The biggest news in the cryptoverse for Nov. 11 includes FTX filing for bankruptcy as John Ray III takes over from Sam Bankman-Fried as CEO, FTX users seeking to bypass bankruptcy process using the “Bahamas loophole”, US Congressman accused SEC Chairman of having dubious ties to FTX, and Crypto.com disclosing reserve holdings to allay rumors of insolvency.

CryptoSlate Top Stories

FTX files for bankruptcy, Sam Bankman-Fried steps down from CEO role

About 130 companies affiliated with the FTX Group have collectively filed for Chapter 11 bankruptcy on Nov. 11. The exchange said that it will work to restructure its remaining assets so as to refund affected stakeholders.

In addition, John Ray III will take up the CEO role from Sam Bankman-Fried.

Binance CEO expects more regulatory scrutiny following FTX implosion

Binance CEO Changpeng Zhao “CZ” said it had to back off the FTX deal, as a result of the regulatory scrutiny FTX has to battle with.

CZ added that the FTX collapse will call for increased scrutiny of crypto exchanges. For more transparency, CZ recommends that regulators should consider auditing the exchange’s business models and proof-of-reserves, in addition to KYC and AML laws.

Crypto.com discloses partial reserves in bid to counter insolvency rumors

Following the FTX fallout, several crypto exchanges including Crypto.com have moved to disclose their reserve holdings, to allay fears of insolvency.

According to details shared by Crypto.com CEO Kris Marszalek, the exchange holds about 53,024 Bitcoin, 391,564 Ethereum, and some altcoins which totaled approximately $3 billion.

Pantera Capital swiftly implements precautionary measures following FTX, Alameda fallout

Venture Capital firm Pantera said it conducted a risk assessment for projects in its investment portfolio, so as to take preventive measures following the FTX collapse.

From the assessment report, about 95% of the projects in Pantera’s portfolio have no exposure to FTX or Alameda. However, two startups were affected and will receive further assistance from the investment firm.

US Congressman says SEC’s Gensler allegedly had dubious ties to FTX, promises investigation

SEC Chairman Gary Gensler, FTX CEO Sam Bankman-Fried, and Alameda CEO Caroline Ellison, reportedly have a long-standing relationship that was linked to MIT.

As a result, rumors are spreading that Gensler had sinister ties to FTX, in an attempt to help FTX gain more control over the crypto space.

In response to the speculations, crypto-friendly U.S. Congressman Tom Emmer said he would launch an investigation to uncover Gensler’s role in helping FTX gain a regulatory monopoly.

Desperate FTX users employ shady tactics to bypass bankruptcy process

In the wake of the FTX collapse, the Bahamas’ authority froze FTX’s assets. However, it authorized Bahamians to withdraw their remaining funds.

As a result, many FTX users are opting to collaborate with Bahamian citizens to help withdraw their funds. While some crypto community members have criticized the act as illegal, many investors including @depression2019 said it was better to employ such tactics to reclaim full funds instead of waiting for a 5-year bankruptcy process.

BlockFi halts withdrawals amid FTX crisis, Genesis Trading, Crypto.com emphasize transparency

The FTX fallout effect has caught up with BlockFi as it moved to suspend withdrawals and trading activities on its platform. BlockFi reportedly has a $400 million loan from FTX.US due for July 2023.

Kucoin CEO addresses rumours surrounding FTX, FTT exposure

In efforts to distance Kucoin from the FTX collapse, CEO Johnny Lyu shared some details of the Kucoin proof-of-reserve.

As of publication, Kucoin held about 20,504 BTC, 180,299 ETH, 69.6 million KCS, 1.08 million USDT, and 365 million USDC.

Realized Bitcoin losses spike as Grayscale GBTC trades at less than $10k BTC equivalent

FTX’s collapse which started on Nov. 9 forced Bitcoin to fall below $15,590. As a result, the realized losses on the flagship asset have spiked to new highs.

Similarly, Grayscale’s GBTC share has declined to an all-time low of $9,771. The GBTC is trading at a 41% discount to its net asset value (NAV).

FTX crash pushes Bitcoin to self-custody; Ethereum switched for stablecoins

As the FTX contagion unfolds, more investors are moving their Bitcoin way from centralized exchanges into self-custody wallets. Glassnode data shows that as of Nov. 11, out of roughly 19 million BTC in circulation, up to 78% (approximately 15 million) are held in self-custody. As a result, Bitcoin’s illiquid supply chart has spiked to new highs.

Further on-chain investigation revealed that the market cap of the top four stablecoins has flipped that of Ethereum. By implication, more investors are moving funds into stablecoins to hedge against the growing crypto market uncertainty.

Research Highlight

In spite of FTX catastrophe, Bitcoin whales lead aggressive accumulation phase

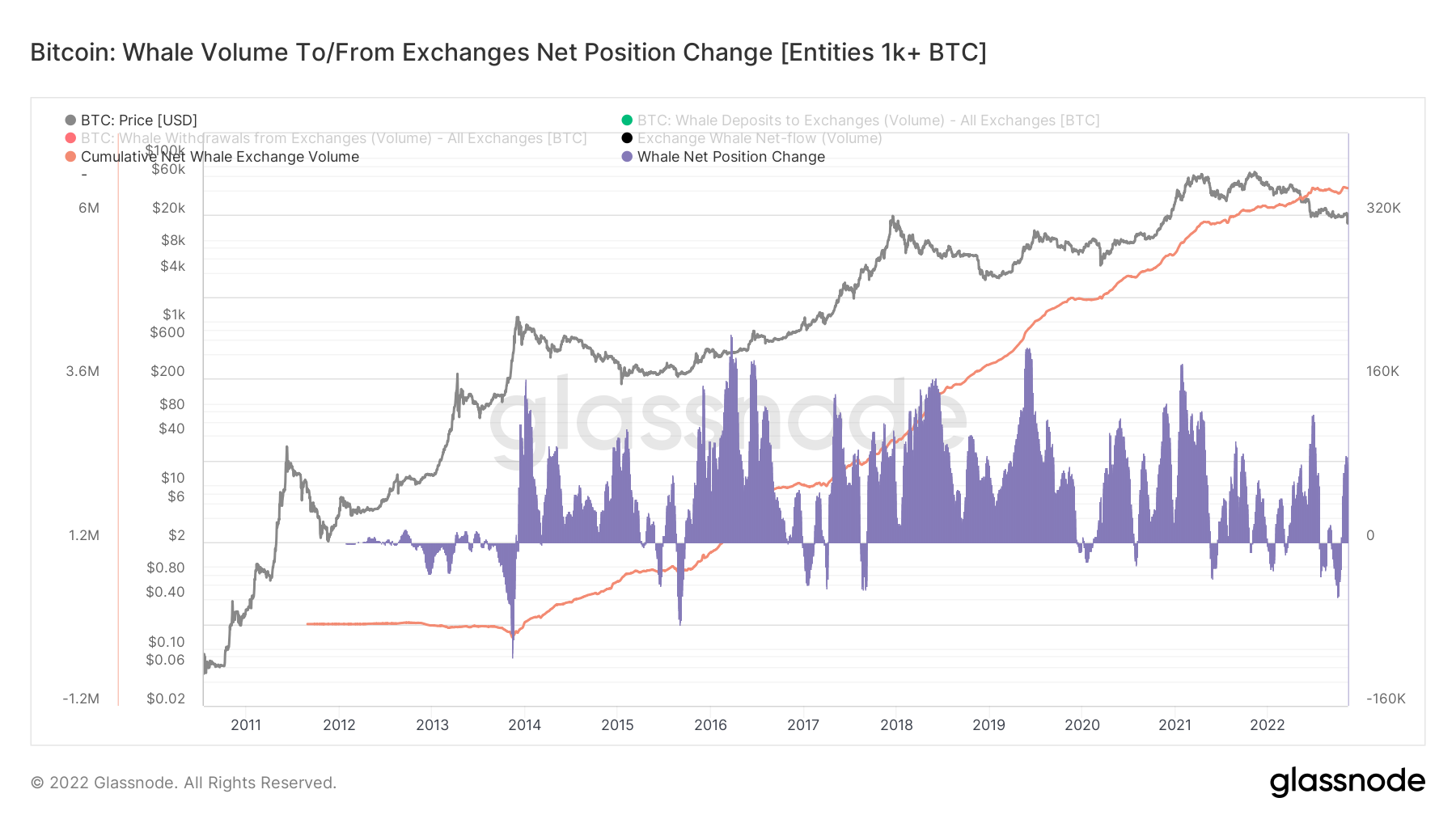

The FTX collapse has fueled bearish sentiment across the market. However, on-chain data analyzed by CryptoSlate indicates that Bitcoin whales increasing their holdings.

As of Nov. 10, the accumulation trend score (ATS) reached about 0.74, which indicates that Bitcoin investors are actively accumulating.

Similarly, the exchange net position change chart shows that holdings of whales and super whales have increased significantly more recently.

News from the Cryptoverse

FTX withdraws US CFTC derivatives plan

Following the bankruptcy filing of the FTX Group earlier on Nov. 11, Bloomberg reported that the company has withdrawn a derivatives clearing plan submitted to the U.S. Commodity Futures Trading Commission (CFTC).

The proposal would have allowed FTX users to access and mitigate derivatives risk in real time.

Deribit adjusts withdrawals and deposits procedure

Deribit exchange has notified users to create new wallet addresses following its Fireblocks update. Users were cautioned against sending funds to their previous accounts.

Withdrawal requests on the exchange will be approved and processed manually by a Deribit withdrawal.

Crypto Market

In the last 24 hours, Bitcoin (BTC) decreased by over 3% to trade at $16,722, while Ethereum (ETH) declined by 2.2% to trade at $1,258.

Biggest Gainers (24h)

Biggest Losers (24h)

Read More: cryptoslate.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Avalanche

Avalanche  Sui

Sui  Wrapped stETH

Wrapped stETH  Toncoin

Toncoin  Shiba Inu

Shiba Inu  Chainlink

Chainlink  Wrapped Bitcoin

Wrapped Bitcoin  Stellar

Stellar  Hedera

Hedera  Polkadot

Polkadot  WETH

WETH  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Uniswap

Uniswap  Pepe

Pepe  Hyperliquid

Hyperliquid  Wrapped eETH

Wrapped eETH  NEAR Protocol

NEAR Protocol  Ethena USDe

Ethena USDe  USDS

USDS  Internet Computer

Internet Computer  Aptos

Aptos  Aave

Aave  Mantle

Mantle  MANTRA

MANTRA  POL (ex-MATIC)

POL (ex-MATIC)  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Render

Render  Bittensor

Bittensor  Monero

Monero  Tokenize Xchange

Tokenize Xchange  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Dai

Dai  Virtuals Protocol

Virtuals Protocol  Arbitrum

Arbitrum