Robinhood, the crypto-friendly online trading platform, has experienced a significant 18% decrease in crypto trading revenue in the second quarter, as revealed in its latest earnings release.

Those revenues fell to $31 million in the second quarter, making up 16% of the total trading revenue. These revenues stood at $38 million in the previous quarter.

Crypto trading wasn’t the only area impacted, either.

Overall transaction-based revenues saw a drop of 7% to $193 million. Specifically, options revenues registered a loss, dropping by 5% to $127 million, while equities also saw a decrease of 7%, landing at $25 million.

This drop in crypto trading mirrors much of the current state of the crypto market, which has been rocked by events such as the implosion of Terra, the FTX collapse, and ongoing regulatory issues stateside.

Robinhood also discontinued support in June for several tokens identified as securities in the SEC lawsuits against crypto exchanges Binance and Coinbase: Cardano (ADA), Polygon (MATIC), and Solana (SOL).

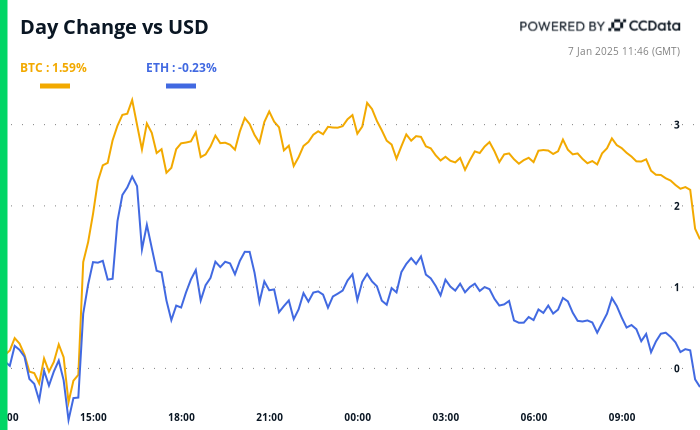

Robinhood continues to offer trading for 15 different cryptocurrencies, including Bitcoin (BTC), Ethereum (ETH), Dogecoin (DOGE), and Avalanche (AVAX).

Moreover, the company managed to maintain $11.5 million in crypto under custody, matching the amount held at the end of the first quarter.

Robinhood rolls with the punches

Despite the downturn in its trading operations, Robinhood’s overall second-quarter results exceeded analyst estimates.

The company reported a 10% increase in total net revenues to $486 million, primarily driven by seasonally higher proxy revenue and increased net interest revenues.

Undeterred by the transaction-based revenue drop, Robinhood is forging ahead with its expansion plans. The company is gearing up to launch its services in the UK by year-end, having recently onboarded Jordan Sinclair, a former Barclays executive, as the new CEO of its UK operations.

At the time of writing, Robinhood has not responded to Decrypt’s requests for comment.

Stay on top of crypto news, get daily updates in your inbox.

Read More: decrypt.co

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Avalanche

Avalanche  Sui

Sui  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Toncoin

Toncoin  Shiba Inu

Shiba Inu  Stellar

Stellar  Wrapped Bitcoin

Wrapped Bitcoin  Hedera

Hedera  Polkadot

Polkadot  WETH

WETH  Bitcoin Cash

Bitcoin Cash  Uniswap

Uniswap  Pepe

Pepe  Hyperliquid

Hyperliquid  LEO Token

LEO Token  Litecoin

Litecoin  Wrapped eETH

Wrapped eETH  NEAR Protocol

NEAR Protocol  Aptos

Aptos  Ethena USDe

Ethena USDe  USDS

USDS  Internet Computer

Internet Computer  Aave

Aave  Render

Render  Mantle

Mantle  Bittensor

Bittensor  Cronos

Cronos  POL (ex-MATIC)

POL (ex-MATIC)  Ethereum Classic

Ethereum Classic  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  WhiteBIT Coin

WhiteBIT Coin  Virtuals Protocol

Virtuals Protocol  Arbitrum

Arbitrum  MANTRA

MANTRA  Tokenize Xchange

Tokenize Xchange  Monero

Monero