There’s been speculation about the real-world utility of blockchain and web3 platforms for a long time, but it still has a long way to go. There is an ever-growing number of people #BUIDLing products and services using this technology, but outside of developers and speculators, we still don’t have a majority user base who are interested in the utility of the technology over the speculative side of this.

Shifting focus from speculation to real-world utility and problem solving

We know that there are a plethora of potential applications for web3 technologies from self-sovereign identity to collectables, but if you take a web3 community at random right now, the chances are they’re interested in seeing the price appreciation of some token or cryptocurrency. This isn’t a bad thing per se, but it is reflective of where we are currently in the evolution of web3 — seeing some significant return on investment is still the primary use case.

Developers and technologists are generally attracted to web3 because there is so much that still needs to be built. The idea of greenfield development is what excites most developers — creating something new that solves a real problem.

But we need applications and projects being adopted at scale that do not contain a token-based incentive mechanism. Cryptocurrencies and tokens do serve some very real purposes, as a mechanism to secure decentralised networks they are essential, and it’s fair that those helping to secure these networks can see a return from providing this valuable service.

However, the majority of projects running on top of these networks should be focused on solving a real-world problem for people and disconnected from tokeneconomic effects. These tokeneconomic effects often take what starts off as a project with utility, such as a new decentralised messaging platform, and turn it into something that is akin to a multi-level marketing scheme. Where you have layers of promoters (token holders) whose primary interest is shilling a token.

A real utility token

When someone hears the word “NFT” we want them to be thinking about a hotel room key, an event ticket, a digital trading card, not a crypto punk or Bored Ape. When we consider high transaction volumes on Ethereum’s mainnet, we don’t want it to be caused by NFT mints going crazy, we want it to be due to the volume of activity taking place on layer 2 networks. Where these activities are being driven by apps which again have real-world utility.

DeFi

The DeFi and crypto ecosystems do provide valuable services to those living in less stable monetary regimes. They give their citizens another choice which isn’t a currency that hyper-inflates away. However, without being armed with the knowledge of the pros and cons of various networks and currencies, they could end up unintentionally holding the next UST. Even with this, the rewards still outweigh the risks for many.

Stablecoins are a great enabler for these regions, and USDT has established itself as a defacto currency for cross-border remittance payments across Asia and the Americas. Outside of the remittance use case, the leading stablecoins USDT and USDC are primarily used as trading stablecoins.

In trading stablecoins, their main utility is to facilitate the trading of crypto assets. It’s far easier to trade out of a crypto position to a stablecoin such as USDC if you anticipate you’ll be putting the funds back into crypto down the line. Whilst the payment utility is there for stablecoins held on exchange, stablecoins or cryptocurrencies for that matter are unlikely to be used for payments for the majority of users.

Although, where they could gain additional traction is where the size of the transfer is significant. For low-value payments, existing payment services offered by banks and fintechs such as PayPal suffice. If I wanted to send $1 million dollars to someone overseas, using USDC is likely to cost me less than using traditional payment rails, which is a potential opportunity. But these large payments are relatively infrequent if they take place at all for retail or small business users.

In TradFi ring-fenced, private-permissioned blockchain networks are still being embraced en-mass, especially in initiatives such as CDBCs and cross-border payments that service the wholesale markets. But these solutions are unlikely to be in service to public networks due to their permissionless nature.

Meme coins versus infrastructure

If we want web3 to go mainstream and be taken seriously, this association with price everywhere needs to subside. For anyone digging around in crypto or DeFi it’s easy to attack the entire ecosystems when you have both Dogecoin and Shiba Inu making up $16 of the entire crypto market cap. How can an industry be taken seriously when meme coins that pump every time Elon Musk references a dog or bitcoin are the 8th and 14th largest cryptocurrencies by market cap. I like memes as much as the next person, but c’mon really?

One does need to provide incentives to projects to build on their network, but we also need to get to a point where the base layer infra projects are stickier and properly established. With such stable bases where there isn’t constantly a “better layer X” coming onboard, projects and companies will be willing to make greater investments in the technology on specific blockchain networks.

This will in turn strengthen the foundations upon which web3 is being built, and there will be fewer opportunities to spin up new competitive platforms with tokens due to the ever-increasing barriers to entry.

Once this price fever goes away, perhaps then web3 will be ready for its AI moment as Satya Nadella described which we’ve all been experiencing this year with ChatGPT.

This will be when those building will rejoice, as we’ll have an ecosystem that is truly valuable in the sense of solving real world problems and providing genuine utility which is where anyone committed to web3 wants to get to.

Read More: blog.web3labs.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  Wrapped Bitcoin

Wrapped Bitcoin  Hyperliquid

Hyperliquid  Sui

Sui  Wrapped stETH

Wrapped stETH  Chainlink

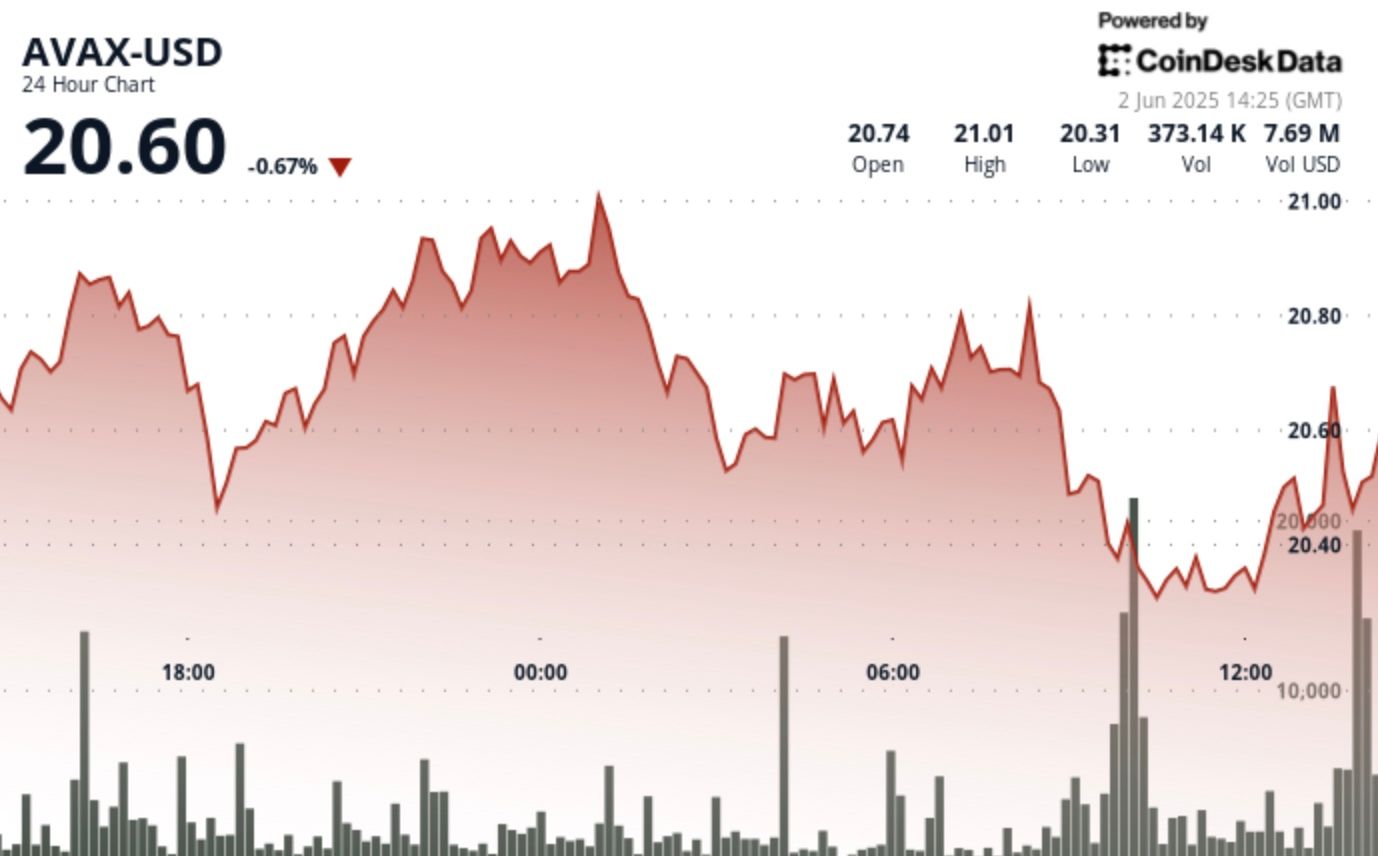

Chainlink  Avalanche

Avalanche  Stellar

Stellar  Toncoin

Toncoin  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Shiba Inu

Shiba Inu  Hedera

Hedera  USDS

USDS  Litecoin

Litecoin  WETH

WETH  Monero

Monero  Wrapped eETH

Wrapped eETH  Polkadot

Polkadot  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Ethena USDe

Ethena USDe  Bitget Token

Bitget Token  Pepe

Pepe  Pi Network

Pi Network  Coinbase Wrapped BTC

Coinbase Wrapped BTC  WhiteBIT Coin

WhiteBIT Coin  Dai

Dai  Aave

Aave  Uniswap

Uniswap  Bittensor

Bittensor  Ethena Staked USDe

Ethena Staked USDe  Cronos

Cronos  Aptos

Aptos  OKB

OKB  NEAR Protocol

NEAR Protocol  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Jito Staked SOL

Jito Staked SOL  Internet Computer

Internet Computer  Ondo

Ondo  Ethereum Classic

Ethereum Classic