulls use the momentum to their advantage?

Read Solana’s [SOL] price prediction 2023-24

SOL flared green: was a price reversal likely?

In the three-hour time frame, a pattern breakout from the falling channel. However, the immediate support at the 23.60% Fib level failed to stop the downtrend. The next support level at $11.08 provided solid ground.

Technical indicators suggested that SOL could fall lower and retest the aforementioned support at $11.08. In particular, the Relative Strength Index (RSI) fell into the oversold territory but showed an uptick. This suggested that buying pressure eased while selling pressure increased.

But, the uptick showed that some accumulation had taken place. However, the bulls may only have a chance if the RSI is not rejected at the 30-mark. Historically, an RSI rejection at this level gives sellers more leverage.

Also, the Directional Movement Index (DMI) showed that sellers had more leverage at 35, well above the 25 mid-level, as buyers were at 8.9 units. Therefore, sellers could push SOL down to $11.03. The level can serve as a target for short-selling.

However, a break above immediate resistance at the 23.6% Fib level ($11.41) would invalidate the above bearish forecast. Such a bounce would allow SOL to focus on the 12-period exponential moving average (EMA) of $11.65 or the 38.2% Fib level of $11.62.

How much SOLANA [SOL] can I get for $1?

SOL saw an uptick in development activity, but investors remained pessimistic

According to Santiment, SOL saw an upswing in development activity, but analysts remain pessimistic as weighted sentiment remained unchanged.

However, trading volume increased with the recent price increase. This meant that buying pressure increased with the rise in trading volume.

In addition, trading volume continued to increase even after the price decline of SOL. Could the increase in trading volume and the RSI reaching the oversold area cause a price reversal?

[ad_2]

Read More: ambcrypto.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Wrapped Bitcoin

Wrapped Bitcoin  Hyperliquid

Hyperliquid  Wrapped stETH

Wrapped stETH  Bitcoin Cash

Bitcoin Cash  Sui

Sui  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Avalanche

Avalanche  Toncoin

Toncoin  USDS

USDS  WhiteBIT Coin

WhiteBIT Coin  Shiba Inu

Shiba Inu  WETH

WETH  Wrapped eETH

Wrapped eETH  Litecoin

Litecoin  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Hedera

Hedera  Monero

Monero  Ethena USDe

Ethena USDe  Polkadot

Polkadot  Bitget Token

Bitget Token  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Uniswap

Uniswap  Pepe

Pepe  Pi Network

Pi Network  Aave

Aave  Dai

Dai  Ethena Staked USDe

Ethena Staked USDe  OKB

OKB  Bittensor

Bittensor  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Cronos

Cronos  Aptos

Aptos  Internet Computer

Internet Computer  NEAR Protocol

NEAR Protocol  Jito Staked SOL

Jito Staked SOL  sUSDS

sUSDS  Ethereum Classic

Ethereum Classic