Liquidators in the Bahamas working on the now-bankrupt crypto exchange FTX believe there was “serious fraud and mismanagement” occurring at the exchange, court documents have revealed.

“The Joint Provisional Liquidators’ findings to date indicate that serious fraud and mismanagement may have been committed” by FTX and the related group of companies, the documents said, according to multiple media reports.

The documents are likely referring to revelations in the media from last week when news emerged that Sam Bankman-Fried’s crypto trading firm Alameda Research owed around $10bn to FTX. Reports have also indicated that FTX misused customer funds and made a failed loan of $500m to crypto lender Voyager Digital in May.

Voyager Digital filed for bankruptcy in July of this year after being caught in the contagion after the collapse of crypto hedge fund Three Arrows Capital.

The allegations against FTX by the liquidators were made in documents submitted on Wednesday to the U.S. Bankruptcy Court for the Southern District of New York. The documents were filed on behalf of the Bahamian liquidators Brian Simms, Kevin Cambridge, and Peter Greaves.

In addition to calling out the “fraud and mismanagement” happening at FTX, the newly filed documents also seek to block the sale of any FTX assets until the court has made a decision on the next steps in accordance with US bankruptcy law.

Nansen: “Close (on-chain) ties” between FTX and Alameda

Meanwhile, a report from crypto analytics platform Nansen on Thursday revealed that ties between FTX and Alameda, two of Bankman-Fried’s most prominent companies, have been close “since the very beginning.”

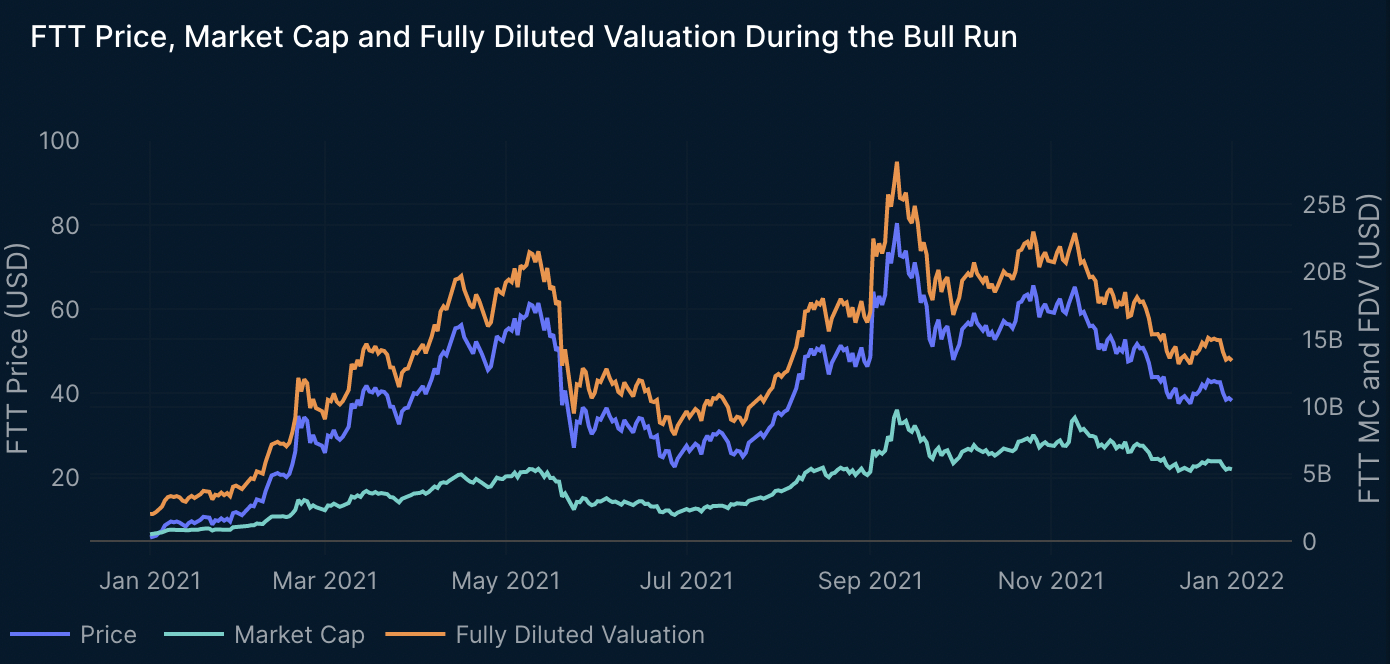

Analysts at Nansen came to the conclusion by studying a number of on-chain transactions between Bankman-Fried’s companies, finding evidence of large transfers of FTX’s own FTT token between the two entities. It added that the majority of net equity in Alameda “consisted of FTX’s own centrally controlled token, FTT.”

“The sudden fallout of FTX had induced a growing fear within the crypto market participants – both investors and traders alike. If anything, this situation only strengthens the need for more transparency in crypto,” Nansen’s analysts wrote in the report.

Read More: cryptonews.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Wrapped Bitcoin

Wrapped Bitcoin  Sui

Sui  Chainlink

Chainlink  Avalanche

Avalanche  LEO Token

LEO Token  Stellar

Stellar  Toncoin

Toncoin  Shiba Inu

Shiba Inu  Wrapped stETH

Wrapped stETH  Hedera

Hedera  USDS

USDS  Bitcoin Cash

Bitcoin Cash  Litecoin

Litecoin  Polkadot

Polkadot  Hyperliquid

Hyperliquid  Bitget Token

Bitget Token  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  WETH

WETH  Ethena USDe

Ethena USDe  Pi Network

Pi Network  Monero

Monero  WhiteBIT Coin

WhiteBIT Coin  Wrapped eETH

Wrapped eETH  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Pepe

Pepe  Uniswap

Uniswap  Aptos

Aptos  Dai

Dai  OKB

OKB  NEAR Protocol

NEAR Protocol  Bittensor

Bittensor  Ondo

Ondo  Gate

Gate  Official Trump

Official Trump  Internet Computer

Internet Computer  Tokenize Xchange

Tokenize Xchange  Ethereum Classic

Ethereum Classic  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Aave

Aave