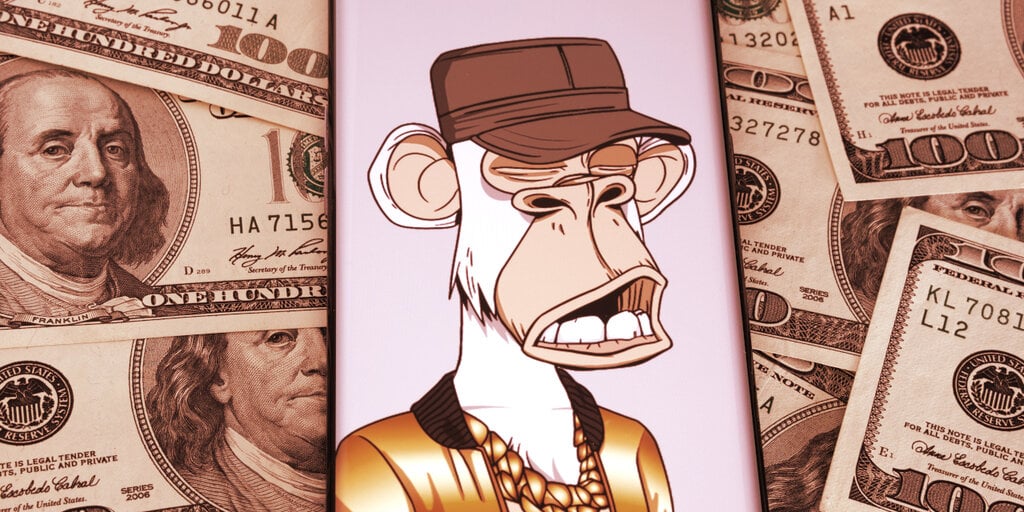

Last week, a sliver of news leaked from an unknown source sent the NFT world into uproar.

An anonymous source tipped Bloomberg that the Securities and Exchange Commission is currently investigating whether NFTs sold by Yuga Labs, the $5 billion company behind the Bored Ape Yacht Club, violated security registration laws. The SEC did not deny the report.

Depending on who you ask, the news confirmed a likelihood either once unthinkable or inevitable: the U.S. government may be seeking to regulate the nascent, multi-billion dollar NFT industry as a securities market.

Multiple legal experts, in speaking to Decrypt, took the development as a clear signal that the SEC—which has aggressively ramped up its attitude towards crypto regulation in recent months—is taking unprecedented steps towards asserting its dominion over the virtual art market. Other legal minds dismissed the move as loud but empty political jockeying on the part of the SEC—one that is unlikely to lead to any dramatic changes in regulation.

Across that spectrum of opinion, however, there was consensus that if the SEC did elect to escalate its current investigation of Yuga Labs to litigation, the implications would be seismic.

“The potential for regulatory enforcement action is greater than I had anticipated, even with respect to NFT collections where each digital asset is unique,” Alfred Steiner, an artist and attorney specializing in NFTs, told Decrypt. Steiner currently represents Ryder Ripps, a conceptual artist and provocateur who is currently the target of a Yuga Labs lawsuit over trademark infringement.

Prior to Monday’s news, Steiner believed the SEC was unlikely to ever go after a blue chip NFT collection like BAYC, simply because most of the 10,000 Bored Ape NFTs in circulation are distinguished by different visual traits (e.g., an earring or a different colored background). Those distinctions, Steiner thought, would make these NFTs appear less like securities and more like art pieces.

“My impression prior to this news had been that the sort of diversity you have among digital resources in a collection like BAYC would be sufficient to keep regulatory action at bay,” Steiner said. “I don’t know of any previous signal that they were going to do what they’ve done.”

Other legal experts disagreed, however, and said they’ve been anticipating this escalation for some time.

“I’m not surprised. I’ve seen this coming for the last two years,” Brian Fyre, a law professor at the University of Kentucky, told Decrypt.

“What are all the different NFT collections that Yuga Labs is selling other than, functionally, investments in the future value of the Bored Ape Yacht Club brand?” said Fyre. “That’s all they really are, at the end of the day.”

To the law professor, it makes perfect sense that the SEC would target a major NFT brand to kick off its push into regulating the NFT space. People buy into blue chip NFT collections like Bored Apes because of their collective reputations, said Fyre, not because of the artistic value of individual NFTs. And that looks a lot like purchasing stocks in a company, the professor argued.

“What you’re buying is a piece of Bored Ape Yacht Club, and the value of your NFT rises or falls along with the value of the Bored Ape Yacht Club brand,” said Fyre.

On that Steiner concurred. “I don’t think there’s much doubt that the vast majority of people buying very expensive NFTs are expecting a profit,” he said.

But stepping into regulating the NFT space by starting with the biggest NFT brand of them all would seem to go against the SEC’s modus operandi, said Jeremy Goldman, an attorney specializing in NFTs.

“It seems much more likely that if the SEC is going to go after someone, they’re going to go after projects that much more easily fit the framework of what the SEC believes is a security,” Goldman told Decrypt. Goldman has previously represented Yuga Labs, though he does not currently; he has also represented Decrypt.

Goldman believes that there are other NFT projects besides Bored Ape Yacht Club that much more obviously check the boxes of appearing like securities. He is confident the SEC would almost certainly go after those projects first—if it were to go after any.

“The SEC usually starts by going after lower hanging fruit. Think of a project where the marketing said, ‘This is going to be a great investment,’ ‘We’re going to 10x what you’ve put in and take you to the moon,’” Goldman said. “That is really easy for them to prove falls within their purview as a security. And I just don’t see BAYC in that category.”

Goldman believes it’s highly unlikely the SEC will ever actually sue Yuga Labs for securities violations. He believes Yuga has only been implicated here to assist the SEC in a publicity-oriented battle for sovereignty over regulating the crypto space. Goldman went so far as to suggest that the leak may have been planted by the SEC itself.

“To me, it’s a little suspect. Suddenly an anonymous source says, ‘Oh, yeah, Yuga’s on the list,’ and then it makes headlines,” Goldman said. “I just do wonder whether this is part of government in-fighting for control. They’re putting it out there, ‘We’re already investigating this,’ and they want to put out a big name so it gets the attention of the public.”

Others sources familiar with the matter, who wished not to be named, concurred that the SEC could be using Yuga Labs as a pawn in a greater game intended to stave off competing regulators including the Commodities Future Trading Commission (CFTC), the Treasury Department, and the Judiciary.

“The SEC is very clearly engaged in turf protection,” said Fyre. “Whichever agency steps into this arena first is going to be ultimately the one most likely to take it on in the long term. And I don’t think the SEC wants to cede that regulatory turf to competing agencies.”

Regardless of the underlying motivation, what would happen if the SEC went ahead with a case against Yuga Labs and won?

“It would be an issue for the entire industry,” said Goldman. “Launching an NFT would become like going public with a stock. It would require a tremendous amount of legal work and accounting work and disclosures and registration […] that is just not feasible or practical for the vast majority of startups.”

Fyre doesn’t think a scenario in which NFTs are legally treated as securities would be that catastrophic for NFT creators, as a lot of necessary disclosure information would be already publicly available on the blockchain. He does, however, think such a scenario would quickly become a nightmare for the SEC.

“The NFT market is just a really radically transparent, radically efficient, radically pared down version of the art market,” said Fyre. “But the economic logic of both is exactly the same. I don’t know how the SEC goes about distinguishing the NFT [profile picture] market from the art market.”

Fyre has, for years, insisted that the SEC should regulate NFTs, but that doing so would open a Pandora’s Box that would logically obligate the agency to regulate the art market, a complicated headache that it has avoided for decades.

For that reason, the SEC has potentially found itself between a rock and a hard place for years, eager to go after crypto—a novel and volatile economic sector that has been winning and losing investors billions—but simultaneously cautious about setting an explosive precedent with regard to the art market.

In the interim, though, as flashy NFT companies like Yuga have acquired massive amounts of capital, swathes of headlines, and loads of celebrity endorsements, it may now be too hard for the SEC to stay idle.

“The bigger impact they see Yuga making on markets, the more likely they are to see it as something that they want to be regulating,” said Fyre. “The question isn’t whether BAYC is a security. The only real question here is, what does the SEC want to regulate?”

Stay on top of crypto news, get daily updates in your inbox.

Read More: decrypt.co

Shadow Token

Shadow Token  Euler

Euler  Kujira

Kujira  Alien Worlds

Alien Worlds  Metadium

Metadium  Access Protocol

Access Protocol  Peapods Finance

Peapods Finance  Portal

Portal  OMG Network

OMG Network  Aergo

Aergo  ArbDoge AI

ArbDoge AI  Hoppy

Hoppy  Bertram The Pomeranian

Bertram The Pomeranian  Heroes of Mavia

Heroes of Mavia  YES Money

YES Money  Ethernity Chain

Ethernity Chain  BUSD

BUSD  REI Network

REI Network  Project89

Project89  Gearbox

Gearbox  DIMO

DIMO  Perpetual Protocol

Perpetual Protocol  Onyxcoin

Onyxcoin  Sanctum Infinity

Sanctum Infinity  Orchid Protocol

Orchid Protocol  Opus

Opus  crvUSD

crvUSD  Gemini Dollar

Gemini Dollar  Dione

Dione  USDX

USDX  tokenbot

tokenbot  Keyboard Cat (Base)

Keyboard Cat (Base)  WATCoin

WATCoin  INSURANCE

INSURANCE  Matr1x Fire

Matr1x Fire  Magpie

Magpie  Liquity USD

Liquity USD  OmniFlix Network

OmniFlix Network  Manta mETH

Manta mETH  Mainframe

Mainframe  Save

Save  Vector Smart Gas

Vector Smart Gas  Reef

Reef  TANUKI•WISDOM (Runes)

TANUKI•WISDOM (Runes)  Loom Network (OLD)

Loom Network (OLD)  Contentos

Contentos  GOGGLES

GOGGLES