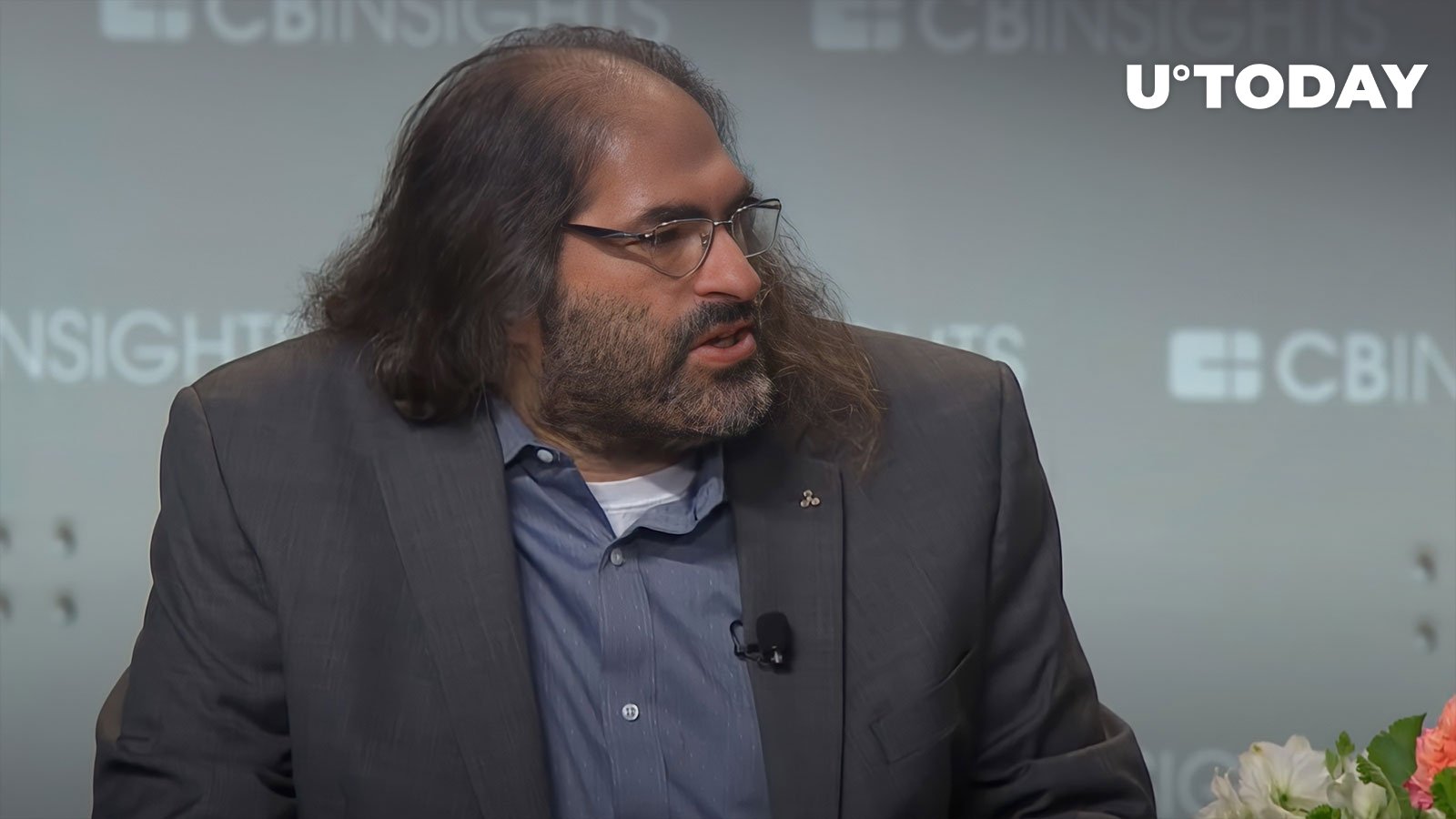

Ripple executive David Schwartz took to Twitter to criticize the SEC’s recent actions, suggesting that they may be motivated by incompetence or a desire to protect insiders and early investors

In a series of tweets, Schwartz criticized the SEC’s actions, suggesting that they may be motivated by incompetence or a desire to protect insiders and early investors.

Schwartz’s comments were in response to Coinbase receiving a Wells notice from the SEC, which typically precedes an enforcement action.

“Unless you wanted to allow the founders, insiders, and early investors to profit and then shift much of the losses due to this litigation onto a large number of retail investors. I guess it could also just be incompetence that they didn’t notice this sooner,” he tweeted.

The Ripple executive questioned the SEC’s motivation behind the recent enforcement action. “If this is the SEC protecting American investors, imagine if they tried to hurt them,” he quipped.

He expressed frustration with the SEC’s application of the Howey test, which he described as not being simple as some people believe since the agency struggles to determine whether or not Ethereum (ETH), the second-largest cryptocurrency, is an unregistered security.

His comments echo those made by Meta’s former blockchain lead David Marcus who noted that even the top securities lawyers at major law firms don’t know how it applies to many tokens.

Some members of the XRP community also expressed disappointment with the industry’s failure to stand together when Ripple was under fire, suggesting that the industry may now be weaker as a result.

Coinbase commented on the SEC’s actions in a blog post, saying that they had asked for “reasonable crypto rules” for Americans and had instead received legal threats.

The company said that it had met with the SEC more than 30 times over the past nine months, sharing details of its business to build a path to registration. However, the SEC had given “basically 0 feedback on what to change, or how to register,” according to Coinbase.

The company also noted that when it filed to go public in 2021, its S1 described its business in much detail, including references to staking and details on its asset listing process. The SEC approved the filing, knowing those details, but has now changed its mind on what is allowed, according to Coinbase.

Ripple has been enmeshed in a gruesome legal battle with the SEC since late 2020. It is expected to come to an end in the first half of 2023.

Read More: u.today

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  Wrapped Bitcoin

Wrapped Bitcoin  Hyperliquid

Hyperliquid  Sui

Sui  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  LEO Token

LEO Token  Avalanche

Avalanche  Stellar

Stellar  Bitcoin Cash

Bitcoin Cash  Toncoin

Toncoin  Shiba Inu

Shiba Inu  USDS

USDS  Hedera

Hedera  Litecoin

Litecoin  WETH

WETH  Wrapped eETH

Wrapped eETH  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Polkadot

Polkadot  Monero

Monero  Ethena USDe

Ethena USDe  Bitget Token

Bitget Token  Pepe

Pepe  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Pi Network

Pi Network  WhiteBIT Coin

WhiteBIT Coin  Aave

Aave  Uniswap

Uniswap  Dai

Dai  Ethena Staked USDe

Ethena Staked USDe  Bittensor

Bittensor  OKB

OKB  Aptos

Aptos  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Cronos

Cronos  NEAR Protocol

NEAR Protocol  Jito Staked SOL

Jito Staked SOL  Internet Computer

Internet Computer  sUSDS

sUSDS  Ethereum Classic

Ethereum Classic